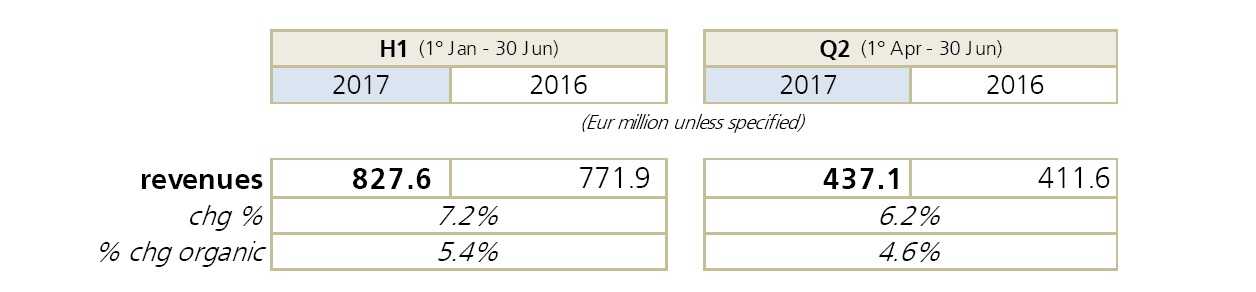

TREVISO – The Board of Directors of De’Longhi S.p.A. has approved on July 28, 2017, the consolidated results of the first six months of 2017. Revenues were up to € 827.6 million, growing by 7.2% vs. the first half of 2016 or by +5.4% organic1.

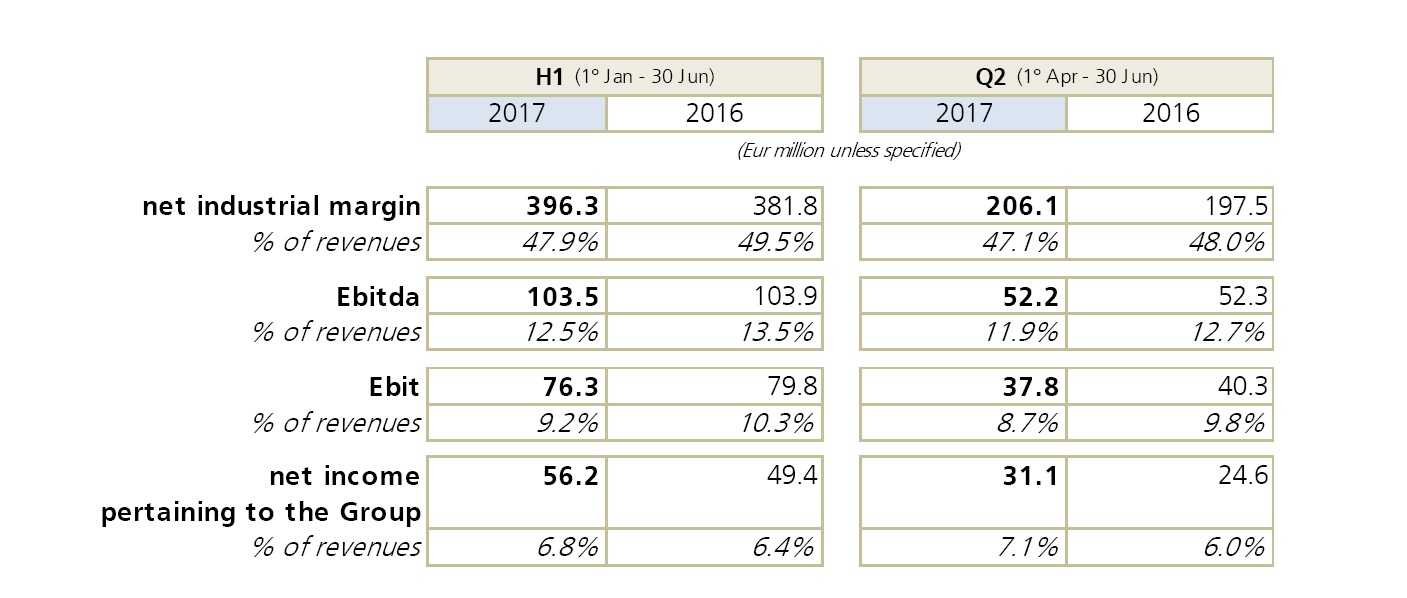

Net Industrial Margin was growing by +3.8% to € 396.3 million. Ebitda amounted to € 103.5 million, in line with the first half of 2016, after having absorbed higher media investments.

