Share your coffee stories with us by writing to info@comunicaffe.com.

MILAN – On Tuesday, 25 November, the J.M. Smucker Co. published its quarterly results for the 2Q ending 31 October 2025, showing lower-than-expected profits, with higher green coffee costs set to squeeze margins. As a major importer of green coffee from Brazil and Vietnam, the parent company of Folgers has been negatively affected by the heavy tariffs imposed by U.S. President Donald Trump.

Financial results for the second quarter of fiscal year 2026 reflect the divestiture of certain Sweet Baked Snacks value brands on March 3, 2025, and the divestiture of the Voortman business on December 2, 2024.

Executive Summary

- Net sales was $2.3 billion, an increase of $58.9 million, or 3 percent. Net sales excluding the divestitures and foreign currency exchange increased 5 percent.

- Net income per diluted share was $2.26. Adjusted earnings per share was $2.10, a decrease of 24 percent.

- Cash provided by operations was $346.5 million compared to $404.2 million in the prior year. Free cash flow was $280.2 million compared to $317.2 million in the prior year.

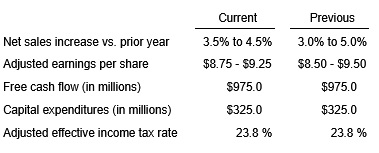

- The Company updated its full-year fiscal 2026 financial outlook.

The J.M. Smucker Co. – Net Sales

Net sales increased $58.9 million, or 3 percent. Excluding $50.5 million of noncomparable net sales in the prior year related to divestitures and $1.6 million of unfavorable foreign currency exchange, net sales increased $111.0 million, or 5 percent.

The increase in comparable net sales reflects an 11 percentage point increase from net price realization, primarily driven by higher net pricing for coffee. Comparable net sales also reflects a 6 percentage point decrease from volume/mix, primarily driven by decreases for coffee, peanut butter, dog snacks, and lapping contract manufacturing sales related to the divested pet food brands in the prior year.

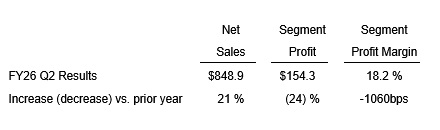

U.S. Retail Coffee

Net sales increased $144.9 million, or 21 percent. Net price realization increased net sales by 27 percentage points, primarily driven by higher net pricing across the portfolio.

Volume/mix decreased net sales by 6 percentage points, reflecting decreases for the Folgers and Dunkin’ brands, partially offset by an increase for the Café Bustelo brand.

Segment profit decreased $48.4 million, primarily reflecting higher commodity costs, tariffs, unfavorable volume/mix, and higher marketing spend, partially offset by higher net price realization.

Full-Year Outlook

The Company updated its full-year fiscal 2026 guidance, as summarized below.