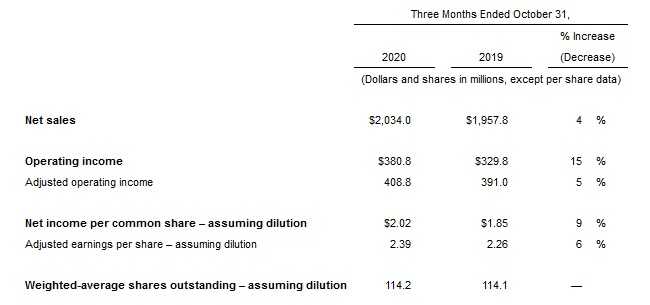

MILAN — The J.M. Smucker Co, the parent of Folgers coffee and Cafe Bustelo, raised guidance for fiscal 2021 after bringing in higher second-quarter revenue and earnings, largely from improvements in U.S. food and coffee sales. The company posted net income of $230.8 million, or 2.02 a share, for the quarter to Oct. 31, up from $211.2 million, or $1.85 a share, in the year-earlier period. Adjusted per-share earnings came to $2.39,well ahead of the $2.23 FactSet consensus. Sales rose 4% to $2.034 billion from $1.958 billion, also ahead of the $2.102 billion FactSet consensus.

Chief Executive Mark Smucker said the company’s U.S. retail consumer foods and retail coffee businesses were boosted by at-home consumption trends during the pandemic.

The Company increased its full-year fiscal 2021 net sales, adjusted earnings per share, and free cash flow outlook.

Net sales are expected to increase 1 to 2 percent compared to the prior year, primarily reflecting elevated at-home consumption benefiting the U.S. Retail Coffee and U.S. Retail Consumer Foods segments.

Net sales guidance also reflects a decline for the Company’s Away From Home business and the lapping of a $185 million incremental benefit to net sales related to COVID-19 in the fourth quarter of the prior year.

Adjusted earnings per share is expected to range from $8.55 to $8.85, based on 114.1 million shares outstanding. Earnings guidance reflects the contribution from sales at a gross profit margin range of 37.5 to 38.0 percent, SD&A expenses to increase 1 to 2 percent compared to the prior year, and an effective tax rate of 24.0 percent. Free cash flow is expected to range from $975 million to $1,025 million with capital expenditures of $315 million.

The J.M. Smucker Co.: Second Quarter Consolidated Results

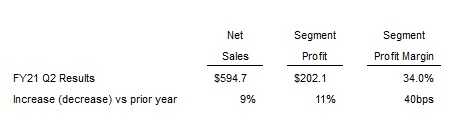

U.S. Retail Coffee

U.S. Retail Coffee

Net sales grew $51.3 million to $594.7 million, reflecting a 10 percentage point increase from volume/mix. Favorable volume/mix was driven by the Dunkin, Café Bustelo, and Folgers brands, reflecting elevated at-home coffee consumption. Net price realization reduced net sales by 1 percentage point.

Net sales grew $51.3 million to $594.7 million, reflecting a 10 percentage point increase from volume/mix. Favorable volume/mix was driven by the Dunkin, Café Bustelo, and Folgers brands, reflecting elevated at-home coffee consumption. Net price realization reduced net sales by 1 percentage point.

Segment profit increased $19.6 million, reflecting the favorable volume/mix and lower SD&A expenses, partially offset by the impact of net pricing and costs.

The Dunkin‘ brand is licensed to The J.M. Smucker Co. for packaged coffee products sold in retail channels such as grocery stores, mass merchandisers, club stores, e-commerce, and drug stores. This information does not pertain to products for sale in Dunkin restaurants.