Share your coffee stories with us by writing to info@comunicaffe.com.

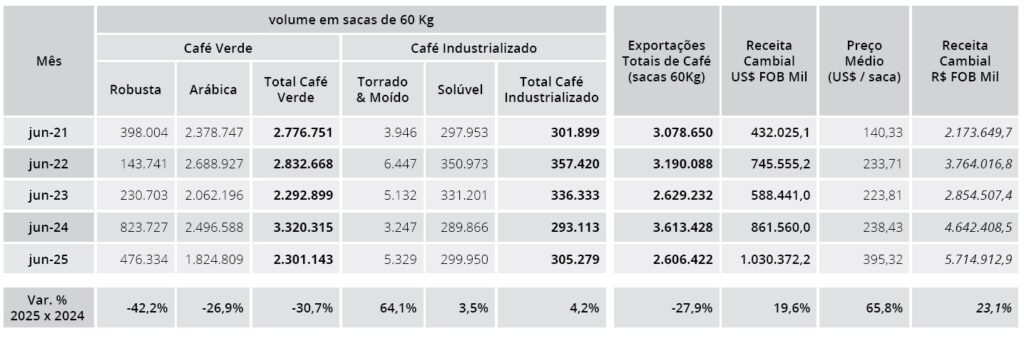

MILAN – Brazilian coffee exports suffered a new setback in June, the last month of the 2024/25 crop year, with a 27.9% year-on-year decline, according to monthly data released on Wednesday, 16 July 2025, by Cecafé. In spite of that, Brazil ended CY 2024/25 with one of the highest export volumes in its history and record-high earnings.

Last month, Brazil exported 2,606,422 bags of all forms of coffee, or more than one million bags less than in June 2024.

Green coffee shipments fell by 30.7% to 2,301,143 bags: sharp declines were recorded for both Arabicas (-26.9%) and Robustas (-42.2%).

On the other hand, there was a slight recovery (+4.2%) in processed coffee exports (mostly soluble coffee).

On the other hand, there was a slight recovery (+4.2%) in processed coffee exports (mostly soluble coffee).

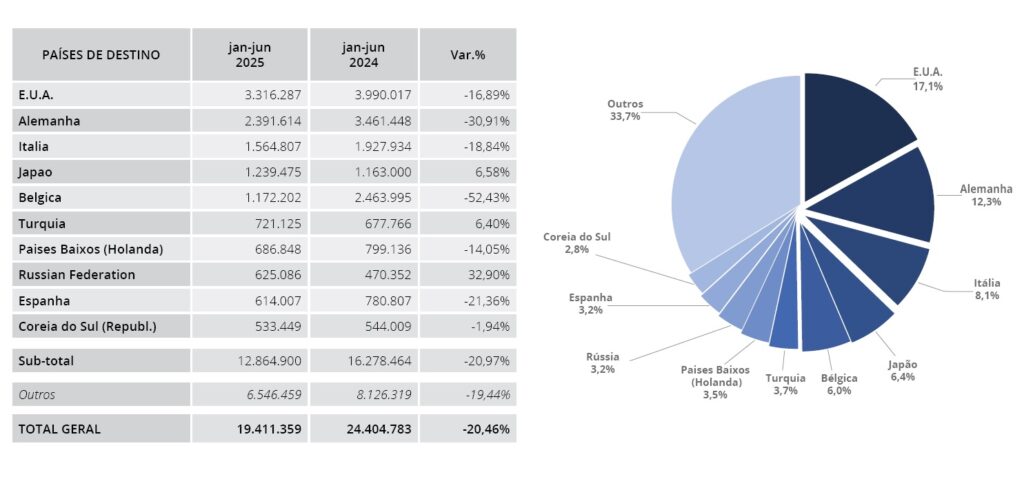

Brazilian coffee exports during the first half of calendar year 2025 were down by more than a fifth (-20.5%) to 19,411,359 bags.

Green coffee exports fell sharply (-22.4%) to 17,439,412 bags, of which 15,951,967 (-12.3%) were Arabica and 1,487,445 (-65.2%) Robusta coffee. Processed coffee sales recovered by 1.7% to reach 1,971,947 bags.

