SINGAPORE, SINGAPORE – While consumer foodservice value nears pre-pandemic levels in 2024, dining-in at restaurants will not return to pre-pandemic level until 2028 in Asia-Pacific, according to a Euromonitor expert.

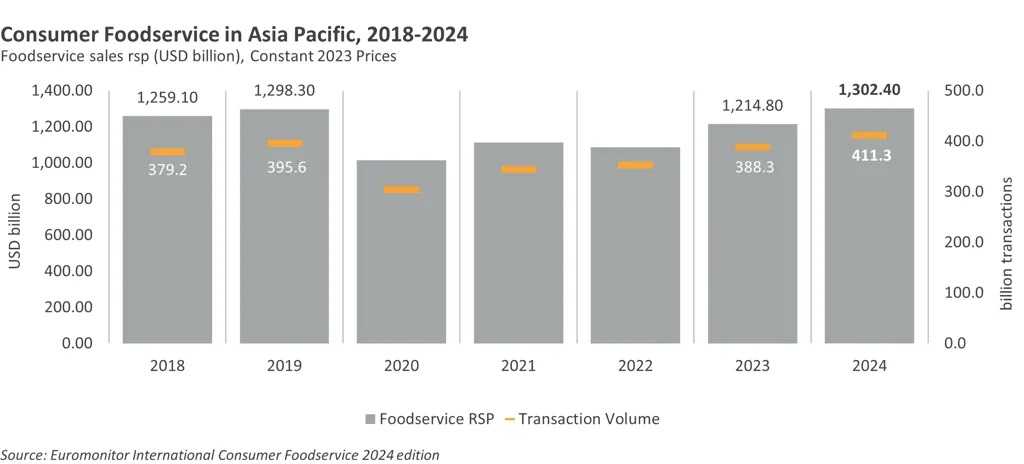

After a disappointing 2022, when consumer foodservice was badly hit by stringent restrictions and economic challenges, its revenues grew 12% to surpass US$1,210 billion in 2023. In transaction volumes, the market experienced 10% growth in 2023, outpacing the rate of new outlets opening, which remained at 3% growth.

However, it showed slower increase in retail value sales per transaction by 1% growth, indicating that order sizes were not growing significantly despite more consumption throughout foodservice in 2023.

Euromonitor expected APAC consumer foodservice spending figures to be back to pre-Covid levels in 2024, both in foodservice value and transaction volumes.

Regular dining out off the menu for cost-conscious consumers until 2028

Home delivery will continue to capture more share in the coming years due to continuous improvements in convenience and service while takeaway is already losing some of gains after the pandemic. The rapid growth of third-party delivery apps is also encouraging more consumers to have food delivered to enjoy a meal at home.

By 2028, delivery is expected to account for 23% of Asia-Pacific sales, compared to 21% in 2023. The share of eat-in is expected to stick at around 60%, with 66% in 2023 and 67% in 2028. The total percentage of eat-in spending in 2019 was 76% before the Covid-19 pandemic.

Emil Fazira, Food Insight Manager in Asia at Euromonitor International, said: “From 2018-2023, the Asia-Pacific consumer foodservice market shrank by 1% CAGR growth. Losses made during the pandemic, from extended restrictions and economic challenges and the volatility of the industry’s supply chain and demand, overpowered growth experienced in 2018 and 2019.

“Besides improving their point of sale and order fulfilment methods, foodservice operators also enhanced the perceived value of dining out, with full menus with a range of options at different price points.”

Coffee shops in Asia Pacific: New era bursting with international flavours

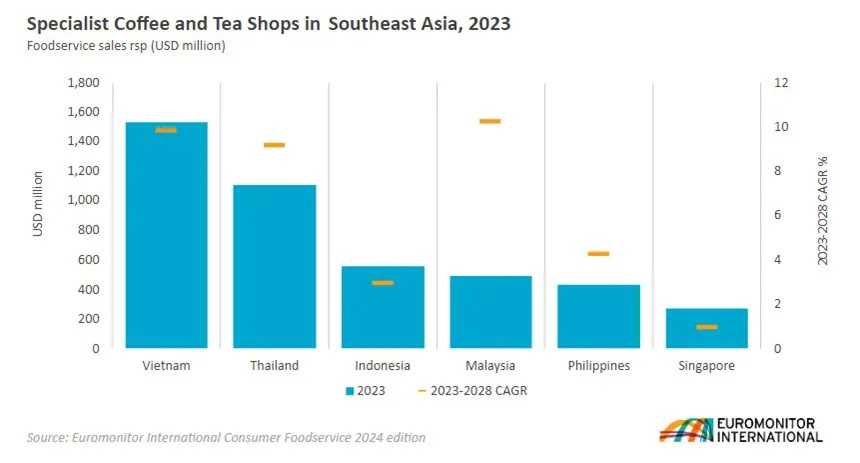

Coffee and tea shops boomed as several global coffee chains entered Asia Pacific countries expanding rapidly, particularly in Southeast Asia; accounting for US$4.4 billion and set to grow further by an 8% CAGR between 2023 and 2028.

In Singapore, China’s Luckin Coffee has expanded by more than 20 outlets in the space of less than a year. Other new names on the scene include South Korea’s Compose Coffee and Canada’s Tim Hortons. Indonesia’s Kopi Kenangan made its debut in Malaysia and Singapore over the last two years with 50 outlets, offering complimentary vouchers and local espresso options.

Nathanael Lim, Beverage Insight Manager in Asia at Euromonitor International, said: “Thanks to the region’s environment full of unique flavours, local consumers in the region are sophisticated, open to trying new flavours and are willing to spend well for their daily caffeine fix.

“With similar pricing strategy, flavour offerings and store formats, it remains to be seen whether they can all thrive in the long term. In fact, the inevitable exit of some chains will be seen especially in a small market like Singapore.”

Lim added: “To thrive in the long term, regional coffee shops must have strong investor funding and launch innovations, while constantly ensuring taste acceptability with affordable pricing to appeal to local consumers. Thet will need to expand further into new channels such as vending, drive thru and subscription services.”