Share your coffee stories with us by writing to info@comunicaffe.com.

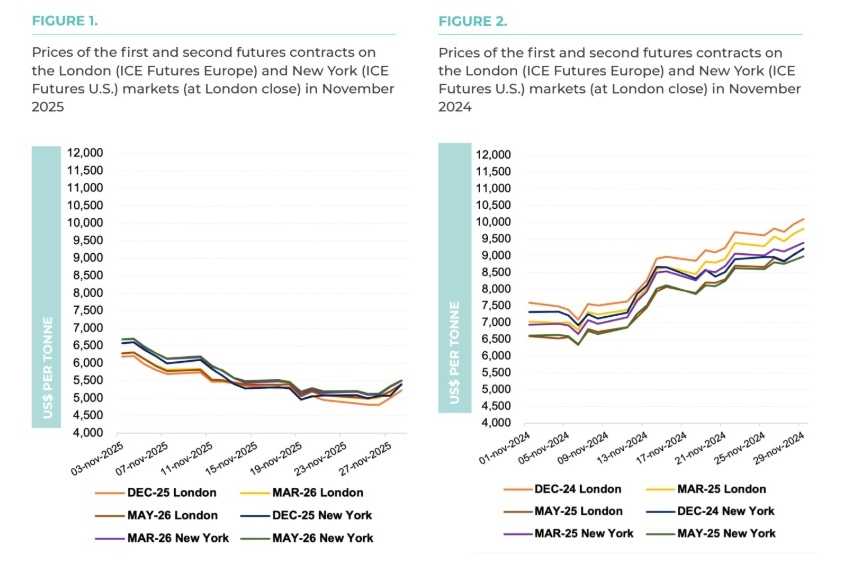

ABIDJAN, Côte d’Ivoire – With reference to Figure 1 and Figure 2, cocoa futures prices exhibited contrasting trends in November 2025 and November 2024. While prices were supported by persistent supply concerns and surged sharply in November 2024, in contrast, prices for November 2025 highlighted the influence of regulatory signals and supply outlook which resulted in an overall bearish tone with only limited price increases.

On the regulatory side, the postponement of the European Union Regulation on Deforestation-Free Products (EUDR) has allowed cocoa trade between the European Union and producing and exporting countries to continue without immediate

strict compliance requirements.

This alleviated short-term supply concerns and reinforced market perceptions of ample availability of cocoa which is a bearish factor for prices.

These bearish sentiments were further amplified by President Trump’s announcement that cocoa would be exempt from reciprocal tariffs, which strengthened the potential supply outlook.

Demand also played a role in the bearish prices observed during the month. The most recent regional grindings report, published in October 2025, revealed notably weak figures, particularly from Europe and Asia.

This underscores that the cocoa market remains in a phase of a slowdown in demand. The elevated cocoa prices seen throughout much of the last several years have led to a significant reduction in both industrial and consumer demand for cocoa. This contraction in demand has also been a key driver behind the overall decline in cocoa futures prices observed in November 2025.

These contrasting dynamics underscore the volatility inherent in cocoa markets and the importance of monitoring fundamental factors, financial drivers, regulations and policy developments.

Early price rally

At the start of the month, cocoa prices experienced a sharp rally on 4 November. Compared to cocoa futures prices on 31 October 2025, prices for the nearby contract i.e., DEC-25 contract, rose by 7% and 8% in London and New York respectively. In London the price for the DEC-25 contract rose from US$5,808 per tonne to US$6,211 per tonne while in New York it increased from US$6,133 per tonne to US$6,607 per tonne.

Mid-month price declines

The bullish price momentum reversed sharply by the middle of November. Regulatory and policy developments, including the European Union’s delay of its deforestation law and the United States waiver on cocoa import tariffs, eased supply concerns.

In addition, cocoa arrivals in Ivorian ports were reported to be picking up after a slow start at the beginning of the season. With supply less of a concern this caused a downturn in prices. In London, prices declined from the early month’s highs by 15% to US$5,287 per tonne and in New York by 20% to US$5,316 per tonne.

End of month price rebound

Toward the end of the month, inventory drawdowns in ICE Futures U.S. licensed warehouses supported a modest rebound in cocoa prices. Cocoa certified stocks in ICE Futures U.S. licensed warehouses declined from 1,964,090 bags or 127,538 tonnes on 1 October 2025 to 1,711,039 bags or 111,106 tonnes by 28 November 2025. This reflects physical drawdowns in United States warehouses which in turn may reinforce supply constraints.

By the final trading week of the month, prices in London increased by 9% from the low level of US$4,812 per tonne to US$5,222 per tonne while in New York prices increased by 8% from US4,999 per tonne to US$5,404 per tonne.