Share your coffee stories with us by writing to info@comunicaffe.com.

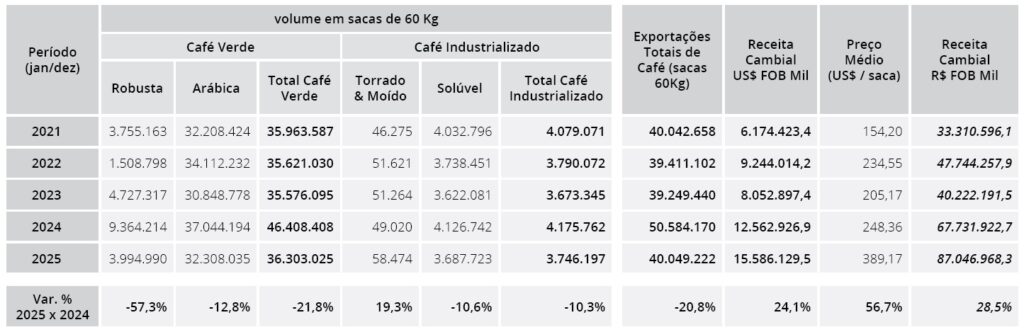

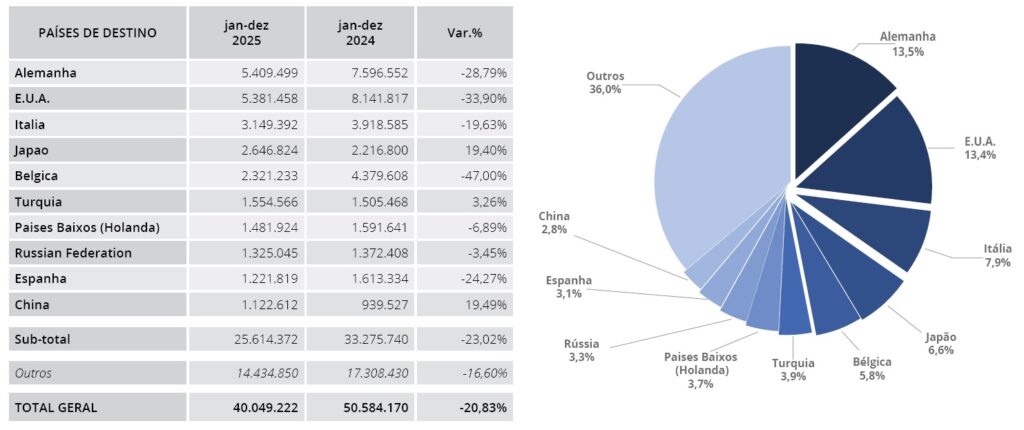

MILAN – Brazilian coffee exports fell sharply in calendar year 2025, according to the monthly statistics report by Cecafé, released yesterday evening, Monday 19 January. Over the past 12 months, exports of all forms of coffee went down by 20.8% to 40,049,222 bags: over 10.5 million lower than the record figure of 50,584,170 bags achieved in 2024.

Neverthless, this is still higher than the historical average for the previous three years (2021-2023), which was less than 40 million bags.

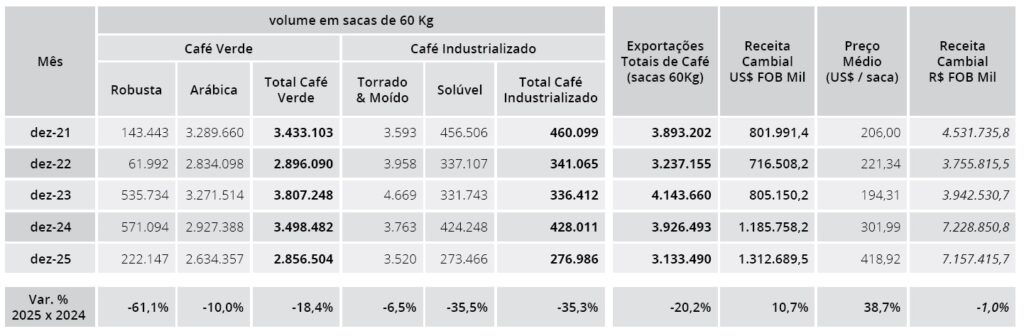

A similar decline was recorded in December: exports totalled 3,133,490 bags last month, a fall of 20.2% compared to December 2024.

Green coffee shipments fell by 18.4% to 2,856,504 bags, of which 2,634,357 (-10%) were Arabica and 222,147 (-61.1%) were Robusta.

Foreign sales of processed coffee fell by more than a third (-35.3%), amounting to 276,986 bags, mostly soluble coffee.

Returning to the figures for the whole of 2025, green coffee exports fell by 21.8% to 36,303,025 bags, compared to the unprecedented figure of 46,408,408 bags in 2024.

The decline in Arabica exports was relatively lower (-12.8%), falling to 32,308,035 bags. Robusta shipments, on the other hand, plummeted (-57.3%), settling at just under 4 million bags.

Processed coffee exports were down 10.3% on 2024, amounting to 3,746,197 bags.

