ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of September 2019.

It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

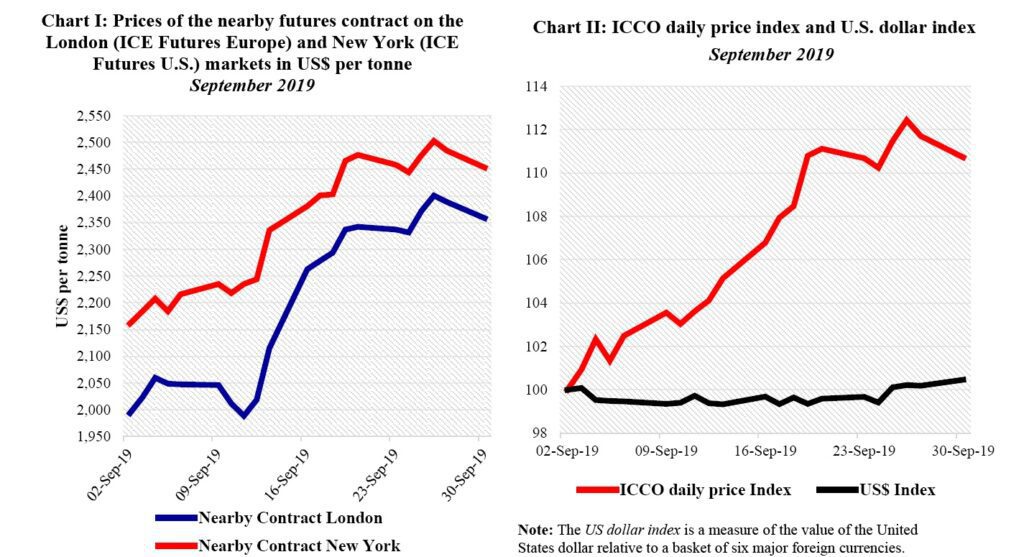

Chart I shows the development of the nearby futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars.

Chart II depic ts the change in the ICCO daily price index and the US dollar index in September By comparing these two developments, one can disentangle the impact of the US dollar exchange rate on the development of the US dollar denominated ICCO daily price index.

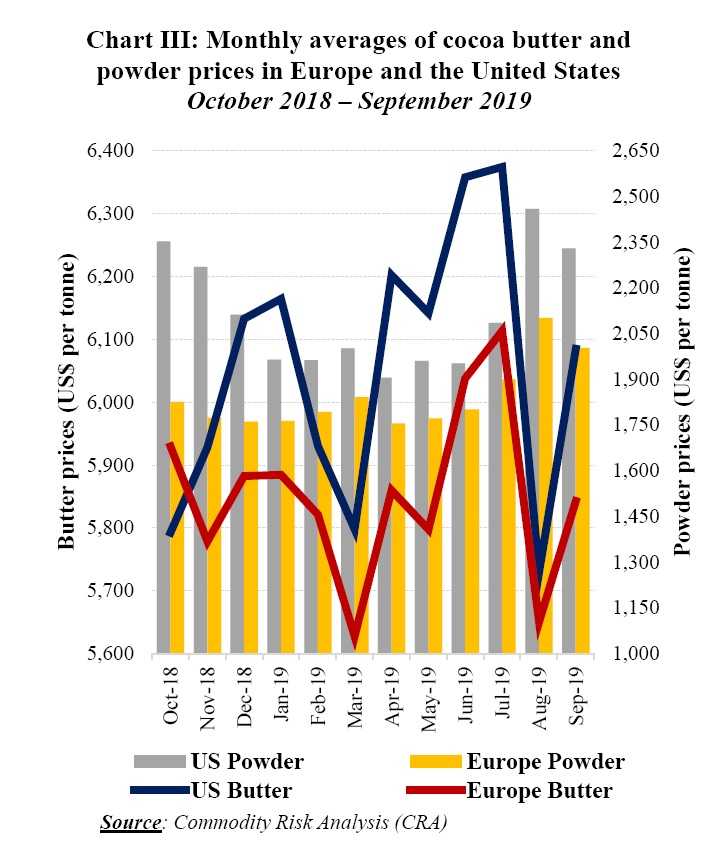

Finally, Chart III illustrates monthly averages of cocoa butter and powder prices in Europe and the United States during the 2018/19 cocoa season

Price movements

During September, the prices of the nearby contract increased considerably on both the London and New York markets Chart I.

