TAMPA, FL, U.S. – Cott Corporation, a leading provider of home and office bottled water delivery and filtration services in North America and Europe, today announced its results for the fiscal year and fourth quarter ended December 28, 2019.

“We closed 2019 with a strong fourth quarter. Adjusted EBITDA increased over 20% led by our route-based services business, driven by organic growth in our HOD Water channel and improved operating leverage across both segments,” commented Tom Harrington, Cott’s Chief Executive Officer. “For the full year, we delivered adjusted revenue growth of 6%, adjusted EBITDA growth of 7% and delivered more than $150 million of adjusted free cash flow.”

Mr. Harrington continued, “We enter 2020 with strong momentum as we aggressively execute our transformation into a pure-play water solutions provider. We remain focused on successfully completing the acquisition of Primo Water while also smoothly transitioning the S&D business to Westrock Coffee Company. We are confident we will capture the previously identified $35 million in cost synergies, deliver margin expansion, and drive increased organic growth as a pure-play water solutions provider. We are truly excited about the opportunity to provide sustainable hydration solutions to a growing customer base and positioning the Company for continued growth, while also ensuring we deliver long-term shareholder value.”

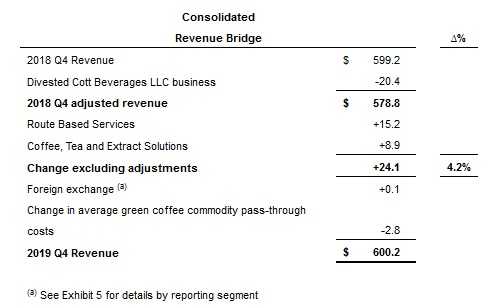

Cott Corporation: Fourth Quarter 2019 Global Performance from Continuing Operations

- Revenue was flat at $600 million (increased by 4% excluding the impact of foreign exchange, the divested Cott Beverages LLC business and the change in average cost of coffee), driven by organic growth within both the Route Based Services and the Coffee, Tea and Extract Solutions reporting segments, and the benefit of acquisitions. Revenue growth by segment in the quarter is tabulated below:

- Gross profit increased 5% to $306 million (7% excluding the divested Cott Beverages LLC business). Gross margin as a percentage of revenue increased 250 basis points to 50.9% compared to 48.4%. Excluding Cott Beverages LLC, gross margin as a percentage of revenue increased 140 basis points to 50.9% compared to 49.5% driven primarily by improved operating leverage within our operations.

- Income tax benefit was $2 million compared to $9 million due primarily to the benefit of the release of a $6 million valuation allowance in the prior year.

- Reported net income and net income per diluted share were $7 million and $0.05, respectively, compared to reported net income and net income per diluted share of $4 million and $0.03, respectively, as the growth in operating income was partially offset by a reduction in income tax benefit. Adjusted EBITDA increased 22% to $85 million compared to $70 million driven primarily by growth in revenue and improved operating leverage.

- Net cash provided by operating activities of $133 million, less $27 million of capital expenditures, resulted in $106 million of free cash flow, or $111 million of adjusted free cash flow (adjusting for the items set forth on Exhibit 7), compared to adjusted free cash flow of $65 million in the prior year driven by growth and working capital benefits.

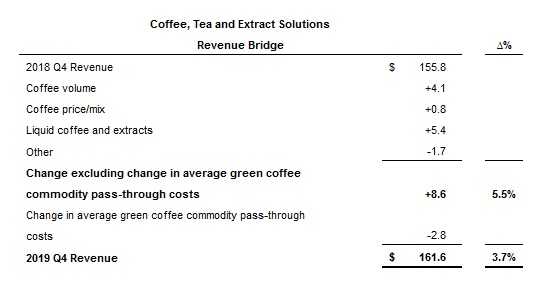

Coffee, Tea and Extract Solutions in 4Q 2019

- Revenue increased 4% (6% adjusting for the change in average cost of coffee) to $162 million driven primarily by 3% growth in coffee pounds sold and 66% volume growth in liquid coffee and extracts. A detailed breakdown is tabulated below.

- Gross profit was $45 million compared to $41 million and gross margin as a percentage of revenue increased to 28.1% compared to 26.0% driven primarily by the improved margin profile generated by liquid coffee and extracts as well as through leveraging the volume growth generated during the quarter.

- SG&A expenses were $39 million compared to $36 million driven primarily by higher selling and operating costs which supported the volume and revenue growth of the business segment.

