TREVISO, Italy – The Board of Directors of De’ Longhi SpA approved today the consolidated results of the first quarter of 2022. In the last two years, the change in consumer habits, with a prevalence of “stay at home”, and the consolidation of some trends already in place in the market, have favored the expansion of the small domestic appliance business globally.

De’ Longhi Group financial report

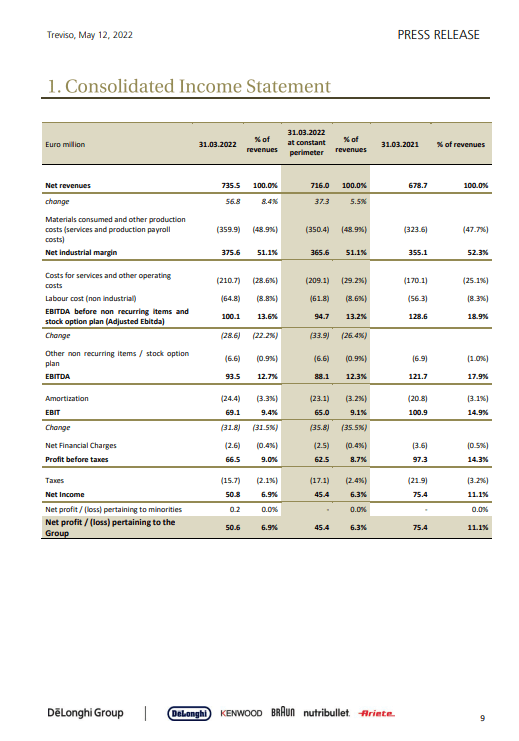

- revenues up 8.4% to € 735.5 million (+ 5.5% on a like-for-like basis);

- an adjusted Ebitda of € 100.1 million, equal to 13.6% of revenues, comparing with 18.9% of Q1-2021 (but improving the 10.7% of 2020);

- an Ebit of € 69.1 million, equal to 9.4% of revenues compared to 14.9% of the previous year ;

- a net profit of € 6 million, equal to 6.9% of revenues;

- a positive net financial position of € 6 million, resulting from the contribution of the 12 months free cash flow (before dividends and acquisitions) of € 170.7 million.

In the words of Massimo Garavaglia, Ceo: “We are very satisfied with the results of this first quarter, even more significant in light of the difficult comparison with the first quarter of 2021 which had recored exceptional results with revenues growing by around 60% on a like-for-like basis.”

“At the start of the year, our group is responding with determination to the numerous challenges posed by a highly complex and rapidly evolving macroeconomic and geopolitical scenario, in which cost inflation and difficulties in the supply chain are added to the fears of the impacts of the military escalation in Eastern Europe on the consumption dynamics.”

“However, despite the presence of a strongly evolving macroeconomic context, in the light of the current elements we are not changing the previous guidance.”

“In conclusion we remain convinced that the strategy of focusing on the core categories – in particular the coffee one – constant investment in products and our brands, geographical development and discipline in price management, remains the winning strategy for the creation of value in the medium and long term”.

In this first quarter of 2022, the De’ Longhi Group was able to continue on its development path, despite the difficult comparison with the previous year, which had seen a first quarter up by almost 60% (on a like-for-like basis ), thanks in particular to the favorable evolution of the espresso coffee segment.

The criticalities

At the beginning of the year, however, the Group found itself facing some criticalities, arising globally, especially in the supply chain, which required an extraordinary effort in order to give continuity to the production and distribution of its own products in the reference markets.

In particular, in order to cope with the growing inflation dynamics affecting production and distribution costs in the last 12 months, the Group has implemented various mitigation measures, including production efficiency actions and a selective price increase strategy, with the aim of preserving the industrial margin from the negative impacts of these dynamics.

The reveluation of assets

Finally, a further element of complication and concern, due to the effects it could have on consumption dynamics, is represented by the conflict between Russia and Ukraine, which led the Group to review the valuation of some assets relating to the Ukrainian market and to suspend all investments and the distribution of new supplies to Russia.

