VEVEY, Switzerland – Nestlé reported today that its fiscal 2019 net profit increased by 24.4% to 12.6 billion Swiss francs ($12.9 billion) beating a consensus forecast of 12.36 billion francs in a company-supplied analysts’ poll. Fiscal 2019 sales were 92.6 billion Swiss francs compared to 91.4 billion francs ($94.8 billion), prior year, an increase of 1.2%. Organic sales growth accelerated to 3.5% from 3% in 2018, and just below a 3.6% estimate in the company poll. It slowed to 3.0% in the final quarter of 2019, from 3.7% in the third quarter.

Earnings per share increased by 28.0% to 4.30 francs. Net profit benefited from the sale of Nestlé Skin Health. Underlying trading operating profit increased by 4.8% to 16.3 billion francs. Underlying earnings per share increased by 11.1% in constant currency and by 9.8% on a reported basis to 4.41 francs.

Coffee had good momentum, helped by strong demand for Starbucks products.

Nespresso

Nespresso maintained mid single-digit organic growth, with positive growth across all regions. North America grew at a strong double-digit rate, outpacing market growth. The Vertuo system was the main growth contributor as it continued to gain traction globally. The out-of-home segment also saw good momentum, particularly in France and the United States.

Key figures

- Organic growth of 3.5%, with real internal growth (RIG) of 2.9% and pricing of 0.6%. Growth was supported by strong momentum in the United States and Purina PetCare globally.

- Total reported sales increased by 1.2% to CHF 92.6 billion (2018: CHF 91.4 billion). Net acquisitions had a negative impact of 0.8% and foreign exchange reduced sales by 1.5%.

- One year ahead of Nestlé’s medium-term plan, the company reached its 2020 profitability target range. The underlying trading operating profit (UTOP) margin increased by 60 basis points to 17.6%. The trading operating profit (TOP) margin decreased by 30 basis points to 14.8% due to increased restructuring and related expenses.

- Underlying earnings per share increased by 11.1% in constant currency and by 9.8% on a reported basis to CHF 4.41. Earnings per share increased by 28.0% to CHF 4.30 on a reported basis.

- Free cash flow increased by 10.9% to CHF 11.9 billion.

- Board proposes dividend increase of 25 centimes to CHF 2.70 per share, marking 25 consecutive years of dividend growth. In total, CHF 16.9 billion was returned to shareholders in 2019 through a combination of dividend and share buybacks. At the end of 2019, Nestlé completed the CHF 20 billion share buyback program initiated in July 2017. It started a new share buyback program of up to CHF 20 billion in January 2020.

- Nestlé divested Nestlé Skin Health in 2019 and announced the sale of its U.S. ice cream business for USD 4 billion to Froneri (transaction closed January 31, 2020). Nestlé also agreed to sell a 60% stake in its Herta charcuterie (cold cuts and meat-based products) business to Casa Tarradellas. Portfolio rotation over the past three years amounts to 12% of total 2017 sales.

- 2020 Outlook: continued increase in organic sales growth, expecting further acceleration in 2021/2022 towards sustainable mid single-digit growth. Underlying trading operating profit margin with continued improvement. Underlying earnings per share in constant currency and capital efficiency expected to increase. It is too early to quantify the financial impact of the coronavirus outbreak at this time.

Mark Schneider, Nestlé CEO, commented:

“We saw strong progress in 2019, with key operating and financial metrics improving significantly for the second consecutive year. Organic growth accelerated, fueled by strong momentum in the United States and Purina PetCare globally. Profitability improved again and reached our guided range one year ahead of plan. Cash flow was strong, while underlying earnings per share and returns to shareholders reached record levels. In 2020, we expect continued organic sales growth improvement as we take further steps to decisively address underperforming businesses.

In 2019, we made significant progress in our portfolio transformation. We did what we said we would do and more. We are not done yet. We will respond to rapid changes in the industry and fast-evolving consumer preferences to position our portfolio for higher growth.

Nestlé will continue to focus on fast innovation. The launch of our premium Starbucks products, for example, has been a great success. We are very pleased with the speed of the product rollout and the positive response by consumers. The company is fully embracing the need for speed, as the rapid expansion of our new plant-based food and beverage offerings has shown. We are getting to market faster with must-have products.

