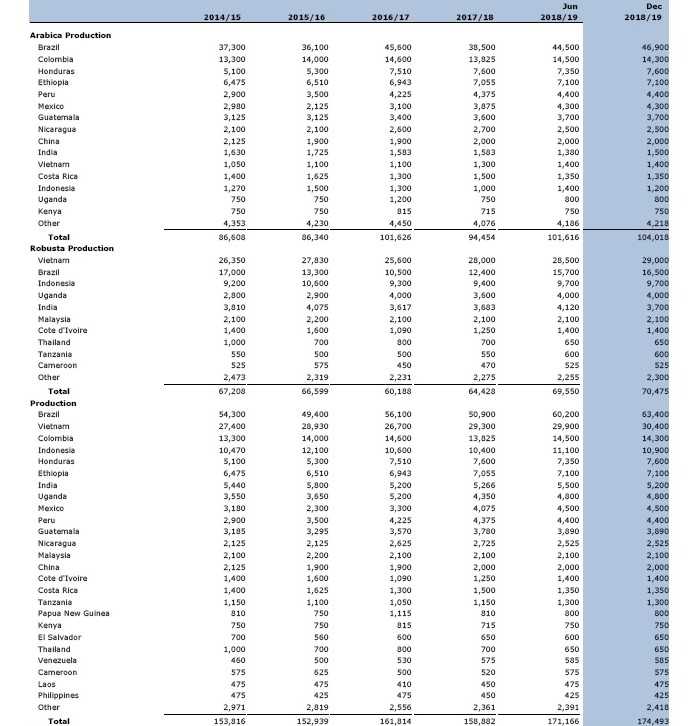

WASHINGTON, U.S. – The U.S. Department of Agriculture’s “Coffee: World Markets and Trade” report pegs world coffee production for CY 2018/19 at a record 174.5 million bags, up 15.6 million from the previous year. Brazil is forecast to account for nearly all the gain as its Arabica crop enters the on-year of the biennial production cycle and Robusta continues to rebound.

Record world exports are forecast, largely on the strength of Brazil.

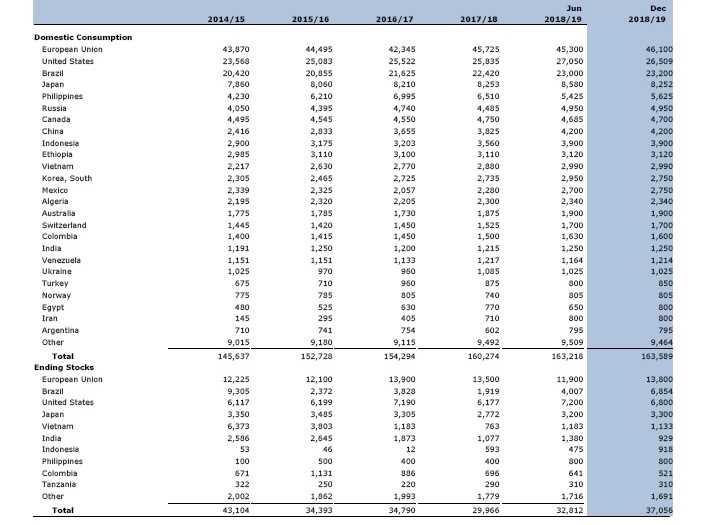

Although world consumption is forecast to rise by a modest 3.3 million bags to a record 163.6 million, ending stocks are expected to rebound sharply by 7.1 million bags to 37.1 million.

Against this backdrop, coffee prices as measured by the International Coffee Organization (ICO) composite price index have dropped over 10 percent in the last year.

Brazil’s Arabica output is forecast to surge 8.4 million bags above the previous season to 46.9 million, with over 80 percent of output coming from regions with trees in the on-year of the biennial production cycle.

Good blossoming between September and November 2017 was followed by ideal weather during the fruit-set and fruit development period in Minas Gerais and Sao Paulo.

Although Parana and the southeast of Minas Gerais are in the offyear of the biennial production cycle, the drop is expected to be less intense than average. Robusta production is forecast to continue rebounding, gaining 4.1 million bags to 16.5 million.

Favorable temperatures and abundant rainfall boosted yields in the three major producing states of Espirito Santo, Rondonia, and Bahia.

Also, expansion of clonal seedlings and improved crop management techniques are expected to aid this year’s gain. The combined Arabica and Robusta harvest is forecast up 12.5 million bags to a record 63.4 million.