The Ebitda before non recurring items and the accounting for the stock option plan amounted to €105.3 million (€106.6 million in the first half 2016).

Net Income pertaining to the Group was growing by +13.6% up to € 56.2 million, vs. € 49.4 million of the first half of 2016.

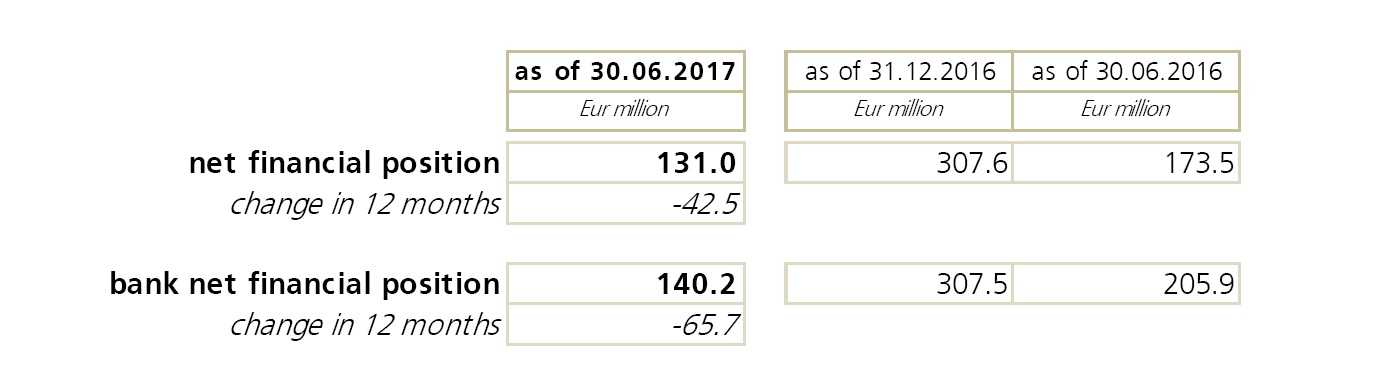

The Net Financial Position was positive by € 131.0 million (it was positive by 307.6 million at Dec. 31, 2016), after the payment of dividends, higher investments and the acquisition of the 40% stake in the Swiss group Eversys.

The guidance for 2017 has been confirmed: a revenues organic growth at a “mid-single-digit” rate and an increase of Ebitda in absolute terms.

Results summary

- In the first half of 2017 were amounting to € 827.6 million, growing by +7,2% vs € 771.9 million of the first half 2016, or by +5,4% in organic terms.

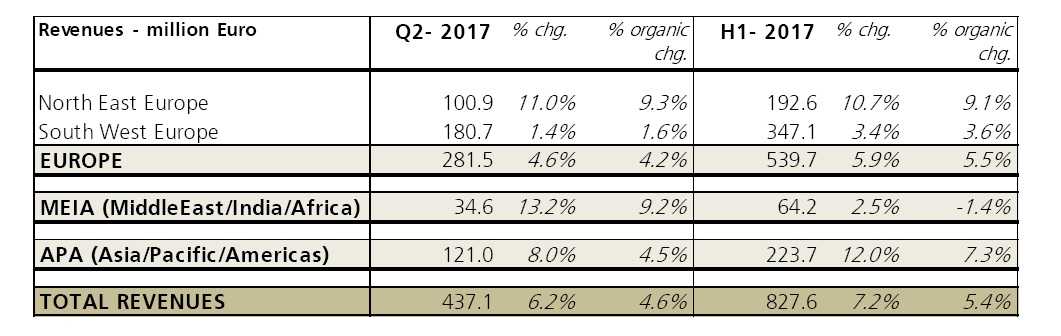

All regions were reporting growth, i.e. the APA region (+12.0%), Europe (+5.9%) and MEIA (+2.5%) respectively. As regards product categories, coffee makers stood out (+16.0%), thus more than compensating the decline of Kenwood products in food preparation.

As for profitability, the increased sales volumes, by way of the operating leverage mechanism, have supported the growth of the net industrial margin, which also benefitted from the positive contribution of the product mix (mainly due to the growth of coffee makers) and of the exchange rates.

Said increase of the net industrial margin was counterbalanced by increasing cost items affecting the Ebitda, i.e. supply chian, marketing and advertising & promotion, in line with management’s plans to stimulate the future growth and incisively support the new product launches and the geografic expansion through higher media investments.

