VEVEY, Switzerland — Nestlé S.A. reported on Thursday that its sales in fiscal 2021 increased by 3.3% to CHF 87.1 billion, from CHF 84.3 billion in 2020. Organic growth reached 7.5% in the twelve-month period and reported earnings per share (EPS) surged by 22.2% to 2.06 Swiss francs, while underlying EPS climbed 6% to 4.42 Swiss francs.

The largest contributor to organic growth was coffee, fueled by strong momentum for the three main brands Nescafé, Nespresso and Starbucks.

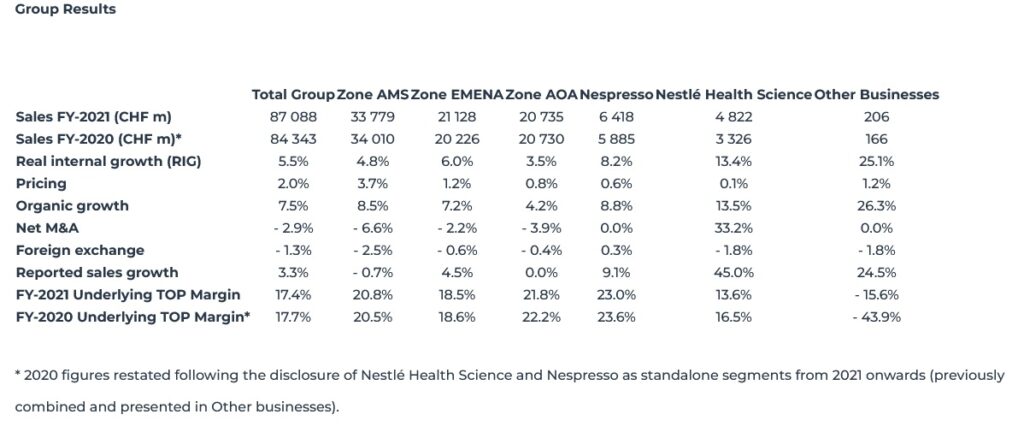

Key figures:

- Organic growth reached 7.5%, with real internal growth (RIG) of 5.5% and pricing of 2.0%. Growth was supported by continued momentum in retail sales, steady recovery of out-of-home channels, increased pricing and market share gains.

- Total reported sales increased by 3.3% to CHF 87.1 billion (2020: CHF 84.3 billion). Foreign exchange reduced sales by 1.3%. Net divestitures had a negative impact of 2.9%.

- The underlying trading operating profit (UTOP) margin was 17.4%, decreasing by 30 basis points. The trading operating profit (TOP) margin decreased by 290 basis points to 14.0% on a reported basis, largely reflecting impairments related to the Wyeth business.

- Underlying earnings per share increased by 5.8% in constant currency and by 5.1% on a reported basis to CHF 4.42. Earnings per share increased by 41.1% to CHF 6.06 on a reported basis, mainly reflecting the gain on the disposal of L’Oréal shares.

- Free cash flow decreased by 14.9% to CHF 8.7 billion, reflecting temporarily higher capital expenditure and inventory levels.

- Board proposes a dividend of CHF 2.80 per share, an increase of 5 centimes, marking 27 consecutive years of dividend growth. In total, CHF 13.9 billion were returned to shareholders in 2021 through a combination of dividend and share buybacks.

- Continued progress in portfolio management. Portfolio rotation since 2017 now amounts to around 20% of total 2017 sales.

- 2022 outlook: we expect organic sales growth around 5% and underlying trading operating profit margin between 17.0% and 17.5%. Underlying earnings per share in constant currency and capital efficiency are expected to increase.

- Mid-term outlook: sustained mid single-digit organic sales growth. Continued moderate underlying trading operating profit margin improvements. Continued prudent capital allocation and capital efficiency improvements.

Mark Schneider, Nestlé CEO, commented:”In 2021, we remained focused on executing our long-term strategy and stepping up growth investments, while at the same time navigating global supply chain challenges. Our organic growth was strong, with broad-based market share gains, following disciplined execution, rapid innovation and increased digitalization. We limited the impact of exceptional cost inflation through diligent cost management and responsible pricing. Our robust underlying earnings per share growth shows the resilience of our value creation model. The entire Nestlé team demonstrated exemplary perseverance and agility in a challenging environment.”

Nespresso

Organic growth reached 8.8%, based on strong RIG of 8.2% and pricing of 0.6%. Foreign exchange positively impacted sales by 0.3%. Reported sales in Nespresso increased by 9.1% to CHF 6.4 billion.

Nespresso posted high single-digit growth, moderating to a mid single-digit rate in the second half following a high base of comparison in 2020. Growth was fueled by new consumer adoption, particularly for the Vertuo system, continued momentum in e-commerce and a recovery in boutiques and out-of-home channels.