The additional supply of both Arabica and Robusta will fuel a sharp rebound in exports and ending stocks, while also allowing continued growth in consumption.

Vietnam’s production is forecast to add 1.1 million bags to reach a record 30.4 million as cooler weather and off-season rains helped stimulate coffee trees just prior to flowering and cherry-setting.

Some areas experienced heavy rains during flowering, prompting concern that yields would be lower than initial estimates.

However, the additional rain resulted in larger cherries, which more than offset some areas where the rain damaged the flowers. Last year’s large crop compensated for weak prices, allowing farmers to buy adequate inputs for this year’s crop and boost yields.

Cultivated area is forecast up slightly from last year, with nearly 95 percent of total output remaining as Robusta. Exports, domestic consumption, and ending stocks are expected to rise on higher available supplies.

Total output for Central America and Mexico is forecast up slightly to a record 20.6 million bags.

Coffee rust remains in the region and continues to impact output, even though the last two harvests have been records.

In Honduras in early 2017, coffee rust was found on a previously resistant coffee variety (Lempira). Then in April 2018, the Honduran Coffee Institute identified four new strains of coffee rust, though they had not affected producers on a large scale.

Honduras accounts for nearly 40 percent of the region’s output and is forecast unchanged at 7.6 million bags. Mexico and Guatemala each account for about 20 percent of the region’s output and they continue to implement programs to replace trees with disease-resistant varieties.

The combined bean exports for Central America and Mexico are forecast down 100,000 bags to 17.0 million. Over 45 percent of the region’s exports are destined for the European Union, followed by about one-third to the United States.

Colombia’s production is forecast up 500,000 bags to 14.3 million on favourable growing conditions and improving yields. In the last decade, yields have increased about 30 percent due largely to a renovation program that replaced older, lower-yielding trees with rust-resistant varieties.

More than 420,000 hectares have been renovated since the replanting program began in 2012, representing nearly half of coffee’s area, bringing total area planted with rust-resistant varieties to about 80 percent.

Each year, an average 84,000 hectares are renovated, but the National Federation of Colombian Coffee Growers (FEDECAFE) and the Colombian Government plan to raise it to at least 90,000 hectares to reach production of 18 million bags.

Only 72,000 hectares were renovated in 2017 because government support was not available to farmers until later in the year.

Bean exports, mostly to the United States and European Union, are forecast up 600,000 bags to 12.3 million, drawing ending stocks lower a third consecutive year.

Indonesia’s production is forecast to gain 500,000 bags to 10.9 million. Robusta output is expected to reach 9.7 million bags on favorable growing conditions in the lowland areas of Southern Sumatra and Java, where approximately 75 percent is grown.

Arabica production is also seen rebounding to 1.2 million bags. Higher yields in the main growing region of Northern Sumatra are expected to more than offset lower yields from certain areas that experienced heavy rainfall and strong winds during fruit development.

Bean exports are forecast little changed at 7.0 million bags, while ending stocks are seen rising 300,000 bags to 900,000.

European Union imports are forecast up 1.1 million bags to 48.5 million and account for nearly 45 percent of the world’s coffee bean imports. Top suppliers include Brazil (29 percent), Vietnam (24 percent), Honduras (7 percent), and Colombia (7 percent). Ending stocks are expected to rise 300,000 bags to 13.8 million.

The United States imports the second-largest amount of coffee beans and is forecast to jump 2.1 million bags to 26.5 million. Top suppliers include Brazil (23 percent), Colombia (22 percent), Vietnam (15 percent), and Honduras (6 percent). Ending stocks are forecast to gain 600,000 bags to 6.8 million.

Revised 2017/18

World production is revised down from the June 2018 estimate by 900,000 bags to 158.9 million.

- Colombia is reduced 600,000 bags to 13.8 million on lower yields following heavy rains and cloud cover during the first half of 2018.

- Indonesia is down 200,000 bags to 10.4 million.

World bean imports are raised 500,000 bags to 108.3 million.

- European Union is up 500,000 bags to 47.5 million as consumption was stronger than expected.

World ending stocks are raised 600,000 bags to 30.0 million.

- European Union is up 2.4 million bags to 13.5 million on updated data from the European CoffeeFederation.

- United States is reduced 400,000 bags to 6.2 million on lower imports.

- Brazil is down 400,000 bags to 1.9 million on higher consumption.