This is the ICCO Cocoa Market Review for April 2015. The current review reports on cocoa price movements on the international markets during April 2015.

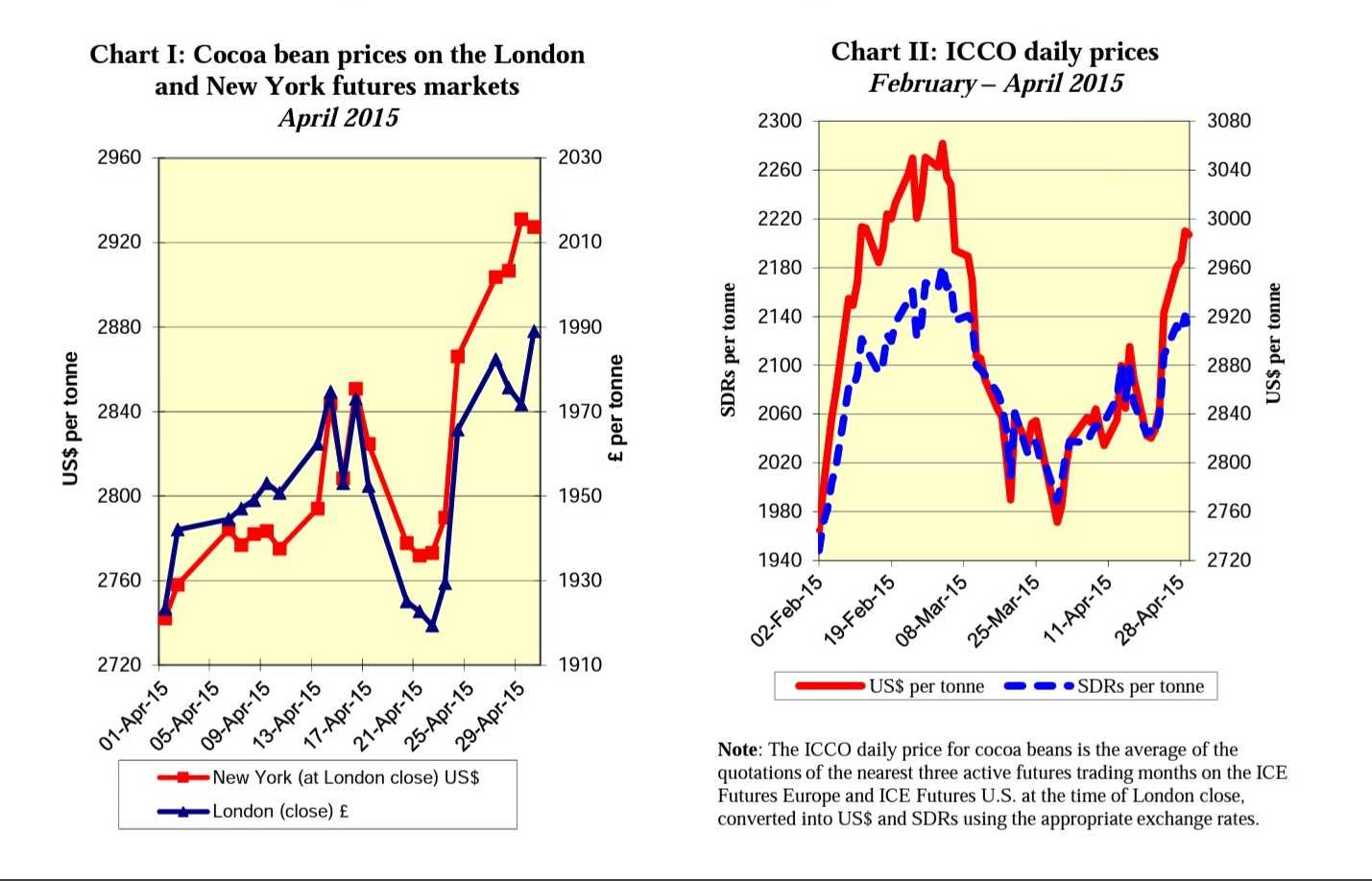

Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets for the month of April. Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from February to April 2015.

