ABIDJAN, Côte d’Ivoire – Cocoa production during 2021/22 dropped year-on-year in both Côte d’Ivoire (-6%) and Ghana (-34%) as a result of periodically inappropriate weather conditions in Côte d’Ivoire and the devastating effect of the Cocoa Swollen Shoot Virus Disease (CSSVD) in Ghana, wrote the International Cocoa Organization in its latest report.

The reduction in the outputs of the top two world cocoa producers plunged the global cocoa market into a supply deficit, and as such brought the size of the main crop for the 2022/23 season in the two countries to one’s attention.

Growing conditions for the ongoing main crop of the 2022/23 season are generally good in West Africa, hence boding well for the region’s cocoa production. In Côte d’Ivoire, cumulative arrivals of cocoa beans at ports were estimated at 954,000 tonnes as at 11 December 2022, representing a 10% year-on-year increase compared to 867,000 tonnes reported last year.

Though information on volumes of purchases of graded and sealed cocoa beans in Ghana is yet to be released, favourable weather conditions during the development stage of the current crop are envisaged to result in a better harvest as compared to the previous crop year.

Cocoa supply currently does not seem to be of concern especially as harvest seems to be following a positive trend combined with a decrease in freight rates and transit times.

It is noteworthy that the unusually above-average rainfall recorded in the main cocoa-growing regions of West Africa during November raised concerns over the ongoing crop as excess rain could potentially result in the propagation of the black pod disease, and thereby cut into the volume of the crop.

However, the demand side of the market seems uncertain. The slowdown in the global economy and inflationary impact on raw materials, combined with exorbitant energy prices in Europe1 which is the leading region for cocoa processing, are likely to take a toll on the operations of cocoa processors.

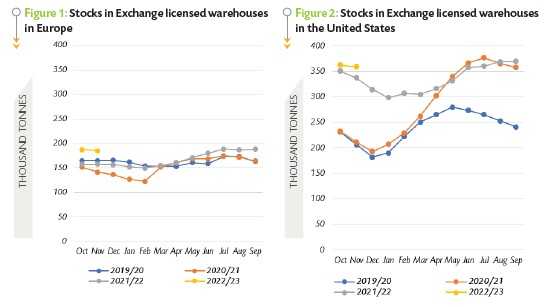

Size of cocoa beans stocks in exchange-licensed warehouses in Europe and the United States

Figure 1 and Figure 2 indicate that at this stage of the 2022/23 cocoa year, total stocks of cocoa beans in the Exchange-licensed warehouses are higher year-over-year on both sides of the Atlantic. At the end of November 2022, total stocks in Exchange-licensed warehouses in Europe amounted to 185,090 tonnes, up by 18% compared to the volume of 157,329 tonnes seen a year ago. Similarly, stocks of cocoa beans in licensed warehouses in the United States were up by 6% to 358,762 tonnes year-on-year.

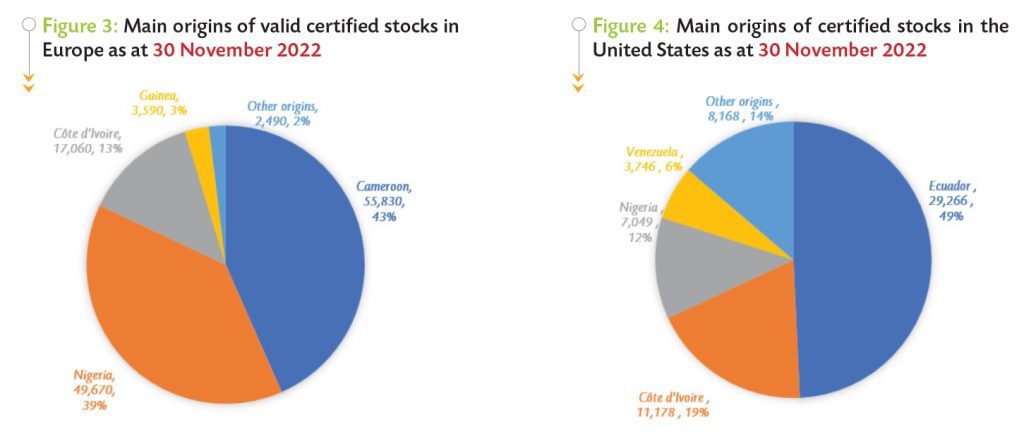

Based on data published at the end of November 2022 by the Exchange in its reports on the composition by origin of stocks, valid certified stocks of cocoa beans held in European Exchange-licensed warehouses originated mainly from Cameroon (43% or 55,830 tonnes), Nigeria (39% or 49,670 tonnes), Côte d’Ivoire (13% or 17,060 tonnes) and Guinea (3% or 3,590 tonnes) (Figure 3).

In the United States (Figure 4), certified stocks comprised cocoa beans mainly from Ecuador (49% or 29,266 tonnes), Côte d’Ivoire (19% or 11,178 tonnes), Nigeria (12% or 7,049 tonnes), and Venezuela (6% or 3,746 tonnes).

Cocoa bean stocks in European Exchange warehouses are mainly made up of African origins while in the United States, certified stocks of cocoa beans mostly originate from neighboring Latin American countries.

