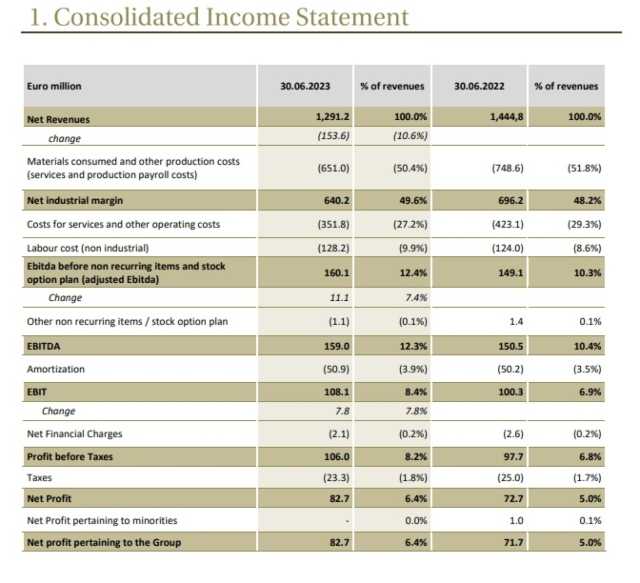

TREVISO, Italy – The Board of Directors of De’ Longhi SpA approved the consolidated results for the first six months of 2023: revenues of € 1,291.2 million, down by -10.6% (-10% at constant exchange rates); an adjusted Ebitda of € 160.1 million, equal to 12.4% of revenues (up from 10.3%); a net profit of € 7 million, equal to 6.4% of revenues (an improvement from 5%); a free cash flow (before dividends) of € 85.

In the second quarter, the Group De’ Longhi achieved:

- revenues of € 8 million, down by -2.9% (-0.9% at constant exchange rates), but up by 1.8% net of the effect of the exit from the air conditioning business on the American market ;

- an adjusted Ebitda of € 88 million, equal to 12.5% of revenues (a marked improvement from 6.9%);

- a free cash flow (before dividends) of € 5 million.

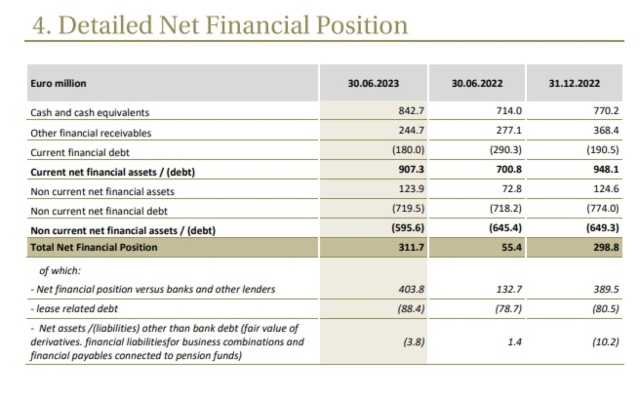

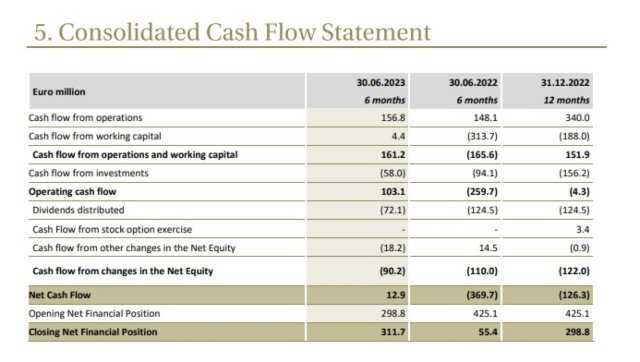

As at 30 June 2023, the Group’s net financial position was positive by € 311.7 million, improving from € 298.8 million as at 31.12.2022. The Board of Directors also approved the Group’s Sustainability Report for the 2022 financial year.

Commented the Chief Executive Officer Fabio de’ Longhi:

“We are very satisfied with the results achieved in the quarter, which confirm our expectations of a progressive normalization of growth and profitability trends in this post-pandemic phase. In particular, I would like to highlight the recovery of margins, which has resulted from a careful pricing strategy and strict control of investments, as well as a recovery of logistics costs and an easing of pressure on the remaining operating costs.”

“We are returning to normal business dynamics, despite a macroeconomic scenario characterized in the short term by the potential impacts of inflation and the increase in interest rates on households’ wealth and on consumption. Nonetheless, the Group can count on the intact development potential of the coffee and the Nutribullet-branded nutrition segments, which accounted for almost 65% of total turnover in the half-year and which are destined to represent the main engine in the medium term for the growth and the profitability of the Group”.