- Operating income was $6 million compared to $4 million while adjusted EBITDA increased 15% to $13 million, driven by growth in revenue and the resulting operating leverage, offset in part by the higher selling and operating costs associated with driving volume growth.

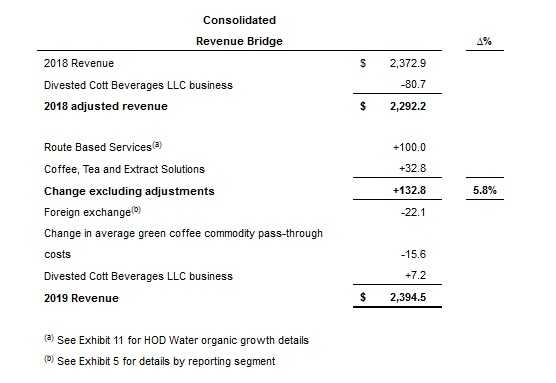

Cott Corporation: Fiscal Year 2019 Global Performance from Continuing Operations

- Revenue increased 1% to $2,395 million (increased 6% excluding the impact of foreign exchange, the divested Cott Beverages LLC business and the change in average cost of coffee) driven by organic growth within both the Route Based Services and Coffee, Tea and Extract Solutions reporting segments, as well as the benefit of acquisitions, including Mountain Valley. Revenue growth by segment in the quarter is tabulated below:

- Gross profit increased 4% to $1,228 million (5% excluding the divested Cott Beverages LLC business). Gross margin as a percentage of revenue increased 180 basis points to 51.3% compared to 49.5%. Excluding Cott Beverages LLC, gross margin as a percentage of revenue increased 60 basis points to 51.4% compared to 50.8% driven primarily by improved operating leverage within our business segments.

- Income tax expense was $10 million compared to a benefit of $5 million due primarily to increased income incurred in taxable jurisdictions in the current year and the benefit of the release of a $6 million valuation allowance in the prior year.

- Reported net income and net income per diluted share were both nil, compared to reported net income and net income per diluted share of $29 million and $0.21, respectively, as growth in operating income was offset by a decrease in other income as the prior year benefited from non-recurring gains absent in the current year as well as higher income tax expense in the current year. Adjusted EBITDA was $329 million compared to $307 million driven primarily by growth in revenue and the resulting operating leverage, offset in part by the negative impact of foreign exchange.

- Net cash provided by operating activities of $250 million less $115 million of capital expenditures resulted in reported free cash flow of $135 million and adjusted free cash flow of $153 million (adjusting for the items set forth on Exhibit 7).

2020 Full Year Revenue and Adjusted Ebitda

The below targets exclude the S&D Coffee and Tea business whose sale was announced on January 31, 2020 and whose operations will be included in discontinued operations. The sale of S&D Coffee and Tea is expected to close in the first quarter of 2020. The targets do not include the Primo Water Corporation (“Primo”) acquisition which is expected to close during the first quarter of 2020. Upon closing the Primo transaction, a modeling call will be held in order to provide guidance around 2020 expectations inclusive of Primo.

This call is currently scheduled for March 24, 2020 and we will issue additional information upon closing the transaction. Including tuck-in acquisitions, Cott is targeting full year 2020 revenue growth from continuing operations of 4% to 5%, adjusted EBITDA of $300 to $310 million and adjusted free cash flow of $115 to $125 million (See Exhibit 12).

Declaration of Dividend

Cott’s Board of Directors has declared a dividend of $0.06 per share on common shares, payable in cash on March 25, 2020 to shareowners of record at the close of business on March 10, 2020.

Share Repurchase Program

On December 11, 2018, Cott’s Board of Directors approved a 12-month share repurchase program of up to $50 million of our outstanding common shares that commenced on December 14, 2018 and replaced the then-existing program, which was scheduled to expire on May 6, 2019. During 2019, Cott repurchased approximately 2 million shares at an average price of $13.88 totaling approximately $28 million. Cott utilized all funds available under or earmarked for this program. Shares purchased pursuant to the share repurchase program were subsequently cancelled.

On December 11, 2019, Cott’s Board of Directors approved a new 12-month share repurchase program of up to $50 million of our outstanding common shares that commenced on December 16, 2019. Cott made no repurchases of our common shares under the new repurchase plan during 2019.

In addition, 0.3 million shares totaling approximately $4 million were withheld during 2019 to satisfy employees’ tax obligations related to share-based awards.