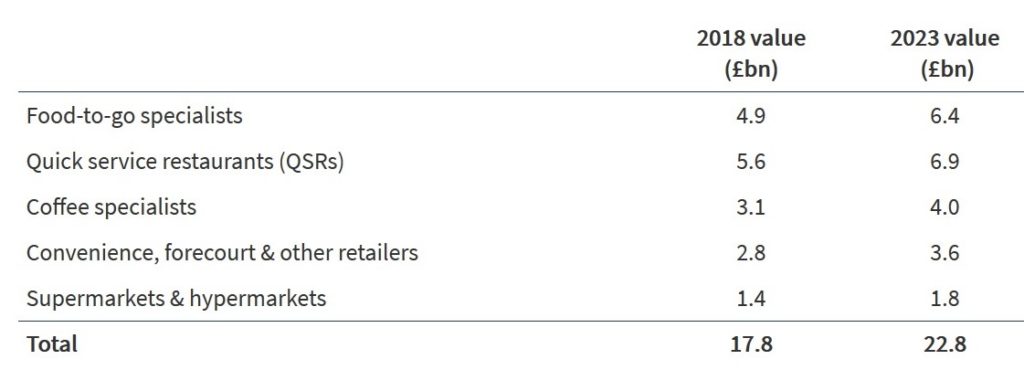

The UK’s food-to-go sector is set to grow at twice the rate of overall grocery retail, with international research organisation IGD predicting the channel to grow to £22.8bn by 2023, up from £17.8bn in 2018.

Food-to-go specialists include operators such as Pret A Manger, Greggs, Subway, Leon and Chipotle; coffee specialists include operators such as Starbucks, Costa Coffee and Caffe Nero; and QSRs include operators such as McDonalds, Burger King and KFC

IGD’s food-to-go research splits the market into five segments, with the organisation’s latest forecasts suggesting food-to-go specialists will experience the fastest growth. Increasing fusion between the different segments within the market is also anticipated as businesses look to extend their core capability into new areas.

Gavin Rothwell, Head of Food-to-Go at IGD, says:

Gavin Rothwell, Head of Food-to-Go at IGD, says:

“The food-to-go market remains a strong growth opportunity that continues to provide a great source of inspiration and innovation. We’re forecasting solid growth across each of the five segments, but this will become harder to come by for operators, retailers and suppliers amid an increasingly competitive landscape. But while growth will slow, we’re expecting it to remain strong as more consumers buy food-to-go more often and as more operators target different types of locations and missions.”

Increasing blurring between the different segments

“As more business look to extend their food-to-go capability, retailers and food-to-go operators alike will look to add new capabilities to meet more missions. Specifically, food-to-go specialists as diverse as Greggs and Coco di Mama have been bolstering their coffee credentials, while convenience stores, among the most notable this year being EAT17 and the Coop, have focused on enhancing the range of food-to-go options on offer to meet more missions more effectively.”

The partnerships trend of the past year has much further to run

“Across food-to-go, collaboration between partners with the same values and mutually beneficial propositions, have been in the ascendance. Crussh and Sainsbury’s, M&S and Wasabi are two high profile collaborations, but there are already many more underway and we expect significant development here. Larger retail stores undergoing remodelling in particular offer some great opportunities for collaborations between retailers and food-to-go partners.”

Evolving with consumers’ demands in health and wellness and around sustainability is increasingly critical

“The best food-to-go operators are highly attuned to the wider mindset of their shoppers. They have responded to shape their wider propositions accordingly. Increasingly this will become expected by food-to-go consumers, and those that don’t keep up will stand out.”

Food-to-go is increasingly moving beyond the high street, as operators look to open up new types of location

“While online ordering and delivery is one aspect of this, perhaps in its current form the online opportunity will only be transformational for a select few. More widely however, getting into new, different types of locations, including forecourts and other travel locations, is likely to be an increasingly significant route to growth for a growing number of players in food-to-go. Across a variety of missions, locations and segments, the food-to-go market remains worthy of considerable focus and attention for those looking to grow food and drink businesses over the next five years.”