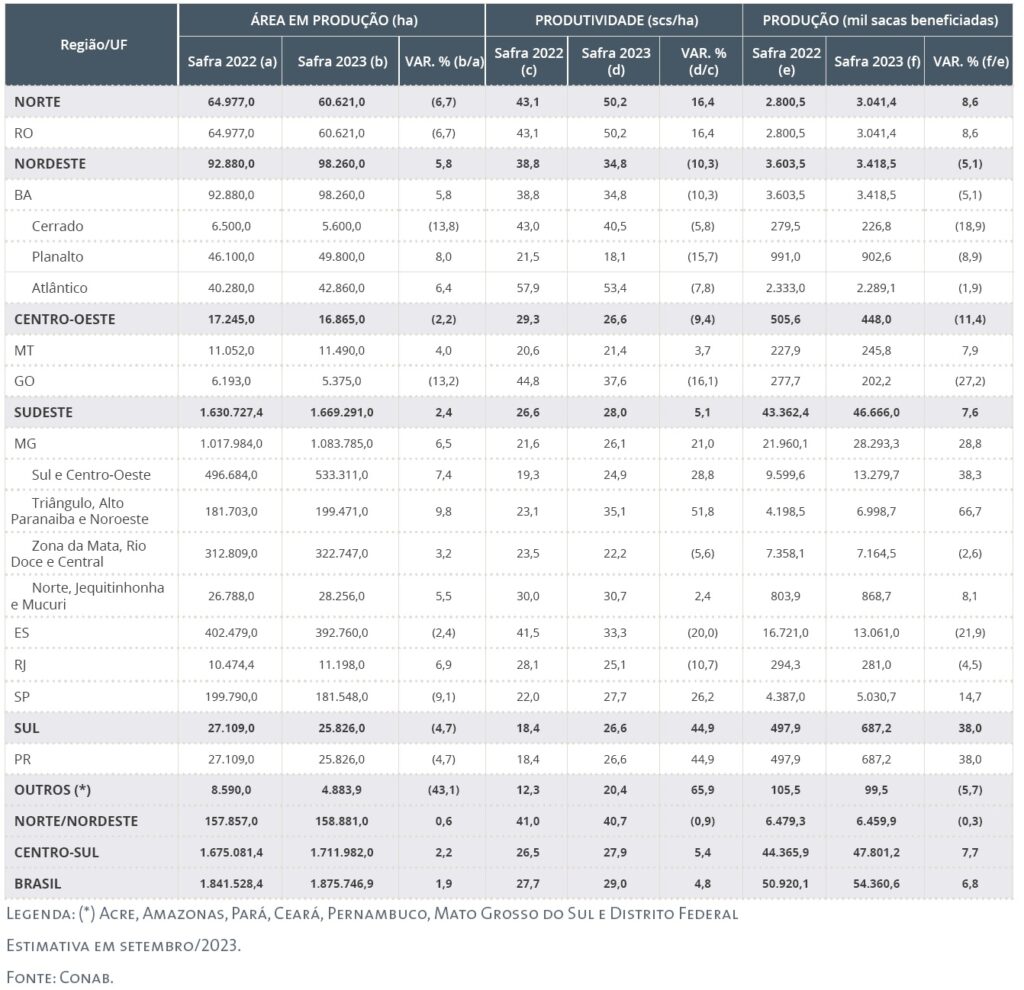

MILAN – In its third official estimate for 2023/24, Conab slightly revised downwards its forecast of the Brazilian coffee crop. The government food and statistics agency lowered its estimate of coffee production by 380,000 bags to 54.36 million bags. This is still a 6.8% increase over the previous year and this year’s crop is the third highest on record, trailing only the 2020 and 2018 seasons.

Even as 2023 is an off-year in Brazil’s biennial cycle that alternates years of high and low output, the Arabica crop is seen at 38.16 million bags – a 16.6% increase from last year, and 230,000 more than the estimate released in May.

This reflects a 2.4% expansion of the productive area, with trees recovering from the frost of 2021, and a 13.9% boost in productivity.

Conab highlighted the performance of Brazil’s top coffee-growing state Minas Gerais, “which, despite the effects of the negative biennial on many of the producing regions, saw a 29.5% increase in production,” said Fabiano Vasconcellos, the agency’s crop monitoring manager in a statement.

The prospects look worse for the Robusta variety. In fact, the output of the conilon variety is now estimated by Conab to be 16.2 million bags, an 11% decrease from the previous year and the worst performance of the last three years.

“This is due to a 10.8% fall in productivity, which is a result of partially adverse weather conditions in the state of Espírito Santo, the main producer of this variety.

These conditions had a significant impact on crops, particularly during the initial stages of the crop cycle. This fall in production is only partially offset by the bigger crops expected in Rondônia and Mato Grosso” Vasconcellos added.

Overall productivity (Arabica+Robusta) rose to 29 bags per hectare from 27.7 bags last year, or a 4.8% increase.

The planted area covers 2.24 million hectares, of which 1.88 million are in production and 362,500 are in formation.

Production is Minas Gerais is 28.8% up to 28.29 million bags, thanks to a 6.5% expansion of the area in production and a 21% rebound in productivity.

Espírito Santo’s output was heavily reduced to 13 million bags, a 21.9% decrease from a bumper crop of 16.72 bags recorded in 2022. Productivity decreased sharply (-20%) to 33.3 bags per hectare, from 41.5 bags per hectare last year.

The Arabica crop was negatively affected by the off-cycle. The impact was made worse by the climate and diseases. Production fell by more than a third to 2.86 million bags.

Drought, heavy winds and low temperatures undermined the Robusta crop, which was 17.5% down to little less than 10.2 million.

In São Paulo, productivity surged to 27.7 bags per hectare and production rose to 5 million bags (+14.7%), despite a reduction in the productive area.

Production in Bahia was down by 5.1% to 3.42 million, of which 1.13 of Arabica (-11.1%) and 2.29 million of Robusta (-1.9%).

Rondônia saw record-breaking productivity, resulting in a production of more than three million bags, an increase of 8.6% year-over-year.