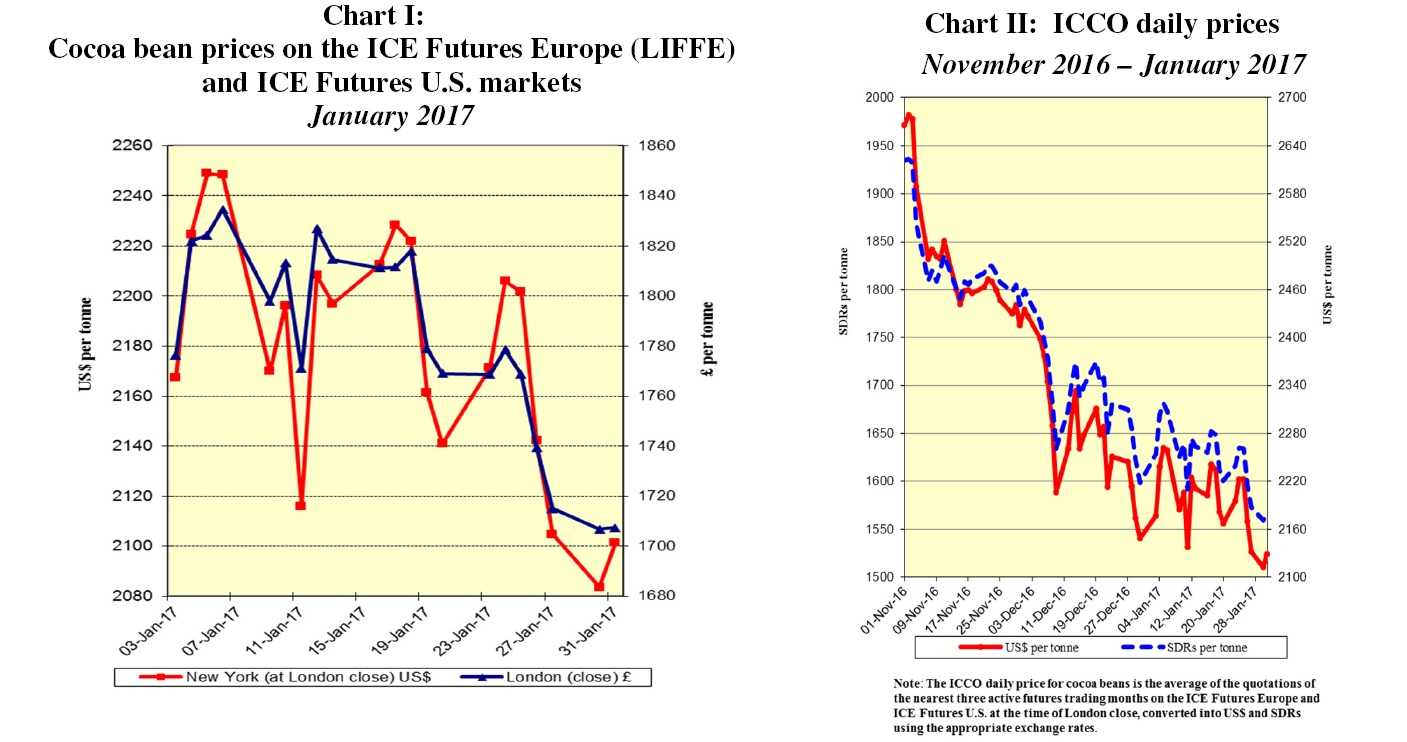

LONDON, UK – The current cocoa market review reports on cocoa price movements on the international markets during the month of January 2017. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

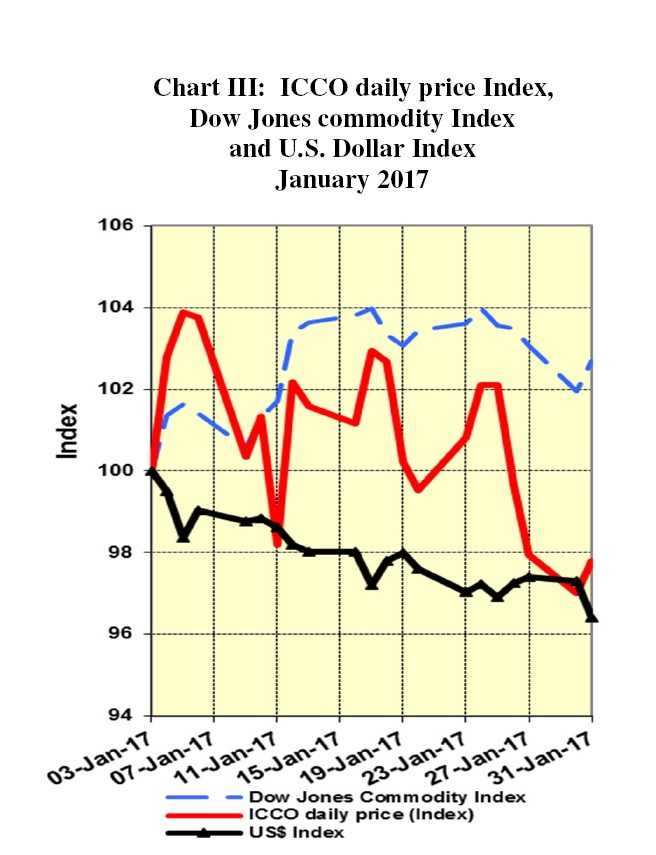

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from November 2016 to January 2017.

