BURLINGTON, Mass. and PLANO, Texas, U.S: — Keurig Dr Pepper Inc. yesterday reported second quarter 2018 results for Keurig Green Mountain (“KGM”) and Dr Pepper Snapple Group (“DPS”) for the period ending June 30, 2018.

Keurig Dr Pepper filed a Form 8-K/A with the U.S. Securities and Exchange Commission containing a presentation of KGM’s results for the second quarter ended June 30, 20181 and a Form 10-Q containing a presentation of DPS’s second quarter results.

Subsequent to the end of the second quarter, the merger of KGM and DPS was successfully completed.

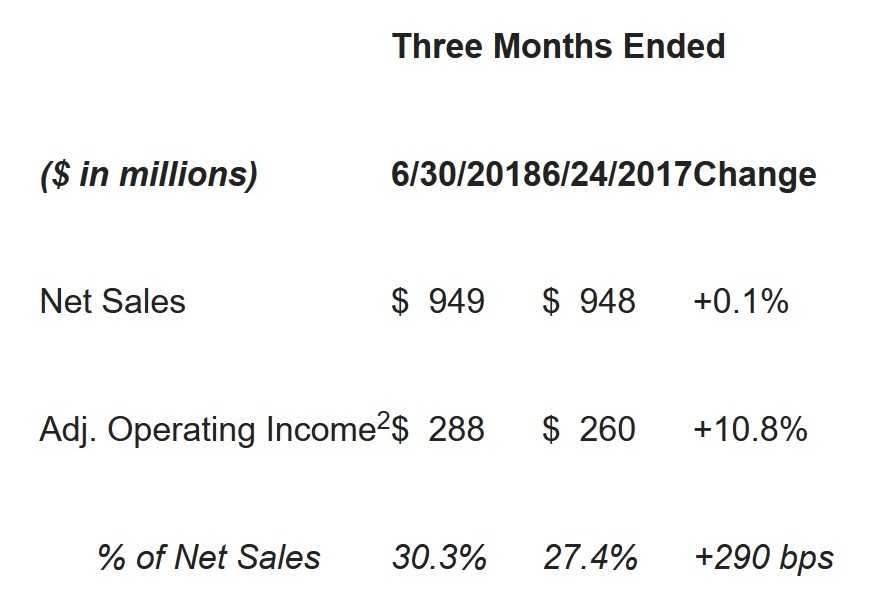

Keurig Green Mountain Q2 2018 Results

- KGM net sales were even with year-ago, as strong volume/mix of 3.2% and favorable foreign currency translation of 0.5% were essentially offset by the moderating impact of strategic pricing actions initiated in 2016.

- Operating income in the second quarter of 2018 totaled $170 million, after giving effect to merger-related expenses totaling $74 million and expenses related to the amortization of intangibles. Adjusted operating income2 advanced 10.8% versus year-ago to $288 million, an improvement of 290 basis points as a percentage of net sales.

KGM’s net sales performance in the second quarter of 2018 reflected high single-digit pod volume growth, driven primarily by growth in U.S. household penetration of the Keurig single-serve system, offset by lower net price realization due to strategic pricing actions and lower brewer sales due to timing related to brewer innovation.

Household penetration responded positively to increased marketing investment behind new brewer innovations, such as the K-Elite, introduced in March, and the K-Café, which debuted during the quarter. KGM Adjusted operating income advanced 10.8% versus year-ago, primarily driven by the benefits of significant productivity savings and SG&A overhead cost management, partially offset by significantly higher planned advertising investment.

KGM has continued to significantly reduce net debt3, with a reduction of $481 million at the end of the second quarter of 2018, compared to net debt at December 31, 2017, reflecting strong cash flow management and improved operating results. Since the end of the second quarter of 2017, KGM’s strategy of rapid deleveraging has reduced term loans and the revolving credit facility by a total of approximately $1.1 billion.

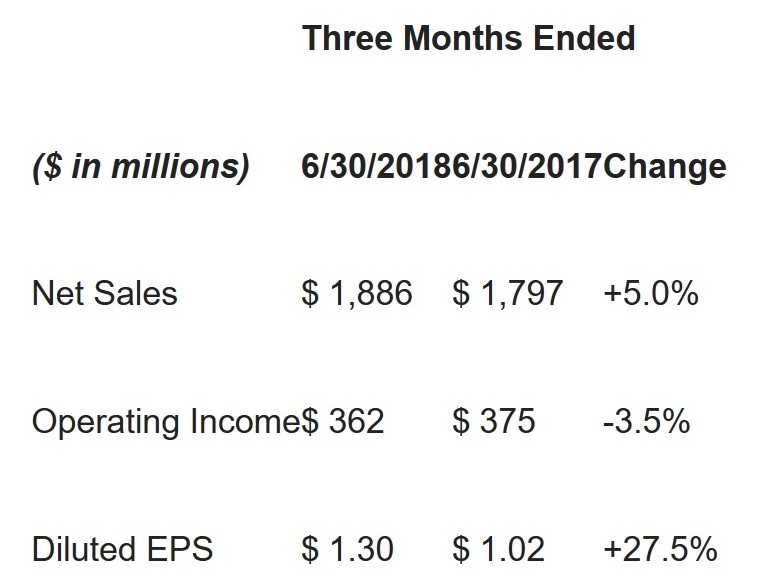

Dr Pepper Snapple Group Q2 2018 Results

- DPS net sales increased 5.0% versus year-ago, primarily reflecting favorable mix and higher volume, despite the shift of Easter into the first quarter of 2018.

