GRAND DUCHY OF LUXEMBOURG – The Board of Directors of IVS Group S.A. (Milan: IVS.MI), convened on November 14th, 2023, and chaired by Mr. Paolo Covre, examined and approved the Interim Financial Report at 30 September 2023, as summarised below.

Summary of results at 30 September 2023

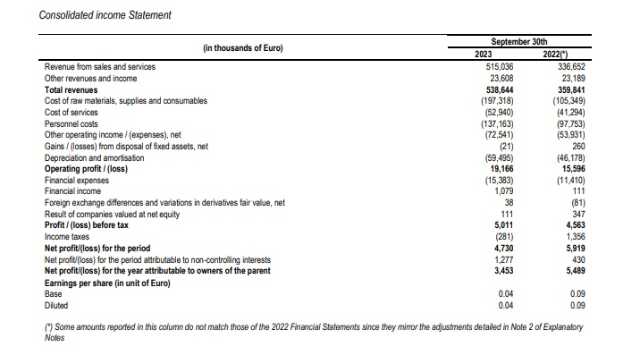

Consolidated Revenues: Euro 538.6 million, +49.7%, compared to September 2022. EBITDA reported: Euro 78.6 million. EBITDA Adjusted: Euro 81.4 million, +30.2%. EBIT reported: Euro 19.1 million. EBIT Adjusted Euro 21.9 million (+34.4%).

Consolidated Net Profit: Euro 4.7 million. Net Profit Adjusted: Euro 6.9 million.

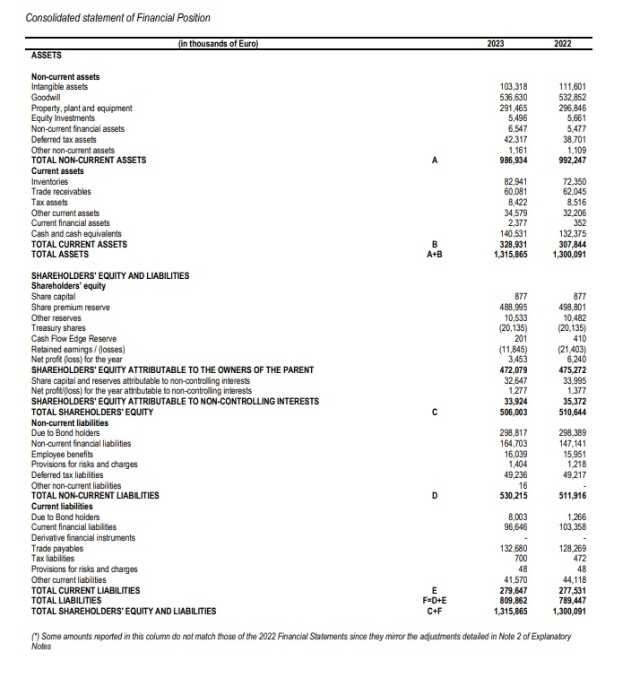

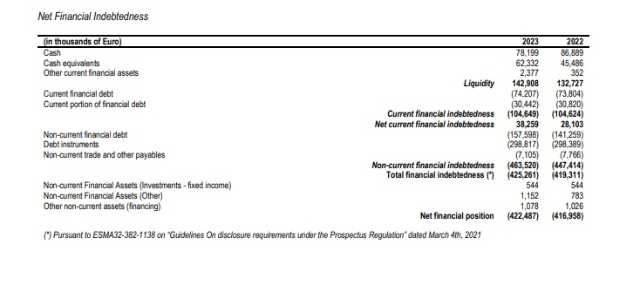

Net Financial Debt equal to Euro 422.5 million (including Euro 64.0 million debt related to IFRS 16).

Operating performances

Consolidated revenues at 30 September 2023 reached Euro 538.6 million, +49.7% compared to Euro 359.8 million at 30 September 2022, that included just one quarter of the businesses entered in the group with business combination with Liomatic, GeSA and Vendomat.

According to the new division of the groups’ activities, the operating businesses showed the following turnover performances (before intra group elisions).

1) Vending business (including four areas: Italy, France, Spain and Other countries): Euro 364.7 million, +33.2% compared to 273.8 million at 30 September 2022.

2) Resale business: Euro 99.5 million. This division was not present before the business combination and therefore the comparison between 2023 and the third quarter 2022 (sales of Euro 29.3 million) is not significant. Through the acquired businesses, the group is now also the Italian leader in this important market segment.

3) horeca business: Euro 16.3 million. This is a new business segment too for IVS Group (sales at 30 September 2022 were Euro 5.1 million), and it is mostly represented by activities owned by Liomatic (in Spain), and some business started by IVS in the second half of 2022.

4) Coin division business: Euro 28.0 million (+45.6%), from Euro 19.2 million, with no contributions from the business combination, but including N-and Group, specialized in production and sale of touch screens, mostly destined to the vending sector, and to the improvement of digital users’ interfaces; this division shows a sales growth in all the most important businesses, and the ongoing increase of the payment app CoffeecApp® (over 1.5 million registered users and around 430,000 active users).

The total number of vends at 30 September 2023 was equal to 740.3 million +28.7% from 575.2 million at 30 September 2022.