“In this context, therefore, we confirm the guidance for the year, which forecasts a slight decrease in revenues compared to 2022 and an adjusted Ebitda in the range of 370-390 million euros.”

The first half of 2023 ended with a decrease in turnover compared to the previous period, mainly due to some extraordinary and temporary factors which had a greater impact on the first months of the year.

As already highlighted in recent months, the challenging comparison with the first quarter of the last two years, the reduction in stock levels held by retailers and the exit from the mobile air conditioning business on the American market affected the sales’ trend in this first phase of 2023.

However, despite these factors, the revenues’ trend was continuously improving month after month, achieving a growing second quarter, if we exclude the aforementioned discontinuity on the American market. This result was favored by the recovery of growth in the European market, by the expansion of the coffee sector (in marked recovery after the temporary decline in the first quarter) as well as by the marked progression of Nutribullet’s personal blenders.

To complete the positive picture, margins appeared to be clearly improving compared to 2022, despite the decline in volumes, thanks to the positive contribution of prices and the product mix, as well as the cost containment.

In general, although the geopolitical and macroeconomic context remains difficult to read, especially as regards the dynamics of consumption, the expectations of organic growth recovery in the second half of the year, together with the improvement in margins compared to the previous year, allow the Group to be confident on the feasibility of the guidance for the year.

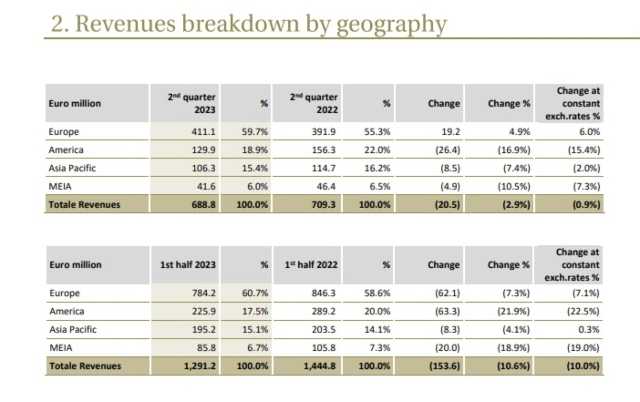

In the first half of 2023 revenues were down by 10.6%, reaching € 1,291.2 million, with a second quarter down by 2.9% to € 688.8 million. The impact of the discontinuity of mobile air conditioning in America was ca. € 56 million in the 6 months, net of which the turnover in the six months fell by 7.1%, while in the quarter it showed a positive trend of +1.8%.

The exchange rates component (including hedging management) contributed negatively by 0.6 percentage points of revenue growth in the half year and by 2 percentage points in the second quarter.

Over the last 12 months, the European region has been heavily affected by both the effects of the Russian-Ukrainian conflict (and the related deterioration in consumer sentiment) and the weakening of consumers’ purchasing power. However, over the last few months the region has shown signs of improvement compared to previous dynamics, returning to positive territory.

In detail, in the second quarter:

• the area of south-west Europe showed a turnover almost unchanged compared to the previous year (-1.2%), thanks to a strong recovery in France and Austria, while Italy and Germany still remained in negative territory;

• double-digit growth was achieved in North-East Europe, which benefited from an almost homogeneous recovery of the countries of the area, characterized by a significant acceleration of coffee combined with a substantial stabilization of the cooking and food preparation sector;

• the MEIA region saw its turnover fall mainly due to the macroeconomic context and the weakness of food preparation;

• in the Americas area, revenues were significantly penalized by the discontinuity relating to the exit from mobile air conditioning, with an impact of approximately Euro 33 million in the quarter; net of this effect, the area grew by 5.5% thanks to the expansion of the coffee and nutrition sector, linked to the Nutribullet brand;

• lastly, the Asia Pacific region showed a drop of -7.4% (-2% at constant exchange rates), as an effect of the negative performance of Australia and New Zealand, a marked slowdown compared to a particularly brilliant 2022, but with other major markets of Greater China, Japan and South Korea in strong growth.

As regards the evolution of the product segments, the second quarter delivered a return to growth in coffee, after the temporary decline in the first quarter, and a food preparation which, although still suffering, saw some product families (food processors, personal blenders, spin juicers and fryers) return to positive territory.

The comfort segment (portable heating and air conditioning) was heavily penalized by the aforementioned discontinuity represented by the exit from the portable air conditioning business on the American market.