- Operating income declined 3.5% versus year-ago, as expected, as inflationary cost increases have not yet been fully offset by pricing actions and productivity benefits, particularly in the Packaged Beverage segment.

- Diluted EPS of $1.30 advanced 27.5%, including the significant benefit in the second quarter of 2018 from the Tax Cuts and Jobs Act enacted in December 2017 and the favorable year-over-year impact from the 2017 loss on the early extinguishment of debt.

DPS’s net sales growth of 5% versus year-ago reflected the benefits of favorable mix of 3% and higher volume of 2%, including growth in contract manufacturing. Also benefitting the net sales comparison was modestly higher net pricing, offset by unfavorable foreign currency translation.

The strong net sales performance in the second quarter of 2018 was driven by successful innovation behind Canada Dry, continued growth of Bai and gains in Mott’s juices and several Allied Brands.

DPS operating income declined 3.5% to $362 million, reflecting commodity inflation, particularly in plastics, aluminum and apples, higher logistics costs, increased planned marketing investments and higher administrative expenses, primarily behind the Packaged Beverage DSD organization. Partially offsetting these factors were the benefits of the strong growth in net sales and the favorable year-over-year impact of mark-to-market adjustments. Excluding mark-to-market adjustments and other items affecting comparability, Adjusted operating income4 declined 6.4% versus year-ago to $363 million.

Adjusted diluted EPS5 increased 4.0% to $1.30 in the second quarter of 2018, compared to $1.25 in the second quarter of 2017, primarily due to a 720 basis point reduction in the effective tax rate to 26.1%, compared to a 33.3% effective tax rate in the year-ago quarter.

Commenting on the announcement, Keurig Dr Pepper CEO Bob Gamgort stated, “With the merger of these two great companies now behind us, our focus is on integration, optimization and ensuring delivery of the financial expectations we established. We are very pleased with the progress to date. The integration, in particular, is well on track, as evidenced by the establishment of the new KDP leadership team, and we remain very confident in our promised synergies and the future of our new Company. On financials, the second quarter results reported today are fully consistent with our full year outlook for 2018, and we are equally confident in the longer-term value creation framework we shared at our March 20, 2018 Investor Day.”

KDP Outlook

KDP will report combined results of both KGM and DPS beginning with the third quarter ending September 30, 2018. The Company’s outlook for the business remains unchanged, including the following:

- 2018 Adjusted diluted EPS5 of $1.02 to $1.07, on a pro-forma basis, after the impact of preliminary Purchase Price Accounting adjustments

- Merger-related synergies totaling $600 million over the 2019-2021 period, with $200 million in savings expected per year

- Significant cash flow generation and rapid deleveraging, with leverage ratio targeted to be less than 3.0x in two to three years

1 Presentation of KGM results reflects the results of Maple Parent Holdings Corp, KGM’s parent company. Maple Parent Holdings Corp. is a holding company that does not have any operations or material assets other than its interest in KGM through which Maple conducted all of its operations.

2 KGM Adjusted operating income is a non-GAAP financial measure. Please see the discussion of non-GAAP measures and the reconciliation to GAAP at the end of this press release.

3 KGM Net debt is a non-GAAP financial measure. Please see the discussion of non-GAAP measures and the reconciliation to GAAP at the end of this press release.

4 DPS Adjusted operating income (or “Core” operating income) is a non-GAAP measure. Please see the discussion of non-GAAP measures and the reconciliation to GAAP at the end of this press release.

5 Adjusted diluted EPS (or “Core” diluted EPS) is a non-GAAP financial measure. Please see the discussion of non-GAAP measures and the reconciliation to GAAP at the end of this press release.

About Keurig Dr. Pepper

Keurig Dr Pepper (KDP) is a leading coffee and beverage company in North America, with annual revenue in excess of $11 billion. KDP holds leadership positions in soft drinks, specialty coffee and tea, water, juice and juice drinks and mixers, and markets the #1 single serve coffee brewing system in the U.S.

The Company maintains an unrivaled distribution system that enables its portfolio of more than 125 owned, licensed and partner brands to be available nearly everywhere people shop and consume beverages.

With a wide range of hot and cold beverages that meet virtually any consumer need, KDP key brands include Keurig®, Dr Pepper®, Green Mountain Coffee Roasters®, Canada Dry®, Snapple®, Bai®, Mott’s® and The Original Donut Shop®.

The Company employs more than 25,000 employees and operates more than 120 offices, manufacturing plants, warehouses and distribution centers across North America. For more information, visit www.keurigdrpepper.com.