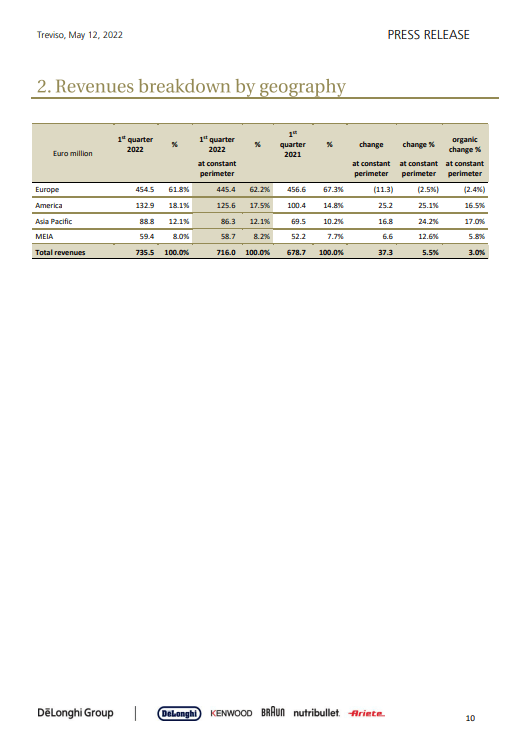

In the first quarter of 2022, revenues grew by 8.4%, reaching € 735.5 million. On a like-for-like basis, growth stood at 5.5%, with a contribution from currencies equal to 2.5 percentage points of growth. The main geographic areas – with the exception of North-Eastern Europe – closed the quarter in positive territory.

At the reported level:

• South-western Europe grew by 3.9% in the period, thanks to the expansion of Germany at a double digit growth rate and a high single digit expansion of the Iberian region and Austria;

• North-eastern Europe recorded a negative performance, both due to the difficult geopolitical situation, which affected consumer sentiment in some countries, and due to the challenging basis of comparison with last year (as an example, the UK market which had recorded revenues up by + 93% on a like-for-like basis in the first quarter of 2021);

• the MEIA region closed the period with double-digit positive growth, thanks to the expansion of the main markets;

• the America region has accelerated the path of expansion, achieving significant double-digit growth thanks to the development of the coffee business and an early sales season of portable air conditioners;

• finally, in the Asia Pacific region, the double-digit growth was driven by the strong dynamics of Greater China as well as by a significant expansion of the other main markets in the area (Australia and New Zealand, Japan, South Korea).

The evolutions of product segments

As regards the evolution of product segments, in the first quarter of 2022 the double digit growth of the coffee sector drove the expansion of the Group, accompanied by an increase in comfort and a decrease in food preparation.

More specifically, the coffee segment confirmed the solid growth trend highlighted in recent years, with a strong boost from the main countries of the Euro area, USA and Asia.

Core products grew at a double-digit rate, despite the high level of turnover achieved in 2021, also supported by the launches of new products and the success of the global communication campaign that sees Brad Pitt as Ambassador of the De’ Longhi brand.

A more diversified scenario for food preparation, which, though suffering from the challenging comparison with 2021, remains largely positive compared to the values achieved in the years 2020 and 2019.

In this context, some categories such as food processors or deep-fryers maintained a positive trend compared to last year, while the kitchen machines family showed a decline compared to the important levels reached in 2021 (while remaining higher than the 2020 and 2019 values).

The contribution of the comfort segment (portable air conditioning and heating) was positive, thanks to an early sales season of portable air conditioners.

Finally, home care is negative with opposite trends for the two product families of cleaning (negative) and Braun branded ironing (positive).

De’ Longhi: the evolutions of margins

Looking now at the evolution of margins in the first quarter:

• the net industrial margin, equal to € 375.6 million, stood at 51.1% of revenues compared to 52.3% last year. However, at constant exchange rates the margin improved slightly (to 52.6%). In particular, in the quarter, the impacts of cost inflation on raw materials and freight were only partially offset by the positive effect of price-mix;

• adjusted Ebitda amounted to € 100.1 million, equal to 13.6% of revenues (compared to 18.9% in 2021 and 10.7% in 2020 reported), down due to investments in communication and media (which accounted for 12.1% of revenues in the new perimeter compared to 10.5% of the previous year), higher operating and overhead costs and a negative exchange rate effect of

€ 8.4 million;

• EBITDA was € 93.5 million, or 12.7% of revenues, including a negative impact of € 6.6 million relating to non-recurring charges and the notional cost of the stock option plan;

• EBIT amounted to € 69.1 million, equal to 9.4% of revenues;

• finally, net income was € 50.6 million, with an incidence of 6.9% on revenues.

The dynamics

Non-recurring expenses included a review, in relation to the recent geopolitical crisis in Ukraine, of the valuation of some current assets of the working capital held at the balance sheet date, for a negative amount of approximately € 5.1 million, in addition to the donation of € 1 million in favor of non-governmental organizations in support of the populations affected by the conflict in Ukraine.

