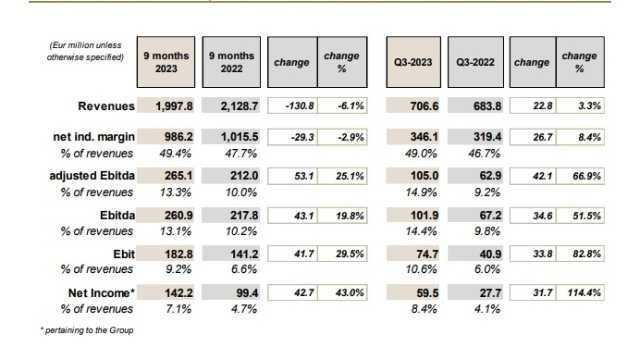

TREVISO, Italy – The Board of Directors of De’ Longhi SpA approved the consolidated results for the first nine months of 2023. In the third quarter the Group achieved: revenues of € 706.6 million, up 3.3% (+8.1% at constant exchange rates); an adjusted Ebitda of € 105 million, equal to 14.9% of revenues (a marked improvement compared to 9.2% last year); positive free cash flow before dividends of € 14.3 million.

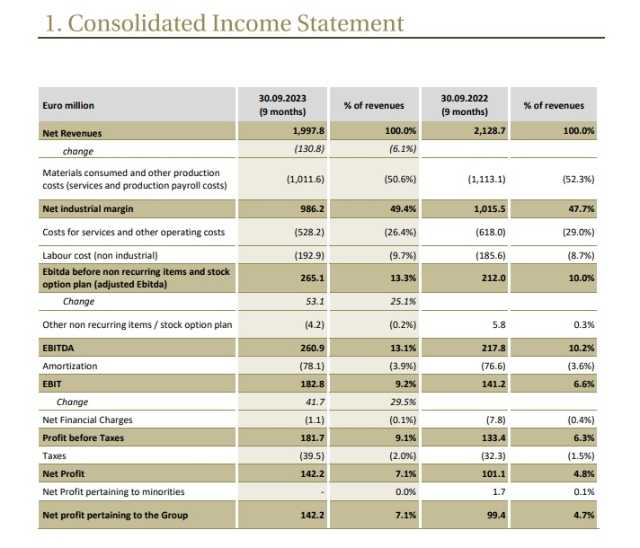

In the first nine months the Group De’ Longhi achieved:

• revenues of € 1,997.8 million, down by -6.1% (-4.2% at constant exchange rates);

• adjusted Ebitda at € 265.1 million, equal to 13.3% of revenues (up 25.1%);

• net profit at € 142.2 million, equal to 7.1% of revenues (improving from 4.7%);

• positive free cash flow before dividends of € 99.3 million.

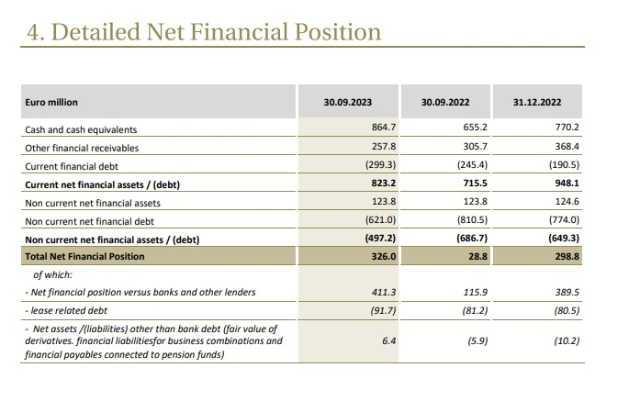

As of 30 September 2023, the Group’s net financial position was positive by € 326 million, an improvement of € 27.2 million compared to the € 298.8 million as of 31.12.2022.

In the words of the Chief Executive Officer Fabio de’ Longhi:

“The excellent results of the quarter allow us to look with extreme confidence to this phase of gradual normalization of the growth and profitability trends of the post-pandemic period. In particular, in recent months, our Group has achieved strong organic growth and an Ebitda at record levels, progressively offsetting the negative effects of inflationary pressures on production cost and consumption.

Aware of the complexity of the current macroeconomic and geopolitical scenario, we trust in the Group’s ability to overcome the challenges that this context presents us and to exploit the development potential offered by coffee and Nutribullet’s nutrition segments, thnaks to the renewed commitment to invest in innovation and communication and also supported by the new “Perfetto” and “Nutribullet: it’s that simple” campaign being launched in these current weeks.

Having said that, in light of the dynamics of progressive recovery of profitability, we look at the targets for the year with optimism. In particular, while confirming the estimate of slighlty decreasing revenues, we raise the guidance on the adjusted Ebitda for the year, which we estimate in the range of 420-440 million euros”.