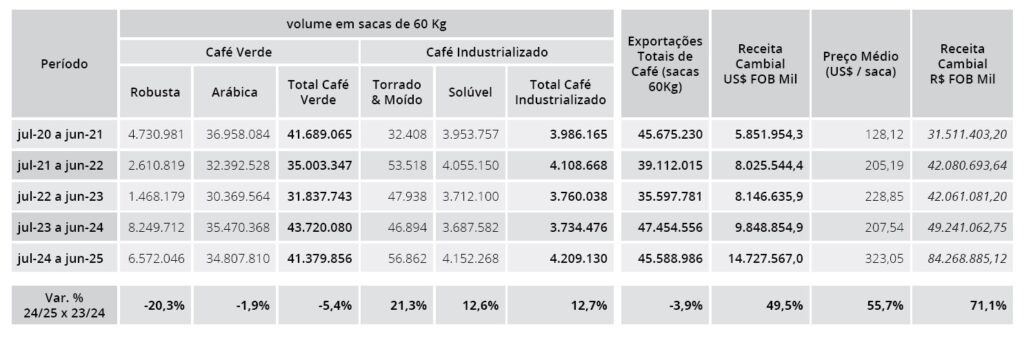

During CY 2024/25 (July-June), Brazil’s exports of all forms of coffee amounted to 45,588,986 bags: the third-highest volume on record behind 47.45 million last year and 45.67 million in 2020/21.

Revenues reached an unprecedented $14.7 billion, up 49.5% from 2023/24, thanks to a 55.7% surge in the average price per bag to $323.05.

Although down 5.4% year-on-year, green coffee exports stood at a remarkable 41,379,856 bags, of which 34,807,810 (-1.9%) were Arabica and 6,572,046 (-20.3%) Robusta. Processed coffee sales increased by 12.7% to 4,209,130 bags.

Exports to the USA were up (+5.7%) in 1H of calendar year 2025, at almost 7.5 million bags. Exports to Germany were stable (+0.25%) at over 6.5 million bags.

On the other hand, exports to Italy (-6%), Belgium (-21.2%) and Japan (-7.4%) declined.

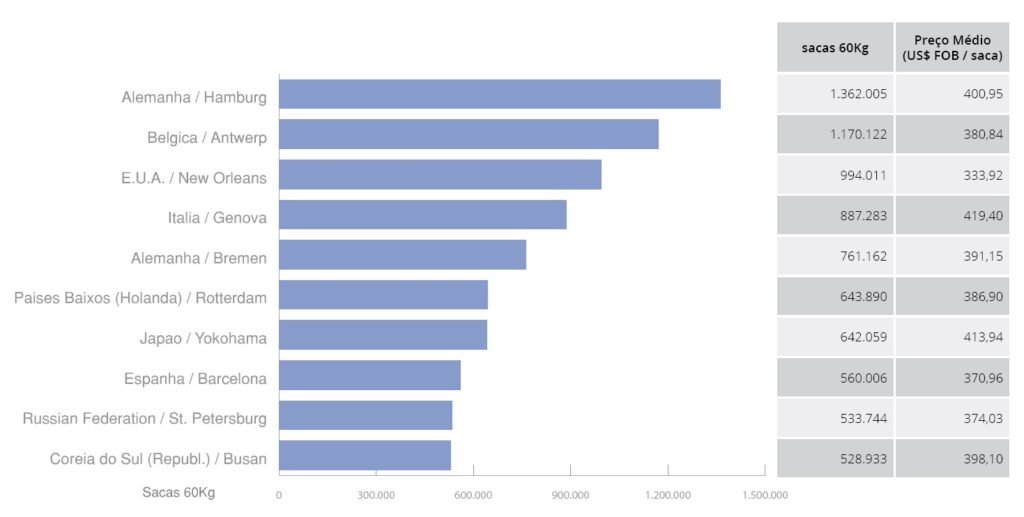

Among the ports of destination, Hamburg still prevails, ahead of Antwerp, New Orleans, Bremen and Genoa.

“Prices, especially in the second half of 2024, were strongly influenced by lower production potential in the world’s main producing countries — a situation observed over practically the past five years, as extreme weather events have affected coffee plantations in Brazil, Vietnam, Colombia, and Indonesia,” said Cecafé president Márcio Ferreira. “This led to a significant increase in the value of coffee.”

Arabica prices rose again yesterday supported by dry weather conditions in the Brazilian coffee belt.

In New York, the contract for September delivery closed up 3.7% at 308.45 cents. September ICE Robusta coffee posted smaller gains, (+0.6%) to settle at $3,427.