This review of the cocoa market situation reports on cocoa price movements on the international markets during the month of January 2018. It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

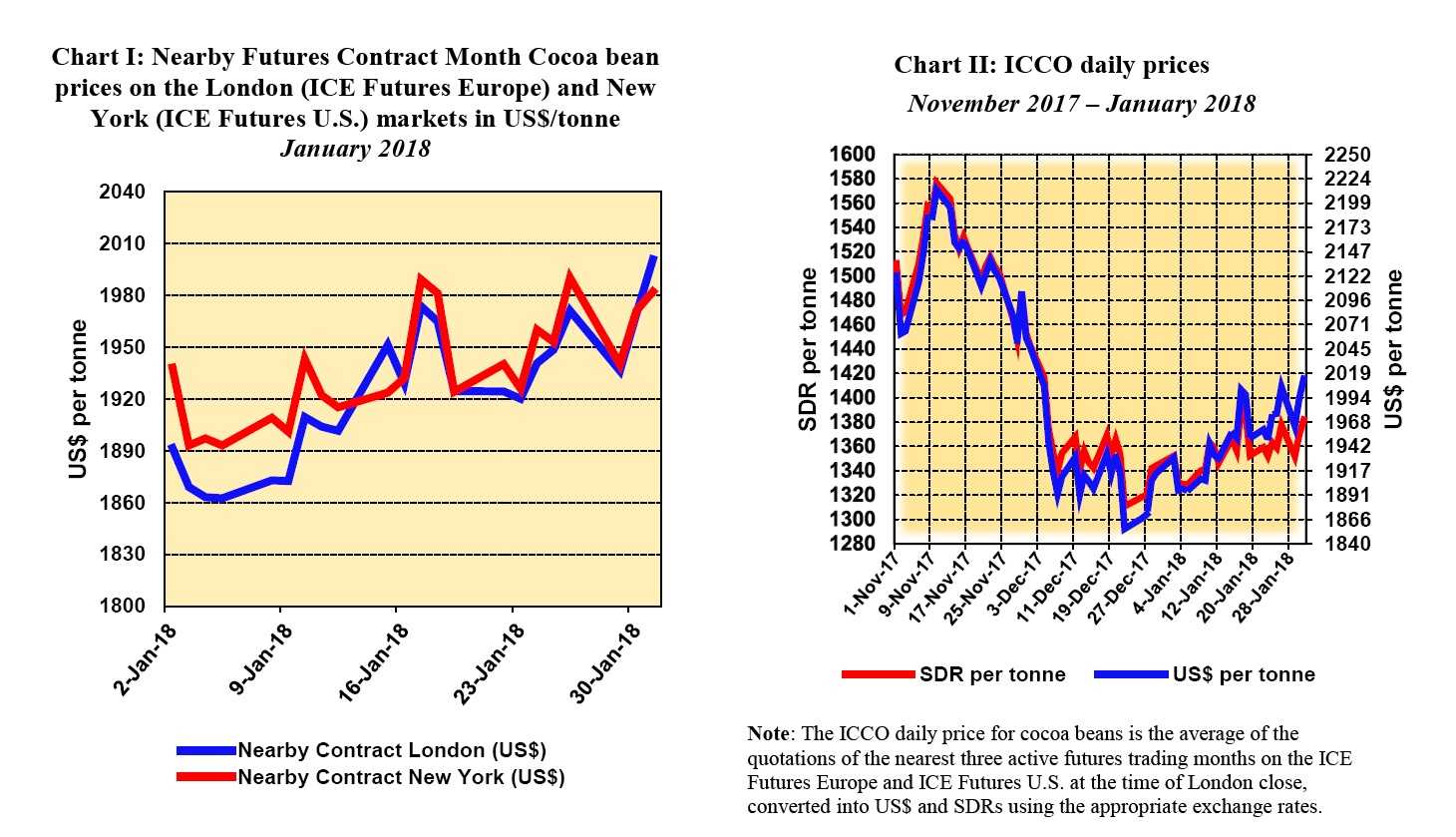

Chart I shows variations in the London and New York prices of the nearby cocoa futures contract, both expressed in United States dollars.

Since the London market is pricing at par African origins, and the New York market at par Southeast Asian origins, the London futures price is expected, under the same market conditions, to be higher than that of New York.

As a result, a study of their price differences provides insights into the relative, expected availability of cocoa beans on these exchanges at the expiry of the futures contract.

