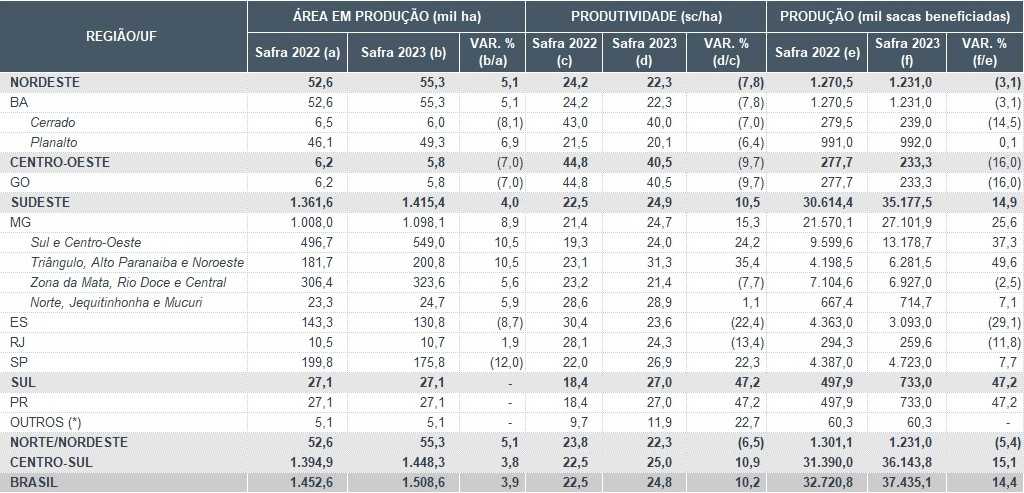

MILAN – Brazil’s Conab expects coffee production to reach this year a total of 54.9 million bags, or a 7.9% increase over CY 2022/23. More in detail, the country’s National Supply Company, depending from the Ministry of Agriculture and Supply (MAPA), sees Arabica output for CY 2023/24 (July-June) at 37.4 million bags, up 14.4% from the previous cycle.

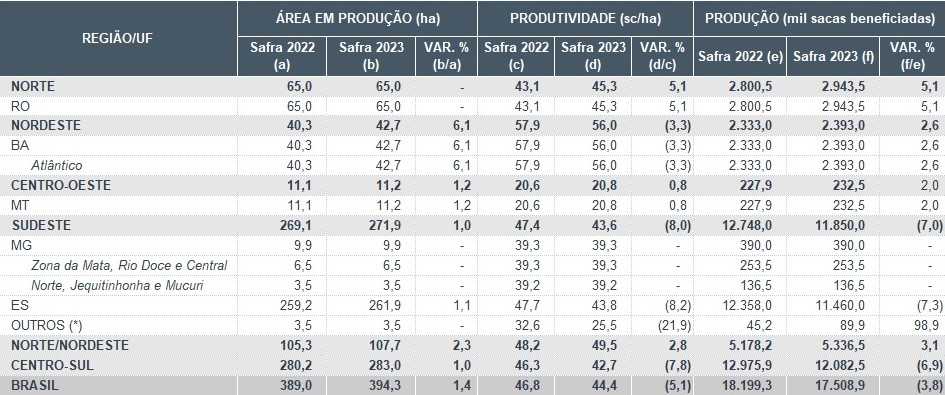

On the Robusta side of things, referred to in Brazil as conilon, production is set to decrease by 3.8% to 17.5 million bags.

The area planted with coffee will expand slightly to 2.258 million hectares (+0.8%), of which 1.9 million ha in production, up by 3.3%, and 355,500 ha for formation, down by 11%.

Productivity for the 2023 coffee crop is forecast at 28.9 bags/ha, up by 4.4% from the 27.7 bags/ha recorded in 2022, but well below a record level of almost 33.5 bags/ha reached in 2020.

Arabica productivity will rebound to 24.8 bags/ha, a 10.2% increase over last year, but still much lower than the peaks reached in 2020 and 2018.

The productivity for Robusta is seen at 44.4 bags/ha, down from a record level of 46.8 bags/ha in 2022.

Brazil’s Arabica coffee plant development and production normally follow a two-year cycle, with smaller crops in odd-numbered years as the plants grow the branches that will bear the usually much bigger crop produced in even-numbered years.

But frosts and droughts in 2021 hit the development of the plants and the Arabica crop was only slightly bigger in 2022 than the previous year.

Brazil had a record harvest of Robusta in 2022, but unhelpful weather last year affected plant development and the crop this year will be a bit smaller than last year, according to Conab.

The output in the state of Minas Gerais, Brazil’s biggest producer of Arabica, is expected to rebound by over 25% to 27.49 million bags, with productivity at 24.8% bags/ha, up 15% from the previous cycle.

Sul e Centro-Oeste (+37.3%) and Triângulo, Alto Paranaiba e Noroeste (+49.6%) will boost production to 13.2 and 6.3 million bags respectively. Norte, Jequitinhonha e Mucuri will see a slight increase, while production in Zona da Mata, Rio Doce e Central will decrease by 2.4% following an on-year in 2022.

Espirito Santo is the only major producer where the output is set to fall. Overall production is seen at 14.553 million bags, down 13% on year. The Robusta crop, of which this state is the biggest producer, will drop to 11.46 million bags, or a 7.3% decrease over year. Following a bumper crop in 2022, Arabica will fall sharply to little less of 3.1 million bags (-29.1%).

Sao Paulo will experience a 7.7% increase to 4.7 million bags.

Production in Bahia will stay flat (+0.6%) at 3.6 million bags, with a further increase of the crop of Robusta to 2.4 million bags (+2.6%) and a slight decrease in the Arabica crop, down 3.1%.

Production in Rondonia is nearing 3 million bags, or a 5.1% increase over year. Finally, Parana will rebound strongly (+47.2%) to 733,00 bags.