GRAND DUCHY OF LUXEMBOURG – The Board of Directors of IVS Group S.A. (Milan: IVS.MI), convened on March 30th, 2023 and chaired by Mr. Paolo Covre, examined and approved the Annual Report 2022 (statutory and consolidated), the Management Report and related documents and the Sustainability Report.

The Chairman has been mandated by the Board to convene the AGM, in accordance with law and the Company’s statute, on June 27th, 2023, at 11:00 at IVS Group registered office, 18 Rue de l’Eau L – 1449, L-Luxembourg, Grand Duchy of Luxembourg, to vote on the approval of the Annual Report 2022 and related matters, the allocation of the Company’s result and directors’ indemnification, appointment of directors, renewal of the mandate to the board for directors for capital increase transactions. The Board also discussed and approved the reports on Corporate Governance, Remuneration, Risks Control.

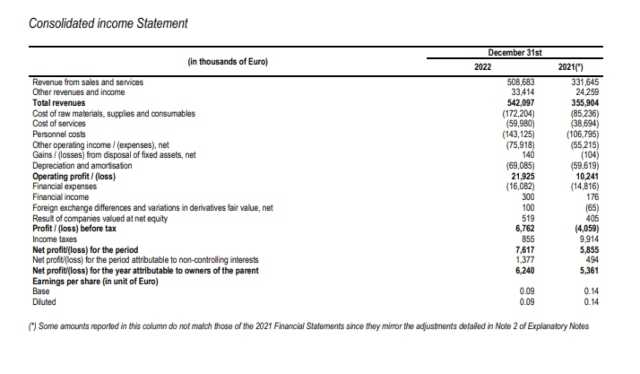

Summary of consolidated results at 31 December 2022

- Consolidated Revenues: Euro 542.1 million, +52.3% compared to 2021

- Adjusted EBITDA: Euro 92.1 million, +26.6% compared to 2021

- Adjusted EBIT: Euro 23.0 million, +75.1% compared to 2021

- Consolidated Net Profit: Euro 7.6 million (before profits attributable to minorities).

- Adjusted Net Profit: Euro 8.3 million

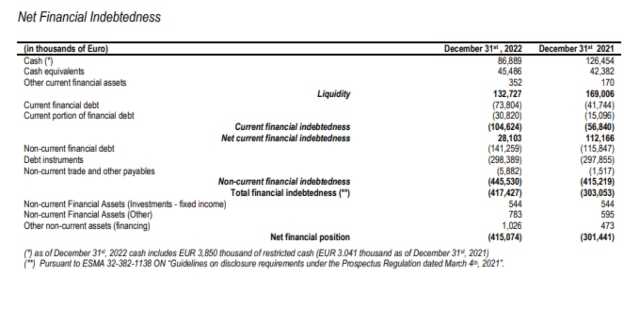

- Net Financial Debt equal to Euro 415.1 million (including Euro 69.4 million debt related to IFRS 16)

- Completed 16 acquisition in Italy and abroad, including the business combination with Liomatic, GeSA and Vendomat

Pro-forma Consolidated revenues considering IVS Group including the Business Combination and acquired businesses from the beginning of 2022, of approximately Euro 680 million, and pro forma Adjusted EBITDA exceeding Euro 105 million.

Operating performances

Consolidated revenues at 31 December 2022 reached Euro 542.1 million, +52.3% from Euro 355.9 million of 2021.

Following the Business Combination with Liomatic and GeSA groups (the “Business Combination”), whose effects started on July 1st, 2022 and therefore are included since the second half 2022, the group’s activities were divided into seven macro- businesses, that at 31 December 2022 generated the sales indicated below (pro-rata temporis and before intra companies elision).

- Vending business (including four areas: Italy, France, Spain and other countries): Euro 417.4 million, +33.1% million compared to 313.5 million at 31 December 2021, further divided into the following markets: (i) Italy (Euro 344.8 million), (ii) France (Euro 38.6 million), (iii) Spain (Euro 30.2 million), (iv) other Europe markets (Euro 3.8 million). Italy includes most of Liomatic vending businesses and GeSA; France has the same previous IVS Group perimeter; Spain includes also some local Liomatic vending business; the other European markets include the former IVS Group businesses in Switzerland and Poland, and those in Germany, Portugal and San Marino brought by Liomatic.

- Resale business (Euro 66.55 million pro-rata temporis for the second half 2022 only), including the businesses owned by Liomatic and Vendomat SpA. This business was not present in IVS Group before the Business Combination and therefore the comparison between 2022 and 2021 is not significant. Through the acquired businesses, the group is now the Italian market leader also in this important market segment.