Group De’ Longhi: general outlook

The third quarter highlighted high-single digit organic growth, so strengthening the improvement trend already noted in the second quarter and consolidating the phase of progressive post-pandemic normalization.

After a start to the year affected by some extraordinary factors, the Group showed a progression in the trends of the main categories, which can be interpreted as a substantial alignment between the sell-in and sell-out dynamics.

This progression was supported by the continuation of the expansion of the coffee category, both domestic and professional, and by the robust growth of the Nutribullet brand, which also partially contributed to bringing the cooking and food preparation sector back into positive territory.

In these first 9 months of 2023, the trend in margins was constantly improving compared to the previous year, thanks to a rigorous control of investments, a recovery of logistics costs and an easing of pressure on the remaining operating costs.

A further contribution to the improvement in profitability came from the positive effect of the price increases implemented last year and from the product mix which has been showing a path of premiumitization for years now.

In general, although the current macroeconomic and geopolitical context still remains characterized by uncertainty and variability, the core business segments give signals that confirm that resilience that we have mentioned several times in the past and which is based on a balanced combination of innovation, investments, leadership and product culture.

Group De’ Longhi: revenues

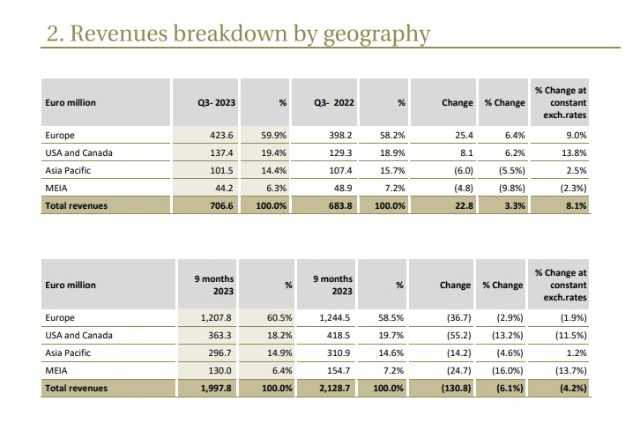

In the first nine months of 2023, revenues were down 6.1% to € 1,997.8 million, but with a third quarter growing by 3.3% to € 706.6 million.

The currency component had a significant negative impact on revenues equal to 2 percentage points of growth in the 9 months and 4.8 percentage points in the third quarter.

As a general comment, we highlight the positive data of a generalized organic growth of all macro-regions in the third quarter (with the sole exception of MEIA).

In particular, the European area showed a growth rate at a mid-single- digit rate (high-single-digit at constant exchange rates), after having been heavily affected in 2022 by both the effects of the geopolitical crisis and the weakening of consumers’ purchasing power.

In more detail, in Group De’ Longhi third quarter:

• South-West Europe showed an expansion in turnover of +7%, thanks to the increase in both core categories which contributed to achieving double-digit performance in Germany, Austria and the Iberian region;

• North-East Europe accelerated vs. the previous quarter, benefiting from significant growth in the UK, Benelux and in the area of the Czech Republic, Slovakia and Hungary, supported both by a recovery in the food preparation business and by a continuation of coffee expansion in the area;

• the MEIA region was still in negative territory, mainly due to the macro context and the currency impact;

• in the Americas area, turnover – which in the first 6 months had been affected by the discontinuity in mobile air conditioning – achieved an acceleration in the quarter (+13.8% organic) thanks to the contribution of coffee and the Nutribullets’ nutrition segment;

• finally, the Asia Pacific region showed an expansion in turnover of +2.5% at constant exchange rates, but with a significant negative currency impact in many countries in the area both in the quarter and in the nine months (8 percentage points of growth subtracted from third quarter).

As to the evolution of product segments, the core categories showed a progressive improvement over the course of the year, achieving good organic growth in the quarter.

As regards the performance of coffee machines for households, the company highlights the expansion, at constant exchange rates, of the entire segment, driven by fully automatic machines and capsule systems.

A positive discontinuity was provided by cooking and food preparation, which achieved growth at a mid-teens rate in the quarter, thanks to the strong expansion of the nutrition segment, under the Nutribullet brand, in addition to the recovery of many of the product families, such as food processors, spin juicers and fryers (but with Kenwood’s kitchen machines still in moderate decline).

Comfort products (portable heating and air conditioning) remained in negative territory in the quarter due to the postponement of the winter season in some relevant markets.

Home care (floor care and ironing) achieved double-digit growth, thanks to a significant acceleration in the ironing category branded Braun.

