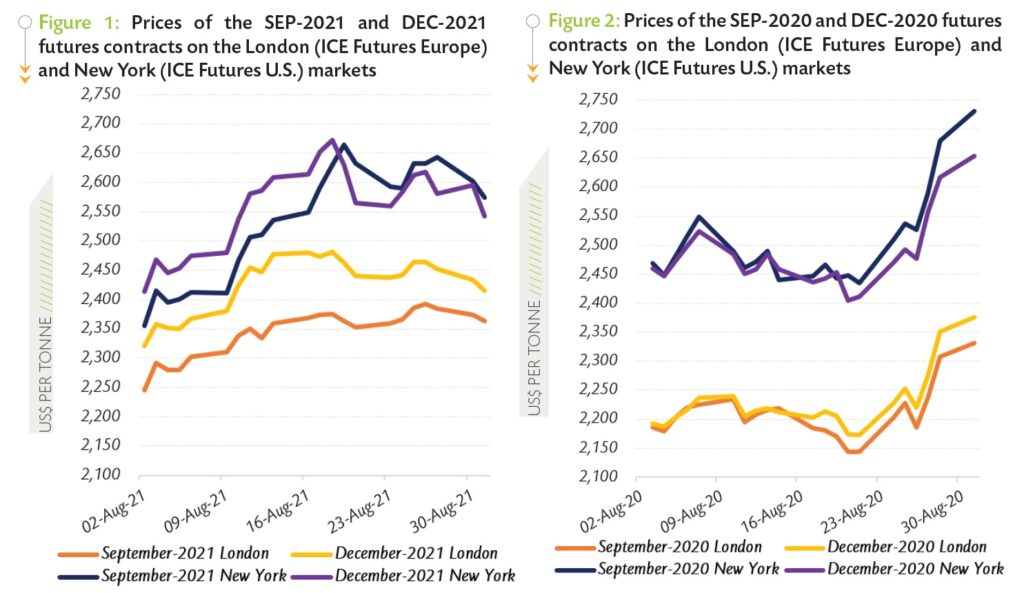

ABIDJAN, Côte d’Ivoire – The report on the movements of cocoa futures prices for the month under review highlights the September-2021 (SEP-21) and December-2021 (DEC-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York). It aims to provide insights on the price developments for these two specific futures contracts.

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in August 2021, while Figure 2 presents similar information for the previous year.

As presented in Figure 1, the SEP-21 contract was cheaper compared to the deferred one (DEC-21) on both the London and New York markets during August 2021. This situation expresses that, there was no anticipation of a supply bottleneck that could trigger market tension over the deliveries against the last futures contract of the 2020/21 cocoa year.

Hence, the SEP-21 contract priced with an average discount of US$83 per tonne compared to the DEC-21 contract in London, while in New York, prices of the SEP-21 contract were discounted on average by US$24 per tonne compared to DEC-21.

Hence, the SEP-21 contract priced with an average discount of US$83 per tonne compared to the DEC-21 contract in London, while in New York, prices of the SEP-21 contract were discounted on average by US$24 per tonne compared to DEC-21.

Figure 2 illustrates that the London market was in contango whilst New York was in backwardation in August 2020. At the time, certified stocks with valid certificates represented 64% of the total stocks held in exchange licensed warehouses in Europe whilst in the United States, the share of certified stocks in total stocks in exchange licensed warehouses was very low (4%).

Focusing on the developments of the SEP-21 futures contract prices, two distinct sequences emerge. Indeed, a bullish stance was observed during the first nineteen days of the month, while a virtually flat trend was seen over the last ten days of the month under review. Over 02-19 August, the upward trend seen in the prices of the SEP-21 contract was triggered by various fundamental factors.

On the one hand, the main cocoa growing areas of Côte d’Ivoire and Ghana were reported to have witnessed less conducive meteorological conditions (i.e. below normal rainfall; which is detrimental to soil moisture and thereby harmful for cocoa yields).