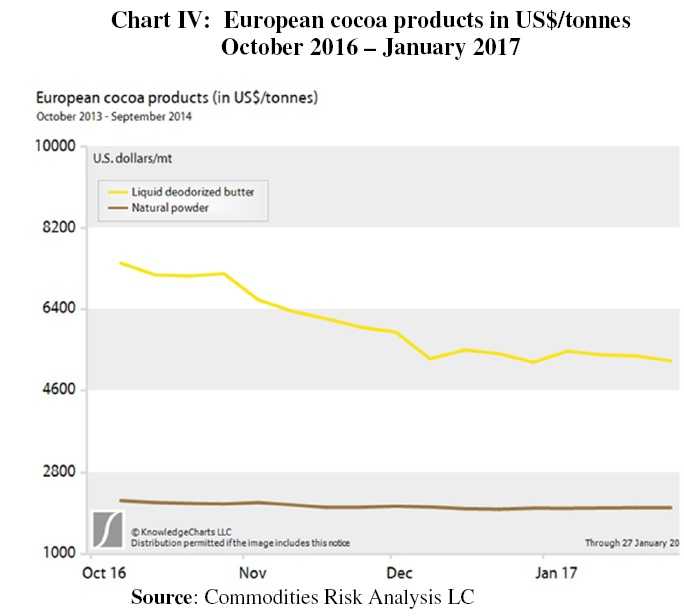

Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in January while Chart IV presents the prices of European cocoa products from the beginning of the 2016/2017 cocoa year to the present.

Price movements

Price movements

In January, the ICCO daily price averaged US$2,196 per tonne, down by US$91 compared to the previous month’s recorded average (US$2,287), and ranged between US$2,112 and US$2,262 per tonne.

During the first week of January, cocoa futures markets witnessed a slight recovery from the general downward trend that featured prices movements in the previous month.

As seen in Chart I, the unrest in Côte d’Ivoire that resulted from an armed uprising was the main contributing factor in the short-lived recovery in futures prices, pushing them to their highest level of the month, at £1,835 per tonne in London and at US$2,249 per tonne in New York.

However, the markets retreated in the second week after the Government reached a deal to calm the aforementioned uprising. This retreat was exacerbated on the New York market by a weakening pound.

Thereafter, from the second half of the month onwards, cocoa futures moved sideways, as the release of weaker-than-expected grindings data from Europe and North America combined with irregular currency movements influenced the markets.

Moving towards the end of the month, cocoa futures prices followed a sustained downward trend, as data from the annual survey from the International Cocoa Organization (ICCO) Expert Working Group on Stocks showed that the 2015/2016 end-of-season world cocoa bean stocks were higher than expected; thus reinforcing concerns about excess supplies.

This led cocoa futures prices to fall to a more than three-year low, at £1,707 per tonne in London and to an almost four year-low, at US$2,084 per tonne in New York.

As shown in Chart III, while the US$ gradually weakened throughout the month under review, cocoa futures globally followed a declining trend. The broader commodity complex considerably outperformed cocoa futures prices from the second half of the month of January onwards.

Supply & demand situation

Supply & demand situation

On the supply side, as reported by news agencies, cumulative season cocoa arrivals to ports in Côte d’Ivoire increased by just over one per cent to 1,187,000 tonnes by 12 February, as compared to the previous cocoa season.

Nevertheless, the current level of arrivals may underestimate the total volume harvested due to falling prices, which has caused some traders to default on contracts not adequately hedged; being unable to afford to buy the beans for which they had secured exports rights at auction.

The large availability of beans and the reduced demand is placing pressure on the official minimum farm gate price of 1,100 FCFA per kg, and may lead the Government to consider reducing the price for the forthcoming midcrop.

In Ghana, seasonal cocoa purchases were still lower than those recorded for the previous year, as the Ghana Cocoa Board indicated that 611,763 tonnes had been declared as at 12 February 2017.

Despite the weather conditions not being as favourable as in Côte d’Ivoire, total output is still expected to exceed last year’s level and reach over 800,000 tonnes.

On the demand side, the data published by the European Cocoa Association show a fall by almost one per cent of grindings to 339,379 tonnes of cocoa processing in Western Europe for the first quarter of the season, compared with the previous year.

On the other side of the Atlantic, grindings data released by the National Confectioners’ Association indicate a decrease of 1.1% to 117,588 tonnes in North America.

On the other side of the Atlantic, grindings data released by the National Confectioners’ Association indicate a decrease of 1.1% to 117,588 tonnes in North America.

Surprisingly however, a report from the Cocoa Association of Asia shows that grindings rose by almost 17% to 188,493 tonnes for the same year.

As seen in Chart IV, prices of both butter and powder remained relatively stable during the month of January.

At the end of February, the ICCO Secretariat will release its first crop forecasts for the current 2016/2017 cocoa year in the Quarterly Bulletin of Cocoa Statistics.