Share your coffee stories with us by writing to info@comunicaffe.com.

MILAN – The Board of directors of IVS Group S.A. (Milan: IVS.MI), convened on March 4th, 2022 and chaired by Mr. Paolo Covre, examined and approved the annual report 2021 (statutory and consolidated), the management report and related documents and the Sustainability Report.

The Board of Directors

The Board resolved to propose to the AGM a total dividend of euro 10 million. The dividend per share will be defined (by the AGM or by the Board of director) according to the number of shares circulating at the completion of the capital increase previously announced and related to the Business Combination with Liomatic and GeSA.

The Chairman has been mandated by the Board to convene, in accordance with law and the Company’s statute, on June 28th, 2022 (postponed from May 10th, 2022 previously communicated), at 11.00 at IVS Group registered office, 18 Rue de l’Eau L – 1449, L- Luxembourg, Grand Duchy of Luxembourg, to vote on the approval of the annual report 2021 and related matters, the allocation of the Company’s result and directors’ indemnification. The Board also discussed and approved the reports on corporate governance, remuneration, risks control, and mandated the Co-CEOs to submit to the relevant authorities the prospectus for the capital increase connected with the acquisitions of Liomatic and Ge.S.A. and all the related documents, including the admission to listing of the new shares issued in connection with the capital increase.

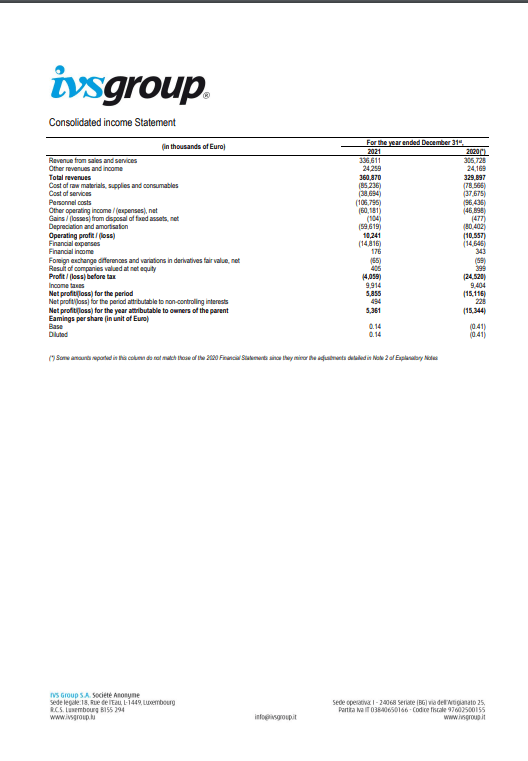

Summery of results at 31 December 2021

Consolidated revenues: Euro 360.9 million (+9.4% compared to 2020)

Adjusted EBITDA: Euro 72.7 million (+17.5% from 2020)

(“Adjusted EBITDA’’: is equal to operating income, increased by depreciation, amortisation, write-downs, non-recurring costs and exceptional in nature)

Reported net profit equal to Euro 5.9 million. Adjusted Net Profit: Euro 8.3 million (before profits attributable to minorities).

Net financial Debt reduced by Euro 52.3 million and equal to Euro 301.4 million (including Euro 48.2 million of IFRS16 operating leases effects)

Completed 7 new acquisitions in Italy with an Enterprise Value of around Euro 5.3 million.

Operating perfomances

Consolidated revenues in 2021 reached euro 360.9 million (of which 313.5 million related to the core vending business), with an increase of 9.4% from 329.9 million in 2020 (of which euro 284.8 million in vending).

The increase of total sales is very significant considering that in 2021 the business was still strongly affected by the effects of Covid pandemic. In the first quarter and until the beginning of the second quarter 2021, the effects of lock downs were very hard.

The business was good during the central part of the year, but with growing infections in November and December, the last weeks of 2021 saw again a slowdown of consumptions. The recovery, although with different timing and size, was seen all major areas: sales increased by 7.2% in Italy, 46.6% in France, 2.0% in Spain and decreased by 2.6% in Switzerland.

The noticeable French performance is mostly related to the new Paris Metro contract, although, with Covid, travellers are still much lower than expected, as it generally happens in the travel and public transport sector. Coin GCU sales increased by 13.6%, and in more detail: CoinService sales (metallic coins business) increased by 9.2%; Venpay sales (digital money, telemetry and App payments systems) increased by 29%, but the spending by clients in the vending sector in new Digital Payments Systems was still quite weak, and Moneynet S.p.A. sales (payment services) increased by 16.8%.

The public sector

In the core vending business the total number of vends in 2021 was equal to around 652.5 million, +7.4% from 607.3 million of 2020. As in former years, IVS has always an acquisition rate of new clients higher than the churn rate. Volumes recovery was higher in the corporate sector, especially in manufacturing segments, that returned to levels close to 2019 pre Covid. The public sector (schools, universities, hospitals, public offices) and the travel sector (railways stations, airports, underground) still have a large gap to recover.

