Share your coffee stories with us by writing to info@comunicaffe.com.

MILAN – Coffee futures fell sharply yesterday, Wednesday 12 November, on both markets, following the US administration’s announcement of an imminent reduction in tariffs on coffee and other agricultural products. In New York, the contract for December delivery fell 4.5% to close at 403.65 cents. The most active contract for March delivery fell by as much as 5.7%, settling at 376.65 cents.

There were also sharp declines in London, where the January contract lost 5.5%, ending the session at $4,366.

Profit-taking in both terminals was triggered after statements to the media by President Trump and Treasury Secretary Scott Bessent.

The latter, answering a question during an interview with Fox News about cutting tariffs on coffee imported from Brazil and Vietnam, said: “It’s tough to do a lot of specific things, but I can tell you … you’re going to see some specific announcements in coming days in terms of things we don’t grow here in the United States, coffee, coffee being one of them, bananas, other fruits, things like that.”

These measures are intended to reduce the rising cost of living, which have caused much discontent among American consumers and is believed to have contributed to the electoral defeats of Republicans in New Jersey, Virginia and New York.

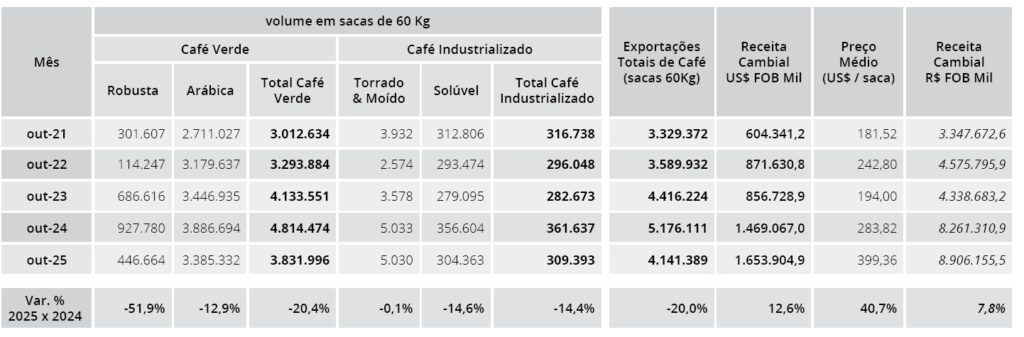

Brazilian exports continue to decline. According to data released yesterday by Cecafé, Brazil’s exports of all forms of coffee amounted to 4,141,389 bags in October: over one million bags less (-20%) than in the same month a year ago.

Green coffee exports fell by 20.4% to 3,831,996 bags. Arabica exports were 12.9% down to 3,385,332 bags. Robusta volumes fell by a further 51.9% to just 446,664 bags. Sales abroad of processed coffee fell by 14.4% to 309,393 bags.

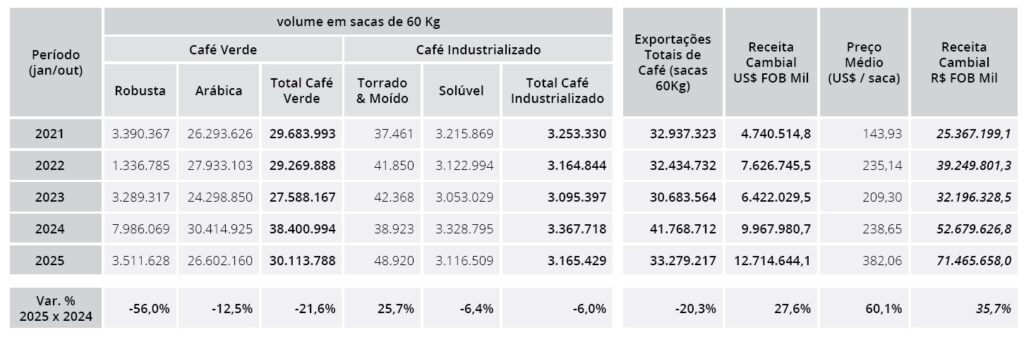

Since the beginning of the year, exports of all forms of coffee have totalled 33,279,217 bags, again down by more than a fifth (-20.3%) compared to the first 10 months of 2024, but still above the levels of the previous three years.

Green coffee shipments amounted to 30,113,788 bags (-21.6%), of which 26,602,160 bags (-12.5%) were Arabica and 3,511,628 (-56%) were Robusta. Sales of processed coffee amounted to 3,165,429 bags, down 6%.

A similar trend was seen for the first four months of the current crop year (July-October), which saw total exports fall to 13,845,584 bags (-20.3%).

Green coffee exports stood at 12,657,180 bags (-20.6%), of which 10,634,863 bags (-13%) were Arabica and 2,022,317 bags were Robusta (-45.4%).