Home care (floor-care and ironing) was also down, however accounting for only 2.9% of total turnover in the six months.

Finally, we point out the extraordinary growth of the Eversys professional coffee machine sector (+60.7% in the quarter and +58% in 6 months), the weight of which on total revenues for the half-year went from 3% to 5.2 %.

It should be noted that total coffee, both consumer and professional, now represents almost 60% of the Group’s turnover, a threshold which is reasonably expected to be exceeded in the next 12-18 months.

With regard to the evolution of the Group’s profitability, the six-month period saw a substantial improvement in margins despite the declining turnover. The price increase actions implemented last year, the improvement of the mix and a careful cost management made it possible to offset the negative effect of the decline in volumes.

In the quarter:

• the net industrial margin amounted to € 335.8 million, equal to 48.8% of revenues (49.6% in the half year) compared to 45.2% in 2022, benefiting from an improvement in the price-mix component, in addition to a substantial stability of the effect relating to production costs. More specifically, the price-mix effect contributed positively by approx. € 20 million (€ 40.2 million in the 6 months);

• adjusted Ebitda amounted to € 85.8 million, or 12.5% of revenues (12.4% in the half year), a marked improvement compared to 6.9% in the second quarter of 2022, and in line with the margin achieved in the first quarter. Profitability also benefited from the lower exposure in terms of investments in advertisement and promotions, which went down by € 8.8 million in the quarter and by € 24.5 million in the 6 months, in line with the management’s plans;

• Ebitda amounted to € 83.5 million, or 12.1% of revenues (8% in 2022) after

€ 2.3 million of non-recurring charges (compared to € 8 million of non- recurring income in the second quarter of 2022);

• Ebit stood at € 58 million, equal to 8.4% of revenues (4.4% in 2022), after amortization in line with the previous year (equal to € 25.5 millions);

• finally, the net profit attributable to the Group amounted to € 44 million, (€

82.7 million in the half year) or 6.4% of revenues (3% in 2022).

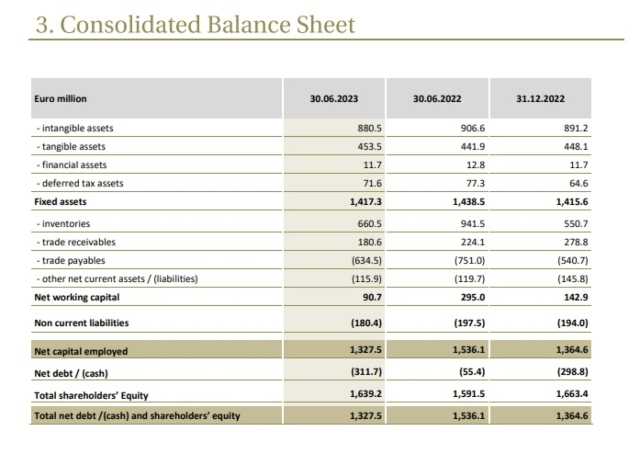

The Group ended the first half of 2023 with an active Net Financial Position of € 311.7 million, up by € 12.9 million in the half-year and € 256.3 million in the 12 months. Similarly, the Net Position with banks and other lenders was also positive for € 403.8 million, improving both in the half year (+14.4 million) and in the 12 months (+271.1 million).

Free Cash Flow before dividends and acquisitions was € 66.5 million in the quarter, € 85 million in the half year and € 328.3 million in the 12 months.

Looking at the main determinants of this positive result, the company highlights that in the half year the Group was able to generate € 161.2 million of cash flow from current operations and working capital movements (compared to the first half of 2022 in which there had been a absorption of € 165.6 million).

In terms of operating working capital (equal to 6.9% of rolling 12-month revenues), in the six months the company highlights an important cash generation of the trade receivables-payables aggregate (€ 200.1 million), only partially absorbed by the negative change in inventories (€ 123.2 million), physiologically increasing to € 660.5 million, but € 281 million lower than at the same date of last year.

Lastly, capital expenditures absorbed € 58 million of cash in the first half, a clear decrease compared to the 94.1 million of the previous year.

The company recalls that during the second quarter the Group paid out dividends for a total of € 72.1 million.

Events occured after the end of the period

There are no significant events following the end of the half year period.

Other resolutions of the Board of Directors

In today’s meeting, the Board of Directors also approved, in continuity with the publication of the Non- Financial Disclosure, the Group’s Sustainability Report for the 2022 financial year. The Report is accessible on the company’s website, clicking here.

The results in detail