MEXICO CITY, Mexico – Alsea, S.A.B. de C.V., the leading Quick Service Restaurant (QSR), Coffee Shop, Casual Dining and Family Restaurant operator in Latin America and Europe, released its results for the fourth quarter and full year 2021.

Alsea has a diversified portfolio, with brands such as Starbucks, Domino’s Pizza, Burger King and TGI Fridays, Ole Mole and Corazón de Barro. The company operates more than 4,000 units in Mexico, Spain, Argentina, Chile, Colombia, France, Portugal, Netherlands, Belgium, Luxembourg and Uruguay.

This information is presented in nominal terms pursuant to International Financial Reporting Standards (IFRS). The comments presented in this report include the effect of IFRS 16, as well as the effect regarding restatement due to hyperinflation in Argentina.

Fourth Quarter and Full Year 2021 Results and Highlights:

- Alsea reported sustained sales growth for all four quarters and positive EBITDA in all regions during 2021

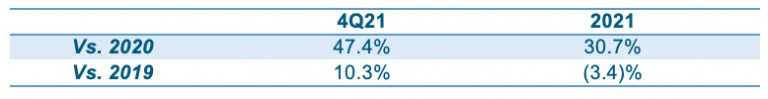

- Same-Store Sales (SSS):

- The Company has reached dine-in restaurant sales similar to 2019 levels, while achieving home delivery sales growth of 25.2% vs. 4Q20, and reaching over 3,300 million pesos with a 20.4% share of consolidated sales

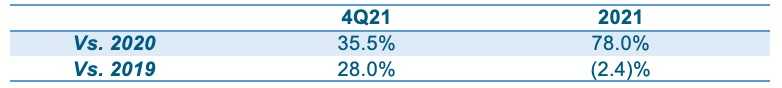

- EBITDA:

- Net Profit in 4Q21 increased by 857 million pesos compared to 4Q20, and by 4,680 million pesos in 2021, compared to the previous year

- Successful issuance of a US$500 million bond for debt refinancing, ending 2021 with 92% of the total debt as long-term and a solid cash position.

FY Results

Net sales in 2021 increased 38.7% to 53,379 million pesos (US$2.599 billion) compared to 38,495 million in the previous year. This increase is mainly due to the recovery from the pandemic-related impact on consumption, which mainly affected the first quarter of the year.

The year’s net sales were 91.8% of 2019 levels, and same-store sales decreased 3.4%, also compared to 2019.

The home delivery sales segment in 2021 grew 41.1% compared to 2020, which represents more than 12,500 million pesos, more than 43.1 million orders, and a 23.4% share of Alsea’s consolidated sales.

In terms of same-store sales during the year, compared to 2020, the South American business portfolio increased 63.4%, brands in Mexico grew by 34.3%, and the European operation presented a 12.7% increase.

EBITDA

EBITDA in 2021 increased 78% to 12,311 million (US$599.4 million) from 6,918 million last year. The increase in EBITDA of 5,394 million is mainly related to the significant recovery in the consumption trend throughout the year. All geographies where Alsea has a presence reported positive EBITDA at the end of 2021.

For all 2021, EBITDA was 97.6% of 2019’s level.

During the year, we reported a cost improvement of 110 basis points resulting from a decrease in waste, higher productivity in the supply chain, and a positive business mix effect from the increase in the share of casual food and family restaurant brands as a result of the increase in foot traffic and mobility. Additionally, we continued to reduce non-essential operating and corporate expenses, achieving a 400 basis point reduction in operating expenses, compared to 2020, mainly because of the agreements reached in rents, government support, and higher labor productivity in all brands.

The above was offset by impacts related to store closures and brand impairment, among others, for approximately 200 million pesos in the full year 2021.

In addition, other expenses and income were impacted because of the 2021 profit sharing allocation of approximately 40 basis points, as well as an impact of approximately 248 million related to unit closures, severance payments, and the cost of social security related to the ERTE government support program in Europe.

EBITDA margin increased 5.1 percentage points from 18.0% in 2020 to 23.1% in 2021.

Net Income

Net income increased 4,680 million compared to the same period of the previous year, closing at 784 million pesos, compared to a loss of -3,985 million pesos reported at the end of 2020. This increase is mainly due to a 5,650 million increase in operating income as a result of the recovery in sales following the easing of pandemic-related restrictive measures.

Additionally, the increase in net income was driven by a 439 million peso reduction in the comprehensive financing result as a result of a 577 million peso positive variation from a favorable foreign exchange result related to the call and put options of Ps. 21.0% of Grupo Zena during the first nine months of the year, coupled with a 122 million pesos foreign exchange gain, which was partially offset by a 260 million increase in net interest paid, as well as a 1,414 million increase related to income taxes.