HOBOKEN, N.J., U.S. — Newell Brands Inc. announced today that in light of the closing of executive departments and agencies of the U.S. federal government, including the Securities and Exchange Commission, on Monday, December 24, 2018, the Company has extended the expiration date of its previously announced debt tender offers to midnight, New York City time, at the end of January 4, 2019, unless further extended or earlier terminated (the “Expiration Date”).

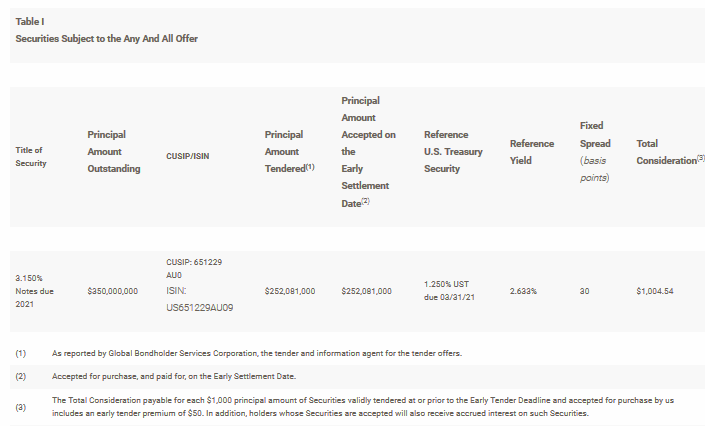

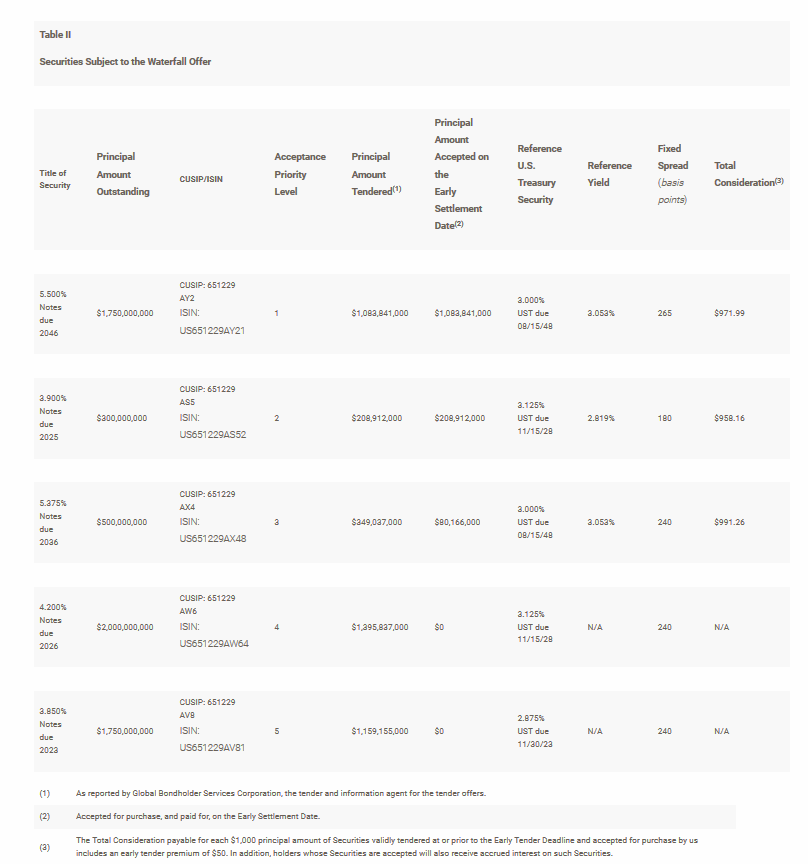

On December 4, 2018, the Company announced the commencement of its tender offers to purchase for cash (i) any and all of the Company’s outstanding securities listed in Table I below (the “Any and All Notes”) (such offer, the “Any and All Offer”), and (ii) up to the Maximum Waterfall Tender Amount (as defined below) in aggregate principal amount of the Company’s outstanding securities listed in Table II below (collectively, the “Waterfall Notes” and, together with the Any and All Notes, the “Securities”), subject to the Acceptance Priority Levels as defined below (such offer, the “Waterfall Offer”). The “Maximum Waterfall Tender Amount” is an aggregate principal amount equal to $1,625,000,000 less the aggregate principal amount of the Any and All Notes validly tendered and accepted for purchase in the Any and All Offer. The tender offers are being made upon and are subject to the terms and conditions set forth in the Offer to Purchase, dated December 4, 2018, and the related Letter of Transmittal (as they may each be amended or supplemented from time to time, the “Tender Offer Documents”).

