ABIDJAN, Côte d’Ivoire – For the 2022/23 mid-crop, the Ivorian and Ghanian regulators have left unchanged the fixed farm-gate price to 900 XOF per kg ($1,507 per tonne) and 12,800 GHS per tonne ($1,206 US per tonne), respectively¹, says the Cocoa Market Report for March 2023 of the International Cocoa Organization (ICCO).

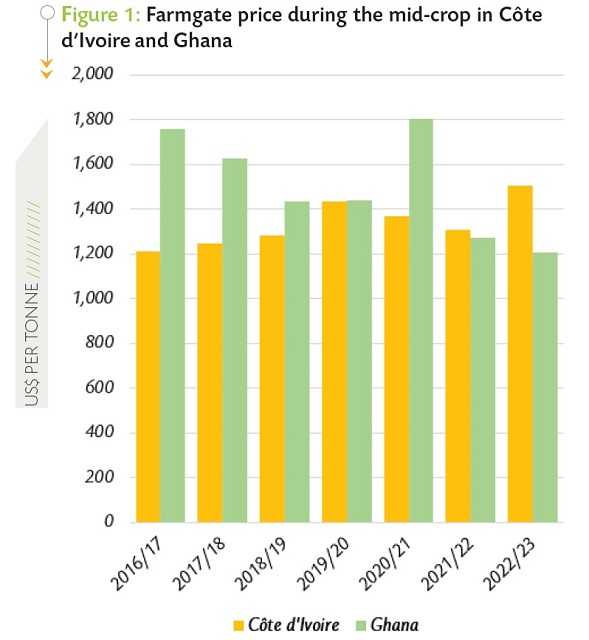

As presented in Figure 1, over the past five mid-seasons, farmgate prices in US$ nominal terms have been higher in Ghana compared to Côte d’Ivoire.

However, the situation was reversed during the mid-crops of the 2021/22 and 2022/23 seasons mainly due to the substantial depreciation of the GHS vis-à-vis the USD.

Current low year-on-year ports arrivals in Côte D’ivoire are virtually compensated by increases in Ghanaian cocoa purchases

While it has been recently reported that the Ivorian production will reach 2.4 million tonnes, current statistics and market information are not supporting this claim.

At the beginning of the 2022/23 light crop, although adequate meteorological conditions were reported in West Africa’s main cocoa growing regions, cumulative arrivals of cocoa beans in Côte d’Ivoire are lagging behind previous season levels while on the contrary in Ghana, volumes of graded and sealed cocoa beans are higher year-on-year.

Indeed, as at 31 March 2023, cumulative arrivals of cocoa beans in Côte d’Ivoire were seen at 1.779 million tonnes, down by 4.8% (down by 89,000 tonnes) compared to 1.868 million tonnes recorded during the corresponding period of the previous cocoa year.

In addition, gross exports of cocoa beans from the country during October 2022 – February 2023 were reported at 785,700 tonnes, down year-on-year by 1.5% compared to 797,525 tonnes.

In turn, the quantity of graded and sealed cocoa beans purchased in Ghana since the start of the 2022/23 season was reported at 566,846 tonnes by 9 March 2023, representing a robust 18% increase (up by 85,360 tonnes) from 481,486 tonnes recorded over the corresponding period during the 2021/22 cocoa year.

The year-on-year reduction of 89,000 tonnes in Côte d’Ivoire cumulative ports’ arrivals of cocoa beans over the first half of the 2022/23 cocoa year combined with the increase of 85,360 tonnes over the same period in Ghanaian purchases of graded and sealed cocoa beans results in a slightly negative net effect i.e. a year-on-year decrease in the supply of cocoa beans from Côte d’Ivoire and Ghana taken together.

Indeed, based on the latest available information, the total supplies of cocoa beans from the two-top world cocoa producers over the first half of 2022/23 is estimated at 2,345,846 tonnes, slightly down by 0.2% compared to 2,349,486 tonnes recorded at the same period of the previous season. It is however worth mentioning that the current state of play is subject to change as the mid-crop progresses.

Level of cocoa bean stocks in exchange licensed warehouses

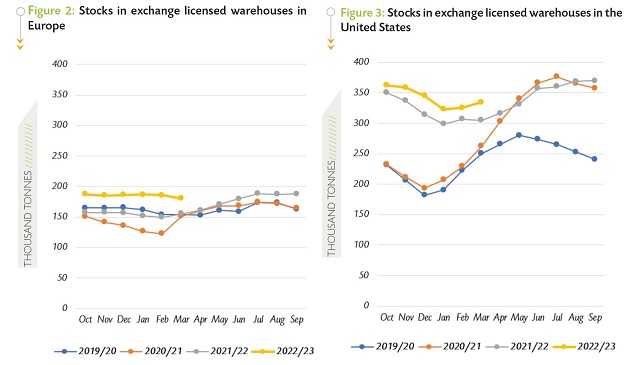

As shown in Figure 2 and Figure 3, despite their declining trend compared to the levels seen at the start of the 2022/23 cocoa year, stocks of cocoa beans held in ICE Futures licensed warehouses in Europe and the United States are high compared to the previous season.

