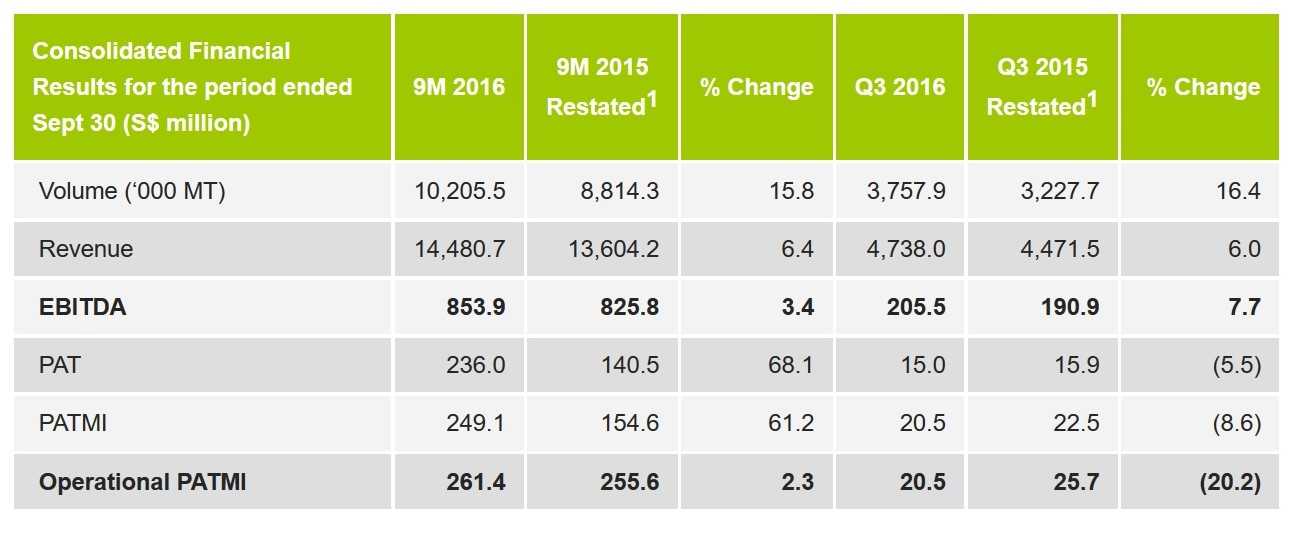

SINGAPORE – Olam International Limited (Olam, the Group, or the Company) on Monday reported financial results for the quarter (Q3 2016) and nine months (9M 2016) ended September 30, 2016.

Headquartered in Singapore and listed on the SGX-ST on February 11, 2005, is a leading agri-business operating across the value chain in 70 countries, supplying various products across 16 platforms to over 16,200 customers worldwide.

Q3 2016

For Q3 2016, Olam reported an 8.6% decrease in Profit After Tax and Minority Interest (PATMI) year-on-year to S$20.5 million, on higher depreciation and amortisation charges despite higher operating profit. Operational PATMI declined by S$5.2 million or 20.2% to S$20.5 million.

Operating profit improved with Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA) up by 7.7% to S$205.5 million on the back of strong performance from Confectionery & Beverage Ingredients and Food Staples & Packaged Foods, which offset declines in other business segments.

Operating profit improved with Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA) up by 7.7% to S$205.5 million on the back of strong performance from Confectionery & Beverage Ingredients and Food Staples & Packaged Foods, which offset declines in other business segments.

Net finance costs were down to S$100.5 million on initiatives taken to optimise loan tenures and reduce borrowing costs while taxes were lower at S$7.5million due to a change in the geographical mix of earnings.

Sales volumes were up 16.4% as all segments except Confectionery & Beverage Ingredients showed growth. Revenues rose by 6.0% as lower prices for some commodities offset the higher volumes.

9M 2016

For 9M 2016, Olam reported a 61.2% increase in PATMI to S$249.1 million due to lower exceptional losses from buying back high priced bonds (9M 2016: S$12.3 million; 9M 2015: S$101.0 million). Operational PATMI was up 2.3% at S$261.4 million.

EBITDA grew 3.4% year-on-year to S$853.9 million and was driven by growth from the Confectionery & Beverage Ingredients and Food Staples & Packaged Foods businesses, which offset lower contribution from other segments.

Despite higher overall debt, net finance costs fell from S$327.6 million in 9M 2015 to S$291.6 million in 9M 2016 as a result of the initiatives to optimise loan tenures and reduce borrowing costs.