On December 19, 2018, the Company announced the early results and pricing terms of the tenders offers. The following tables set forth certain information regarding the tender offers, including such pricing terms and the aggregate principal amount of each series of Securities that were validly tendered and not properly withdrawn at or prior to 5:00 p.m., New York City time, on December 18, 2018 (the “Early Tender Deadline”). As of 5:00 p.m., New York City time, on December 25, 2018, no additional Securities have been tendered in the tender offers.

As listed in the tables above, on December 26, 2018 (the “Early Settlement Date”), the Company accepted for purchase, and paid for, $252,081,000 aggregate principal amount of its 3.150% Notes due 2021, $1,083,841,000 aggregate principal amount of its 5.500% Notes due 2046, $208,912,000 aggregate principal amount of its 3.900% Notes due 2025 and $80,166,000 aggregate principal amount of its 5.375% Notes due 2036 which had been validly tendered and not properly withdrawn at or prior to the Early Tender Deadline.

As listed in the tables above, on December 26, 2018 (the “Early Settlement Date”), the Company accepted for purchase, and paid for, $252,081,000 aggregate principal amount of its 3.150% Notes due 2021, $1,083,841,000 aggregate principal amount of its 5.500% Notes due 2046, $208,912,000 aggregate principal amount of its 3.900% Notes due 2025 and $80,166,000 aggregate principal amount of its 5.375% Notes due 2036 which had been validly tendered and not properly withdrawn at or prior to the Early Tender Deadline.

Because the Waterfall Offer was fully subscribed as of the Early Tender Deadline, the Company does not expect to accept for purchase any Waterfall Notes tendered after the Early Tender Deadline. Holders of Any and All Notes who validly tender such notes following the Early Tender Deadline and at or prior to the Expiration Date will only receive the applicable Tender Offer Consideration for Securities accepted for purchase, which is equal to the applicable Total Consideration minus an early tender premium of $50. Securities not accepted for purchase will be promptly returned or credited to the holder’s account. As a result of the extension of the Expiration Date, the settlement date for Securities tendered following the Early Tender Deadline and at or prior to the Expiration Date and accepted for purchase is expected to be January 8, 2019 (the “Final Settlement Date”).

The withdrawal deadline of 5:00 p.m., New York City time, on December 18, 2018 has passed and, accordingly, Securities validly tendered in the tender offers may no longer be withdrawn except where additional withdrawal rights are required by law.

Goldman Sachs & Co. LLC is serving as the Lead Dealer Manager, and RBC Capital Markets, LLC and Wells Fargo Securities, LLC are serving as Co-Dealer Managers, in connection with the tender offers. The information agent and tender agent is Global Bondholder Services Corporation. The full details of the tender offers, including complete instructions on how to tender Securities, are included in the Tender Offer Documents. Holders are strongly encouraged to read carefully the Tender Offer Documents, including materials incorporated by reference therein, because they contain important information. Copies of the Tender Offer Documents and related offering materials are available by contacting the information agent at (212) 430-3774 (banks and brokers) or (866) 807-2200 (all others). Questions regarding the tender offers should be directed to Goldman Sachs & Co. LLC, Liability Management Group, at (212) 357-0215 or (800) 828-3182 (toll free).

None of the Company or its affiliates, their respective boards of directors, the dealer managers, the information agent and tender agent or the trustee is making any recommendation as to whether holders should tender any Securities in response to any of the tender offers, and neither the Company nor any such other person has authorized any person to make any such recommendation. Holders must make their own decision as to whether to tender any of their Securities, and, if so, the principal amount of Securities to tender.

This press release shall not constitute an offer to sell, a solicitation to buy or an offer to purchase or sell any securities. The tender offers are being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law.