Share your coffee stories with us by writing to info@comunicaffe.com.

TREVISO – Approved by the Board of Directors of De’ Longhi S.p.A. the consolidated results for the nine months of 2025. In the nine months the Group achieved:

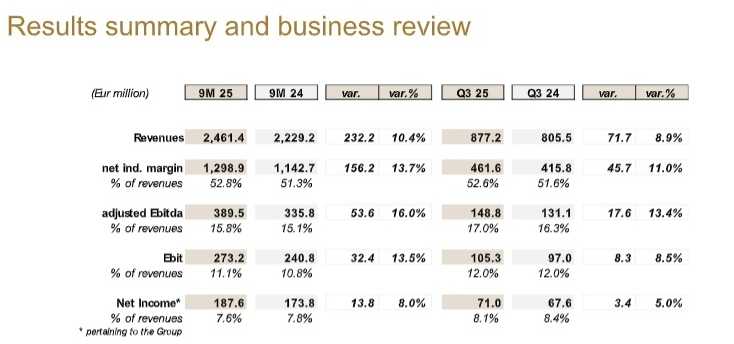

• revenues for € 2,461.4 million, up by 10.4% with respect to 2024 (11.7% at constant currency);

• an adjusted Ebitda of € 389.5 million, equal to 15.8% on revenues (vs. 15.1% last year);

• a net income pertaining to the Group equal to € 187.6 million (+8.0% with respect to last year);

• a positive net financial position equal to € 308.7 million.

In the third quarter the Group achieved:

• revenues for € 877.2 million, up by 8.9% with respect to 2024 (11.5% at constant currency);

• an adjusted Ebitda of € 148.8 million, or 17.0% on revenues (vs. 16.3% last year)

• a net income pertaining to the Group amounting to € 71.0 million (+5.0% vs 2024)

The Group CEO Fabio de’ Longhi commented:

“The Group closed another quarter with excellent results, outperforming the market even in a challenging environment.

The household division reaffirms the strength of its recent growth momentum, supported in particular by the structural trend in coffee. The effectiveness of our ongoing communications investments has amplified this momentum, as evidenced by the success of the new global campaign starring Brad Pitt, directed by Oscar-winning director Taika Waititi. These investments reaffirm our leadership in the coffee market and mark a further evolution of our marketing strategy, which also includes the opening of a social media hub in London where we will concentrate our resources for brand communication.

At the same time, the professional division is accelerating, thanks to the contribution of both brands, in a context of ongoing premiumization of the espresso market, where La Marzocco and Eversys are consolidating their leadership. The outstanding response of the public to events such as ‘Out of the Box’ in Milan or the premiere of the documentary film ‘The rise of Espresso’ in New York is further demonstration of our ability to be a reference point for the global community of professionals and enthusiasts in the world of coffee.

Based on the solid results achieved, and while continuing to closely monitor persistent geopolitical uncertainties, we are raising our guidance for the year. We now expect revenue growth for the new perimeter between 7.5% and 8.5%, thanks to the positive contribution of both divisions, with an adjusted EBITDA between 610 and 620 million.”

General outlook

The first nine months of 2025 closed with revenue growth at constant currency of around 12%, once again confirming the Group’s ability to capture the growth trends of its reference markets. These results were driven by the continuation of positive momentum in the household division, expanding organically at a mid-to-high single-digit rate, and strengthened by the sustained growth of the professional division, which recorded an increase of around 30% on a pro-forma basis.

The positive trends observed in the first half of the year were confirmed in the third quarter across both divisions.

The Group’s growth continues to be driven in particular by the coffee segment (now accounting for 65% of revenue), which benefits from both the structural expansion of the espresso market and the consumer push towards premiumization. The Group’s ongoing investments in media and communication have further amplified and supported these trends. Among these, we highlight the launch of the third global campaign with ambassador Brad Pitt and our brands’ participation in high-profile international events, such as the Venice Film Festival or the F1 film premiere in New York.

The expansion of revenues in both divisions, together with the improvement of the product mix, supported an increase in the Group’s adjusted EBITDA margin of approximately 70 basis points over the nine months.

This was achieved despite the partial increase in media and communication (A&P) investments and the tariff impact in the US market.

The strong results achieved in the first nine months of the year and the positive outlook for the current quarter consolidate and strengthen the Group’s expectations for achieving its annual targets in terms of growth, margins, and cash generation.

Revenues

In the first nine months of 2025, the Group revenues reached €2,461.4 million, an increase of 10.4% compared to 2024, including a negative currency impact of approximately 1.3 percentage points, without which revenue expansion would have stood at 11.7%.

In the third quarter, growth was 8.9%, penalized by a significant negative currency impact of approximately 2.6 percentage points. Net of this impact, growth would have been 11.5%.

It should be noted that La Marzocco contributed € 70.4 million to the Group’s turnover in the first three months of 2025, while in the Q1 – 2024 the contribution, relating only to the month of March, amounted to € 21.0 million.

Revenues by Geography

Over the nine months, growth occurred across all major geographical areas, with favorable dynamics persisting into the third quarter of the year. In particular, we highlight the sound performance of the Asia-Pacific region, which recorded revenue expansion at a high-teens rate at constant currency over the nine months.