Sales volumes increased 15.8% as all segments registered higher volumes. Revenues grew 6.4% year-on-year as lower prices for some commodities offset the impact of higher volumes.

Olam recorded substantially higher net operating cash flow of S$812.6 million in 9M 2016, more than double the S$322.3 million from the previous corresponding period. However, this was offset by a significant increase in net capital expenditure from the acquisition of wheat milling assets from BUA Group, Brooks Peanut Company (Brooks) and continued investments in upstream and midstream assets, resulting in negative Free Cash Flow to Firm (FCFF) of S$150.5 million.

Net gearing as at September 30, 2016 was 1.87 times, within the Group’s gearing target of around 2.0 times.

M&A and Strategic Partnership with Mitsubishi Corporation

In Q3 2016, in addition to Brooks, the Group completed the following acquisitions:

- Palm and palm oil assets from SIAT Gabon for US$24.6 million through 60.0% owned joint venture Olam Palm Gabon

- Remaining 50.0% in Acacia Investments (palm refining assets in Mozambique) for US$24.0 million

Post Q3 2016, it acquired 100.0% of East African coffee specialist Schluter S.A. for US$7.5 million.

The Group’s 30:70 joint venture with strategic partner Mitsubishi Corporation, MC Agri Alliance, commenced operations on October 1, 2016. The joint venture imports and distributes coffee, cocoa, sesame, edible nuts, spices, vegetable ingredients and tomato products for the Japanese market.

Olam’s Co-Founder and Group CEO Sunny Verghese said: “Our differentiated strategy has enabled us to deliver improved performance year-to-date under challenging conditions. We continue to explore selective opportunities in our prioritised platforms, while remaining focused on ensuring the performance of our gestating assets.”

Olam’s Executive Director and Group COO, A. Shekhar said: “We have taken several steps during the quarter to further strengthen our balance sheet, including a benchmark perpetual bond issuance, tap of our senior bonds and refinancing of our syndicated loans.”