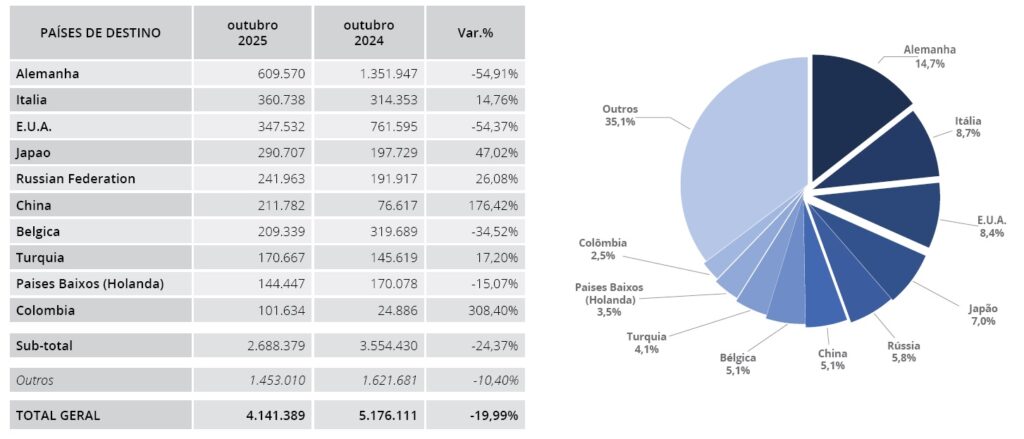

The October data broken down by country continue to reflect the fall in exports to the US due to Trump’s tariffs. Germany has thus become the main destination for Brazilian coffee, although volumes have more than halved (-54.9%) compared to a year ago.

On the other hand, exports to Italy, which was the second largest market for Brazilian coffee last month, increased by almost 15%. Behind Italy is the US, with less than 350,000 bags exported (-54.4%). Exports to Japan, the Russian Federation and, above all, China are also growing.

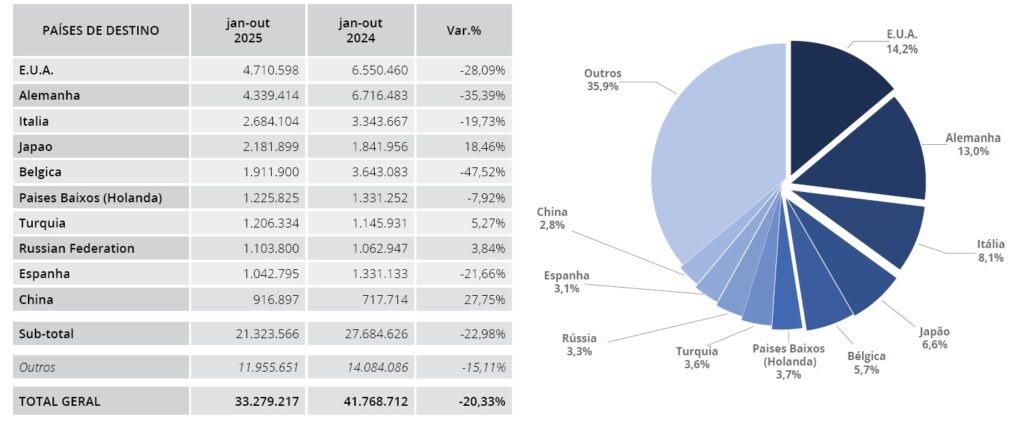

In the first 10 months, the US remained the main market ahead of Germany and Italy. Exports to Japan grew, while those to Belgium and the Netherlands declined. It should be noted that exports to China are now close to one million bags.

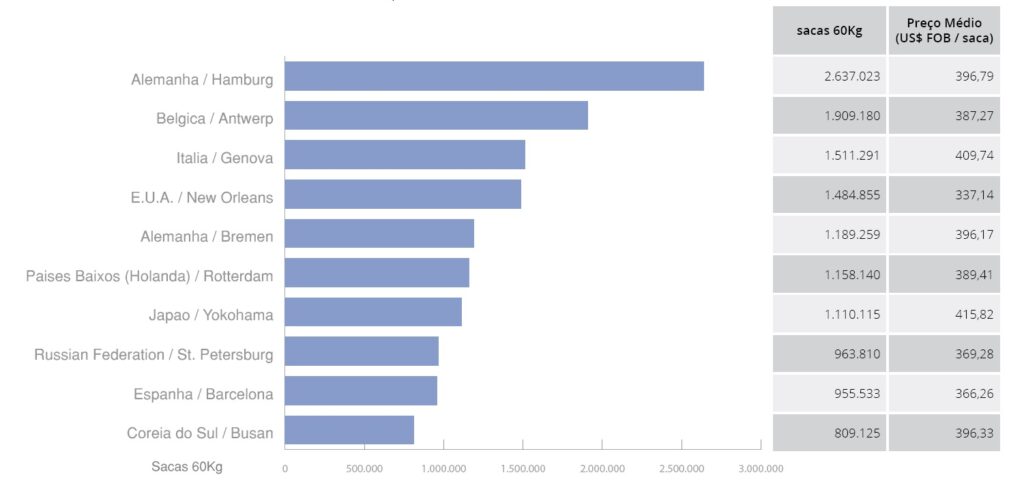

Hamburg remains the leading port of destination, ahead of Antwerp and Genoa.

According to Cecafé president Márcio Ferreira, shipments – despite being negatively impacted by a series of logistical, infrastructural and political factors – remain within the expected scenario.

“The decline was expected, mainly because we are coming off record shipments in 2024 and a harvest with lower production potential,” said Cecafe President Marcio Ferreira in a statement.

“The situation was aggravated, however, by outdated infrastructure in Brazilian ports and by the 50% tariff imposed by the United States, which greatly reduced shipments. On the other hand, higher earnings reflect higher prices on the international market,” Ferreira concluded.