ABIDJAN, Côte d’Ivoire – The current review of the cocoa market situation reports on cocoa price movements on the international markets during the month of August 2017.

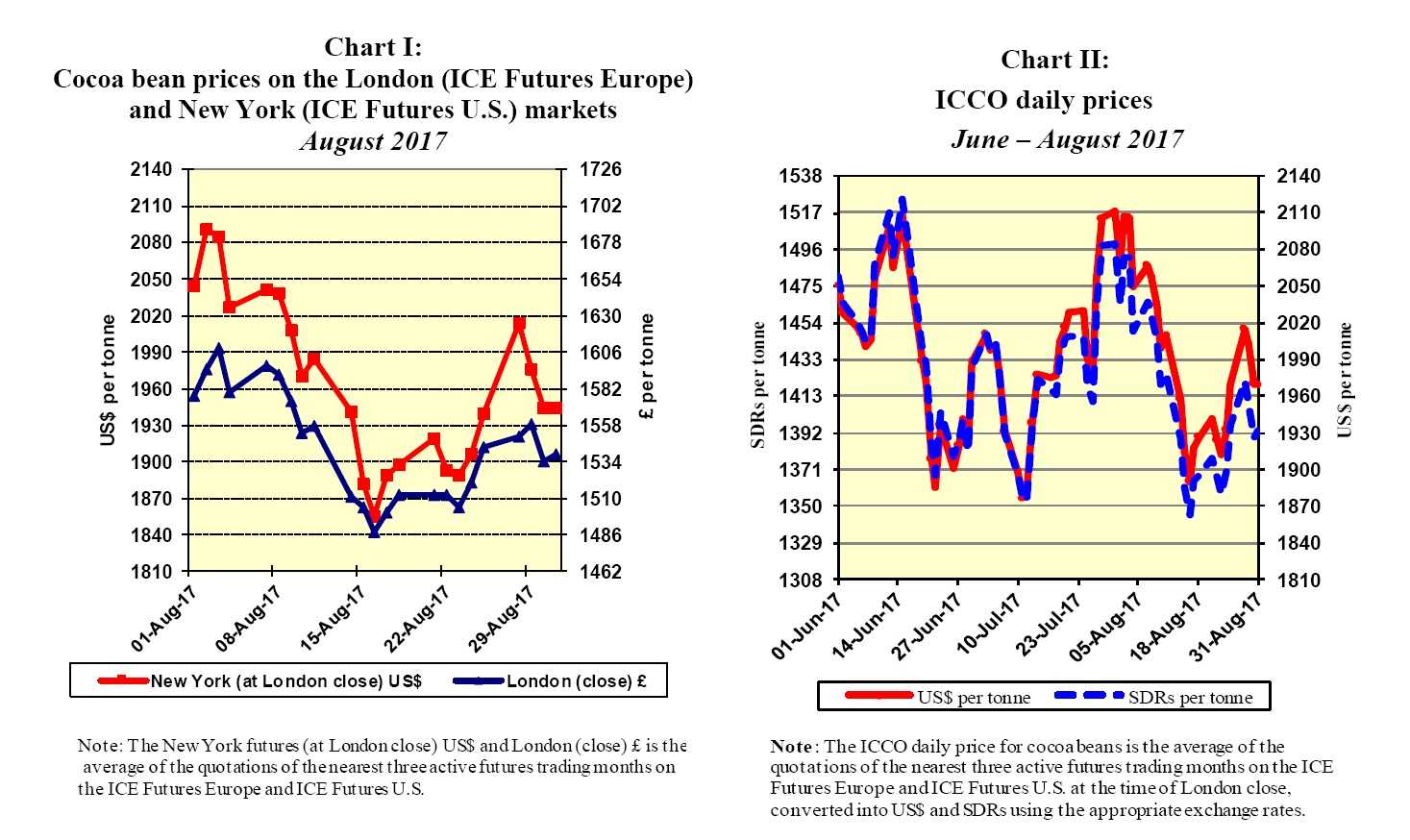

Chart I illustrates price movements of the average of the nearest three active futures trading months on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

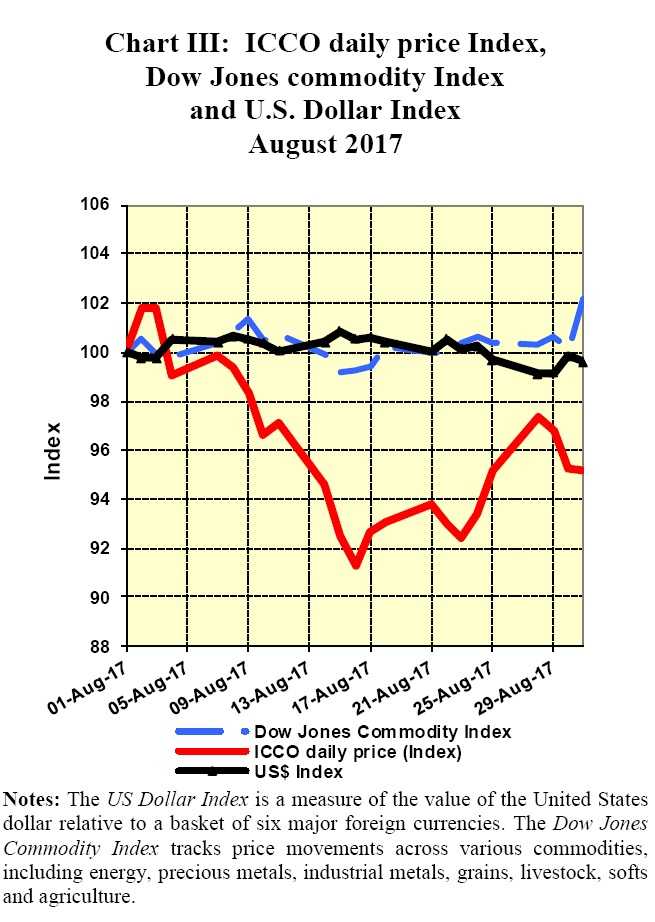

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from June to August 2017.

