MILAN, Italy – The Board of Directors of Italmobiliare S.p.A., the mother company of Caffè Borbone, on July 29, 2020, reviewed and approved the consolidated interim financial statements at June 30, 2020. Italmobiliare S.p.A. is an investment holding company listed on the Milan Stock Exchange owner of a majority stake of 60% in Caffè Borbone, one of the top names on the national market and a leading supplier of single serve coffee. The remaining 40% share is held by the founder and Executive President of Caffè Borbone Massimo Renda.

The Net Asset Value (NAV) of Italmobiliare at June 30, 2020, excluding treasury shares, amounted to 1,629.3 million (1,741.1 million at December 31, 2019).

The main changes in NAV are due to the distribution of ordinary and extraordinary dividends for a total of 76 million euro, the reduction in the market value of the investment in HeidelbergCement AG (-59.1 million euro) and other listed investments (-7.6 million euro, mainly attributable to the investment in Fin.Priv., a finance company that holds Mediobanca shares) against an overall increase in the value of the Portfolio Companies (+42 million based on the same scope of consolidation).

In particular, as regards the latter, there was an increase in the value of Caffè Borbone, a reduction in the value of Tecnica Group and stability in the value of the other equity investments. Furthermore, the acquisition of 20% of Officina Santa Maria Novella led to an increase in the component represented by the portfolio companies (+41.4 million euro, corresponding to the investment in the newco which acquired the equity investment) with an equivalent reduction in liquidity.

At June 30, 2020, Italmobiliare S.p.A.’s NAV per share, excluding treasury shares, amounted to 38.6 euro.

Summary of Results

Taking into account the impacts of the Covid crisis on financial markets, for Italmobiliare S.p.A. the first half of 2020 closed with a negative result of 16.6 million euro (positive for 9.2 million euro at June 30, 2019).

Net income and charges from equity investments are positive for 8.6 million euro, down on the 10.1 million euro at June 30, 2019, mainly due to the lower dividends collected or approved (-11.5 million euro, mainly due to postponement of the distribution of dividends by Caffè Borbone following the Covid-19 risk, which should be distributed in the second half of 2020), partially offset by lower write-downs of certain equity investments.

Net gains on investments of cash and cash equivalents show a negative balance of 10.9 million euro (positive for 12.1 million euro at June 30, 2019). The change is mainly due to the performance of trading investments and investment funds penalized by the negative performance recorded by international markets because of the pandemic.

Other income and expense are negative for 19.1 million euro (-11.6 million euro at June 30, 2019), mainly due to higher non-recurring operating costs of 5.8 million euro (MBO and LTI payments referring to the previous three years and donations). At the end of the half-year, the net financial position of Italmobiliare S.p.A. decreased by 116.94 million euro, going from 569.6 million euro at December 31, 2019 to 452.7 million euro at the end of June 2020.

The main flows include the payment of the ordinary and extraordinary dividend for a total of -75.9 million euro and the acquisition of 20% of Officina Santa Maria Novella (-41.4 million euro). Equity at June 30, 2020 amounts to 1,204.5 million euro, 142.5 million euro down on December 31, 2019 (1,347 million euro).

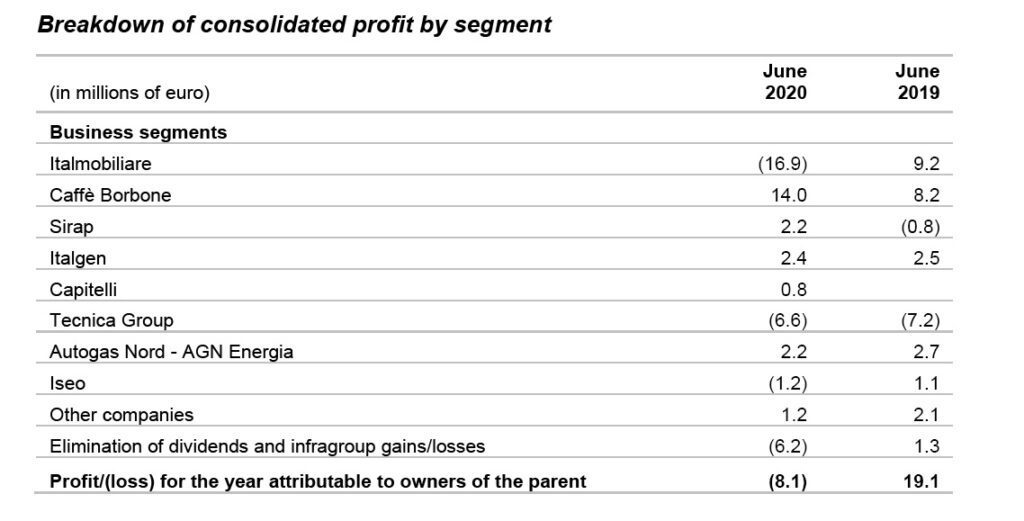

At a consolidated level, the profit (after tax of 3.7 million) came to 1.4 million (24.5 million in the first half of 2019). The result attributable to the owners of the parent company was a loss of 8.1 million euro. The consolidated equity attributable to the owners of the parent company at June 30 was 1,224.9 million (1,358.7 million at the end of 2019).

