Share your coffee stories with us by writing to info@comunicaffe.com.

MILAN – World production at new all-time highs – thanks mainly to a recovery in production in Vietnam, Indonesia and Ethiopia – slightly rising exports and continued strong world consumption – this is the picture painted by the Foreign Agricultural Service (FAS) of the United States Department of Agriculture’s (USDA) biannual report, ‘Coffee: World Markets and Trade”, released yesterday, Wednesday 25 June.

The report opens with a focus on Uganda, a country that has almost doubled its coffee production (mostly robusta) over the past 10 years. Last year, coffee exports reached a value of USD 1.1 billion, accounting for almost 20% of the African nation’s foreign exchange earnings.

Italy is by far the largest market, accounting for 39% of exports. Europe absorbs around two-thirds of Ugandan exports.

Elevated coffee prices in the last 2 years could incentivize growers to continue expanding output towards the original UCDA goal to boost production to 20 million bags by 2030.

Although the National Coffee Bill dissolved the UCDA in November 2024 to increase efficiencies and reduce costs, the organization’s functions were transferred to the Ministry of Agriculture.

As for 2024/25, the world coffee production estimate was lowered by half a million bags compared to the forecast made in the previous report in December.

- Ethiopia is raised 2.3 million bags to 10.6 million on higher yields following a national

program to replace older trees with higher-yielding varieties. - Brazil is down 1.7 million bags to 64.7 million following drought and high temperature

conditions that lowered Arabica yields. - Vietnam is reduced 1.1 million bags to 29.0 million as drought conditions limited output.

World bean exports are revised down 800,000 bags to 121.5 million.

- Ethiopia is up 1.8 million bags to 7.0 million on higher output.

- Vietnam is reduced 1.4 million bags to 23.0 million on lower output.

- India is down 700,000 bags to 3.7 million on rising domestic consumption and stocks.

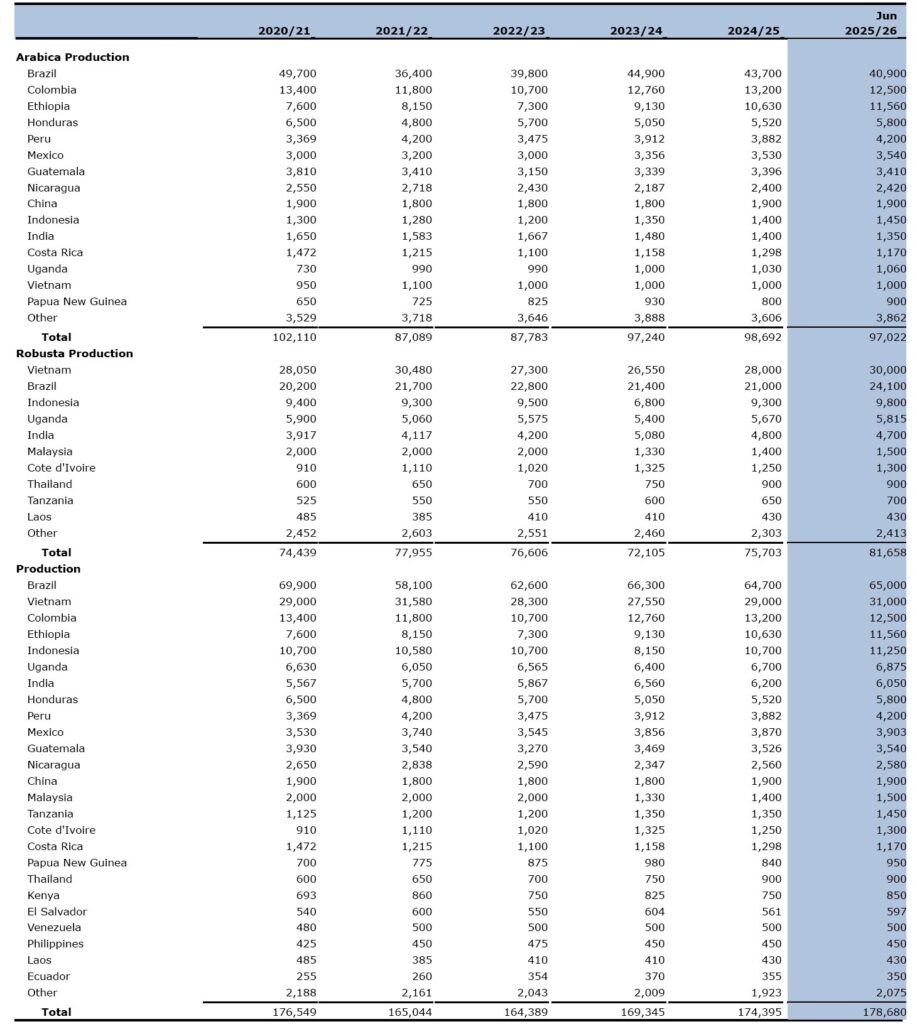

As a result, world production for 2024/25 is now estimated at 174.395 million bags, almost 3% higher from 169.345 million in 2023/24.

Arabica production is estimated at 98.692 million, up about 1.5%. After the previous year’s decline, Robusta production is up by 5%, to 75.703 million.

The world’s major producers are recovering, with the sole exception of Brazil. Exports are estimated at 147.161 million, up 2.6%.

World coffee production for 2025/26 is forecast by USDA 4.3 million bags higher than the previous year to a record 178.7 million due to continued recovery in Vietnam and Indonesia as well as record output in Ethiopia.