On the other hand, signs of improvement in the demand for chocolate and cocoa in conjunction with the announcement of the Côte d’Ivoire government to stop the sales of exports licenses for the 2021/22 cocoa season contributed to fuelling the price rallies. In London, prices of the SEP-21 futures contract were bolstered by 5% from US$2,245 to US$2,364 per tonne while in New York they climbed by 13% from US$2,355 to US$2,664 per tonne.

However, from 20 August onwards, prices of the SEP-21 contract stopped ascending and remained range-bound on both sides of the Atlantic. Hence, in London, they averaged US$2,372 and seesawed between US$2,353 and US$2,392 per tonne while in New York, they averaged US$2,612 and wobbled between US$2,574 and US$2,643 per tonne.

At the time, robust supplies and continuously higher purchases were recorded in Côte d’Ivoire and Ghana respectively. In addition, the global cocoa market was bracing itself for a larger supply surplus for the 2020/21 cocoa season.

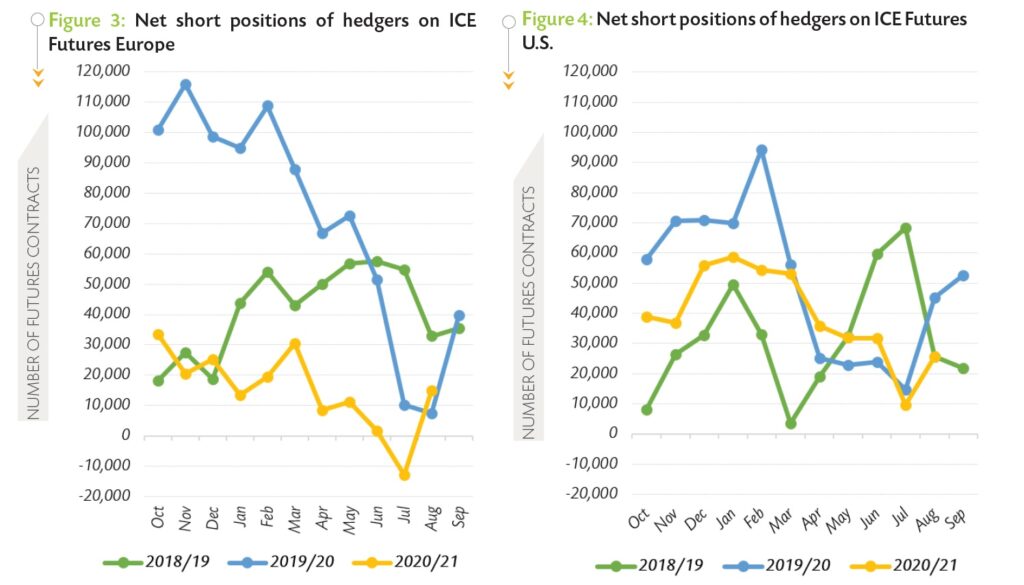

Commercial traders (Hedgers) net short futures positioning

Figure 3 presents the net short positions for commercial traders in Europe over the period 2018/19 – 2020/21, while Figure 4 portrays the same information in the United States. The weekly report on the Commitments of Traders is the information source. The size of net short positions can be thought of as a demand for “insurance” against price drops; and, its change over time assesses the evolution of the risk perception of the entire spectrum of merchants and producers in the cocoa futures markets.

Over October 2020 to August 2021, the average net short positions in both Europe and the United States were generally lower than recorded over the same period in 2019/20. In New York, they declined by 22% from an average of 58,449 contracts to 45,624 contracts.

Over October 2020 to August 2021, the average net short positions in both Europe and the United States were generally lower than recorded over the same period in 2019/20. In New York, they declined by 22% from an average of 58,449 contracts to 45,624 contracts.

Concurrently, in London, they were down by 80% from an average of 74,146 contracts to 15,128 contracts compared to 2019/20 (Figure 3 and Figure 4). The COVID 19 pandemic reducing the risk perception of a bearish market has in turn reduced the need for “insurance”.

Focusing on the change in the net short positions in July 2021 versus August 2021, a converging view emerges when comparing the commercial net short positions in New York and London. In London, the net short position increased from -12,770 futures contracts to 14,934 futures contracts suggesting a somehow slight increase in the perception of a price risk (i.e., bullish market). Similarly to hedgers in London, those in New York increased their aggregate net short positions from 9,653 futures contracts in July 2021 to 25,627 futures contracts in August 2021.

