The United States Department of Agriculture on Friday released its second biannual report “Coffee: World Markets and Trade” for the year 2016.

The report includes data on U.S. and global trade, production, consumption and stocks, as well as analysis of developments affecting world trade in coffee.

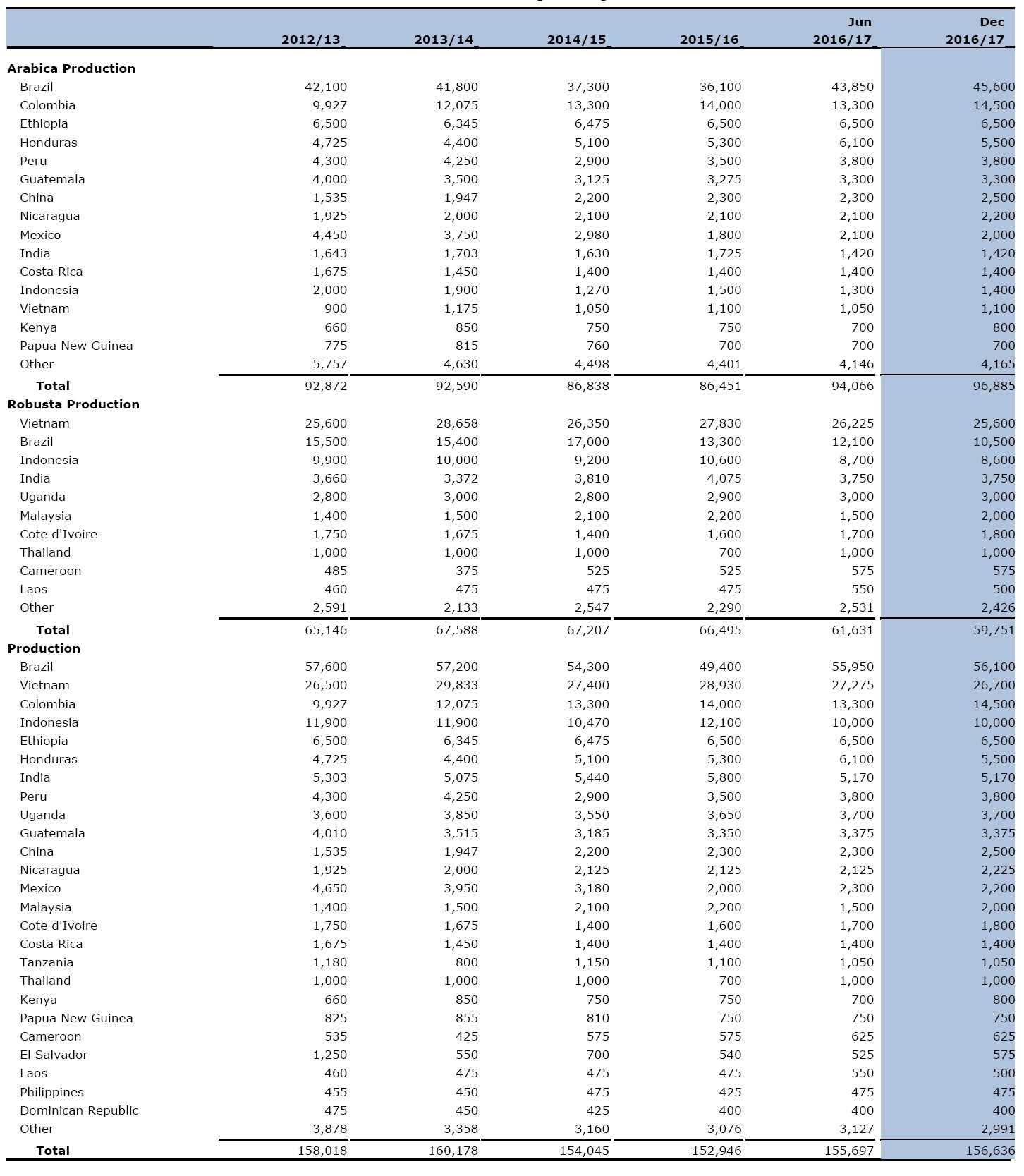

World coffee production for 2016/17 is forecast 3.7 million bags higher than the previous year to 156.6 million bags (60 kilograms) as record Arabica output in Brazil more than offsets lower Robusta production in Brazil, Vietnam, and Indonesia.

Global consumption is forecast at a record 153.3 million bags, drawing ending inventories to a 5-year low, particularly in producing countries.

With stocks continuing to tighten, the International Coffee Organization (ICO) composite price rebounded 31 percent between January and November 2016 to reach $1.46 per pound.