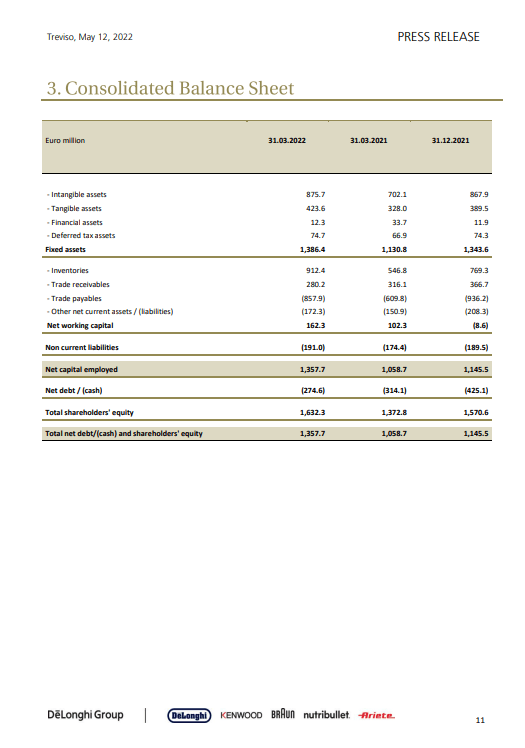

As to the balance sheet, the quarter was characterized by a dragging of the dynamics of increase in inventories seen in 2021 and by an increase in industrial investments linked to the new Romanian plant, all factors which led to a temporary cash absorption and not representative of the overall trend. expected for the year.

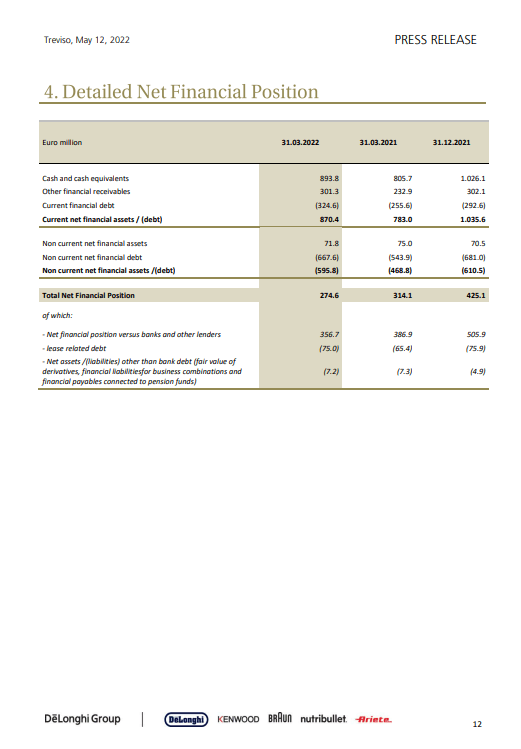

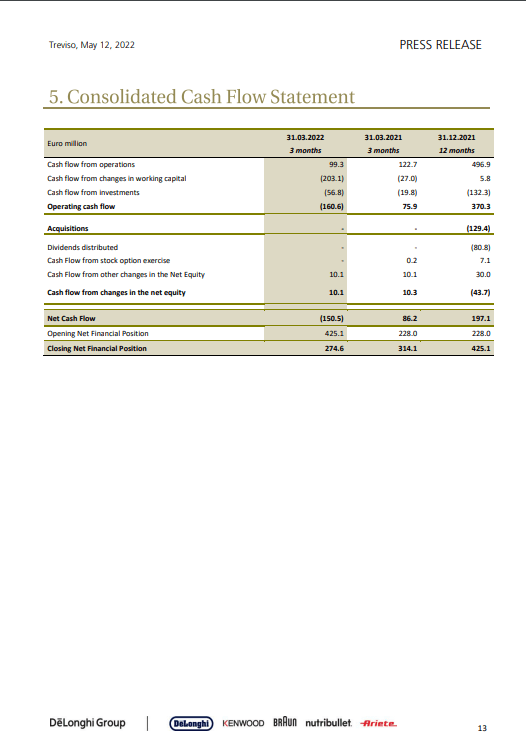

At the end of the quarter, the Net Financial Position was positive for € 274.6 million, compared to € 425.1 million at the end of 2021 and to € 314.1 million at the end of March 2021.

The net position with banks and other lenders was positive for € 356.7 million (compared to € 505.9 million at the end of 2021).

However, having said the above, excluding the disbursements relating to dividends (€ 80.8 million) and acquisitions (€ 129.4 million), the 12-month Free Cash Flow was solid, equal to € 170.7 million.

More in detail, in the first quarter:

- capex amounted to € 56.8 million (an increase of € 36.9 million compared to the same quarter of 2021), including the disbursement of € 21 million for the acquisition of a new plant in Romania;

The ratio of operating net working capital to 12 month rolling revenues stood at 10.2%, compared to 6.2% at the end of 2021 and 9.6% at the end of Q1-2021.

The financial report