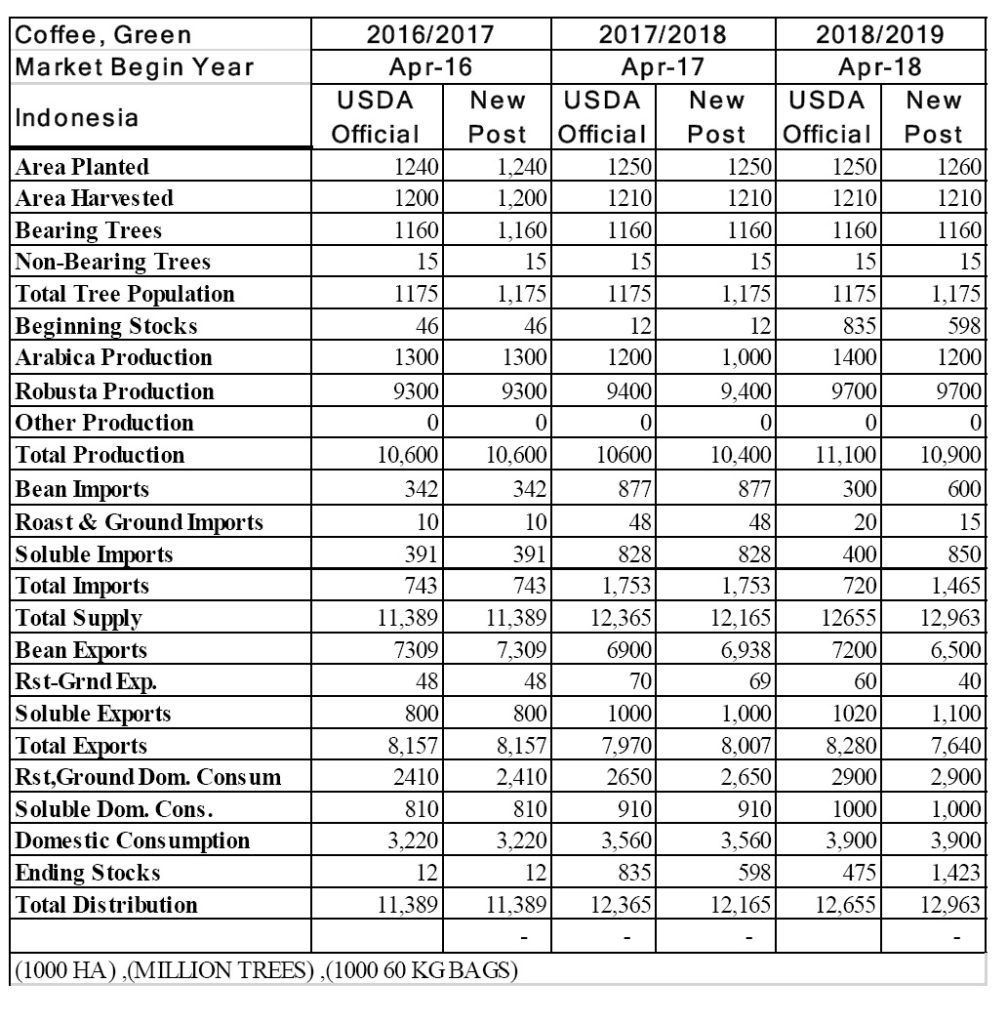

JAKARTA, Indonesia — USDA semi-annual Gain Report on Indonesia has revised downward forecast for Arabica production, while 2018/19 imports are increased and exports are decreased, resulting in higher ending stocks. Domestic demand remains strong, and the 2018/19 consumption forecast is unchanged.

Production

Production in 2018/19, based on favorable weather in key production areas, is forecast at 10.9 million bags, 500,000 bags higher than 2017/18, with the robusta production unchanged at 9.7 million bags.

Due to a downward revision in 2017/18 Arabica output, the 2018/19 Arabica forecast output is similarly lowered.

Consumption

The consumption forecast is unchanged at 3.9 million bags. While growing, consumption is still much less than in neighboring economies such as Vietnam and Philippines.

Expectations for continued consumption growth are supported by the growth in the number of coffee business outlets. Major brands continue to open new outlets in shopping centers, office buildings, and transportation hubs. In addition, convenience stores increasingly offer both hot and cold coffee beverages.

Trade

Due to continued strong domestic demand amid lower international prices and sluggish export demand, 2018/19 bean exports are lowered to at 6.5 million bags. The graph below shows the slow pace of exports this year relative to 2017/18.

Green bean imports reached 477,000 bags during April to September 2018. Due to this pace, the 2018/19 import forecast is raised to 600,000 bags in 2018/19. Benefitting from proximity and the ASEAN duty free import status, Vietnam’s coffee prices were quite competitive following their harvest.

At the end of 2017 when stocks were low, Indonesian importers made multiple purchases for one-year delivery contracts. However, the pace of imports is expected to slow in the next few months as domestic stocks rebound.