The weighted average price per vend was equal to euro 48.04 cents, from euro 46.90 cents of 2020 (+2.4%). During 2021, where applied, prices increase were higher than the weighted average mentioned above. The total effect, however, was influenced by the different mix of products and, even more, by the different sales channels where consumption take place.

In public locations, where prices are usually much higher, the strong reduction of volumes affects the weighted average price; in the corporate sector volumes recovery was higher, but the starting level of prices is usually lower, and therefore an increase of unit prices there can just compensate the effect of lower volumes in public locations.

The current policy of price increase, that will continue in the next quarters on the whole clients base, and the gradual recovery of volumes in public and travel locations, the most affected by the pandemic, will have growing effects on sales and contribution margins. In 2021 were completed 7 acquisitions in Italy, with an Enterprise value of euro 5.3 million, contributing Euro 1.8 million to sales on pro-rata basis from the date of the acquisition.

EBITDA

EBITDA reported in 2021 was equal to euro 69.9 million just higher than euro 69.8 million of 2020 (that however included euro 8.0 million extraordinary income for the partial reimbursement of the Antitrust fine paid in previous years). Adjusted EBITDA2 was equal to euro 72.7 million, from euro 61.9 of 2020 (+17.5%) with an EBITDA margin on sales of 20.2% (22.4% on sales net of positioning fees and redevances). The difference between Reported EBITDA and Adjusted EBITDA is mainly due to non recurring income / costs related to acquisitions.

Considering the period, still heavily influenced by the pandemic effects, operating profitability (EBITDA margin) stood at excellent levels, higher than 20% on sales. This performance was achieved by paying strict attention to all cost categories and with timely actions of restructuring in the logistic of the branches, necessary to face the volatile trend of volumes due to the pandemic effects.

In the second part of 2021 was finished the use the various public subsidies for temporary unemployment that were put in place for the Covid emergency. The overall number of the groups’ employees at the end of 2021 was equal to 2,688 from 2,873 at the end of 2020; the decrease by 185 units (around -6.4%), is due to the expiry of term contracts, standard personnel rotation and partly to voluntary incentivized exits.

Group Reported Net Profit in 2021 is equal to euro 5.9 million (from a loss of euro 15.1 million of 2020), and the Adjusted Net Profit is equal to euro 8.3 million (from a loss of Euro 6.3 million in 2020), before profit to minorities of euro 0.7 million. Net Profit is influenced by the higher operating profit, by the extraordinary cost/income mentioned above and by lower depreciation (decreased by euro 2.0 million in one year), due to the lower capex since the start of the Covid period, a decrease that is expected to continue in the next quarters.

Financial costs include some extraordinary costs related to the early reimbursement and refinancing, with new maturity at December 2025, of the credit facility arranged by BNP Paribas and to interest rates risks coverage. Finally, are included in the P&L euro 9.9 million positive income taxes (tax credits) that, with those matured in 2020 (euro 9.4 million), will significantly reduce the cash-out for future taxes.