Continuous innovation resonated strongly with consumers and significant new product launches included the expansion of the World Explorations and Reviving Origins ranges, as well as strong demand for year-end festive offerings.

By geography, the Americas and AOA posted double-digit growth. Sales in EMENA grew at a mid single-digit rate. Overall Nespresso gained market share, with contributions from most markets.

The underlying trading operating profit margin of Nespresso decreased by 60 basis points. Increased growth investments more than offset operating leverage.

Nestlé – Group sales

Organic growth was 7.5%, with RIG of 5.5%. Pricing increased to 2.0%, reaching 3.1% in the fourth quarter, to offset significant cost inflation.

Growth was broad-based across most geographies and categories. Organic growth reached 7.2% in developed markets, the highest level in more than a decade, based mostly on RIG with positive pricing. Organic growth in emerging markets was 7.8%, with robust RIG and positive pricing.

By product category, the largest contributor to organic growth was coffee, fueled by strong momentum for the three main brands Nescafé, Nespresso and Starbucks. Sales of Starbucks products grew by 17.1% to reach CHF 3.1 billion, generating over CHF 1 billion of incremental sales compared with 2018. Purina PetCare posted double-digit growth, led by science-based and premium brands Purina Pro Plan, Fancy Feast and Purina ONE, as well as veterinary products. Prepared dishes and cooking aids reported high single-digit growth, based on strong sales developments for Maggi, Stouffer’s and Lean Cuisine. Sales in vegetarian and plant-based food grew at a double-digit rate, reaching around CHF 800 million. Nestlé Health Science recorded double-digit growth, reflecting strong demand for vitamins, minerals and supplements, as well as healthy-aging products. Dairy saw mid single-digit growth, based on strong demand for premium and fortified milks, coffee creamers and ice cream. Sales in confectionery grew at a high single-digit rate, supported by a strong sales development for KitKat and gifting products. Water posted high single-digit growth, driven by premium brands and a recovery in out-of-home channels. Infant Nutrition reported negative growth, impacted by a sales decline in China and lower birth rates globally. Sales of human milk oligosaccharides (HMOs) products continued to see robust growth, reaching CHF 1.2 billion.

By channel, organic growth in retail sales was 6.4%. E-commerce sales grew by 15.1%, reaching 14.3% of total Group sales, with strong momentum in most categories, particularly Purina PetCare, coffee and Nestlé Health Science. Organic growth in out-of-home channels reached 24.5%, helped by a low base of comparison due to the pandemic.

Net divestitures decreased sales by 2.9%, largely related to the Nestlé Waters North America, Yinlu and Herta transactions. Divestitures were partially offset by acquisitions, including the core brands of The Bountiful Company and Freshly. The negative impact on sales from foreign exchange moderated to 1.3%. Total reported sales increased by 3.3% to CHF 87.1 billion.

Underlying trading operating profit

Underlying trading operating profit increased by 1.4% to CHF 15.1 billion. The underlying trading operating profit margin decreased by 30 basis points to 17.4% in constant currency and on a reported basis, reflecting time delays between cost inflation and pricing actions. The one-off integration costs related to the acquisition of The Bountiful Company’s core brands had a negative impact of around 10 basis points.

Gross margin decreased by 130 basis points to 47.8%, reflecting significant broad-based inflation for commodity, packaging, freight and energy costs. The impact of cost inflation, which increased strongly in the second half, was partly offset by price increases, operating leverage and efficiencies.

Distribution costs as a percentage of sales decreased by 20 basis points, mainly as a result of the disposal of the Nestlé Water brands in North America.

Marketing and administration expenses decreased as a percentage of sales by 80 basis points, based on strong operating leverage and efficiencies. At the same time, the Group continued to invest for growth and increased its consumer-facing marketing expenses in constant currency.

Restructuring expenses and net other trading items increased by CHF 2.3 billion to CHF 3.0 billion, largely reflecting impairments related to the Wyeth business. As a result, trading operating profit decreased by 14.6% to CHF 12.2 billion and the trading operating profit margin decreased by 290 basis points on a reported basis to 14.0%.

Net financial expenses and income tax

Net financial expenses were unchanged at CHF 873 million, as a lower cost of debt offset higher average net debt.

The Group reported tax rate decreased by 330 basis points to 20.9%, mainly as a result of one-off items in 2020, including the divestment of the U.S. ice cream business. The underlying tax rate decreased by 40 basis points to 20.7%, mainly due to the geographic and business mix.

Nestlé – Net profit and earnings per share

Net profit grew by 38.2% to CHF 16.9 billion. Net profit margin increased by 490 basis points to 19.4%. The gain on the disposal of L’Oréal shares more than offset higher asset impairments and other one-off items.