Compared to the first trading session of the month and the closing values observed during the month under review prices rose by 18% from US$ 1 993 to US$ 2 358 per tonne in London and by 14% from US$2, 161 to US$2, 453 per tonne in New York.

On closer inspection, the bullish trend started soon after the expiry of the SEP 19 contract, which was pricing the tail end of the 2018/19 season, on 13 September. Indeed, the spreading of Cocoa Swollen Shoot Virus Disease ( in Ghana and wetter weather conditions prevailing in Côte d’Ivoire raised concerns over the size of the 2019/20 main crop in the first and second largest world cocoa producers.

On closer inspection, the bullish trend started soon after the expiry of the SEP 19 contract, which was pricing the tail end of the 2018/19 season, on 13 September. Indeed, the spreading of Cocoa Swollen Shoot Virus Disease ( in Ghana and wetter weather conditions prevailing in Côte d’Ivoire raised concerns over the size of the 2019/20 main crop in the first and second largest world cocoa producers.

As a result, cocoa futures contract prices gained strength on both the London and New York markets As shown in Chart II, the US dollar index stagnated whilst the ICCO daily price index was reinforced by 11% over the reviewed month.

Hence the strengthening of cocoa prices was due to market fundamentals and other factors rather than currency fluctuations.

The developments in cocoa butter and powder prices in Europe and the United States as presented in Chart II I indicate that, during the 2018/19 cocoa season prices for cocoa butter and powder developed in opposite directions on both leading cocoa consuming markets.

Indeed, prices for cocoa butter improved by 5% from US$ 5,792 to US$ 6,085 per tonne in the United States, whilst in Europe they declined by 1.5% moving from US$5,929 to US$5,843 per tonne.

Regarding cocoa powder, as compared to the levels reached at the start of the 2018/19 crop year prices ebbed by 1 from US$ 2 353 to US$ 2 330 per tonne in the United States. At the same time in Europe, powder prices ascended by 10% from US$1,826 to US$ 2,003 per tonne.

In addition compared to their average values recorded in October 2018 the nearby cocoa futures contract prices progressed by 5% and 9% in London and New York respectively at the end of September 2019. They rallied from US$2,092 to US$2,193 in London, while in New York they escalated from US$2, 140 to US$2,341 per tonne.

Cocoa supply and demand situation in the market

The 2018/19 crop year is over and as at 23 September 2019 cumulative arrivals of cocoa beans in Côte d’Ivoire were reported to have reached 2.164 million tonnes, up by 10.7% from the 1.954 million tonnes recorded at the same period last season.

During the period 16 22 September 2019, only 4,000 tonnes of cocoa beans were sent to Ivorian ports, down from 14,000 tonnes seen a year ago.

In addition, the country has exported 1,534 million tonnes of cocoa beans over the timeframe October 2018 August 2019 against 1.491 million tonnes during the same period of the 2017/18 cocoa season

According to officials from the Ivorian cocoa sector regulatory body Le Conseil du Café Cacao, domestic grindings settled at 566,000 tonnes in the course of the 2018/19 season.

As at 3 October 2019, exports of cocoa semi finished, products from Côte d’Ivoire attained 412,577 tonnes, up by 10% from 374,561 tonnes recorded a year earlier.

At the start of the 2019/20 cocoa season, Côte d’Ivoire and Ghana opened the marketing season by jointly announcing their farmgate prices.

In Côte d’Ivoire, the farmgate price of cocoa beans was established at US$ 1,394 per tonne, up by 10% from US$1,267 per tonne applied last season. Concurrently in Ghana the farmgate price of cocoa beans settled at US$1,528 per tonne 8% higher compared to the level of US$1,409 per tonne seen during the 2018/19 season Moreover, Côte d’Ivoire ’s harvest for the 2019/20 cocoa season is envisaged at 2 million tonnes while in Ghana the crop size is anticipated at 850,000 tonnes.