The other main economic results of the Italmobiliare Group are:

The other main economic results of the Italmobiliare Group are:

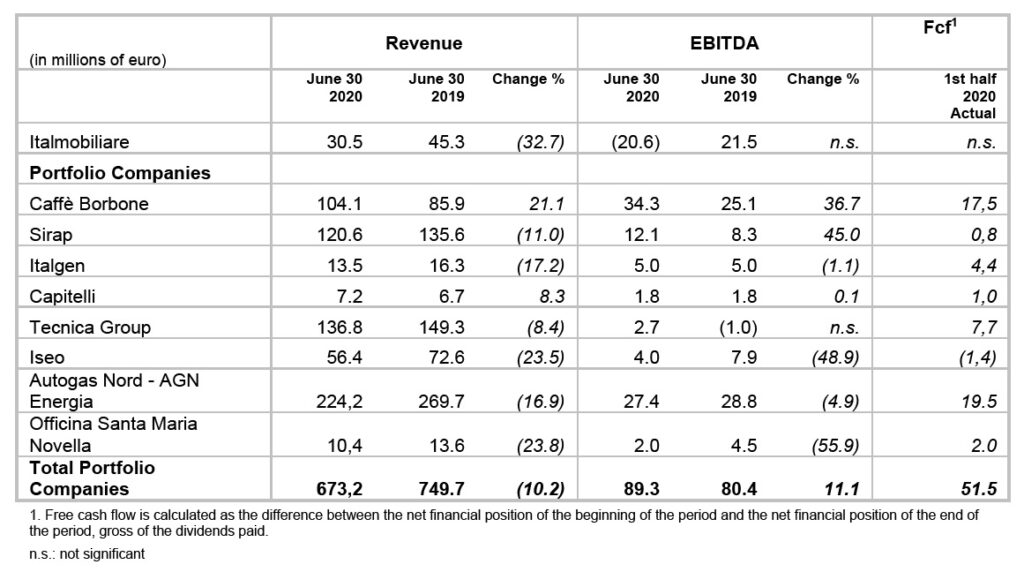

- Revenue: 276.2 million on 278.3 million at June 30, 2019;

- Gross operating profit (EBITDA): 27.6 million (52.1 million);

- Operating profit (EBIT): 13.2 million (38.3 million).

Performance of the main Group companies

Overall, the first half of the year showed that the Portfolio Companies had a significant degree of resilience, brought about by the constant and proactive focus on the operating performance of the individual businesses and by a diversified mix of investments, which made it possible to limit the negative effects on the activities most exposed to the fallout caused by the Covid pandemic. Overall, despite a reduction in aggregate revenue, operating results improved compared with the situation in mid-2019.

Overall, the first half of the year showed that the Portfolio Companies had a significant degree of resilience, brought about by the constant and proactive focus on the operating performance of the individual businesses and by a diversified mix of investments, which made it possible to limit the negative effects on the activities most exposed to the fallout caused by the Covid pandemic. Overall, despite a reduction in aggregate revenue, operating results improved compared with the situation in mid-2019.

Caffè Borbone (60%)

In general, the half year for Caffè Borbone was characterized by a very positive performance on the part of the capsule business, while at channel level the growth trajectory of the online channel and large-scale distribution continues.

Despite the half year characterized by the effects of the global pandemic, performances benefited from some specific features of the company compared with its competitors, such as the excellent quality/price ratio, its strength in the online channel and the very low weighting of the Ho.Re.Ca. channel. In the first half of 2020, Caffè Borbone recorded a turnover of 104.1 million euro, an increase of 21.1% compared with the same period of the previous year.

The gross operating profit for the first half of the year came to 34.3 million euro, with a margin of 32.9% of turnover, a marked improvement compared with the first half of 2019 (+3.7%), mainly thanks to the effect of economies of scale on overheads.

Profit for the first half of the year was 23.6 million euro, 68% up on the previous year. The net financial position at June 30, 2020 is negative for 14.1 million euro, with a positive cash flow of 17.5 million euro in the first half of the year. For prudence sake during the Covid-19 emergency the distribution of dividends was postponed to the second half of 2020.