ORRVILLE, Ohio, U.S. – The J. M. Smucker Company (NYSE: SJM) today announced results for the first quarter ended July 31, 2019, of its 2020 fiscal year. Financial results include the contribution from Ainsworth Pet Nutrition, LLC (“Ainsworth”), which was acquired on May 14, 2018, and reflect the divestiture of the Company’s U.S. baking business on August 31, 2018.

All comparisons are to the first quarter of the prior fiscal year, unless otherwise noted.

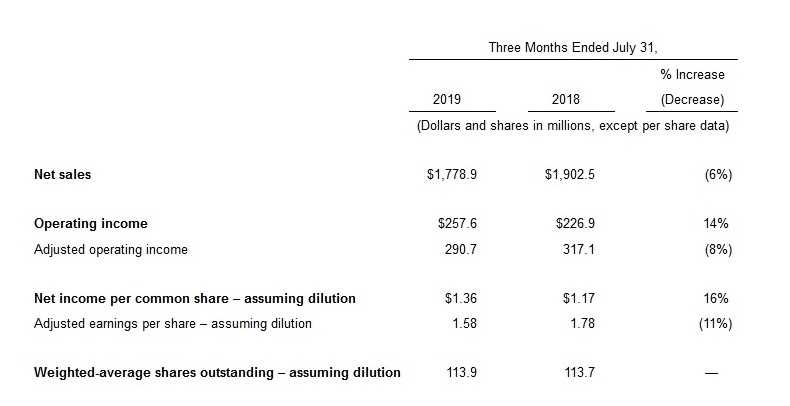

Net sales decreased $123.6 million, or 6 percent. Comparable net sales decreased 4 percent.

Net income per diluted share was $1.36. Adjusted earnings per share was $1.58, a decrease of 11 percent.

Cash from operations was $221.5 million, a decrease of 9 percent. Free cash flow was $148.5 million in the quarter, compared to $141.7 million in the prior year.

The Company updated its full-year fiscal 2020 net sales and adjusted earnings per share outlook.

Chief Executive Officer remarks

“Our first quarter performance fell short of our expectations primarily due to the timing of shipments and deflationary pricing in the coffee and peanut butter categories, as well as competitive activity in the premium dog food category,” said Mark Smucker, Chief Executive Officer.

“We have continued momentum in many key product categories, and we are already taking decisive actions and prioritizing initiatives that strengthen our business. We remain confident in our strategy, which includes a continued focus on our growth imperatives to lead in the best categories, build brands consumers love, and be everywhere, combined with a relentless focus on operating with financial discipline, all of which will enhance shareholder value for the long term.”

First Quarter Consolidated Results

Net Sales

Net sales decreased 6 percent, reflecting the impact of $73.1 million of net sales in the prior year attributed to the divested U.S. baking business, partially offset by an incremental $25.4 million contribution from the Ainsworth acquisition. Excluding items impacting comparability, net sales decreased $75.9 million, or 4 percent. Lower volume/mix reduced sales by 3 percentage points driven primarily by declines for private label pet food offerings and coffee. Net price realization reduced net sales by 1 percentage point, mostly due to lower pricing for coffee and peanut butter, partially offset by higher pricing for pet food and snacks. Foreign currency exchange was neutral.

Operating Income

Gross profit increased $21.4 million, or 3 percent, primarily driven by a favorable net impact of lower prices and lower costs and the noncomparable benefit of the Ainsworth acquisition, partially offset by a decline in volume/mix and the impact of the U.S. baking business divestiture. The favorable net impact of price and cost was mostly driven by a favorable change in derivative gains and losses. Operating income increased $30.7 million, or 14 percent, reflecting the increase in gross profit and decreases in other special project costs, selling, distribution, and administrative expenses (“SD&A”), and amortization.

On a non-GAAP basis, adjusted gross profit decreased $29.6 million, or 4 percent, with the primary difference from GAAP results being the exclusion of unallocated derivative gains and losses, which resulted in a $51.0 million favorable change as compared to the prior year. Adjusted operating income decreased $26.4 million, or 8 percent, further reflecting the exclusion of special project costs.

Interest Expense, Other Income (Expense), and Income Taxes

Net interest expense decreased $4.2 million, reflecting the benefit of reduced debt due to net repayments of $934.0 million during the last twelve months.

The effective income tax rate was 25.2 percent compared to 23.2 percent in the prior year. The effective income tax rate in the prior year included a non-recurring deferred tax benefit related to the Ainsworth acquisition.

Cash Flow and Debt

Cash provided by operating activities was $221.5 million, compared to $243.0 million in the prior year reflecting an increase in working capital, partially offset by the increase in net income adjusted for noncash items. Free cash flow was $148.5 million, compared to $141.7 million in the prior year, as a $28.3 million reduction in capital expenditures more than offset the decrease in cash provided by operating activities. Net debt repayments in the quarter totaled $130.0 million.

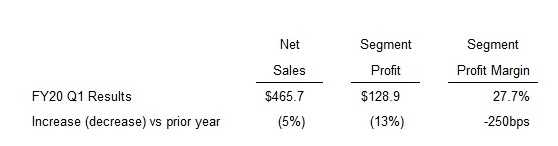

U.S. Retail Coffee

Segment net sales decreased $23.8 million, which included lower net price realization of 3 percentage points. Net pricing reflected planned promotional activity across all brands in the segment resulting from significantly lower green coffee costs. Net sales were further reduced by 2 percentage points due to lower volume/mix, primarily attributable to the Folgers® brand. Retailer inventory adjustments across all brands accounted for a portion of the reduced volume/mix.

Segment net sales decreased $23.8 million, which included lower net price realization of 3 percentage points. Net pricing reflected planned promotional activity across all brands in the segment resulting from significantly lower green coffee costs. Net sales were further reduced by 2 percentage points due to lower volume/mix, primarily attributable to the Folgers® brand. Retailer inventory adjustments across all brands accounted for a portion of the reduced volume/mix.

Segment profit decreased $18.9 million, primarily due to reduced volume/mix and the net impact of lower pricing and green coffee costs.