- The net industrial margin reached € 396.3 million (or 47.9% of revenues), improving vs. € 381.8 million of the first half of 2016 (49.5% of revenues); on a like-for-like basis (excluding NPE srl), the margin would have been equal to 48.8% of revenues;

- About flat the Ebitda, amounting to € 103.5 million (or 12.5% of revenues), which compares with € 103.9 million of the first half of 2016 (13.5% of revenues);

- Ebit amounted to € 76.3 million, equal to 9.2% of revenues, comparing with € 79.8 million of the first half of 2016 (10.3% of revenues);

- The Net Financial Charges were slightly declining from € 13.2 million to € 11.2 million; in the second quarter, the Company recorded non recurring net financial income of € 9.9 million, due to the updated valuation at fair-value of the earn-out payable in relation to the acquisition of the perpetual licence for the use of the Braun brand (a gain of € 16.9 million) and to the economic effect of the early termination of the USPP and its related hedging instrument (a cost of € 7.0 million, with no cash impact).

- Net Income pertaining to the Group amounted to € 56.2 million, improving by 13.6% vs. € 49.4 million of the previous year and equalling 6.8% of revenues (vs. 6.4% in the first half of 2016). Excluding the above mentioned non recurring net financial income, net income would have been about flat vs. the first half of 2016.

As for the balance sheet, the net financial position as at June 30 2017 was positive by € 131.0 million (307.6 million as at Dec. 31 2016), having absorbed the payment of dividends of € 119.6 million, investments of € 51.1 million, the acquisition of a 40% stake in the Swiss company Eversys (€ 18.8 million) and the impact of negative cash flow of NPE srl (- € 14.5 million). It’s worthwhile underlining the increased disbursements, compared to 2016, for dividends (+ € 53.8 million) and capex (+ € 29.2 million). Furthermore, in the six months, there was recorded a cash absorption due to an increase of the net working capital (as commented in the next paragraph). Similarly to the trend of the net financial position, the bank net position evolved from € 307.5 million, as at Dec. 31 2016, to € 140.2 million.

As for the balance sheet, the net financial position as at June 30 2017 was positive by € 131.0 million (307.6 million as at Dec. 31 2016), having absorbed the payment of dividends of € 119.6 million, investments of € 51.1 million, the acquisition of a 40% stake in the Swiss company Eversys (€ 18.8 million) and the impact of negative cash flow of NPE srl (- € 14.5 million). It’s worthwhile underlining the increased disbursements, compared to 2016, for dividends (+ € 53.8 million) and capex (+ € 29.2 million). Furthermore, in the six months, there was recorded a cash absorption due to an increase of the net working capital (as commented in the next paragraph). Similarly to the trend of the net financial position, the bank net position evolved from € 307.5 million, as at Dec. 31 2016, to € 140.2 million.

Net working capital amounted to € 289.4 million (15.2% of revenues) against € 233.3 million as at June 30 2016 (12.5% of revenues); at a constant perimeter, the net working capital (“NWC”), as at June 30 2017, would have been equal to 14.5% of revenues.

Net working capital amounted to € 289.4 million (15.2% of revenues) against € 233.3 million as at June 30 2016 (12.5% of revenues); at a constant perimeter, the net working capital (“NWC”), as at June 30 2017, would have been equal to 14.5% of revenues.

The increase in the NWC is due to the increased accounts receivable – related to the acceleration of the sales in the second quarter – and to the increased inventories, necessary to support the sales flow expected in the second half of the year.

Business review: the first half of 2017

The first half of 2017 recorded a growth of revenues in all main regions, thanks to the continuation of the positive trend in Europe and APA and to a partial recovery in the MEIA region, which was growing in the second quarter, following a decline in the first quarter.

In the Asia-Pacific-Americas region (revenues up +12.0% or 7.3% organic) the performance was particularly dynamic in northern America (up double digit), in Greater China, Australia, New Zealand and Japan (up high single digit), driven by all product categories, like the coffee makers, the Braun products and the portable air conditioners.

In the Asia-Pacific-Americas region (revenues up +12.0% or 7.3% organic) the performance was particularly dynamic in northern America (up double digit), in Greater China, Australia, New Zealand and Japan (up high single digit), driven by all product categories, like the coffee makers, the Braun products and the portable air conditioners.

In Europe – with revenues up by +5.9%, or +5.5% organically – the Company continued to experience a positive trend in the East European markets, growing double digit, and in Russia, growing even in organic terms thanks to a marked acceleration of sales volumes and the expansion of distribution channels.

Growth was experienced also in Germany, France, Iberian region, Switzerland and Turkey.

The weakness of the consumption trend together with the depreciation of the local currency were negatively affecting the revenues in the UK, while, as for Italy, the revenues’ decline is to be explained by the underperforming market and the phasing out of some of the planned commercial campaigns.

