ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation reports on cocoa price movements on the international markets during the month of October 2017. It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

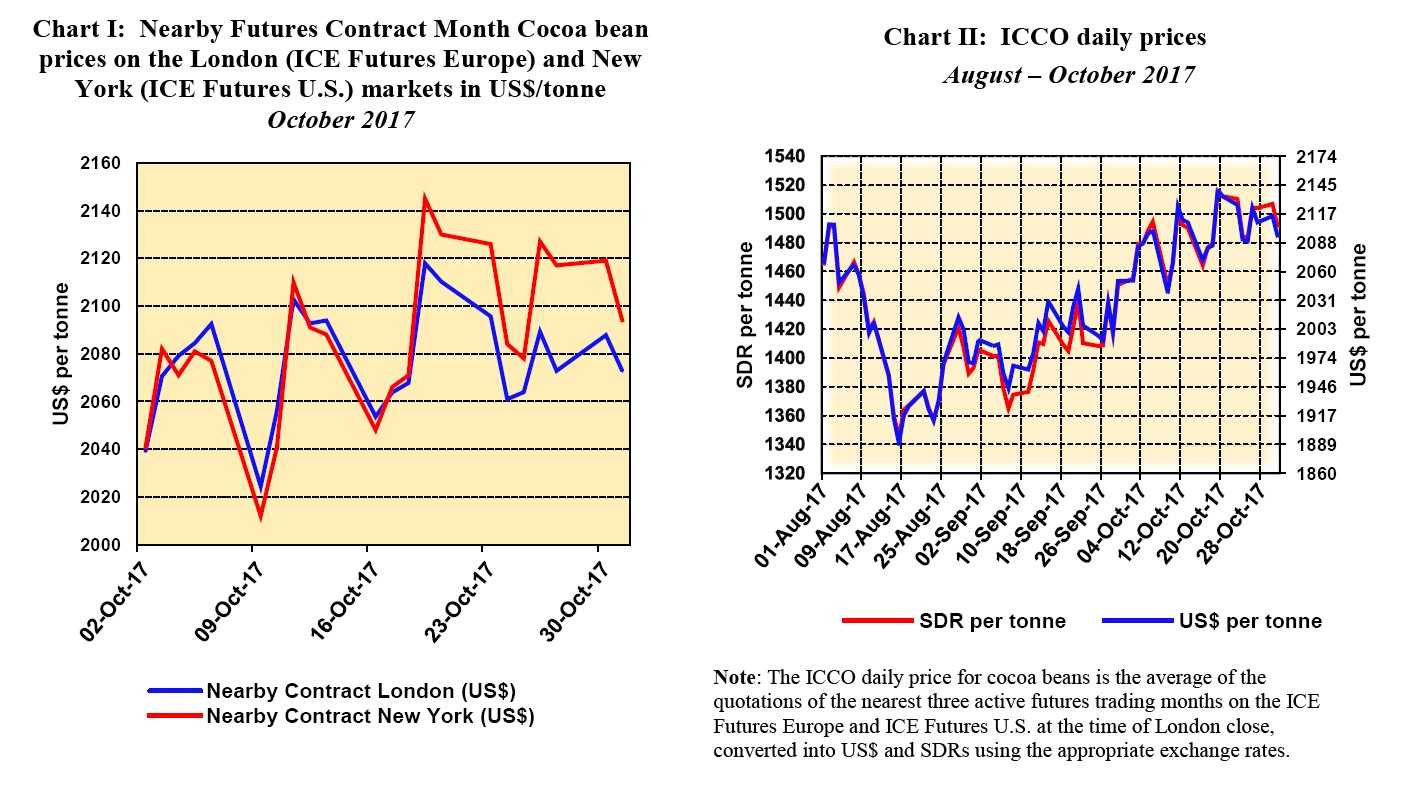

Chart I shows variations in the London and New York prices of the nearby cocoa futures contract, both expressed in United States dollars.

Since the London market is pricing at par African origins, and the New York market at par Southeast Asian origins, the London futures price is expected under the same market conditions to be higher than the New York one.