World coffee bean exports are forecast 700,000 bags higher to 122.3 million as gains from Vietnam, Ethiopia, and Indonesia more than offset losses from Brazil and Colombia.

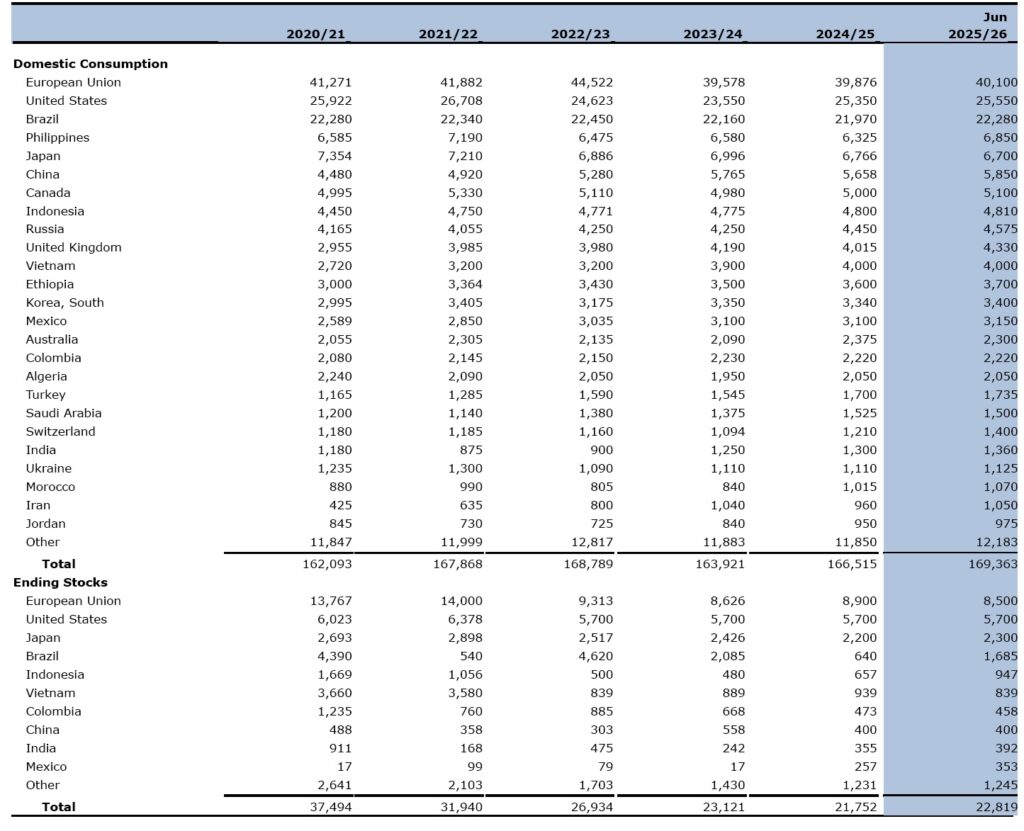

With global consumption forecast at a record 169.4 million bags, ending inventories are expected to remain tight at 22.8 million bags, reports USDA. In response, coffee prices as measured by the International Coffee Organization (ICO) monthly composite price index increased over 90 percent in the last 2 years.

Vietnam production is forecast to continue recovering to reach 31.0 million bags in 2025/26 due to higher yields attributed to favorable weather. Also, high prices allowed coffee growers to increase expenditures on fertilizers and other inputs to further raise yields. Area harvested is forecast to be nearly unchanged, with nearly 95 percent of total output remaining as Robusta. Bean exports are forecast up 1.6 million bags to 24.6 million on higher supplies

Brazil combined Arabica and Robusta harvest is forecast up just 300,000 bags to 65.0 million in 2025/26. The Robusta harvest is expected to be 3.1 million bags higher to a record 24.1 million as good rainfall volumes aided fruit development in the major producing states of Espirito Santo and Bahia.

Arabica output is expected to drop 2.8 million bags to 40.9 million as drought and high temperatures in Minas Gerais and Sao Paulo adversely affected blossoming as well as fruit setting and development. Exports are forecast lower as elevated prices dissuade importing countries from rebuilding stocks.

As a result, ending stocks are forecast up 1.0 million bags to 1.7 million following last year’s sharp drawdown.

Colombia output is expected to retreat by 700,000 bags to 12.5 million as excessive rains and cloud cover disrupted the flowering period to lowered yields. While these conditions were favorable for coffee leaf rust to proliferate, overall detection rates have been relatively low due to the high presence of disease-resistant varieties. Bean exports, mostly to the United States and European Union, are forecast down 500,000 bags to 10.7 million on reduced output.

Indonesia production is forecast to gain by 550,000 bags to 11.3 million. Robusta output is expected to reach 9.8 million bags on favorable growing conditions in the lowland areas of Southern Sumatra and Java, where approximately 75 percent is grown. Arabica production is also seen rising slightly to 1.5 million bags. Elevated output is expected to boost bean exports by 400,000 bags to 6.5 million.

Ethiopia is forecast to increase output by 900,000 bags to a record 11.6 million bags. Growth in the last 3 years has been driven by recently replacing over half the cultivated area with higher-yielding coffee varieties. Growers have also been encouraged to improve yields by pruning after the harvest.

Bean exports are forecast up 800,000 bags to 7.8 million on higher supplies.

Central America and Mexico production is forecast 300,000 bags higher to 17.7 million. Except for a modest decline in Costa Rica, slight gains are expected across the region. Bean exports for the region are forecast flat at 14.1 million bags on steady shipments to top markets.