Share your coffee stories with us by writing to info@comunicaffe.com.

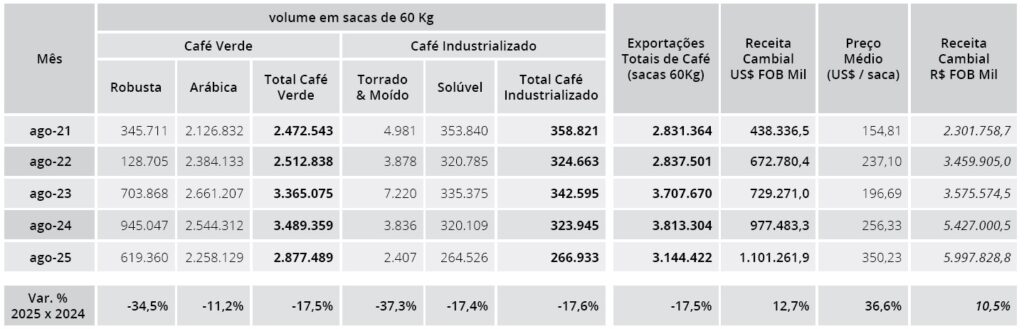

MILAN – Brazilian coffee exports down for the ninth consecutive month: according to statistics released yesterday (Tuesday 9 September 2025) by Cecafé, Brazil exported 3,144,422 bags of all forms of coffee in August, or a 17.5% decrease compared to the same month last year.

Similarly, the shipments of green coffee fell by 17.5% to 2,877,489 bags, of which 2,258,129 (-11.2%) were Arabica and 619,360 (-34.5%) were Robusta.

Sales abroad of processed coffee also slowed (-17.6%), amounting to 266,933 bags, mostly soluble coffee.

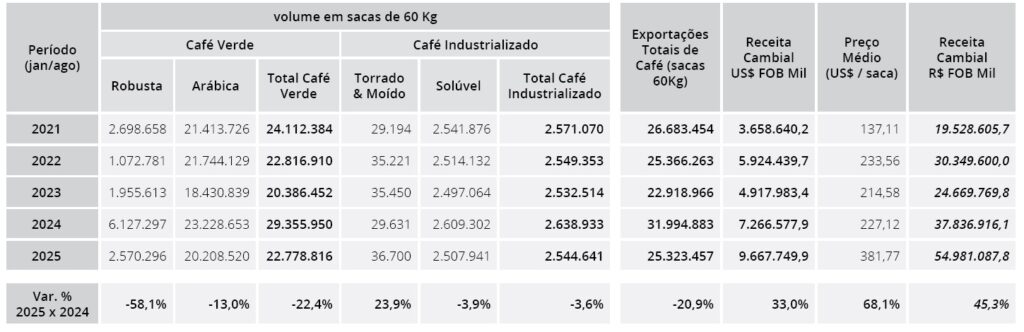

Exports for the first eight months of the calendar year were also down 20.9% to 25,323,457 bags.

Green coffee exports fell by 22.4% to 22,778,816 bags. Arabica shipments were down by 3 million bags (-13%) compared to the equivalent period in 2024, totalling 20,208,520 bags.

Robusta exports amounted to just 2,570,296 bags (-58.1%), compared to over 6.1 million last year. The decline was less pronounced (-3.6%) for processed coffee, with exports amounting to 2,544,641 bags.

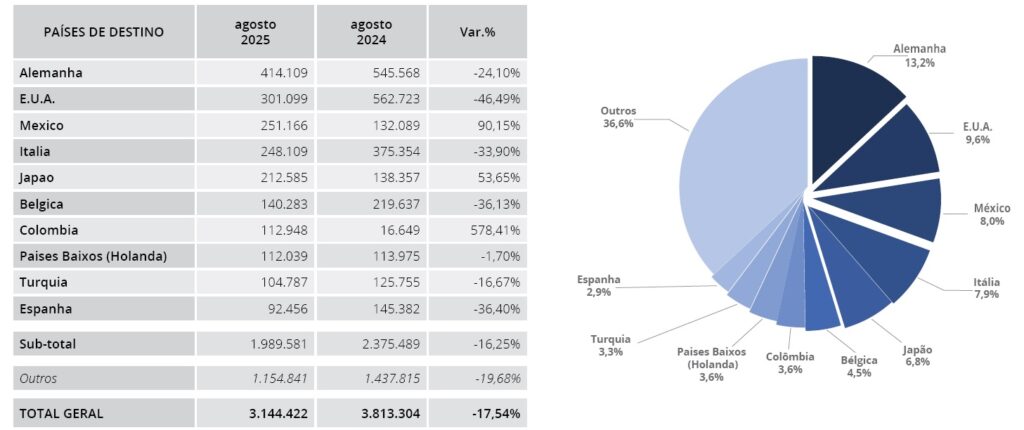

Looking at the monthly breakdown by country of destination, we see a situation that is anomalous to say the least: exports are down to all main destinations, with the sole exception of Mexico, Japan, and Colombia, to which shipments are growing strongly.

In the first eight months of the year, exports to the top two markets for Brazilian coffee – the US and Germany – fell by 20.76% and 32.9% respectively.

A total of 1,981,268 bags were exported to Italy, which is 23.62% less than a year ago. Shipments to Belgium also plummeted, falling by 48.27%. Japan was the only country that bucked this trend, with exports increasing by 15.57%.

The main ports of destination were Hamburg and Antwerp, followed by Genoa, Bremen, and Rotterdam.

According to Márcio Ferreira, president of Cecafé, Trump’s tariffs are already beginning to affect Brazil’s exports.

“The US ceased to be the largest buyer of our coffee in August, falling to second place with 301,000 bags imported—from deals made before the tariff came into effect—which meant a 46% drop compared to the same month in 2024 and a 26% drop compared to July this year. Thus, the Americans fell behind Germany, which imported 414,000 bags last month,” Ferreira said in a statement adding that “the tariffs disrupted the market and opened the door to speculative movements.”

Ferreira told journalists earlier on Tuesday that there was little possibility of re-exporting coffee beans to the United States via third countries.

Though some finished coffee products are exported from other countries to the United States, sending raw beans via third countries would be “very easy for the American government to spot,” Ferreira said.

Tariffs imposed by the United States on Brazilian goods have hit the country’s instant coffee industry hard, Aguinaldo Lima, executive director at ABICS, an organization representing Brazil’s instant coffee producers, was quoted as saying during the press conference.

According to numbers from ABICS, Brazil’s instant coffee exports to the United States in August fell 59.9% to 24,460 60-kilogram bags, versus the 65,914 bags exported in the same month last year.

“This is detrimental not only to our industries, but also to our trading partners in the United States,” Lima said, according to Reuters.

Coffee futures fell yesterday after sharp gains on Monday. The decline in both markets was driven by a stronger dollar.

In New York, the ICE Arabica contract for December delivery fell 0.8% to close at 381.80 cents, after reaching an intraday high of 393 cents. In London, the contract for November delivery of the ICE Robusta lost 1.3% to end the day at $4,371.