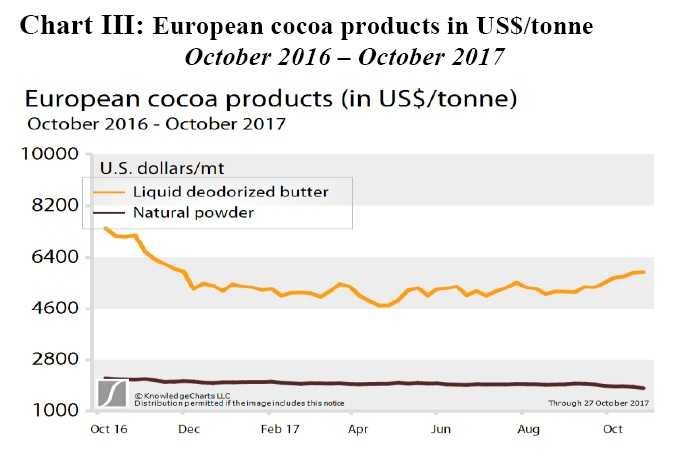

Their price differences provide insights on the relative, expected availability of cocoa beans at these exchanges. Chart II distinguishes the impact of the United States dollar fluctuations on cocoa prices while Chart III presents the prices of European cocoa products from October 2016 to October 2017.

Price movements

As illustrated in Chart I, in October, the nearby contract i.e. the December contract price remained volatile and generally followed an upward trend on both London and New York futures markets.

From the beginning to the end of the month, prices increased from US$2,039 to US$2,073 per tonne in London and from US$2,041 to US$2,094 per tonne in New York. The annualized volatility in contract prices reached 9% for London and 11% for New York during the month under review.

The bullish trend in the cocoa nearby contract prices was supported by unfavorable weather conditions that led to concerns of floods, the outbreak of black pod disease and the spread of brown rot disease which consequently could negatively impact the main crop output.

By the second week of the month, the nearby futures contract dropped sharply by 3% in both markets as active selling of cocoa beans occurred amid anticipation of a large output for the main crop.

Thus, the December contract price attained its lowest level for the month at US$2,012 and US$2,024 per tonne in London and New York respectively.

Thereafter, subsequently to the release of a 3% year-on-year rise in European grindings for the third quarter of 2017, the nearby futures contract price gained support from signs of improved demand.

During this period, the December contract traded on a positive note by increasing to US$2,103 per tonne in London and US$2,110 per tonne in New York.

However, by the middle of the month, with no support from the fundamentals, the nearby futures contract dropped to US$2,054 and US$2,048 per tonne in London and New York respectively.

Nevertheless, following improved year-on-year third quarter grindings data in North America (0.68% increase) and Asia (12.9% increase), the nearby futures contract price rose to US$2,118 per tonne in London and US$2,145 per tonne in New York.

Prices were also supported by a weaker British pound sterling and some fresh interest from industry buyers. This price rise was brief and despite slight upticks in prices, the nearby futures contract in both markets traded under subdued conditions during the last trading sessions of the month.

Under the same market conditions, the London futures price is expected to be higher than that of New York. But, as observed in Chart I, since mid-October, New York prices for the nearby contract have been higher than that of the London futures prices.

This was because the volume of certified beans in the ICE US warehouses declined more rapidly than the volumes on ICE Europe.

Indeed, according to the Intercontinental Exchange (ICE) daily report on stocks of certified cocoa beans, the stocks level of cocoa beans in the United States during the month under review fell by 11% from 289,384 tonnes at the beginning of the month to 258,105 tonnes at the end of the same month.

Over the same time frame, based on ICE reports, stocks of cocoa beans declined by 5% from 275,290 tonnes to 262,050 tonnes in Europe.

As shown in Chart II, the US dollar-denominated ICCO prices generally moved side by side with the SDR-denominated price from August to October 2017.

This reflected the relative stability of the United States dollar against the Euro, Chinese renminbi, Japanese Yen and Pound Sterling that make up the SDR basket of currencies.

Supply & demand situation

News agency reports indicate that the 2017/2018 cocoa season took off slowly in West Africa since production was stressed by fulsome rain.

Indeed, as at 19 November 2017, total cocoa beans arrivals at ports in Côte d’Ivoire had reached around 346,000 tonnes since the start of the cocoa season on 1 October, down nearly by 9% from the 382,000 tonnes produced in the same period of the previous season.

As at the time of writing, there was no news on cocoa purchase from the Ghana Cocoa Board since the new cocoa season started.

As illustrated in Chart III, while European cocoa butter prices stayed above US$5,000 per tonne during the month under review, on the other hand, wide stocks of cocoa powder have led the price of the product to be apparently stable.

Indeed, an increase in consumers’ preference for confectionery with a higher cocoa content supported cocoa butter prices.