ORRVILLE, Ohio, USA –The J. M. Smucker Company announced on Friday results for the third quarter ended January 31, 2015, of its 2015 fiscal year.

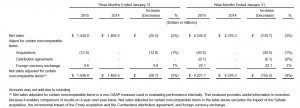

Results for the quarter and nine months ended January 31, 2015 and 2014, include the operations of Sahale Snacks, Inc. (“Sahale”) since the completion of the acquisition on September 2, 2014, Enray Inc. (“Enray”) since the completion of the acquisition on August 20, 2013, and the impact of the Company’s licensing and distribution agreement with Cumberland Packing Corp. (“Cumberland”), which commenced on July 1, 2013.

Executive Summary

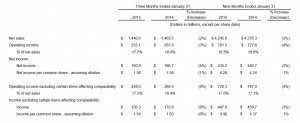

- Third quarter net sales decreased 2 percent in 2015, compared to 2014, reflecting decreased volume, most significantly in the U.S. Retail Coffee segment.

- Operating income excluding the impact of restructuring and merger and integration costs and unallocated derivative gains and losses (“certain items affecting comparability”) decreased 8 percent in the third quarter of 2015, compared to 2014, attributed to the impact of a decline in gross profit, driven by the U.S. Retail Coffee segment.

- Income excluding certain items affecting comparability also decreased 8 percent in the third quarter of 2015, compared to 2014.

- Third quarter income per diluted share excluding certain items affecting comparability decreased 6 percent in 2015, compared to 2014, and benefited from the Company’s share repurchase activities during the fourth quarter of fiscal 2014 which reduced weighted average shares outstanding by 3 percent.

“While we are pleased with the momentum in many of our businesses, our U.S. Retail Coffee business continued to be challenged, which impacted our third quarter performance.

In the near term, we expect results for the coffee segment to remain soft reflecting continued competitive dynamics, which we are addressing responsibly to ensure the long-term health of our brands,” said Richard Smucker, Chief Executive Officer.

“As we remain focused on executing the key initiatives across our businesses, we also look forward to the close of the Big Heart Pet Brands acquisition by the end of our fiscal year.

We are excited to be adding this business to our portfolio as a third platform for growth and as a means to further enhance shareholder value.”

“We entered this quarter with strong merchandising programs in place, and are pleased with the performance of our key brands in the baking and spreads categories,” added Vince Byrd, President and Chief Operating Officer.

“Volume gains for Jif ® peanut butter, Smucker’s® fruit spreads, and Crisco® oils highlighted a successful holiday and return-to-school period for our U.S. Retail Consumer Foods business.

Within our U.S. Retail Coffee business, we are optimistic about the initiatives we have in place to address current challenges and continue our leadership in the coffee category.”

Net Sales

Net sales decreased 2 percent in the third quarter of 2015, compared to the third quarter of 2014. Volume gains were realized in Jif® peanut butter, Crisco® oils, Smucker’s® fruit spreads, and Smucker’s® Uncrustables® frozen sandwiches and were offset by declines in Folgers® coffee, private label canned milk and natural beverages, as well as the impact of the exited private label foodservice hot beverage business.

Net price realization was 1 percentage point higher in the third quarter of 2015, compared to the third quarter of 2014, as coffee list price increases were offset by lower net pricing for peanut butter and oils.

Sales mix was unfavorable during the same period driven by the volume declines in the U.S. Retail Coffee segment, and represented 1 percentage point of the net sales decrease. The acquired Sahale business contributed $12.8 million to net sales in the third quarter of 2015.

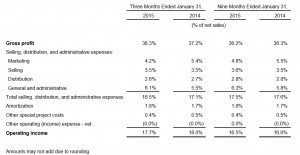

Margins

Gross profit decreased $22.3 million in the third quarter of 2015, compared to 2014, driven by the impact of commodity costs relative to net price realization offset somewhat by a favorable change in unallocated derivative gains and losses.

Overall commodity costs were higher attributed to green coffee which more than offset lower peanut and oil costs.

Overall net price realization was also higher but did not offset the impact of the higher costs and was the main contributor to the gross profit decline.

Most significantly, higher net coffee pricing did not offset the higher green coffee costs while lower net pricing on peanut butter and oils exceeded the benefit of lower costs for those commodities.

Lower volume, unfavorable mix, and foreign currency exchange also contributed to the gross profit decline to a lesser extent.

