ORRVILLE, Ohio, U.S. – The J. M. Smucker Company last week announced results for the third quarter ended January 31, 2020, of its 2020 fiscal year. The company reported quarterly profit above market expectations helped by its coffee business, which sells Folgers and Dunkin’ Donut brands, even as its pet food unit continued to struggle. All comparisons are to the third quarter of the prior fiscal year, unless otherwise noted.

J. M. Smucker: Executive Summary

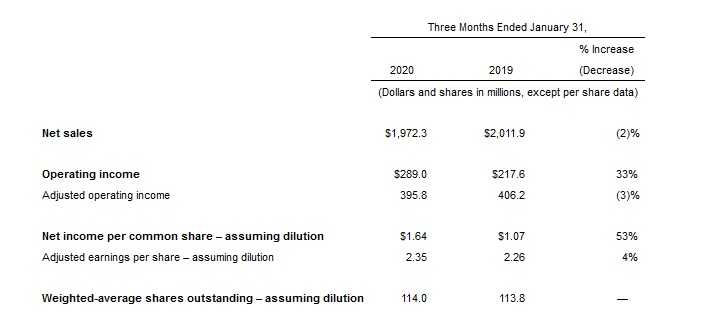

- Net sales decreased $39.6 million, or 2 percent, primarily reflecting anticipated declines within the U.S. Retail Pet Foods segment.

- Net income per diluted share was $1.64. Adjusted earnings per share was $2.35, an increase of 4 percent.

- Cash from operations was $521.6 million, an increase of 24 percent. Free cash flow was $465.1 million in the quarter, compared to $333.0 million in the prior year.

- The Company reaffirmed its full-year fiscal 2020 net sales, adjusted earnings per share, and free cash flow outlook.

Chief Executive Officer Remarks:

“Third quarter results were in-line with our expectations, benefiting from continued investment in our strategic growth imperatives and the decisive actions we are taking to improve certain areas of the business. Net sales performance reflected strong growth for the Smucker’s® Uncrustables® brand and improved volume fundamentals for our coffee and peanut butter brands, which supported market share and household penetration growth in both categories. This helped partially offset the anticipated decline for our dog food business,” said Mark Smucker, President and Chief Executive Officer.

“Our results in the quarter reinforced our commitment to operate with financial discipline, highlighted by adjusted earnings per share growth of 4 percent, strong free cash flow of $465 million, and net debt repayments exceeding $300 million. As we look forward, we are confident in delivering on our full-year guidance, while positioning the business for consistent long-term growth and shareholder value creation.”

J.M. Smucker: Third Quarter Consolidated Results

Net Sales

Net sales decreased 2 percent, driven by reduced volume/mix in the U.S. Retail Pet Foods segment, primarily driven by dog food. Lower net price realization for the remaining segments was primarily driven by lower net pricing for coffee and peanut butter, which was mostly offset by favorable volume/mix for coffee and the Smucker’s® Uncrustables® brand.

Operating Income

Gross profit decreased $13.8 million, or 2 percent, driven by a reduced contribution from volume/mix and the net impact of lower prices in excess of lower costs. Operating income increased $71.4 million, or 33 percent, primarily reflecting a $54.8 million decrease in intangible asset impairment charges, a $15.5 million decrease in other special project costs, and a $14.2 million decrease in selling, distribution, and administrative (“SD&A”) expenses, partially offset by the decline in gross profit. The third quarter of 2020 included a noncash impairment charge of $52.4 million related to the Natural Balance® brand within the U.S. Retail Pet Foods segment, primarily driven by the market environment and the re-positioning of the brand within the Pet Foods portfolio.

Adjusted gross profit decreased $24.4 million, or 3 percent, with the difference from generally accepted accounting principles (“GAAP”) results being the exclusion of a $10.6 million favorable impact, as compared to the prior year, of unallocated derivative gains and losses. Adjusted operating income decreased $10.4 million, or 3 percent, further reflecting the exclusion of intangible asset impairment charges, other special project costs, and amortization.

Interest Expense, Other Income (Expense), and Income Taxes

Net interest expense decreased $6.5 million, primarily as a result of reduced debt due to net repayments of $700.6 million during the past twelve months.

Net other expense decreased by $7.4 million, primarily due to pension and litigation settlements in the prior year.

The effective income tax rate was 22.7 percent compared to 22.8 percent in the prior year. On a non-GAAP basis, the adjusted effective income tax rate was 23.1 percent compared to 25.8 percent in the prior year.

Cash Flow and Debt

Cash provided by operating activities was $521.6 million, compared to $421.1 million in the prior year, primarily reflecting a decrease in cash required to fund working capital. The decrease in working capital requirements was primarily driven by an increase in accounts payable due to working capital initiatives. Free cash flow was $465.1 million, compared to $333.0 million in the prior year, reflecting the increase in cash provided by operating activities and a $31.6 million reduction in capital expenditures. Net debt repayments in the quarter totaled $319.7 million.

J. M. Smucker: Full-Year Outlook

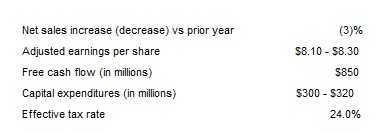

The Company reaffirmed its full-year fiscal 2020 net sales, adjusted earnings per share, and free cash flow guidance as summarized below:

Net sales are expected to be down 3 percent compared to the prior year, which includes the loss of $105.9 million of sales in the first 4 months of fiscal 2019 related to the divested U.S. baking business and $25.4 million of incremental noncomparable sales for Ainsworth Pet Nutrition, LLC (“Ainsworth”). On a comparable basis, net sales are expected to be down 2 percent.

Net sales are expected to be down 3 percent compared to the prior year, which includes the loss of $105.9 million of sales in the first 4 months of fiscal 2019 related to the divested U.S. baking business and $25.4 million of incremental noncomparable sales for Ainsworth Pet Nutrition, LLC (“Ainsworth”). On a comparable basis, net sales are expected to be down 2 percent.

Adjusted earnings per share is expected to range from $8.10 to $8.30, based on 114.0 million shares outstanding. Earnings guidance reflects the contribution from sales at a gross profit margin of approximately 38.2 percent, SD&A expenses declining approximately 2.5 percent compared to the prior year, and an effective tax rate of 24.0 percent. Free cash flow is expected to be approximately $850 million.

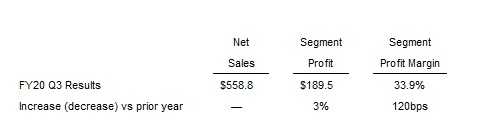

J. M. Smucker: U.S. Retail Coffee in 3Q

Segment net sales decreased $2.8 million. Net price realization reduced net sales by 5 percentage points, primarily driven by the Folgers® and Dunkin’ Donuts® brands, which reflected promotional activity mostly supported by lower green coffee costs. Favorable volume/mix mostly offset lower net pricing, reflecting growth for the Dunkin’ Donuts®, Café Bustelo®, and Folgers® brands.

Segment net sales decreased $2.8 million. Net price realization reduced net sales by 5 percentage points, primarily driven by the Folgers® and Dunkin’ Donuts® brands, which reflected promotional activity mostly supported by lower green coffee costs. Favorable volume/mix mostly offset lower net pricing, reflecting growth for the Dunkin’ Donuts®, Café Bustelo®, and Folgers® brands.

Segment profit increased $5.8 million, primarily due to the favorable volume/mix and reduced marketing expense, partially offset by the net impact of lower net pricing in excess of lower costs.