- horeca business (Euro 10.4 million). This is also a new business segment for IVS Group, and it is mostly represented by activities owned by Liomatic (in Spain), and some business started by IVS in the second half of the year.

- Coin division business (Euro 28.7 million; +20.0%), no contributions from the Business Combination with Liomatic and GeSA (but including N-and Group, specialized in production and sale of touch screens, mostly destined in the vending sector, and in the improvement of digital users’ interfaces), showing a sales growth in all the most important businesses, and the ongoing increase of the payment app CoffeecApp (over 2 million registered users and 295,000 active users).

In the vending business, the total number of vends as of December 31st, 2022 was equal to 827.2 million, +26.8% from 652.5 million at December 2021. Just as a term of reference, considering that the move of the business amongst the different branches of the group was already present, the contribution to the volumes from Liomatic and GeSA in the second half 2022 was around 130.8 million vends, whilst the growth attributable to IVS was around 6.3%.

The 16 acquisitions of the period, including the Business Combination with Liomatic, GeSA and Vendomat, contributed pro-rata to 2022 sales for around Euro 148.7 million.

Average price per vend (net of VAT) was equal to Euro 50.46 cents, from 48.04 cents (+5,0%) in the same period of 2021 (before the Business Combination). The actual price increase in percentage was higher, but the average is diluted by the different selling prices of Liomatic (in Italy quite in line with IVS, but with higher cost of good sold) and GeSA (on average 9.4% lower compared to IVS prices).

Increase in average selling reflects both the ongoing policy of price adjustments, and the different channel mix, with the recovery of volumes in pubic and travel market segments, where prices are usually higher than in the corporate segment.

The price increase policy will continue to deploy its effects for quite a long time on the whole client’s base, while cost of goods sold, and even more of fuel and energy increased fully and quickly during 2022. The ongoing process of increasing prices is expected to generate an overall positive effect higher than inflation on costs. The overall yearly acquisition rate of new clients remains higher than the churn rate.

EBITDA reported at 31 December 2022 is equal to Euro 91.0 million, +30.3% compared to Euro 69.9 million at December 2021. Adjusted EBITDA is equal to Euro 92.1 million, +26.6% from Euro 72.7 million. With the entry in the group of the resale and horeca. businesses and considering the present lower margins of the newly acquired companies (compared to IVS historic levels), overall Adjusted EBITDA margin was around 17% (18.9% net of positioning fees).

In particular, the higher incidence of the cost of goods sold is due to the weight on total sales of the resale business, whose EBITDA margin is currently in the range of 5.3%. In the core vending business EBITDA margin (net of intra group fees and positioning costs) was 21.6% in Italy, 14.8% in France, 15.3% in Spain and 13.7 in the other countries. EBITDA increase at 31 December 2022 was affected by the sharp increase of fuel and energy costs, for a total of Euro 4.1 million compared to 2021 (at par volumes, without considering the newly controlled companies); moreover, within the labour costs, technical intervention increased a little bit more than volumes increase, because of higher use of the personnel devoted to set the prices increase on the vending machines.

Consolidated EBIT Adjusted increased by 75.1% to Euro 23.0 million, from Euro 13.1 million at December 2021, thanks to the EBITDA growth and despite the growth of depreciation charges (Euro 69.1 from 59.6 million), that mostly reflect the allocation to amortisable assets of some parts of the purchase price and goodwill emerging from the Business Combination, whilst the effect of the selectivity on industrial capex started in 2020 is confirmed.