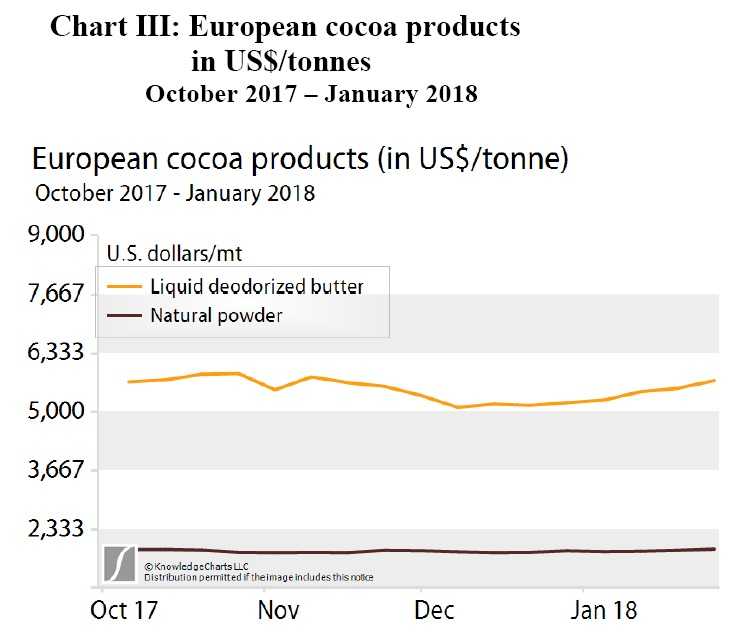

Chart II illustrates the impact of the United States dollar fluctuations on cocoa prices while Chart III depicts the prices of European cocoa products from the start of the 2017/18 cocoa year to present.

Price movements

In January, prices of the nearby futures contracts i.e. March 2018, followed an increasing trend on both markets as illustrated in Chart I. Prices fluctuated between US$1,862 and US$2,001 in London and between US$1,893 and US$1,990 in New York.

The average price for the nearby contract was settled at US$1,937 and US$1,923 in New York and in London respectively. The New York nearby contract price was mostly higher than that of London during January 2018.

According to market participants, unusual premiums emerging from the New York futures market tend to draw increasing quantities of West African cocoa to the United States.

The premium has partly been due to a fall in Ecuadorian cocoa bean supplies to the United States after the discovery of a noxious weed in imports of beans from Ecuador.

During the first two weeks of the month under review, prices rose by 4% in London from US$1,891 to US$1,974 and by 3% in New York to settle at US$1,989. Reports indicate that hot weather conditions during this period raised concerns for the development of the upcoming mid-crop from top producing countries.

This supported the bullish stance on futures prices. In addition, the upward movement in prices was also partly supported by the anticipation of improved grindings data to be released by the middle of the month.

During the third week of the month under review, compared to the aforementioned high levels, nearby contract prices shrank with no support from the market fundamentals in both New York and London.

During this period, prices decreased by 3% in both markets and settled at US$1,926 in New York and US$1,920 in London.

Although they moved sideways during the last week of January, prices by the end of the month, compared to prices at the start of the month, increased by 6% in London, from US$1891 to US$2001 per tonne, and in New York by 2% from US$1938 to US$1982 per tonne.

As illustrated in Chart II, the US-denominated and SDR-denominated ICCO daily prices moved side by side during the first two weeks of the month. However, starting from the third week of January, the US-denominated ICCO price traded at levels higher than the one denominated in SDR.

This was due to the weakening in the value of the US dollar against all major currencies that make up the SDR basket.

Supply & demand situation

Despite some uncertainties prevailing on the crop size at the start of the 2017/18 crop season, arrivals have gained pace over the weeks in the world’s largest cocoa producing country.

As at 4 February 2018, cocoa beans arrivals at ports in Côte d’Ivoire were estimated to have reached 1.179 million tonnes up from 1.175 million tonnes compared to the same period last season.

Nevertheless, facing the threat of Cocoa Swollen Shoot Virus (CSSV) in the main cocoa producing areas in Côte d’Ivoire, the Conseil du Café et du Cacao (CCC) decided to undertake a three-year maintenance operation consisting of uprooting 300,000 hectares of diseased orchards.

According to news agency reports, this operation could reduce Côte d’Ivoire’s production capacity by 150,000 tonnes over the forthcoming three years.

At the time of writing, cocoa purchases in Ghana are reported to have reached 560,000 tonnes (30,000 tonnes below last season) since the start of the season.

On the demand side, Chart III shows that since the start of the 2017/18 crop year, while powder prices remained stable, cocoa butter prices followed a near upward trend and stood at over US$5,000 per tonne.

This reflects the increasing demand for cocoa recorded in recent months as reported by the main regional cocoa associations for the fourth quarter of 2017.

Fourth quarter 2017 data published by the European Cocoa Association showed an increase in demand from Western Europe by 4.4% and the Cocoa Association of Asia figures depicted a rise in grindings by 4.24% while North America’s demand retreated by about 1.28%, according to the National Confectioners’ Association.

At the end of February 2018, the ICCO Secretariat will release its first crop forecasts for the current year in its Quarterly Bulletin of Cocoa Statistics (QBCS).