Finally, we highlight the outstanding growth of Eversys’ professional coffee makers, with a growth beyond +30% in the quarter, thus bringing the weight of this business to 5% of the Group’s total revenues in the nine months.

In the first nine months of 2023, the Group was able to significantly increase the level of profitability, despite the weakness of volumes due to the complexities faced in the very first part of the year.

The price increase strategy implemented last year, together with careful cost management, made it possible to offset the negative effect of the decline in turnover.

In the third quarter:

• the net industrial margin stood at € 346.1 million, equal to 49% of revenues (49.4% in the 9 months) compared to 46.7% in 2022, benefitting from the recovery of some production costs. We highlight that in the 9 months the price-mix effect was positive by € 30.4 million;

• adjusted Ebitda amounted to € 105 million, or 14.9% of revenues (13.3% in the 9 months), a marked improvement compared to the 9.2% of the third quarter of 2022 and in continuity with the marked improvement achieved in the first six months. The improvement in profitability was also supported by the lower exposure to investments in media and communication (“A&P”), which fell by approximately € 9 million in the quarter and by approximately € 33 million in the 9 months, in line with management plans ;

• Ebitda amounted to € 101.9 million, or 14.4% of revenues (9.8% in 2022) after € 3.1 million of non-recurring expenses (which compare with € 4.4 million non-recurring income in the third quarter of 2022);

• Ebit stood at € 74.7 million, equal to 10.6% of revenues (6% in 2022), after depreciation in line with the previous year (equal to € 27.2 million );

• Finally, the net profit pertaining to the Group amounted to € 59.5 million, (€ 142.2 million in the 9 months) or 8.4% of revenues (4.1% in 2022).

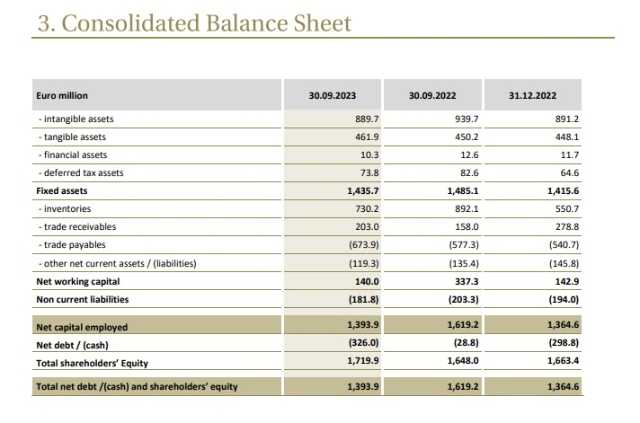

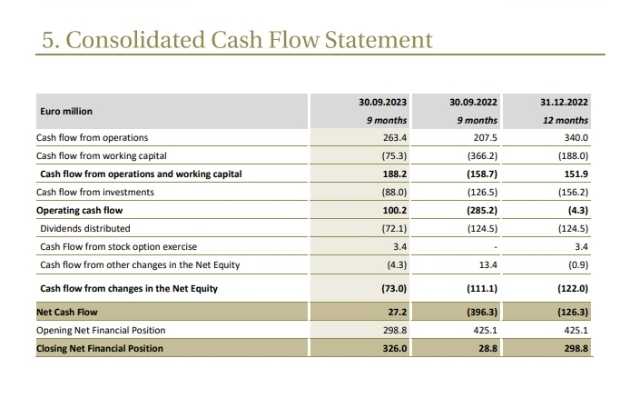

The Group closed the third quarter with a positive Net Financial Position € 326 million, up € 27.2 million in the nine months and € 297.2 million in the 12 months rolling.

Similarly, the Net Position towards banks and other lenders also marked an improvement both in the 9 months (+21.9 million) and in the 12 months rolling (+295.4 million), reaching € 411.3 million.

Free cash flow before dividends and acquisitions amounted to € 14.3 million in the quarter, € 99.3 million in the 9 months and € 369.2 million in the 12 months rolling.

In particular, the company would like to point out that in the nine months, the Group was able to generate € 188.2 million of cash from current operations and working capital movements, compared to a diametrically opposite picture of last year (€158.7 million of absorption in the 9 months of 2022).

At the operating working capital level (equal to 8.6% of 12 months rolling revenues), the increase of € 179.5 million in inventories in the 9 months is in line with the economic-financial cycle of this phase of the year, characterized by an increase in production and stocks in view of the fourth quarter and the related Christmas season.

However, in the 9 months, the increase in trade payables, together with the reduction in trade receivables, contributed to the final positive operating cash flow figure of the period.

Finally, capital expenditures absorbed € 88 million of cash in the 9 months, a sharp decrease compared to the € 126.5 million in the 9 months of last year.

De’ Longhi financial results on detail