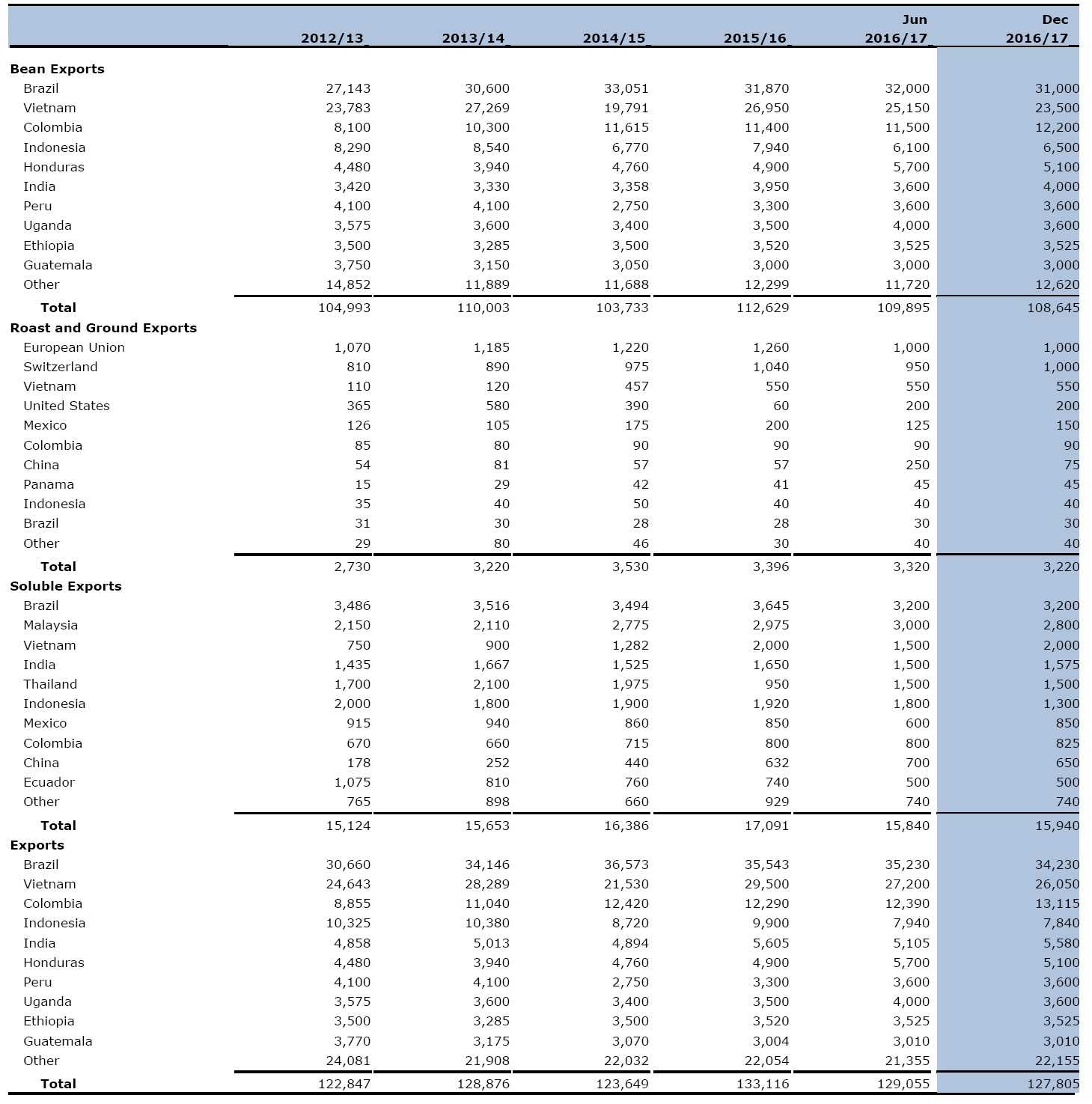

World exports are expected to slip from last year’s record primarily due to lower shipments from Vietnam, Indonesia, and Brazil.

Brazil’s Arabica production is forecast to jump 9.5 million bags to a record 45.6 million as yields improve.

Brazil’s Arabica production is forecast to jump 9.5 million bags to a record 45.6 million as yields improve.

Good blossoming between September and November 2015 was followed by ideal weather during the fruit-set and fruit development period in Minas Gerais and Sao Paulo, two regions that account for about 80 percent of output.

Following last year’s sharp decline, Robusta production is expected to drop an additional 2.8 million bags to a 10-year low of 10.5 million due to above-average temperatures and prolonged dry spells in Espirito Santo, where the vast majority is grown.