This is complemented by the solid performance of the European region, growing at a robust high-single-digit rate in both periods analyzed. We note a positive trend in both the quarter and the nine months in the Americas region, thanks to the steady expansion of the coffee market.

In detail, in the third quarter:

• Europe confirmed its positive growth momentum also in the third quarter, recording growth of 9.3% (9.2% on a constant currency basis). This was thanks to the contribution of both divisions, with home and professional coffee driving the expansion. Several countries in the region posted double-digit growth rates, among these, we mention Spain and Portugal, the Czech Republic and Slovakia area, Hungary, and the Nordic countries area, which achieved a mid-teens growth rate;

• MEIA recorded a sound growth rate of 24.8% at constant currency, with a significant negative currency effect which had an impact of approx. 7.2 percentage points on growth. This performance was supported by both divisions, with professional coffee achieving sound results and home-coffee and homecare categories driving the growth for the household business;

• The Americas area recorded an expansion of turnover of 8.2% at constant currency, with a significantly negative currency effect due to the weakness of the dollar. This growth was supported by the excellent performance of both professional and home coffee;

• Finally, the Asia-Pacific region achieved another quarter of solid organic growth at 20.2% compared to the third quarter of 2024, before a strong negative currency impact. Both divisions sustained this excellent result, with the Chinese market leading the pack.

Revenues by product category

The excellent performance in the first nine months of 2025 was achieved thanks to the contribution of both divisions, which also delivered in the third quarter performance aligned with the first part of the year.

The household division posted revenue of €2,121.0 million in the nine months (+7.3% at constant currency vs. 2024) and €757.0 million in the quarter (+7.6% at constant currency vs. 2024). Meanwhile, professional coffee recorded revenues of €343.5 million (+48.7%) in the nine months, corresponding to a pro-forma growth of 29.2%, and €121.3 million in the quarter (+40.8%).

In the third quarter:

Concerning the household division, we highlight the following:

• The home coffee segment confirmed its role as the main driver of the household division growth, posting a high-single-digit increase in the quarter, mostly thanks to the contribution of manual machines and Nespresso capsule systems;

• The nutrition & food preparation segment was down by a mid-to-high single-digit rate in the third quarter. Such contraction is primarily due to a relevant negative currency effect and a challenging comparison for personal blenders versus 2024, when they had seen double-digit growth compared to the previous year;

• Concerning the other categories, they achieved a mid-teens growth rate in the quarter. Specifically, Braun’s ironing segment again achieved mid-teens growth. Meanwhile, the accessories category, mostly connected to the home-coffee machines business, recorded a significant growth compared to last year.

The professional division closed another excellent quarter, with revenue expanding by over 40%. This solid pace of growth is the result of the continued premiumization of coffee quality and the coffee experience in the out-of-home sector, where our brands are leaders. It is also driven by the unique partnerships and brand awareness that La Marzocco and Eversys have been able to create in the coffee world over the years.

Operating margins

In the first nine months of 2025, the Group significantly improved its margins, benefiting from an increase in volumes in both divisions, as well as an improvement in the product mix in the household division. This increase was achieved despite the rise in media & communication investments, greater pressure on logistics costs, and the partial impact of US tariffs. It should be noted that the currency impact was almost neutral on margins.

In the third quarter:

• the net industrial margin stood at € 461.6 million, equal to 52.6% of revenues, compared to 51.6% in 2024;

• the adjusted Ebitda was equal to € 148.8 million, 17.0% of revenues, improving by 70bps compared to last year. This improvement was primarily driven by the growth of the professional division, with margins above the Group’s average;

• the Ebitda amounted to €137.3 million, or 15.7% of revenues after €11.5 million of costs linked to existing share-based incentive plans. It should be noted that the significant increase in share-based incentive plans costs is due to the outstanding performance of the professional business during the year;

• the operating result (Ebit) stood at € 105.3 million, corresponding to 12.0% of revenues aligned with the third quarter of 2024;

• finally, the net income pertaining to the Group was equal to € 71.0 million, 8.1% of revenues, growing by 5.0% compared to 2024. The financial expenses stood at € 5.2 million in the quarter (vs. € 3.7 million in 2024).

In September 2025, the Group’s Net Financial Position was positive at € 308.7 million, an improvement compared to € 266.1 million in September 2024, while the Net Financial Position toward banks and other lenders stood at € 435.7 million (compared to € 378.8 million in September 2024).

With regard to cash generation, the cash flow before dividends, buybacks and acquisitions (“Free Cash Flow before dividends, buybacks and acquisitions”) was positive for € 298.3 million in the 12 months.

In the nine months, cash flow before dividends, buybacks, and acquisitions was negative at € 82.2 million, due to the effect of an advance on the purchases of goods, with consequent flow of payments to suppliers, and in particular due to the cash absorption linked to the increase in inventory (which had an impact of €288.1 million).

This increase is due to the ordinary seasonality of the business, as well as the extraordinary pile-up of inventories in the United States in the first part of the year in order to mitigate the impact of duties. The inventory level is expected to normalize during the fourth quarter, as per usual seasonality.

Operating working capital amounted to €356.4 million, equal to 9.6% of revenues, an increase of approximately €103.5 million compared to 2024 (which was equal to 7.6% of revenues).

Investment spending amounted to €71.1 million, down €13.5 million compared to the nine months of 2024.