In Europe, since the beginning of the 2022/23 season, Exchange monitored stocks averaged 185,153 tonnes, up by 20% compared to 154,731 tonnes recorded a year earlier.

Meanwhile, the average cocoa bean stocks in Exchange licensed warehouses in the United States have increased by 7% from 318,731 tonnes to 341,497 tonnes.

At the expiration of the DEC-2022 cocoa contract, a total amount of 82,770 tonnes of cocoa beans was tendered while at the maturity of the MAR-2023 cocoa futures contract, 72,280 tonnes of cocoa beans were tendered in Europe.

It is worth recalling that these two futures contracts priced cocoa beans during the main crop of the 2022/23 season. However, the level of certified stocks in Europe remained virtually stable, thereby indicating that the volume of cocoa tendered against the above-mentioned two futures contracts was not taken out from the Exchange licensed warehouses.

By the same token, stocks of cocoa beans in the United States did not present a significant downward trend during the first six months of the 2022/23 cocoa season at the expiration of the DEC-22 and MAR-23 contracts.

This subsequently contributed to maintaining certified stocks on the high in Europe and the United States warehouses.

Future price developments

Halfway through the 2022/23 cocoa year, prices of the first position of cocoa futures were broadly higher year-onyear on both the London and New York markets. Indeed, over October 2022-March 2023, the front-month cocoa futures prices averaged US$2,440 per tonne, up by 6% compared to US$2,304 per tonne recorded a year earlier in London.

At the same time in New York, prices of the nearby cocoa futures remained flat at US$2,560 per tonne during the first semester of 2022/23, merely up by 0.4% from US$2,550 per tonne recorded during the first semester of the 2021/22 cocoa season.

Focusing on March 2023, prices of the front-month cocoa futures contract oscillated between US$2,452 and US$2,670 per tonne in London and averaged US$2,553 per tonne, up by 12% compared to the average price of US$2,273 per tonne for the nearby contract recorded at the same period of the 2021/22 cocoa year.

In New York, the average price of the first position contract settled at US$2,778 per tonne, up by 8% from US$2,564 per tonne recorded in March 2022 and ranged between US$2,586 and US$2,927 per tonne.

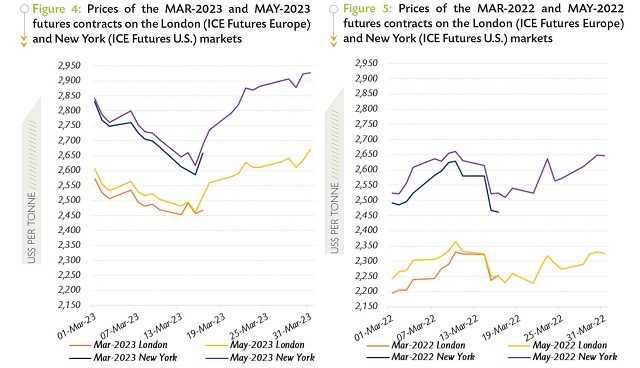

Figure 4 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in March 2023, while Figure 5 presents similar information for the previous year.

During the month under review, the global cocoa market prices were generally bullish, and this increasing momentum could be decomposed into two distinct sequences. At the approach of its maturity date on 16 March, prices of the MAR-23 contract developed downward (Figure 4), plummeting by 4% from US$2,574 to US$2,468 per tonne and by 6% from US$2,831 to US$2,658 per tonne in London and New York respectively.

During this period, the bankruptcy of the Silicon Valley Bank (SVB) brought pessimism to the global financial market and thereby contributed to curbing financial asset prices including cocoa futures contracts.

However, the panic in the financial market was short-lived given the immediate contingency measures taken in the United States to prevent a potential contagion which could have probably resulted in a financial crisis.

At the expiry of the MAR-23 contract, the nearby cocoa futures contract rolled over to the MAY-23 contract during the second half of the month under review. Over this period, prices of the first position of cocoa futures contracts were boosted on both sides of the Atlantic as concerns of a looming potential financial crisis were wearing off and lower year-on-year arrivals were recorded at Ivorian ports of exports.

In London, futures prices hiked by 4% from US$2,559 to US$2,670 per tonne, while in New York prices of the first position of cocoa futures rallied by 7% moving from US$2,737 to US$2,927 per tonne

1 From 01-05 April 2023, the average exchange rate was US$1 = XOF597.33 in Côte d’Ivoire and US$1 = GHS10.62 in Ghana