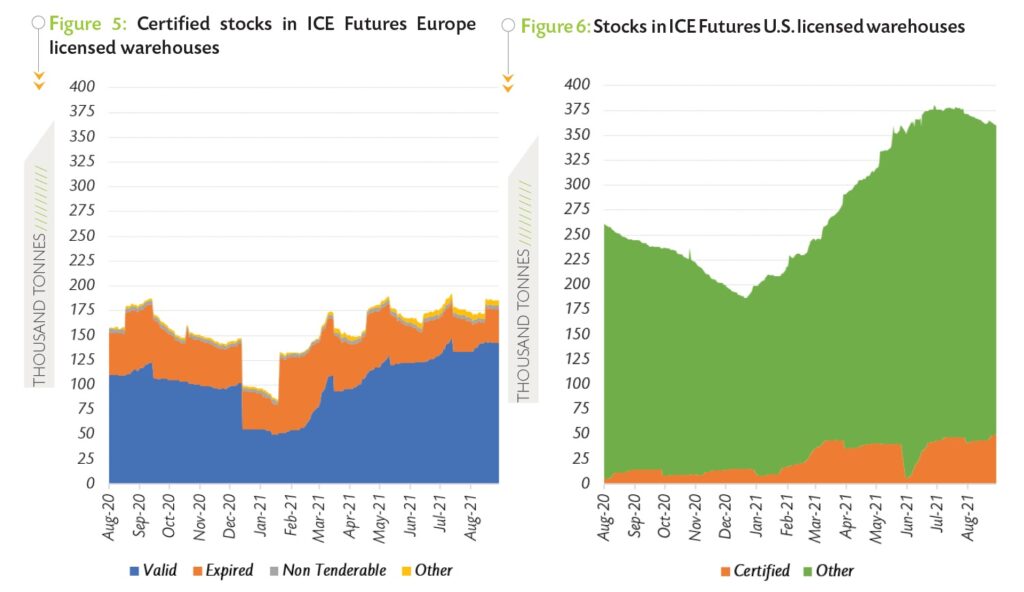

Cocoa gradings and stocks in exchange licensed warehouses

In August, stocks of cocoa beans with valid certificates in European warehouses averaged 140,436 tonnes, representing 82% of the total stocks. As shown in Figure 5, stocks with valid certificates increased by 26% as compared to their average level of 111,025 tonnes seen a year ago. In the United States, total stocks spiked by 45% year-on-year to reach an average of 365,461 tonnes in August 2021 (Figure 6) while certified stocks jumped from 9,859 tonnes to 44,659 tonnes.