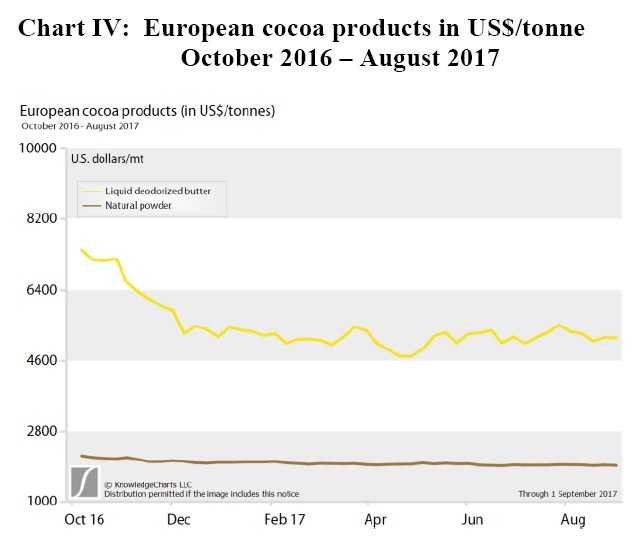

Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in August while Chart IV presents the prices of European cocoa products since the beginning of the 2016/2017 cocoa year.

Price movements

Price movements

In August, the ICCO daily price averaged US$1,989 per tonne, same as the average price recorded in the previous month (US$1,989) and ranged between US$1,889 and US$2,107 per tonne.

As shown in Chart II by the ICCO daily prices, cocoa futures prices rose above the US$2,000 per tonne level during the first week of August.

Expectations of a lower global production for the next season coupled with improved grindings provided support to cocoa prices.

During this period, the ICCO daily prices of cocoa beans ranged between US$2,034 and US$2,107 per tonne.

Thereafter, as seen in Chart I, from the second week of August through to the middle of the month, once expectations of ample supplies from Côte d’Ivoire and Ghana were reported, cocoa futures markets experienced a downturn in prices and dropped to £1,487 per tonne in London and to US$1,855 per tonnes in New York.

The recovery of the United States dollar, as seen in Chart III also pressured commodity prices downwards and cocoa futures followed suit – but to a greater extent.

From the middle of the month onwards, cocoa futures prices rebounded from the lows attained during the previous week.

Reports of chocolate manufacturers reporting improved sales volumes supported cocoa futures prices.

Thus, compared to the aforementioned low levels, cocoa futures prices increased by 5% in London to £1,558 per tonne and by 9% in New York to US$2,013 per tonne.

Nevertheless, with not much expected during this period of the season, by the end of the month cocoa futures dropped to £1,538 per tonne and US$1,944 per tonne.

Supply & demand situation

Supply & demand situation

On the supply side, news agency data showed that cocoa bean arrivals to ports in Côte d’Ivoire reached 1.966 million tonnes as at 3 September 2017, up by almost 35% (508,000 tonnes) compared with the 1.458 million tonnes recorded for the same period of the previous season.

In Ghana, although there is still no data report on the status of the on-going light crop, production has benefitted from conducive weather conditions and cocoa bean supplies are envisaged to be higher than those of the previous season.

Moreover, reports indicate that the higher prices being offered in Ghana have encouraged the smuggling of beans into the country from neighbouring Côte d’Ivoire.

Whereas Côte d’Ivoire reduced the price paid to cocoa farmers to about US$1,252 per tonne (based on the prevailing exchange rate) for the mid-crop, Ghana maintained the producer price of about US$1,924 per tonne for the midcrop.

Indeed, favourable weather conditions are reported to be boding well for the upcoming main crop in most of the West African region.

Should the positive weather conditions prevail, then, expectations are that there may be a second consecutive global surplus of cocoa beans in the next cocoa year.

On the demand side, although cocoa powder prices have been stagnant, Chart IV shows that prices of cocoa butter have found an underlying support from the recovery in chocolate confectionery consumption.

On the demand side, although cocoa powder prices have been stagnant, Chart IV shows that prices of cocoa butter have found an underlying support from the recovery in chocolate confectionery consumption.

The ICCO Secretariat’s revised forecasts for the current 2016/2017 cocoa year, published in August in the Quarterly Bulletin of Cocoa Statistics, envisage a production surplus of 371,000 tonnes.

World cocoa bean production is expected to increase by 18.1% (up by 719,000 tonnes) over the previous season, to 4.700 million tonnes.

Grindings are forecast to increase by 3.7% to 4.282 million tonnes (up by 154,000 tonnes).

If realized, this would increase the total statistical stocks of cocoa beans as at the end of the 2016/2017 cocoa year to 1.781 million tonnes, equivalent to 41.6% of projected annual grindings in 2016/2017.