Underlying earnings per share increased by 5.8% in constant currency and by 5.1% on a reported basis to CHF 4.42. Sales growth was the main contributor to the increase. Nestlé’s share buyback program contributed 1.3% to the underlying earnings per share increase, net of finance costs. Earnings per share increased by 41.1% to CHF 6.06 on a reported basis.

Cash Flow

Cash generated from operations decreased from CHF 17.2 billion to CHF 16.6 billion, mainly due to slightly higher working capital at year-end. In the context of significant supply chain disruptions, the Group increased its inventory levels temporarily. Free cash flow decreased from CHF 10.2 billion to CHF 8.7 billion, mainly due to a temporary increase in capital expenditure to meet strong volume demand, particularly for Purina PetCare and coffee.

Dividend

At the Annual General Meeting on April 7, 2022, the Board of Directors will propose a dividend of CHF 2.80 per share, an increase of 5 centimes. If approved, this will be the company’s 27th consecutive annual dividend increase. The company has maintained or increased its dividend in Swiss francs over the last 62 years. Nestlé is committed to maintaining this long-held practice to increase the dividend in Swiss francs every year.

The last trading day with entitlement to receive the dividend will be April 8, 2022. The net dividend will be payable as from April 13, 2022.

Shareholders entered in the share register with voting rights on March 31, 2022 at 12:00 noon (CEST) will be entitled to exercise their voting rights.

Share Buyback Programs

During 2021, the Group repurchased CHF 6.3 billion of Nestlé shares.

On December 30, 2021, Nestlé terminated its existing CHF 20 billion share buyback program initiated on January 3, 2020. Between January 3, 2020 and December 30, 2021, the Group repurchased 123.1 million of its shares for a total consideration of CHF 13.1 billion at an average price of CHF 106.08 per share.

Nestlé initiated a new share buyback program of up to CHF 20 billion on January 3, 2022. The company expects to buy around CHF 10 billion of shares in the first twelve months. The new share buyback program shall be completed by the end of December 2024.

Net debt

Net debt increased by CHF 1.6 billion to reach CHF 32.9 billion as at December 31, 2021. The dividend payment, share buybacks and the net cash outflow from acquisitions and divestitures more than offset proceeds from the disposal of L’Oréal shares and free cash flow generation.

Return on Invested Capital (ROIC)

The Group’s ROIC decreased by 250 basis points to 12.2%, as a result of impairments related to the Wyeth business. Excluding Wyeth business impairments, the Group’s ROIC was 14.2%.

Portfolio Management

Nestlé completed acquisitions and divestments with a total value of around CHF 9.9 billion in 2021.

Nestlé is transforming its global water business, sharpening its focus on international premium and mineral water brands and healthy hydration products. In March, Nestlé completed the acquisition of Essentia Water, a premium functional water brand in the U.S., and the sale of its regional spring water brands, purified water business and beverage delivery service in the U.S. and Canada.

Nestlé Health Science continues to focus on building the leading global nutrition and health platform. In July, Nestlé completed the acquisition of Nuun, a leading company in the fast-growing functional hydration market, and entered into an agreement with Seres Therapeutics to jointly commercialize SER-109, an investigational oral microbiome therapeutic in the U.S. and Canada. In August, Nestlé completed the acquisition of the core brands of The Bountiful Company for USD 5.75 billion. The Bountiful Company is the number one pure-play company in the highly attractive global nutrition and supplement category.

Building on the successful global coffee alliance, Nestlé continues to expand the reach of Starbucks branded coffee and tea products outside Starbucks retail stores. In July, Nestlé and Starbucks announced a new collaboration to bring Starbucks ready-to-drink coffee beverages to select markets across South-East Asia, Oceania and Latin America.

New Zone structure

As of January 1, 2022, the company is organized into five Zones: Zone North America, Zone Latin America, Zone Europe, Zone Asia, Oceania and Africa, and Zone Greater China. Nestlé will report the sales and growth numbers of the new Zone structure for the first time on April 21, 2022.

The new structure will strengthen the company’s market-led approach and enhance Nestlé’s ability to win in a rapidly changing environment. It also underscores the company’s deep commitment to succeeding in all parts of the world, including its two top markets North America and Greater China.

Nestlé – Outlook

2022 outlook: The company expects organic sales growth around 5% and underlying trading operating profit margin between 17.0% and 17.5%. Underlying earnings per share in constant currency and capital efficiency are expected to increase.

Mid-term outlook: sustained mid single-digit organic sales growth. Continued moderate underlying trading operating profit margin improvements. Continued prudent capital allocation and capital efficiency improvements.

(CHF1 = US$1.08)