MILAN – The J.M. Smucker Co., which owns Folgers and other leading coffee brands, topped estimates in the third quarter, but reported a sales and earnings decline reflecting several divestitures, according to an earnings release. U.S. Retail Coffee segment sales rose 6% to $661.8M during the quarter vs. $643.3M consensus.

Divestitures included Crisco business on December 1, 2020, the Natural Balance business on January 29, 2021, the private label dry pet food business on December 1, 2021, and the natural beverage and grains businesses on January 31, 2022.

Inflation and supply chain headwinds were noted as holding back the full earnings potential.

Management highlighted that it expects these challenges to continue in the fiscal fourth quarter.

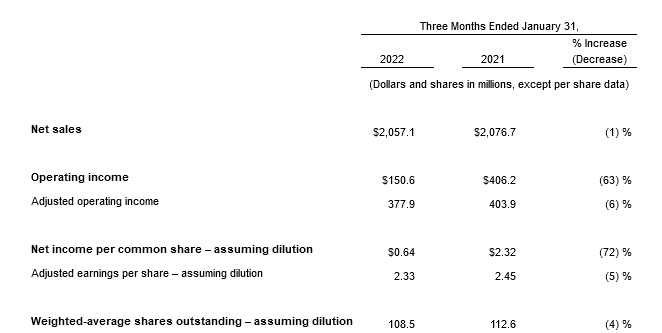

Net sales for the quarter fell 1.0% to $2.06 billion from $2.08 billion last year.. Net sales excluding divestitures and foreign currency exchange increased 4 percent.

Net income per diluted share was $0.64, a decrease of 72 percent, primarily due to a noncash intangible asset impairment charge within the U.S. Retail Pet Foods segment.

Adjusted earnings per share was $2.33, a decrease of 5 percent.

Cash from operations was $439.7 million, a decrease of 10 percent. Free cash flow was $322.4 million, compared to $416.6 million in the prior year.

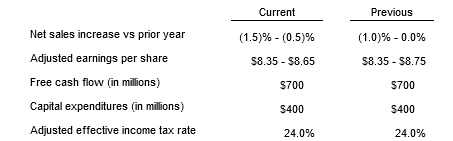

The Company updated its full-year fiscal 2022 financial outlook.

J.M. Smucker Net Sales

The J.M. Smucker Co. net sales decreased 1 percent. Excluding noncomparable net sales in the prior year of $100.7 million for the divested businesses, as well as $1.8 million of favorable foreign currency exchange, net sales increased $79.3 million, or 4 percent.

The increase in comparable net sales was due to higher net price realization for each of the Company’s U.S. Retail segments and for International and Away From Home, partially offset by decreased contribution from volume/mix.

Operating Income

Gross profit decreased $126.3 million, or 16 percent, reflecting higher costs, primarily driven by increased commodity, ingredient, manufacturing, and packaging costs, decreased contribution from volume/mix, and the noncomparable impact of the Crisco, Natural Balance, and private label dry pet food divestitures, partially offset by increased pricing. Operating income decreased $255.6 million, or 63 percent, reflecting a $150.4 million impairment charge related to the Rachael Ray Nutrish brand and the decrease in gross profit, partially offset by a $35.7 million decrease in selling, distribution, and administrative (“SD&A”) expenses.

Adjusted gross profit decreased $63.3 million, or 8 percent, with the difference from generally accepted accounting principles (“GAAP”) results being the exclusion of the change in net cumulative unallocated derivative gains and losses and special project costs. Adjusted operating income decreased $26.0 million, or 6 percent, further reflecting the exclusion of the impairment charge, the net pre-tax gain on divestitures, amortization, and special project costs.

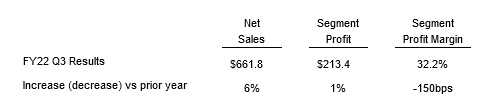

U.S. Retail Coffee

Net sales increased $35.9 million. Net price realization increased net sales by 7 percentage points, primarily reflecting list price increases across the portfolio and trade spend reductions for roast and ground products.

Volume/mix decreased net sales by 1 percentage point, driven by the Folgers‘ brand, partially offset by growth for the Cafe Bustelo brand.

Segment profit increased $2.7 million, primarily reflecting higher net pricing and lower marketing spend, partially offset by higher commodity costs and the decreased contribution from volume/mix.

J.M. Smucker Full-Year Outlook

The Company updated its full-year fiscal 2022 guidance as summarized below:

The pandemic and related implications, along with cost inflation and volatility in supply chains, continue to impact financial results and cause uncertainty and risk for the fiscal year 2022 outlook. Any manufacturing or supply chain disruption, inclusive of any labor shortages, whether related to illness, vaccine requirements, or other factors, as well as changes in consumer mobility and purchasing behavior, retailer inventory levels, and macroeconomic conditions could materially impact actual results. While the broader outlook remains uncertain, the Company continues to focus on managing the elements it can control, including taking the necessary steps to minimize the impact of cost inflation and any business or labor disruption. This guidance reflects performance expectations based on the Company’s current understanding of the environment.