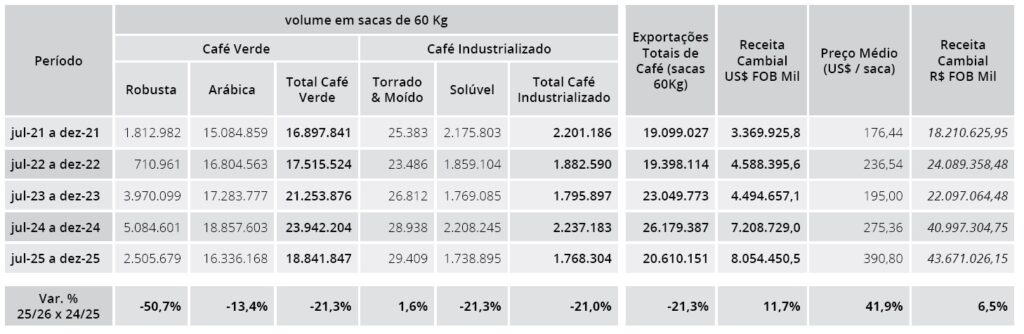

In the first half of the 2025/26 crop year (July-December), Brazilian exports of all forms of coffee fell to 20,610,151 bags, down 21.3% compared to the same period in 2024/25.

Green coffee exports also fell by 21.3% to 18,841,847 bags, of which 16,336,168 (-13.4%) were Arabica and 2,505,679 (-50.7%) were Robusta. Sales of soluble coffee fell to 1,768,304 bags (-21.0%).

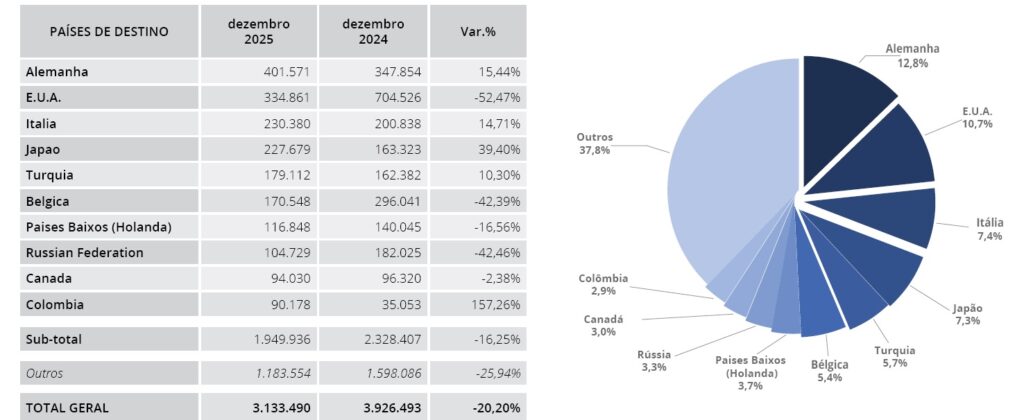

Despite the lifting of tariffs, exports to the US fell by 52.5% in December, while volumes to Germany (+15.4%), Italy (+14.7%) and Japan (+39.4%) recovered.

Looking at the 12-month period, Germany – despite a 28.8% decline – surpassed the US (-33.9%) to become the most important destination for Brazilian exports, with a volume of 5,409,499 bags. Despite lower shipments of 769,193 bags (-19.63%), Italy remains the third destination, with a volume of 3,149,392 bags, ahead of Japan (+19.4%) and Belgium (-47%).

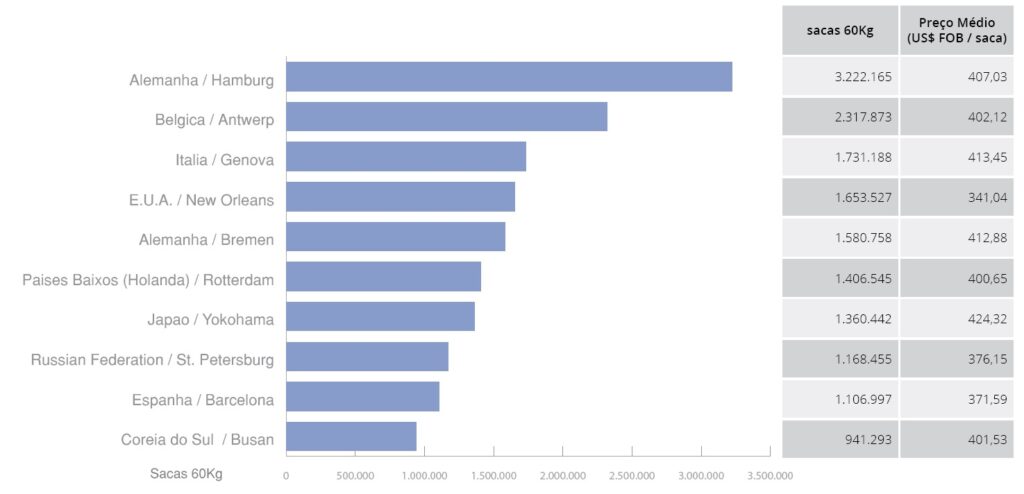

Hamburg remains the leading destination port, with over 3.2 million bags, ahead of Antwerp and Genoa.

Márcio Ferreira, president of Cecafé, said in the report that the sharp decline in exports was widely expected after record shipments in 2024, which greatly reduced stocks, and in view of lower availability due to the decline in Arabica production (and strong demand for Robusta coffee from Brazilian industry, editor’s note).

The 50% tariffs imposed by the Trump administration from August to November also had an impact. It should be noted that executive orders issued in November eliminated tariffs on all coffee imports (including processed coffee), with the sole exception of soluble coffee.

Finally, logistical difficulties and infrastructure delays at Brazilian ports continue to impact the situation.

Despite the volume declines described above, export earnings reached an unprecedented figure of almost $15.6 billion last year, compared to $12.5 billion in 2024 and $6.2 billion in 2021, with a volume almost equal to that of 2025.