Water shortages continue to limit irrigation, a common practice in the state. Although the combined Arabica and Robusta harvest is forecast to expand 6.7 million bags to 56.1 million, total supply is expected nearly unchanged due to the previous year’s drawdown in stocks.

Consumption is expected unchanged at 20.5 million bags.

With bean exports expected to slip 900,000 bags to 31.0 million, ending stocks are forecast to rise slightly.

Vietnam’s production is forecast to decline 2.2 million bags to 26.7 million as high temperatures combined with dry growing conditions between January and April 2016 to weaken yields.

Cultivated area is forecast nearly equal to last year, and over 95 percent of total output is Robusta. Ending stocks are expected to fall a second-consecutive year to total 2.3 million bags following previous year’s large buildup.

Bean exports are forecast 3.5 million bags lower to 23.5 million.

Colombia’s Arabica production is forecast up 500,000 bags to 14.5 million on continued growth due to the replanting program started several years ago as well as favorable weather.

However, some producers are struggling to maintain quality due to labor shortages, which limits their ability to adequately control pests such as the coffee cherry borer. Bean exports, mostly to the United States and Europe, are forecast to gain 800,000 bags to 12.2 million.

Indonesia’s production is forecast to drop 2.1 million bags to 10.0 million due to severe drought throughout most of the growing regions.

Dry weather disrupted the flowering and ripening stage of cherry formation and was most acutely felt in lowland areas of Southern Sumatra and Java where approximately 75 percent of the Robusta crop is grown.

Arabica production, situated in Northern Sumatra, was mostly unaffected by these conditions. Bean exports are forecast to plunge 1.4 million bags to 6.5 million on lower available supplies.

Central America and Mexico account for over 15 percent of the world’s Arabica production, and coffee rust continues to hamper output for most of these countries.

Central America and Mexico account for over 15 percent of the world’s Arabica production, and coffee rust continues to hamper output for most of these countries.

Although the region’s total coffee production is forecast to add nearly 600,000 bags to total 15.4 million, output is still 20 percent below the record set 5 years ago.

Mexico is expected to gain 200,000 bags to 2.2 million following last year’s 1.2 million bag plunge due to coffee rust.

Honduras is expected to rise 200,000 bags to 5.5 million, just short of pre-rust output levels.

Nicaragua is forecast 100,000 bags higher to 2.2 million as a result of good weather during bloom as well as the addition of output from recently renovated land.

Costa Rica, El Salvador, and Guatemala are nearly flat at 1.4 million bags, 575,000 bags, and 3.4 million bags, respectively, as these countries continue to struggle with rust and output remains below their pre-rust level.

Bean exports for the region are forecast to gain 300,000 bags to 13.1 million mainly due to higher exportable supplies in Honduras.

Approximately 40 percent of the region’s exports are destined for the United States, followed by over one-third to the European Union.

The European Union accounts for over 40 percent of the world’s coffee bean imports and is forecast down 300,000 bags to 45.5 million.

Top suppliers include Brazil (33 percent), Vietnam (25 percent), Honduras (7 percent), and Colombia (7 percent). With consumption rising 300,000 bags to 44.4 million, ending stocks are expected slightly lower at 11.9 million bags.

The United States imports the second-largest amount of coffee beans and is forecast down 300,000 bags to 24.8 million. Top suppliers include Brazil (27 percent), Colombia (20 percent), and Vietnam (16 percent). Consumption is expected to gain nearly 200,000 bags to 25.3 million, drawing ending stocks down slightly to 6.0 million bags.

Revised 2015/16

Revised 2015/16

World production is revised down from the June estimate by 300,000 bags to 153.0 million.

- Uganda is reduced nearly 900,000 bags to 3.7 million on lower-than-anticipated yields.

- Mexico is down 500,000 bags to 2.0 million due to coffee rust.

- Malaysia is 700,000 bags higher to 2.2 million on increased Robusta area and yields.

World bean exports are lowered 200,000 bags to 112.6 million.

- Brazil is lowered nearly 900,000 bags to 31.9 million on reduced shipments to the United States and EU.

- Uganda is reduced 500,000 bags to 3.5 million on lower exportable supplies.

- Vietnam is up nearly 1.0 million bags to 27.0 million as rising prices provided an incentive todraw inventories lower.

World ending stocks are lowered 600,000 bags to 34.8 million.

- Vietnam is down 1.8 million bags to 3.8 million on stronger-than-anticipated shipments.

- Brazil is up nearly 500,000 bags to 2.7 million on slower exports to top markets.