Excluding certain items affecting comparability, which primarily consisted of the impact of unallocated derivative gains and losses, gross profit decreased $34.2 million, or 6 percent, and as a percent of net sales from 37.1 percent in the third quarter of 2014 to 35.4 percent in the third quarter of 2015.

Selling, distribution, and administrative expenses decreased $13.0 million, or 5 percent, in the third quarter of 2015, compared to the third quarter of 2014, primarily due to an $18.7 million decrease in marketing expense. Distribution and selling expenses decreased modestly.

General and administrative expenses increased 10 percent in the third quarter of 2015, compared to 2014, and included $4.4 million of deal costs related to the pending acquisition of Big Heart Pet Brands. Excluding these acquisition-related deal costs, general and administrative expenses increased 4 percent during the same period.

Operating income decreased $8.4 million, or 3 percent, in the third quarter of 2015, compared to 2014, reflecting a favorable impact of certain items affecting comparability. Excluding certain items affecting comparability in both periods, operating income decreased $21.5 million, or 8 percent.

Interest Expense and Income Taxes

Net interest expense decreased $1.6 million in the third quarter of 2015, compared to 2014, reflecting the impact of scheduled long-term debt repayments made over the last 12 months.

Income taxes decreased $2.3 million in the third quarter of 2015, compared to 2014, primarily reflecting a decrease in income before income taxes. The effective tax rate increased slightly from 32.3 percent in the third quarter of 2014 to 32.5 percent in the third quarter of 2015.

Segment Performance

U.S. Retail Coffee

The U.S. Retail Coffee segment net sales decreased 1 percent in the third quarter of 2015, compared to the third quarter of 2014, as lower volume was mostly offset by higher net price realization, reflecting list price increases taken during fiscal 2015, and favorable sales mix.

List price increases taken include 9 percent in June 2014 on the majority of the Company’s packaged coffee offerings, and 8 percent in January 2015 on its K-Cup® packs. Segment volume decreased 8 percent in the third quarter of 2015, compared to the third quarter of 2014, primarily driven by the Folgers® brand.

The Folgers® brand volume decline was attributed to consumer response to higher promoted price points on shelf for its roast and ground coffee offerings, competitive activity, and reduced promotional effectiveness.

The Dunkin’ Donuts® packaged coffee volume was flat in the quarter, and the Cafe Bustelo® brand volume increased 5 percent. Volume and net sales of Keurig® portion packs decreased 3 percent and 8 percent, respectively, in the third quarter of 2015, compared to the third quarter of 2014, primarily driven by the Millstone® K-Cup® packs.

The U.S. Retail Coffee segment profit decreased $30.6 million, or 17 percent, in the third quarter of 2015, compared to the third quarter of 2014, reflecting lower sales volume and the impact of higher costs, which were not fully offset by higher net prices.

The unfavorable price to cost relationship was driven by increased promotional spending in support of the Company’s K-Cup® packs and its Dunkin’ Donuts® packaged coffee.

A reduction in marketing expenses contributed favorably to segment profit in the third quarter of 2015, compared to 2014.

Outlook

The Company stated that due to its pending acquisition of Big Heart Pet Brands, which is expected to close in the fourth quarter of the current fiscal year, it is not providing a formal update to its full year earnings per share and free cash flow guidance.

However, the Company is providing selective forward-looking information related to its fourth quarter and a general overview of full year earnings.

The Company expects to provide its outlook for fiscal 2016, including the impact of Big Heart Pet Brands, as part of its fourth quarter earnings release, planned for June 2015.

During the fourth quarter, the Company anticipates a modest decrease in net sales compared to the same period last year before any impact of Big Heart Pet Brands.

This outlook reflects a softer volume expectation in its U.S. Retail Coffee segment than previously anticipated.

Net sales expectations for the Company’s two other segments have not changed significantly from the outlook provided in November 2014. Based on these fourth quarter estimates, the Company expects to realize a decrease in full fiscal year net sales of nearly 3 percent as compared to the prior year.

Excluding any impact from the Big Heart Pet Brands acquisition, the Company stated that fourth quarter earnings per diluted share are expected to result in full year earnings per share below the midpoint of its previous guidance range of $5.45 to $5.65 by approximately 3 percent.

With the impact of anticipated lower coffee volume, the Company now expects full year U.S. Retail Coffee segment profit to decrease by approximately 15 percent, as compared to the prior year.

In addition, the impact of the further weakening of the Canadian dollar in the back half of the fiscal year, and deal and employee-related expenses incurred in the third quarter were not reflected in the previous guidance range.