Segmental Review

Q3 2016

Volume in ’000 metric tonnes; Revenue & EBITDA in S$ million

Volume in ’000 metric tonnes; Revenue & EBITDA in S$ million

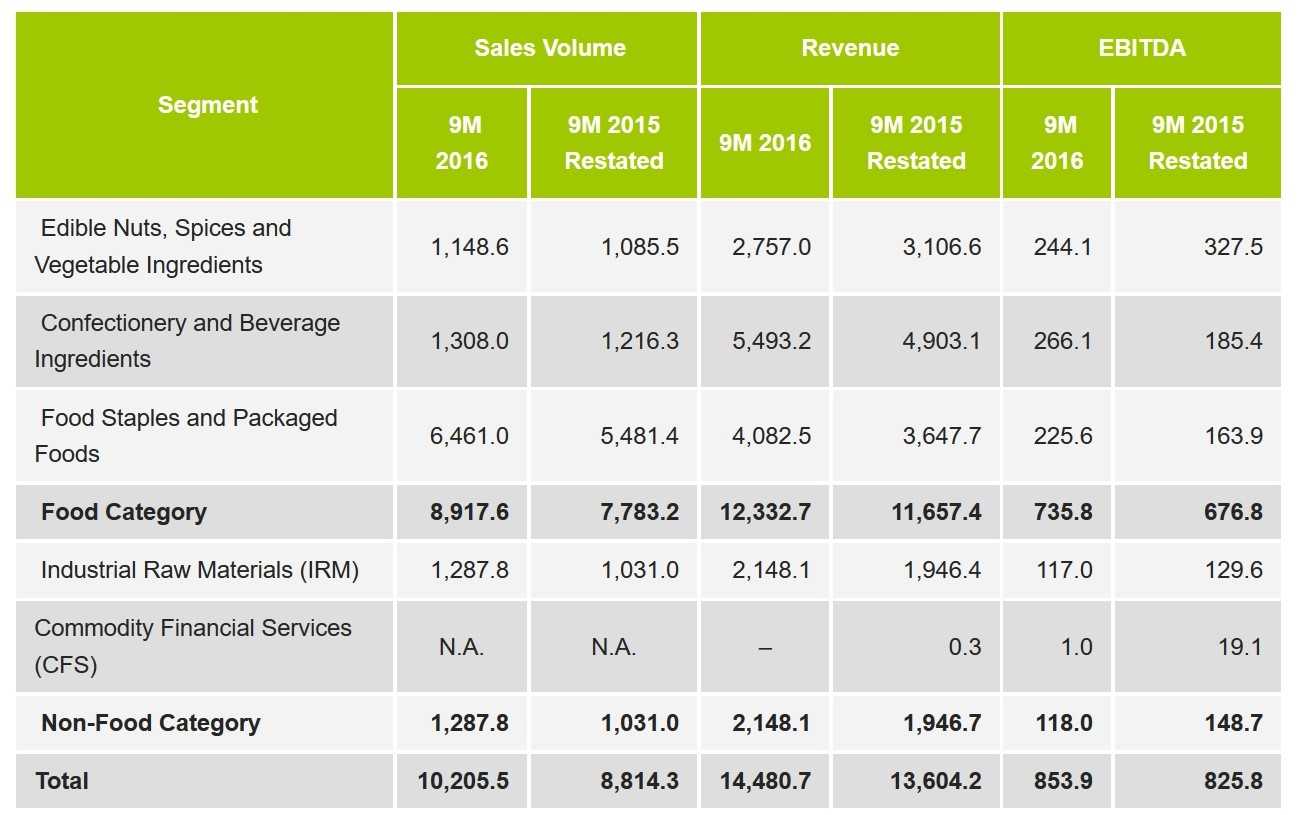

9M 2016

Volume in ’000 metric tonnes; Revenue & EBITDA in S$ million

Volume in ’000 metric tonnes; Revenue & EBITDA in S$ million

The Edible Nuts, Spices & Vegetable Ingredients segment saw volumes increase by5.8% in 9M 2016, as higher peanut volumes, helped by the consolidation of Brooks, and higher cashew volumes compensated for the reduced tomato paste volume. However, revenues were lower by 11.3% mainly on account of lower almond and tomato paste prices. EBITDA declined by 25.5% on lower contribution from the almond business and tomato processing operations, which offset gains in other businesses.

The Confectionery & Beverage Ingredients segment recorded a 7.5% increase in volumes primarily on the consolidation of results for the acquired Cocoa Processing assets, although this was partially offset by lower supply chain volumes on adverse weather impact on cocoa beans in West Africa. Revenues grew 12.0% on the back of higher sales volumes and higher prices for both Cocoa and Coffee. EBITDA increased 43.5% aided by Cocoa recording better year-on-year performance due to the results of the acquired Cocoa Processing assets. Coffee also saw better performance from both green coffee supply chain and soluble coffee operations.

Food Staples & Packaged Foods volumes were 17.9% higher mainly because of higher wheat milling volumes following the acquisition of BUA Group’s wheat milling assets in Nigeria, as well as higher volumes from Grains’ origination and export operations and in Rice trading. As a result of the higher volumes, revenue increased 11.9% even as prices for Rice, Palm and Dairy declined during the period. EBITDA grew 37.6% due to improved performance across most platforms, except Packaged Foods, where performance was affected by ongoing currency volatility and disruption of its dairy and beverage juice production in Nigeria following a plant fire in April 2016.

The Industrial Raw Materials segment delivered 24.9% growth in volumes on higher Cotton volumes in 9M 2016. Revenues rose 10.4% as cotton prices increased along with higher volumes. However, EBITDA declined by 9.7% as lower margins recorded by the Cotton business offset the increased contribution from SEZ in Gabon.

Commodity Financial Services booked an EBITDA of S$1.0 million compared to S$19.1 million in 9M 2015 due to lower contribution from the market-making and volatility trading business while the funds business performed well.

Outlook and Prospects

The long-term trends in the agri-commodity sector remain attractive, and Olam is well positioned to benefit from this as a core global supply chain business with selective integration into higher value upstream and mid/downstream segments. Olam believes its diversified and well-balanced portfolio with leadership positions in many segments provides a resilient platform to navigate current uncertainties in global markets, and continues to execute on its strategic plan to invest in prioritised platforms between 2016 and 2021.

. . . . .

1 Prior period financial statements have been restated due to changes to accounting standards pertaining to Agriculture (SFRS 41) and Property, Plant and Equipment (SFRS 16) that came into effect from January 1, 2016. Please refer to the Management Discussion and Analysis report for more information.

– See more at: http://olamgroup.com/news/q3-2016/#sthash.aYcYyuYO.7EQE8iFO.dpuf