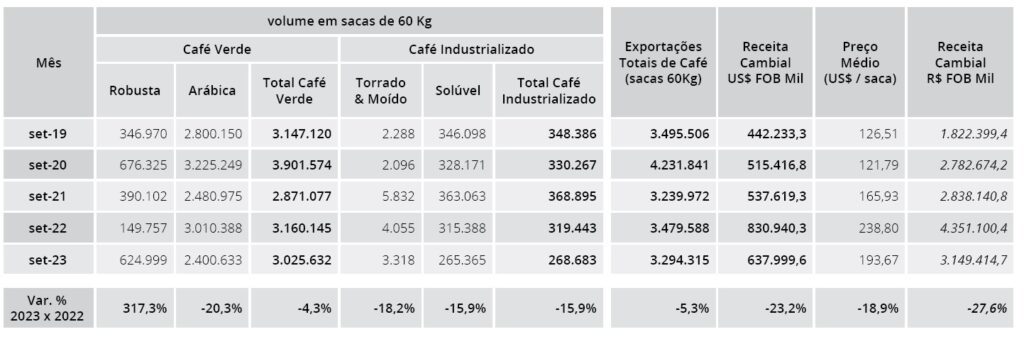

MILAN – Cecafé’s figures show a decline in Brazil ’s coffee exports during the month of September. According to the Association, the county shipped 3.294.315 bags of all forms of coffee, a 5.3% decrease compared to September 2022 and almost 1 million less than in the record year of 2020.

Green coffee exports were 4.3% down to 3,025,632 bags. Arabica shipments fell sharply (-20.3%) to 2,400,633, while Conillon exports surged by a whopping 317.3% to 624,999 bags.

Also, sales of processed coffee (mostly soluble) abroad went down by 15.9% to 268,683 bags.

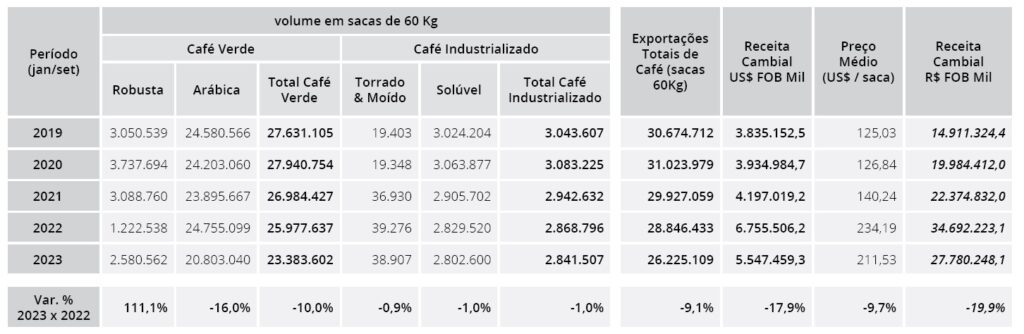

The first nine months of the calendar year 2023 (January-September), saw a 9.1% decrease in exports, reaching 26,225,109 bags, compared to 28.846.433 bags in the same period last year and 31,023,979 bags in 2020.

The first nine months of the calendar year 2023 (January-September), saw a 9.1% decrease in exports, reaching 26,225,109 bags, compared to 28.846.433 bags in the same period last year and 31,023,979 bags in 2020.

Green coffee exports from Brazil dropped by 10% to 23,383,602 bags due to a 16% fall in Arabica shipments, partially offset by a 111.1% increase in Robusta shipments. Sales of processed coffee inched 1% down to 2,841,507 bags.

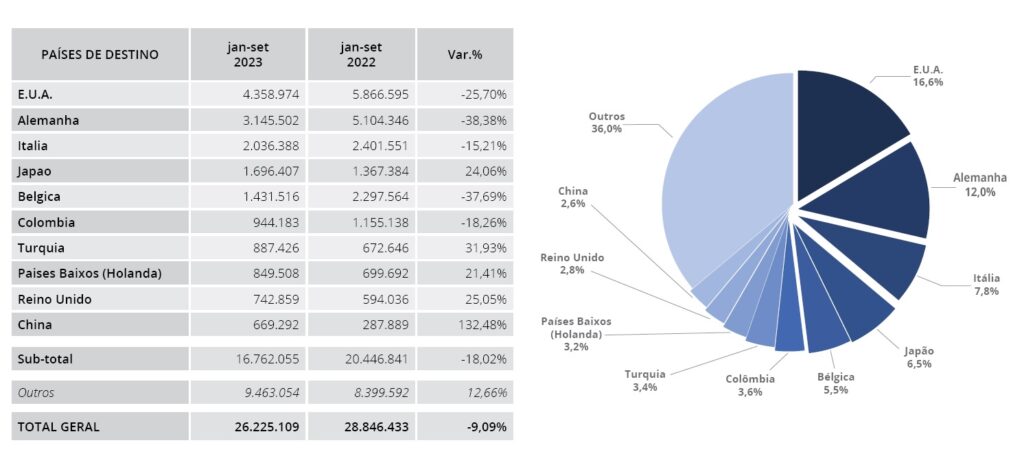

Shipments to the main countries of destination were mostly down, with the exception of Japan and Türkiye. The volumes exported to the USA, Germany, Italy and Belgium fell by 25.7%, 38.38%, 15.21% and 37.69% respectively.

Shipments to the main countries of destination were mostly down, with the exception of Japan and Türkiye. The volumes exported to the USA, Germany, Italy and Belgium fell by 25.7%, 38.38%, 15.21% and 37.69% respectively.

On the other hand, exports to Japan and Türkiye rose by 24% and 31.93%.

The decline in Arabica coffee prices on world market left sellers reluctant to release more of their stocks, according to Cecafe President Márcio Ferreira.

With the lower prices, “coffee growers became more resistant to carrying out new business,” with weak demand from buyers at the same time, he added.

Shipments of Robusta coffee are the only ones with a positive performance this year. The president of Cecafé comments that this Brazilian variety remains more competitive in the global market and is in high demand due to production problems in important Robusta producing origins, especially Vietnam and Indonesia.

“It is not surprising, therefore, that the Vietnamese have increased their imports of green coffee from Brazil by a significant 537% in the year to September, nor that the Indonesians record an increase of 85.5% in purchases of our product in natura in the same period”, concluded Ferreira.

Differentiated coffees accounted for 16.7% of total Brazil’ s exports of the product this year, with 4.382 million bags shipped abroad. This volume represents a drop of 16.1% compared to that recorded between January and September 2022.

The average price of this category of products was US$237 per bag, generating foreign exchange revenues for US$1.038 billion in the first nine months of 2023, which corresponds to 18.7% of that obtained from total coffee shipments.

On an annual basis, the value is 29.5% lower than that measured during the same time span last year.