Share your coffee stories with us by writing to info@comunicaffe.com.

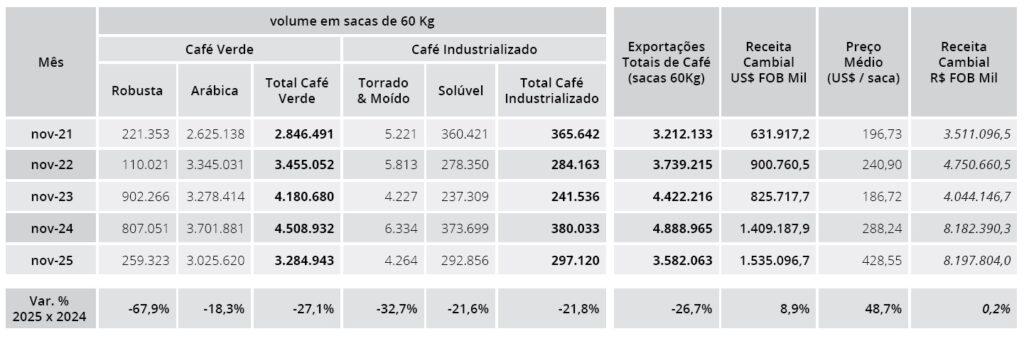

MILAN – Brazilian coffee exports further declined in November: according to data released yesterday, Wednesday 10 December, by Cecafé, exports of all forms of coffee suffered a new setback last month (-26.7%), falling to 3,582,063 bags, the lowest figure since 2021. Green coffee shipments were also down 27.1% to 3,284,943 bags. Arabica volumes plummeted (-18.3%) to 3,025,620 bags.

Despite record levels in Robusta production, exports of this variety continued to fall sharply (-67.9%) to just 259,323 bags (less than a third compared to November 2024), due to strong domestic demand.

Finally, sales abroad of processed coffee were down 21.8% to 297,120 bags, mostly soluble.

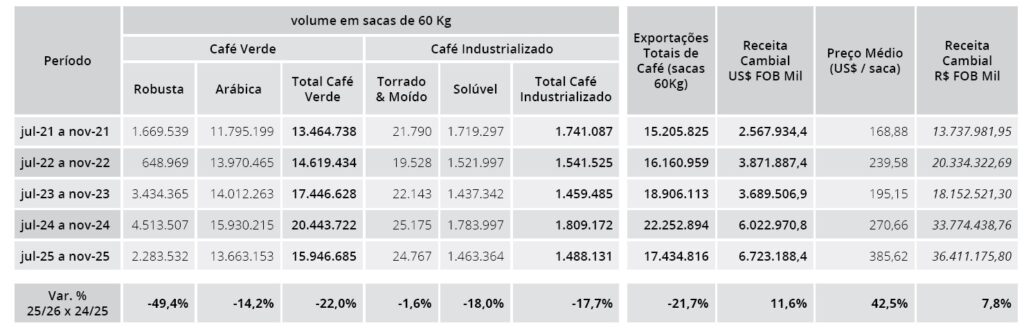

Exports of all forms of coffee in the first five months of the 2025/26 crop year (July-November) fell by 21.7% to 17,434,816 bags.

Green coffee exports fell to 15,946,685 bags (-22%), of which 13,663,153 (-14.2%) were Arabica and 2,283,532 (-49.4%) were Robusta.

Sales of processed coffee stood at 1,488,131 bags (-17.7%).

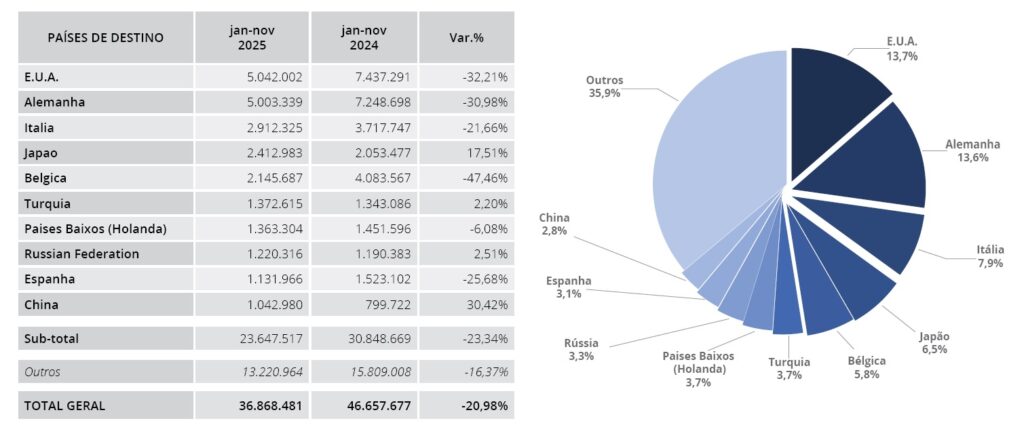

Brazilian coffee exports in the first 11 months of the year totalled 36,868,481 bags, which is almost 9.8 million bags less (a 21% decrease) than in the same period in 2024.