A marked improvement of the trend was shown by the MEIA region (Middle East-India-Africa), growing by +2.5% (but -1,4% in organic terms) in the first half of 2017, thanks to the favourable performance of the second quarter.

Main contributors to this result were Egypt and UAE, which were more than compensating the decline of Saudi Arabia, where however the level of inventories was progressing towards a sound normalization; excluding said market, MEIA region would have been growing by more than 15% in the first six months.

In the second quarter of 2017, with revenues growing by +6.2%, (or +4.6% in organic terms), Europe was showing revenues up by +4.6% (or +4.2% in organic terms), thanks mainly to the North East area (+11.0%, or +9.3% organic) which benefitted from the strong performance of the Russian market.

The revenues’ growth in the APA region (+8.0%, or +4.5% in organic terms) was related mainly to United States, China and Australia/New Zealand, while a positive development of the MEIA region (revenues up by +13.2%, or +9.2% in organic terms) mirrored the overall improvement of the performance of all main markets.

Products

The revenues’ breakdown by product category shows the marked growth of coffee makers, up by +16% in the first six month of the year and accelerating in the second quarter.

As a witness of the successful commercial offer of the Group, all the main categories in the coffee space were growing, including the espresso full-auto and manual machines, the capsule systems – thanks to the newly awarded distribution agreements for Nespresso in North America and Switzerland and to Nescafé Dolce Gusto – and, finally, the filter coffee machines branded Braun.

In food preparation, Braun kept on with its expansion path, confirming its global leadership in the hand-blender category, thanks its growth in the Asian and North American markets. On the contrary, the other categories of food preparation were declining, particularly the kitchen machines, directly affecting the sales of the Kenwood brand, suffering from the downturn of the home British market.

As regards the comfort products (portable air conditioners and heaters), the category was overall showing a positive development, while in the home care segment, the ironing category was on a negative path, where the decline experienced in the first quarter was followed by a partial recovery in the second quarter.

Operating Margins

Net industrial margin reached € 396.3 million (or 47.9% of revenues), growing by 3.8% vs. € 381.8 million of the first haf of 2016 (49.5% of revenues).

Said improvement was made possible especially by the positive impact of the operating leverage, linked to the volumes’ growth, together with the improved product mix generated by the higher sales of espresso coffee makers and the positive effect of exchange rates.

Ebitda of the first six months of 2017, amounting to € 103.5 million (or 12.5% of revenues) was roughly flat vs. the first half of last year (€ 103.9 million or 13.5% of revenues), despite higher transportation and raw material costs and the increase in advertisement and promotional spending aimed at supporting the future growth.

At constant exchange rates and excluding the effects of hedging, Ebitda of the first half 2017 would have amounted to € 93.3 million, down from the € 99.6 million of the first half of last year.

Financial Charges

Net financial charges were declining from € 13.2 million to € 11.2 million, mainly as a consequence of a reduction in exchange rates charges.

Furthermore, in the second quarter, some non recurring net financial incomes, amounting to € 9.9 million, were recorded, due to the updated valuation at fair-value of the earn-out payable in relation to the acquisition of the perpetual licence for the use of the Braun brand (a gain of € 16.9 million) and to the economic effect of the early termination of the USPP and its related hedging instrument (a cost of € 7.0 million, with no cash impact); after said assessment, the residual liabilities related to the Braun deal, and included within the net financial position, amounted to € 5.4 million as at end of June 2017.

Net Income

Net income pertaining to the Group stood at € 56.2 million (or 6.8% of revenues), improving by +13.6% vs. € 49.4 million of the first half of 2016.

Events occurred after the end of the quarter

In order to support the investment commitments for the 2017-2018 period, the Group, taking advantage of the favourable market conditions, entered into two loan agreements, of which one was signed and drawn during the month of July.

There are no other meaningful events occurred after the end of the first half of the year.

Foreseeable business development and guidance

The management, in light of the results of the first six months, confirms its expectations for the year 2017, guiding to an organic growth of revenues in the mid-single-digit area and an increase of Ebitda in nominal terms, but not necessarily as a percentage of revenues, in a context of expected exchange rates neutrality and higher planned investments in R&D, media and production capacity.

1 “Organic” stands for at constant exchange rates and excluding the impact of derivatives. 2017 perimeter includes NPE srl, following the lease of company agreement as per the press release issued on 23/09/2016. In the first half of 2017, the inclusion of NPE srl in the consolidation perimeter had an impact on revenues of about € 16.4 million.