Our shareholders are seeing reliable, sustainable and increasing cash returns even in turbulent times. A key driver is our sustainable dividend practice. We are proud to propose the 25th consecutive annual dividend increase to our shareholders this year.

We have also reaffirmed our sustainability leadership at a time when society is increasingly looking to business for solutions to the major environmental problems we are facing. In addition, we have made significant progress in making our workplace even more diverse and inclusive. New initiatives, such as our enhanced parental leave policy, reaffirm Nestlé’s status as an employer of choice around the world.

In the past few weeks, the spread of the coronavirus has required extraordinary effort from our team in China. We have focused on ensuring the safety of our people and their families and introducing protective measures for all our facilities. We are working closely with the Chinese authorities as they take measures to contain this epidemic, building on our significant experience and expertise on the ground. Our immediate thoughts are with the people directly impacted by this global health emergency. We stand in solidarity with the Chinese people and are working hard to ensure our nutritious food and beverages continue to be widely available, particularly those for the most vulnerable, the youngest and the oldest in society. The Greater China region is our second largest market, representing about 8% of global sales. It is too early to quantify the financial impact of this outbreak at the present time.”

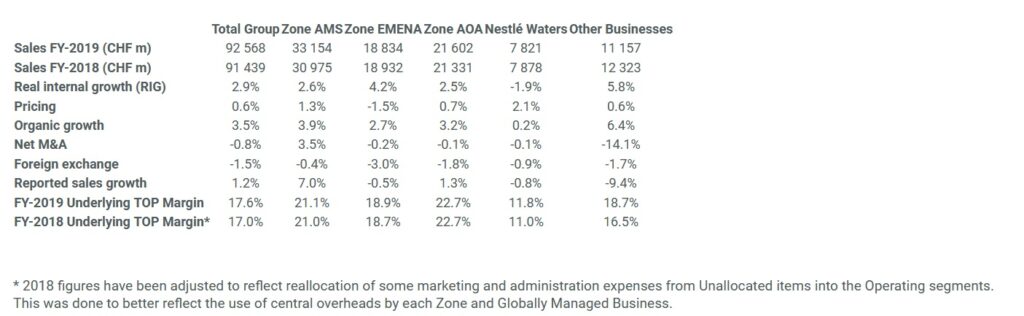

Group Results (click to enlarge)

Group Sales

Organic growth reached 3.5% in 2019, fully in line with our guidance. RIG accelerated to 2.9% for the full year, the highest level in the last six years. Growth was supported in particular by innovation and portfolio management. Pricing contributed 0.6% and returned to positive territory in the fourth quarter.

Year-on-year organic growth acceleration was supported by strong growth in the United States and Brazil, as well as improved momentum in Western Europe. Our Zone AOA saw solid growth despite softness in some categories in China and Pakistan. Organic growth accelerated to 2.6% in developed markets and remained largely unchanged in emerging markets at 4.7%.

All product categories saw positive organic growth. The largest contribution came from Purina PetCare and its premium brands Purina Pro Plan and Purina ONE. Coffee had good momentum, helped by strong demand for Starbucks products, which by now have been rolled out in more than 40 countries. In total, Starbucks products generated more than CHF 300 million of incremental sales in 2019. Nestlé Health Science made good progress, based on strong sales development for medical nutrition and Atrium products. Water was subdued, reflecting pricing pressure in the mainstream segment and soft demand in Europe. Vegetarian and plant-based food products, including the Sweet Earth Awesome Burger and the Garden Gourmet Incredible Burger, saw strong double-digit organic growth, reaching sales of close to CHF 200 million.

Net acquisitions had a negative impact of 0.8%, largely related to the divestment of Nestlé Skin Health and Gerber Life Insurance. Foreign exchange reduced sales by 1.5%. Total reported sales increased by 1.2% to CHF 92.6 billion.

Underlying Trading Operating Profit

Underlying trading operating profit increased by 4.8% to CHF 16.3 billion. The underlying trading operating profit margin reached 17.6%, an increase of 60 basis points in constant currency and on a reported basis.

Margin expansion was supported by structural cost reductions, portfolio management, pricing and improved mix, which more than offset input cost inflation. Consumer-facing marketing expenses increased by 3.4% in constant currency.