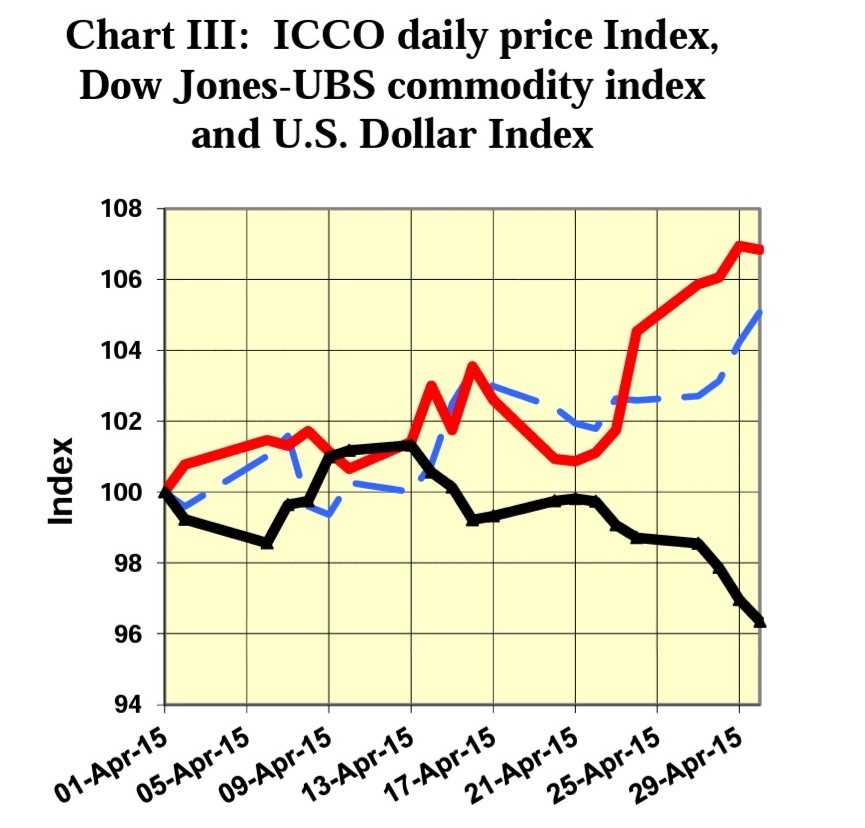

Chart III depicts the change in the ICCO daily price Index, the Dow Jones-UBS Commodity Index and the US Dollar Index during the month under review.

Price movements

In April, the ICCO daily price averaged US$2,868 per tonne, down by US$14 compared to the average price recorded in the previous month (US$2,882) and ranged between US$2,795 and US$2,991 per tonne.

From the beginning till the early part of the second week of April, as seen in Chart I, cocoa futures prices reversed the downward trend experienced throughout the previous month, reaching £1,975 per tonne in London and US$2,844 per tonne in New York.

The upward trend was underpinned by a weakening U.S. dollar, which aided most commodities including cocoa beans. The publication by the Conseil du Café-Cacao of cumulative arrivals for the October-March period (at 1,257,478 tonnes, a figure around 3,500 tonnes lower than previous estimates by the news agencies), also lent support to cocoa futures prices.

However, from the middle of the month to the latter part of the third week of April, cocoa prices moved sideways.

While reports of favourable weather conditions bolstering the mid-crop prospects pressured cocoa prices downwards, the release of stronger-than-expected European grindings data by the European Cocoa Association (ECA) provided some support to cocoa prices.

Nevertheless, the bearish effects on cocoa prices were further heightened by the release of worse-than-expected American grindings data by the National Confectioners’ Association (NCA) for the first quarter of 2015. Thus, cocoa futures prices fell to their lowest level for the month in London at £1,919 per tonne and in New York at US$2,773 per tonne.

Thereafter, towards the end of the month, cocoa futures prices rose sharply and attained their highest levels at £1,989 in London and at US$2,931 in New York.

This price rise was supported by the weakening of the United States dollar as well as betterthan-expected Asian grindings data by the Cocoa Association of Asia (CAA).

Concerns about production from Ghana also lent support to cocoa futures prices. As seen in Chart III, as the US dollar sank on weak American economic growth, the price of most commodities rose from the latter part of April, with cocoa futures prices outperforming the broader commodity complex.

Supply and demand situation

On the supply side, according to news agency data, total cocoa bean arrivals at ports in Côte d’Ivoire reached 1,353,000 tonnes from the start of the season to 4 May 2015, compared with 1,336,000 tonnes recorded for the same period of the previous season.

Weather conditions are expected to remain beneficial to the on-going mid-crop, which started on 1 April 2015.

For the current crop year, data published by the news agencies show that cumulative cocoa purchases for Ghana reached 559,169 tonnes as at 16 April. This represented a sharp fall, compared with the same period for the previous season.

It is alleged that production in Ghana has been severely affected by lack of fungicides and fertilisers, in addition to the spread of black pod disease.

On the demand side, for the first quarter of 2015, the reduction in Asian and European grindings were lower than expected compared to the corresponding quarter of the previous year, at 144,738 tonnes and 337,706 tonnes, representing a decline of 9.3% and 1.6% respectively.

On the other hand, North American grindings data were slightly better than previously anticipated, decreasing by 5.8% to 121,508 tonnes, compared to the same quarter of the previous year.

It should be noted that compared to the previous quarter (October-December 2014), both Asian and European grindings data improved, increasing respectively by 2.4% and 4.5%.

Nevertheless, it would be too optimistic to see this as a sign of recovery in the context of sluggish growth in chocolate demand.

At the end of May, the ICCO Secretariat will release its revised crop and grindings forecasts for the current cocoa year in its Quarterly Bulletin of Cocoa Statistics.