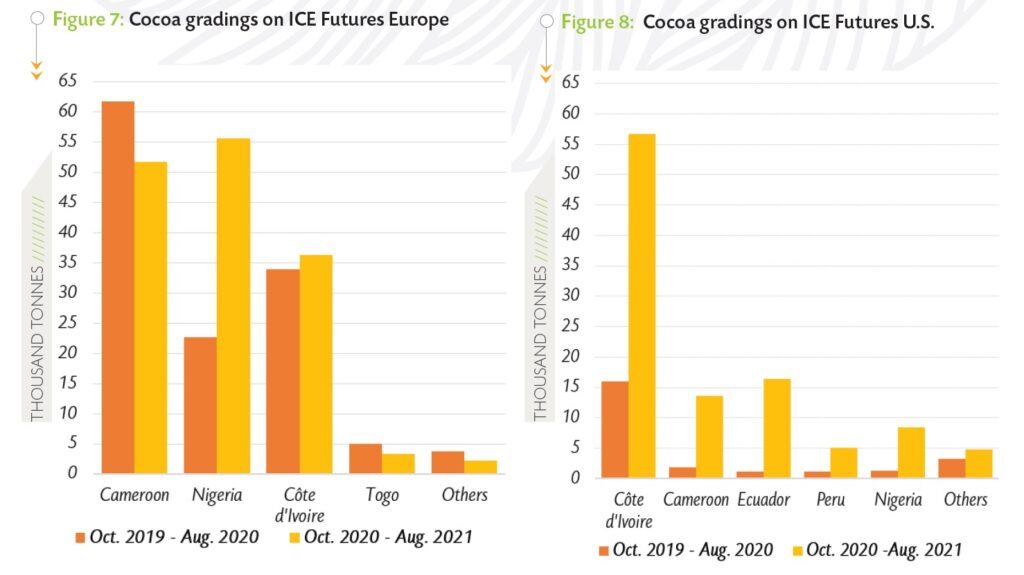

Figure 7 presents the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – August 2020 and October 2020 – August 2021, while Figure 8 shows the same information for the cocoa graded on the U.S. Exchange.

Figure 7 presents the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – August 2020 and October 2020 – August 2021, while Figure 8 shows the same information for the cocoa graded on the U.S. Exchange.

Cocoa graded by the ICE Futures Europe, during October 2020 – August 2021, reached 149,270 tonnes, up by 17% from 127,060 tonnes of cocoa graded over the same period in the previous season. During the above-mentioned periods, the volume of Cameroonian cocoa beans at exchange gradings was reduced from 61,730 tonnes to 51,730 tonnes.

Similarly, the volume of Togolese cocoa beans graded at the exchange was down from 5,040 tonnes to 3,270 tonnes. Other origins’ cocoa beans graded at the exchange ebbed from 3,700 tonnes to 2,260 tonnes. Contrarywise, the volume of cocoa beans from Nigeria rose from 22,630 tonnes in the previous year to 54,690 tonnes while cocoa beans from Côte d’Ivoire increased from 33,960 tonnes to 36,320 tonnes.

In August total volume of cocoa graded on the ICE Futures U.S. amounted to 105,043 tonnes of cocoa beans during October 2020 – August 2021, up from 24,798 tonnes graded during the same period of the preceding cocoa year.

On a year-on-year basis, the volumes of cocoa beans from Côte d’Ivoire and Ecuador in ICE Futures U.S. gradings increased from 16,015 tonnes to 56,768 tonnes, and from 1,169 tonnes to 16,422 tonnes respectively. Similarly, volumes of Cameroonian and Peruvian cocoa beans at exchange gradings went up from 1,861 tonnes to 13,540 tonnes and from 1,153 tonnes to 5,112 tonnes respectively.

Volumes of Nigerian cocoa beans in ICE Futures U.S. licensed warehouses increased from 1,313 tonnes to 8,374 tonnes. Additionally, the volumes of cocoa beans graded on the ICE Futures U.S. for other origins increased from 3,287 tonnes to 4,827 tonnes.