Average price per vend (net of VAT) was equal to Euro 52.30 cents, from 50.50 cents (+3.6%) of the same period of 2022. The actual price increase in percentage was higher, but the average includes the selling prices of Liomatic and GeSA that, compared to IVS, in the Italian market, are quite similar for Liomatic (that however has a higher cost of goods sold) and are around 10% lower for GeSA.

The price increase policy will therefore continue to deploy its effects for quite a long time on the whole client’s base.

EBITDA is equal to Euro 78.6 million, increased by 27.3% compared to Euro 61.8 million at September 2022.

EBITDA Adjusted is equal to Euro 81.4 million, +30.2% from Euro 62.5 million at September 2022. Some specific costs emerged in new countries (Germany) affected the 3Q2023 EBITDA, together with a weak volumes trend in September 2023 compared to September 2022.

EBIT Adjusted increased by 34.3% to Euro 21.9 million, from Euro 16.3 million at September 2022.

Consolidated Net Profit at September 2023 is equal to Euro 4.7 million. Net Profit Adjusted for the exceptional items is equal to Euro 6.9 million (before Euro 1.3 million attributable to minorities).

Margins of the business areas, with their different levels of profitability, in particular vending and resale business, start to reflect the positive effects expected from the business combination.

Amortisations include the allocation to specific amortisable assets of some parts of the purchase price and goodwill emerging from the business combination (around Euro 5.3 million of depreciation in the first nine months of 2023). Overall, the amortisation of intangible assets reflecting the group’s acquisitions (i.e. clients list, brands) are equal to Euro 9.9 million.

If the results at 30 September 2023 were compared in homogeneous terms to September 2022, with equal perimeter, assuming that the business combination were already completed at the beginning of 2022, the increase of all the parameters of profitability (EBITDA, EBIT, pre-tax profit, net profit) would be remarkable, around – respectively – +8%, +31%, +148%, +1000%.

Net Financial Position (“NFP”), is equal to Euro -422.5 million (including Euro 64.0 million debt deriving from rent and leasing contracts according to the definitions of IFRS 16), from Euro -417.0 million (restated) at the end of 2022.

In the Net Debt are included Euro 10.4 million dividend (paid in July) and Euro 8 million interests accrued on the bond expiring on October 2026, while is not included the VAT credit (Euro 13.4 million at the end of September 2023).

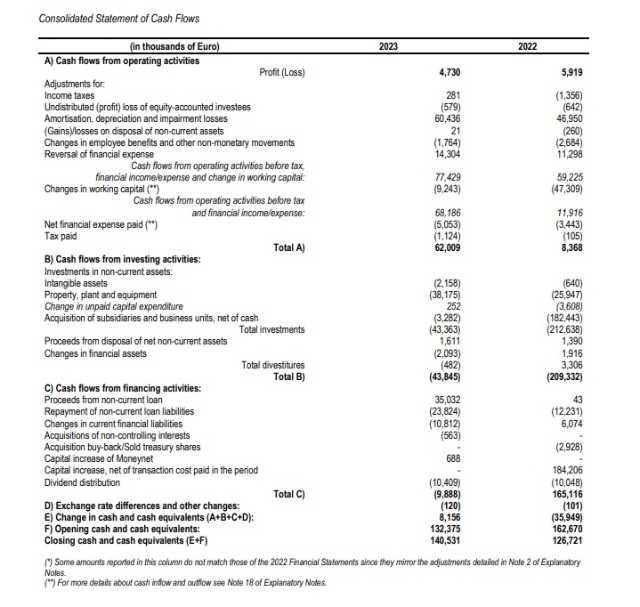

During the first nine months of 2023 the group generated an operating cash-flow of Euro 62.0 million, strongly increased from Euro 8.4 million in the first nine months of 2022). In more detail, operating cash-flow of 3Q2023 includes a remarkable amount of cash absorbed by the increase of working capital (Euro 20.5 million), whilst in 3Q2022 were included several payment made immediately after the completion of the business combination, so making poorly comparable 3Q2023 to 3Q2022.

In the first nine months of 2023 payments were made for net Capex of Euro 38.4 million (Euro 28.8 million at 30 September 2022) and Euro 3.3 million for M&A (not comparable to 30 September 2022 that included the prices paid for the business combination).

Other significant events occurred after 30 September 2023 and prospects for the year

2023 will represent for IVS Group the first full year with the new activities and organisation arising from the business combination, effective in July 2022.

The integration, aimed at strengthening the leadership in the addressed vending markets and business targeted by the group, based on operations excellence, and on costs and revenues synergies, is proceeding according to plans, with the achievement of the expected benefits in a period of around two years from the transaction.

The present scenario, with a high inflation and the consequent impact on consumptions especially starting from 3Q2023, slowed-down the expected recovery of sales volumes. This slow-down will be compensated by new important contracts, already awarded, with large international groups in the automotive industry, and in locations with high visibility and passenger traffic in the transport sector, that will also allow a further development of digital payment systems and contact opportunities with final consumers.

At the same time, the utmost attention will be paid to the efficient allocation of resources and to possible savings opportunities within the larger group size.

In the core vending business, the important target of 1 billion vends at the end of 2023 is achievable, with an increase of margins in all the business areas.

The results in detail