Restructuring expenses and net other trading items increased by CHF 854 million to CHF 2.6 billion, largely reflecting increased impairments of assets related to the Yinlu business. As a result, trading operating profit decreased by 0.8% to CHF 13.7 billion and the trading operating profit margin decreased by 30 basis points on a reported basis to 14.8%.

Net Financial Expenses and Income Tax

Net financial expenses grew by 33.5% to CHF 1.0 billion, largely reflecting an increase in average net debt during the year.

The Group reported tax rate decreased by 550 basis points to 21.0% due to exceptional items including the sale of Nestlé Skin Health. The underlying tax rate declined by 220 basis points to 21.6%, mainly due to the evolution of the geographic and business mix.

Net Profit and Earnings Per Share

Net profit increased by 24.4% to CHF 12.6 billion, and earnings per share increased by 28.0% to CHF 4.30. Net profit benefited from the sale of Nestlé Skin Health.

Underlying earnings per share increased by 11.1% in constant currency and by 9.8% on a reported basis to CHF 4.41. The increase was mainly the result of improved operating performance. Nestlé’s share buyback program contributed 1.9% to the underlying earnings per share increase, net of finance costs.

Cash Flow

Free cash flow grew by 10.9% to CHF 11.9 billion. The increase resulted from stronger operating performance and improved capital discipline. Cash flow is expected to remain at around 12% of sales, with working capital trending to zero.

Dividend

At the Annual General Meeting on April 23, 2020, the Board of Directors will propose a dividend of CHF 2.70 per share, an increase of 25 centimes. If approved, this will be the company’s 25th consecutive annual dividend increase. The company has maintained or increased its dividend in Swiss francs over the last 60 years. Nestlé is committed to maintaining this long-held practice to increase the dividend in Swiss francs every year.

The last trading day with entitlement to receive the dividend will be April 24, 2020. The net dividend will be payable as from April 29, 2020.

Shareholders entered in the share register with voting rights on April 16, 2020 at 12:00 noon (CEST) will be entitled to exercise their voting rights.

Share Buyback Program

During 2019, the Group repurchased CHF 9.7 billion of Nestlé shares. On December 30, 2019, Nestlé completed the CHF 20 billion share buyback program initiated in July 2017 at an average price per share of CHF 88.82. On the same day, Nestlé announced that it will start a new share buyback program of up to CHF 20 billion. Share repurchases under this program are foreseen over a three-year period and commenced on January 3, 2020. Should any extraordinary dividend payments or sizeable acquisitions take place during this period, the amount of the share buyback will be reduced accordingly.

Net Debt

Net debt decreased to CHF 27.1 billion as at December 31, 2019, compared to CHF 30.3 billion at the end of 2018. The decrease in net debt largely reflected strong free cash flow generation and a net cash inflow from acquisitions and divestments, mainly the disposal of Nestlé Skin Health. This more than offset the CHF 16.9 billion returned to shareholders through dividends and share buybacks.

Return on Invested Capital (ROIC)

The Group’s ROIC increased by 20 basis points to 12.3%. The improvement was the result of improved operating performance and disciplined capital allocation. ROIC will trend towards 15% over time, including the impact of any future mid-sized acquisitions.

Portfolio Management

Nestlé completed acquisitions and divestments with a total value of around CHF 10.4 billion in 2019. The most significant transaction was the divestment of Nestlé Skin Health for CHF 10.2 billion.

In December 2019, an agreement was reached to sell Nestlé’s U.S. ice cream business for USD 4 billion to the Froneri ice cream joint venture with PAI Partners. The transaction was closed on January 31, 2020.

Nestlé also agreed to sell a 60% stake in its Herta charcuterie (cold cuts and meat-based products) business to Casa Tarradellas and create a new joint venture for Herta with the respective equity stakes of 40% and 60%. The total business has been valued at EUR 690 million. Closing is expected to take place in the first half of 2020.

Strategic Developments

In May 2019, Nestlé announced the transition of the U.S. pizza and ice cream businesses from a Direct-Store-Delivery network to a warehouse distribution model. The transition was successfully completed at the end of 2019, six months ahead of schedule.

In October 2019, Nestlé announced the integration of its Waters business into the Group’s three geographical Zones, effective January 1, 2020. This move will help utilize the company’s strong local expertise, better respond to rapidly-changing consumer preferences and create synergies. Nestlé will take further steps to improve profitable growth in Waters and to address underperformance in certain segments of this business.