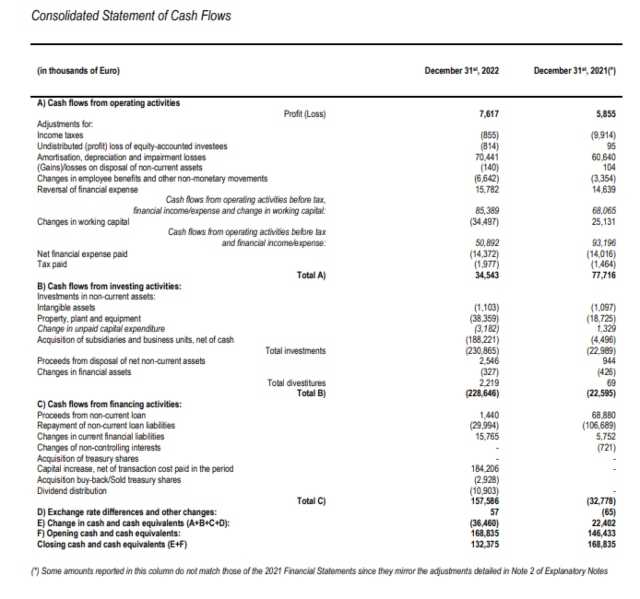

Consolidated Net Profit at 31 December 2022 is equal to Euro 7.6 million (before Euro 1.4 million profits attributable to minorities) compared to Euro 5.9 million in 2021. Notably, Pre-Tax Profit in 2021 was negative for Euro 4.1 million with positive tax proceeds for around Euro 9,9 milioni, whils in 2022 it is positive (Euro 6.8 million) with just Euro 0.9 million of positive tax proceeds, hence with an improvement of around Euro 10.9 million. Net Adjusted Profit (before minorities and net of the exceptional items) is equal to Euro 8.3 million (Euro 8.3 million in 2021, that included Euro 9.9 million of tax proceeds).

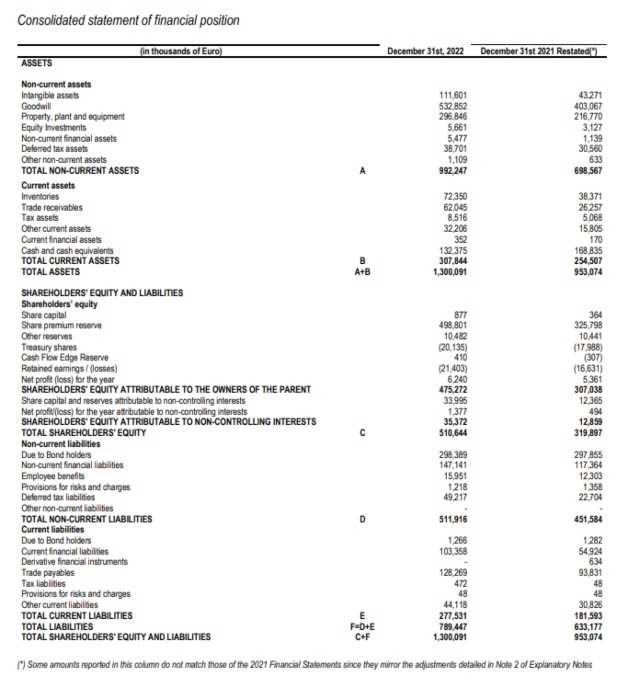

Net Financial Position (“NFP”) is equal to Euro -415.1 million (including Euro 69.4 million related to IFRS 16 effects on rents and leases), comparable to Euro 322.2 at 30 June 2022 before the closing of the Business Combination and excluding the proceeds of the rights issue completed on June 2022.

During 2022 were made other payments related to acquisitions including the Business Combination for Euro 37.1 million (excluding the cash of acquired companies and the share capital increase), with additional Euro 62.9 million financial debt consolidated with of the acquired companies at closing (including Euro 17.6 million IFRS 16); payments for net investment in fixed assets were Euro 40.1 million and was paid a dividend of Euro 10 million.

As of 31 December 2022 the VAT credit, not included in the NFP, increased to around Euro 13.9 million (from Euro 5.2 million at December 2021).

Other significant transactions and events occurred after December 31st, 2022 and outlook for 2023

The present scenario of high inflation affects IVS Group operations, but with lower intensity compared to effects of the past pandemic period. Volumes remain on a gradual recovery trend, although slow, and still influenced by the uncertainty related to presences and hours worked in the locations where vending machines are placed. The difficulties met in 2022 especially by high energy intensity businesses, and the consequent lower presence of workers in those industries, gradually recovered since the end of 2022 and the first two months of 2023 show a good increase in volumes compared to the corresponding period of 2022. The present trend in the vending business support, for the full 2023, an assumption of a total number of vends close to one billion.

Comments Paolo Covre, IVS Group chairman. “2022 was an extraordinary year, for both the complex political and economic scenario, and the extraordinary transactions completed by IVS. The Group is currently – and so will be for a couple of years – focused and strongly committed on the integration with Liomatic and GeSA, that is already generating a first part of the positive effects expected from the Business Combination. We are sure that from this important transaction will also emerge new opportunities, not only in Italy, that will further strengthen our market position, making IVS Group an essential player in strategies for the food and beverages vending sector”.

The financial position of IVS Group

About IVS Group

IVS Group S.A. is the Italian leader and the second player in Europe in the business of automatic and semi-automatic vending machines for the supply of hot and cold drinks and snacks (vending).

The business is mainly carried out in Italy (around 85% of total sales), France, Germany, Poland, Portugal, Spain and Switzerland, with around 289,500 vending machines, a network of 132 branches and around 3,950 employees. IVS Group served more than 15,000 corporate clients and public entities, with more than 825 million vends in 2022.