Futures prices developments

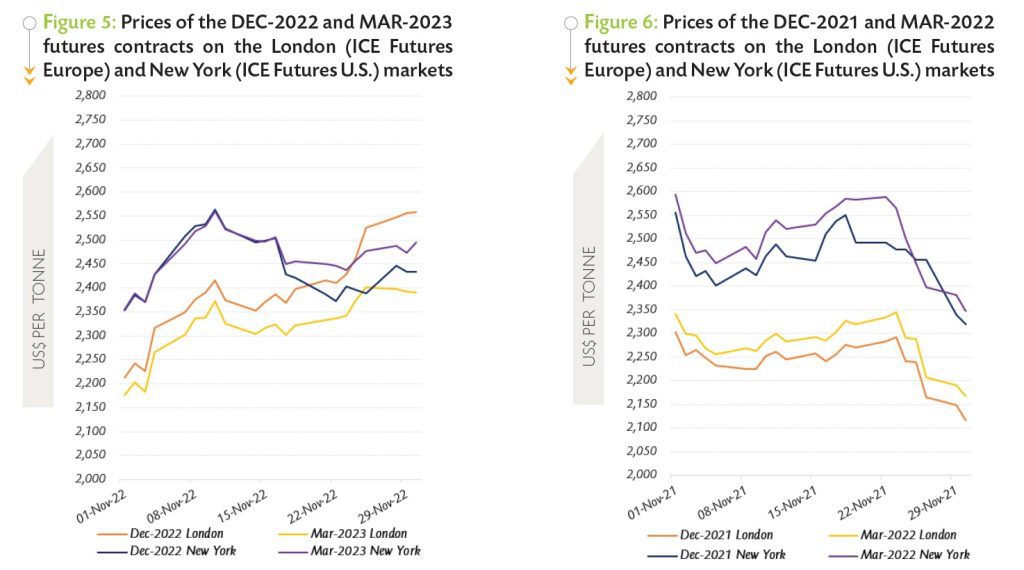

During November, prices of the front-month cocoa futures averaged US$2,394 per tonne and ranged between US$2,211 and US$2,559 per tonne in London, while in New York the first position contract traded at an average price of US$2,445 per tonne and oscillated between US$2,352 and US$2,564 per tonne.

A year back in November 2021, in London, the average price of the front-month contract settled at US$2,241 per tonne and ranged between US$2,117 and US$2,303 per tonne.

Meanwhile, prices of the first position of cocoa futures in New York averaged US$2,460 per tonne and oscillated between US$2,320 and US$2,556 per tonne.

Figure 5 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in November 2022, while Figure 6 presents similar information for the previous year.

As presented in Figure 5, the nearby cocoa futures contract traded on a positive note during November in both London and New York. In London, cocoa futures prices increased substantially by 16% from US$2,211 to US$2,559 per tonne whereas in New York they moved up by 3% from US$2,352 to US$2,433 per tonne. This overall bullish stance could be separated into three main stages.

Over 1-10 November, prices of the first position of cocoa contracts equally firmed by 9% on both sides of the Atlantic moving from US$2,211 to US$2,416 per tonne and from US$2,352 to US$2,564 per tonne in London and New York respectively.

At the time, episodes of torrential rains reported in the main cocoa-growing areas of West Africa raised concerns over a possible outbreak of the black pod disease and thereby, could contribute to the deterioration of the size of the main crop.

In addition, the strike of carriers in the Ivorian port of San Pedro (the main port for exports of cocoa) was seen as a critical parameter that could disrupt the flow of cocoa exports. It should be outlined that, during October 2022, exports of cocoa beans in Côte d’Ivoire plunged by 67% year-on-year from 75,231 tonnes to 24,759 tonnes (Source: Reuters).

This staggering cut in the country’s cocoa exports could have partly been due to the slowing in activities at the San Pedro port. Moving on to 11-22 November, there was a setback of 6% in cocoa prices, from US$2,524 to US$2,372 per tonne in New York while in London they increased slightly by 1% from US$2374 to US$2,410 per tonne.

Meanwhile, information that market participants in the United States were reported to have undertaken substantial long liquidation in the midst of concerns about global demand and weaker projections of the U.S. economy2 combined with the spike in COVID-19 contaminations in China took a toll on cocoa prices. At the latter part of the month under review, prices were improved by 5% from US$2,428 to US$2,559 per tonne in London and by 1% from US$2,403 to US$2,433 per tonne in New York.

ICCO: Summary of global supply and demand estimates for the 2021/22 season

At the end of November, the estimates for the 2021/22 cocoa season published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics (QBCS) mentioned a supply deficit of 306,000 tonnes.

Global production is estimated to have decreased by 8.0% to 4.823 million tonnes. In Africa, production is seen on a decline, moving down by 11.3% to 3.594 million tonnes, whereas in the Americas as well as in Asia and Oceania, crop output is estimated to have increased by 3.2% to 963,000 tonnes and by 4.7% to 266,000 tonnes respectively.

Inversely, grindings increased to 5.081 million tonnes, up by 100,000 tonnes, representing a 2.0% increase compared to the revised estimate of 4.981 million tonnes for the 2020/21 cocoa season.

It is estimated that processing activities have expanded by 2.3% to 1.850 million tonnes in Europe, whereas a growth of 7.5% to 1.128 million tonnes is seen for Africa. In the Americas, processing activities fell by 4.7% to 928,000 tonnes while in Asia and Oceania, grindings went up by 2.2% to 1.175 million tonnes compared to the level attained during the previous season