Origin differentials

Origin differentials

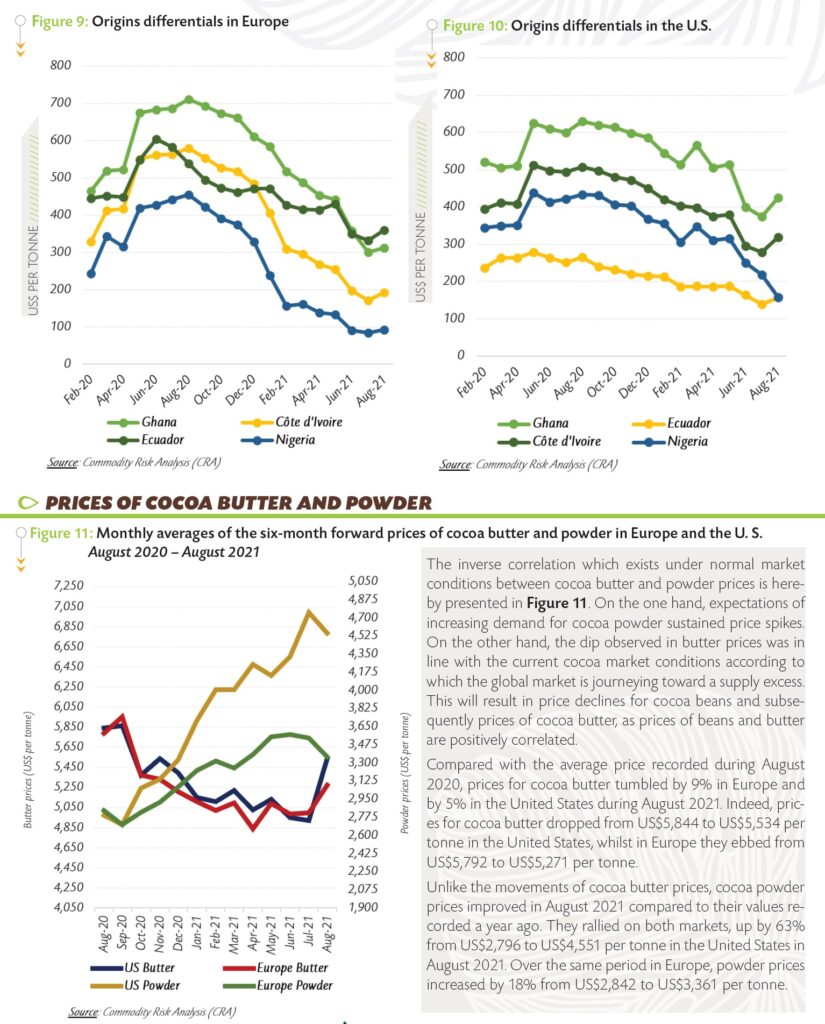

Compared to their levels recorded in July 2021, origin differentials on prices of the six-month forward cocoa contract in Europe and the United States for Ghana, Côte d’Ivoire, Ecuador and Nigeria mirrored signs of recovery in August 2021 (Figure 9 and Figure 10).

In Europe, the differential for Ghanaian cocoa averaged US$312 per tonne in August 2021, 4% up compared to US$301 per tonne recorded in July 2021. Similarly, the origin differential firmed by 13% from US$171 to US$193 per tonne for Ivorian cocoa beans. A 9% increase from US$84 to US$92 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential was reinforced by 9% from US$332 to US$360 per tonne.

On the U.S. market, cocoa beans from Ghana recorded a differential of US$425 per tonne in August 2021 against US$374 per tonne during July 2021. Over the same period, the premium applied to Ivorian cocoa beans rebounded by 15% from US$278 to US$319 per tonne. Premiums received for Ecuadorian beans in the U.S. increased by 12% from US$140 to US$157 per tonne. On the contrary, an isolated 28% reduction from US$219 to US$157 per tonne was seen in the origin differential for Nigeria.

Production and grindings

Production and grindings

Cumulative arrivals of cocoa beans for the 2020/21 cocoa season in Côte d’Ivoire continued to beat all records at the end of August 2021. Indeed, as at 12 September 2021, cumulative arrivals at Ivorian ports were seen at 2.168 million tonnes, up by 5.2% compared to 2.060 million tonnes recorded a year earlier. In Ghana, cumulative purchases of graded and sealed cocoa beans for the 2020/21 cocoa year were reported at 1.03 million tonnes 19 August 2021, representing the country’s all times highest crop size.

The revised forecasts for the 2020/21 cocoa season published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics suggests a production surplus of 230,000 tonnes. Increases in production and grindings are expected at 8% to 5.141 million tonnes and at 3.3% to 4.860 million tonnes, respectively. Production is projected to increase by almost 11.1% to 3.975 million tonnes in Africa and by 1.1% to 281,000 tonnes in Asia and Oceania.

A reduction of 2% to 885,000 tonnes is forecast for the Americas. Grindings are expected to expand to 4.860 million tonnes, up by 157,000 tonnes, representing a 3.3% increase compared to the revised estimate of 4.703 million tonnes for 2019/20.

It is anticipated that processing activities will grow by 5.1% to 1.164 million tonnes in Asia and Oceania, whereas a growth of 7.6% to 961,000 tonnes is projected for the Americas. In Africa, processing activities are forecast to expand by 0.5% to 1.001 million tonnes while a 1.6% increase to 1.734 million tonnes is envisaged in grindings activities for Europe compared to the level attained in the same period of the previous season.