Green coffee volumes fell by 22.2% to 33,403,325 bags, of which 29,630,482 (-13.1%) were Arabica and 3,772,843 (-57.1%) were Robusta.

The decline in processed coffee exports was more moderate (-7.5%), standing at 3,465,156 bags.

Looking at the major destination countries, the US remains, albeit by a small margin, the largest market for Brazilian coffee, with a volume of 5,042,002 bags, down 32.2% compared to the same period of 2024.

Germany follows closely behind, with exports to this country accounting for 5,003,339 bags (-31%).

Despite a decline of 21.7%, Italy remains Brazil’s third largest market with 2,912,325 bags, ahead of Japan (+17.5%) and Belgium (-47.5%).

Also noteworthy is the sharp decline in the shipments to Spain (-25.7%), which is offset by a further increase in exports to China (+30.4%), now exceeding one million bags.

Over the past month, Brazilian exports to Germany increased by 28%, compared with sharp declines in of exports to the US (-62.7%), Belgium (-46.9%) and Italy (-38.8%). Meanwhile, Japan continued to grow (+9.2%).

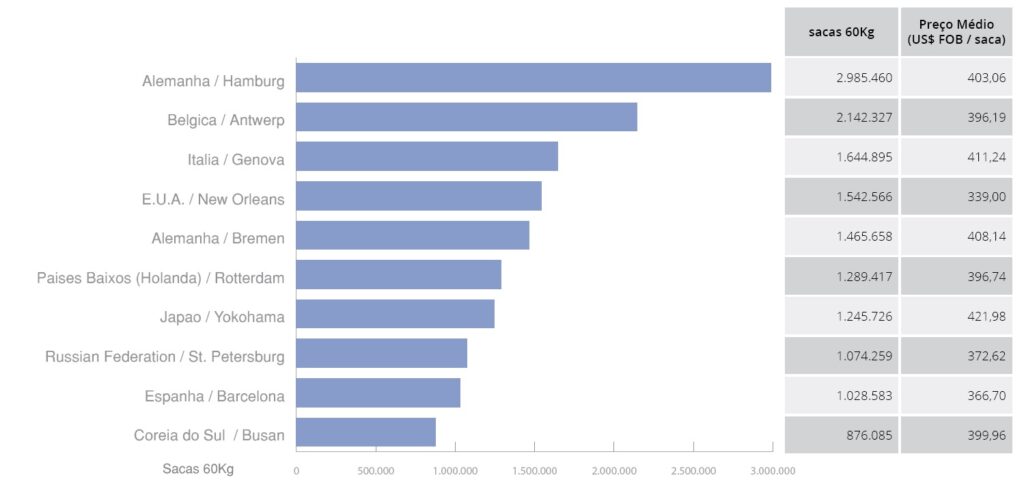

Among the ports of destination, Hamburg leads the way, ahead of Antwerp, Genoa, New Orleans and Bremen.

“The decline in shipment volumes was expected, following last year’s record figures and given the lower availability this year,” said Cecafé President Márcio Ferreira in the report.

Added to this is the impact of Trump’s punitive tariffs, which in just over four months (from 6 August to 21 November, with retroactive effect of the revocation to 13 November) caused exports to the US to fall by more than 1.6 million bags.

“After the removal of the tariff on Arabica, conilon, Robusta, roasted, and roasted-and-ground coffees, we have seen business between Brazil and the United States resume, which suggests we should see improvements in numbers from December onward,” said Ferreira.

“However, it should be remembered that soluble coffee, which accounts for 10% of our exports to the US, continues to be subject to 50% tariffs, and we will therefore continue to work to ensure that this product is also exempted from tariffs,” concluded Ferreira.

Finally, logistical hurdles remain, which – according to Cecafé data collected from its members – prevented the shipment of 681,590 bags of coffee in October alone.