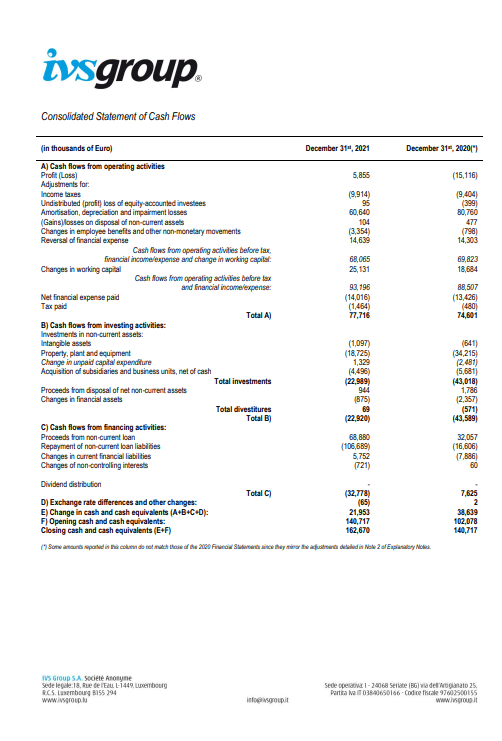

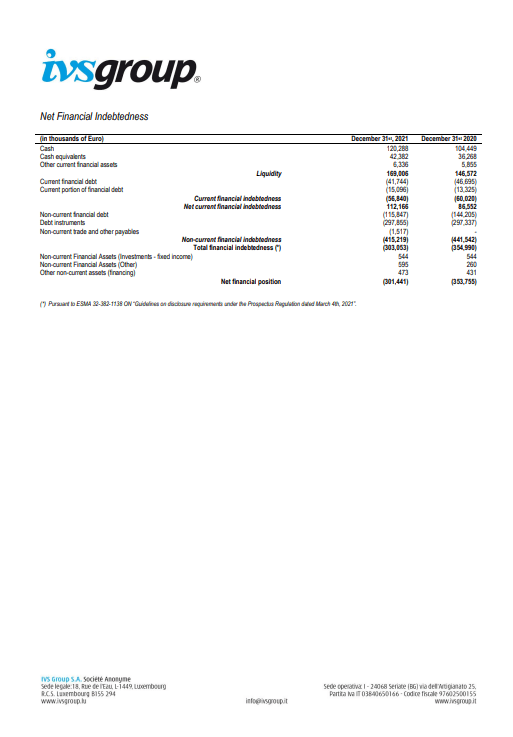

Net Financial Position

Net Financial Position (“NFP”), at 31 December 2021 is equal to euro 301.4 million (including euro 48.2 million of debt related to IFRS16 rules on operating leases), compared to euro -353.8 million at the end of 2020, euro 386.0 million at the end of 2019 (and euro -394.5 million at 31 March 2020, at the start of Covid pandemic).

The decrease of net financial was continuous and remarkable, equal to euro 52.3 million in 2021 and around euro 93 million since the start of the pandemic. Financial debt excluding effects related to the application of the new IFRS 16 rules, would be around euro 253.2 million, lower than the amount of IVS Group euro 300 million bond, 3% fixed rate, expiring on October 2026.

In a long lasting and very difficult scenario, IVS Group was able to generate a high free cash-flow, even continuing to invest a significant amount of money, although lower than in the past years. In 2021 the total cash payments for investments were equal to euro 23.0 million, of which euro 18.5 million for net industrial capex (including those for the new acquisitions and related to previous years) and euro 4.5 million for M&A transactions.

The sizeable investments made in previous years allowed to reduce the new capex, without negative impacts on commercial coverage and service quality. Infact, in the Covid period, technical and commercial workforce developed new skills enabling an effective business practice, with a level of capital expenditure lower than in the past years.

As of 31 December 2021, total liquidity was Euro 169.0 million, increased from euro 146.6 million at the end of 2020. The group has VAT credits in Italy of euro 5.2 million of VAT credit (euro 15.7 million at the end of 2020) not included in Net financial position and holds n. 1,833,736 treasury shares.

Other significant transactions and events occured after 31 December 2021

On October 22nd, 2021 IVS Group announced the signing with Cafim S.r.l., controlled by Caporali family, of a Business Combination with Liomatic Group, with headquarters close to Perugia (Umbria region) and a consolidated presence especially in the regions of Central Italy. Liomatic is active in Italy, Spain, Portugal, Germany and holds qualified minority stakes in other important Italian vending companies, amongst which 24.2% of Ge.S.A. S.p.A..

On December 23rd, 2021 IVS Group signed with a pool of banks, led by BNP PARIBAS, the refinancing of the bank facility signed on December 2018 (for an original amount of euro 150 million, already reduced to Euro 90 million in the first half of 2021 as only partially drawn), to the total present amount of euro 70 million and new maturity December 2025.

On January 5th, 2022 it was announced the signing with the shareholders of Ge.S.A. S.p.A. (GeSA) of the contract aimed at the acquisition of a shareholding of 75.8% capital (calculated net of own shares) of GeSA, with headquarters in Milan, 8 branches and some warehouses effectively covering the territory, GeSA operates in Northers Italy (Lombardia, Piemonte, Veneto, Emilia- Romagna, Valle d’Aosta).

The Italian leaders in the vending sector

Liomatic and Ge.S.A. are amongst the Italian leaders in the vending sector. Both have over 50 years experience, strong identity and excellent skills in the vending business. The total EV of the two transactions is in the range of euro 260 million (including real estate properties).

The total equity price (subject to the final outcome of the due diligence and net debt at closing) for around 81% of Liomatic and 100% of Ge.S.A. and other non consolidated minority interests in other companies, is equal euro 185 million, that will be financed through the issue of new IVS Group shares.

IVS Partecipazioni S.p.A., the controlling shareholder of IVS Group with 62.25% (net of own shares), has already declared that it will underwrite, at least pro-quota, the rights issue (offered in option to the market), that is expected to take place in April-May 2022. Equita S.I.M. has been appointed Financial Advisor to IVS Group and Placement Agent for the capital increase.

From the Business Combination of IVS Group, Liomatic and Ge.S.A., will emerge a market leader, with more than 900 million pro- forma vends in 2021 and around 1.2 billion in 2019 pre Covid, with around 300,000 vending machines installed and 4,000 employees. Consolidated sales (pro-forma, Italy and international business) resulting from the Business Combination were approximately euro 660 million in 2019, with an EBITDA margin of around 20%; in 2020 total combined sales, strongly affected by the pandemic, were around euro 500 million, with an EBITDA margin of 16%; and in 2021 total sales were around euro 550 million, with and EBITDA margin of 17%.

The future of vending

The new group will take advantage from the best practices of the vending sector, thanks to the knowledge and skills that the three partners built along their long and successful histories. The integration will further improve commercial and logistic coverage and efficiency at national level, providing clients with increasingly better and higher value services.

The group size will support innovations in products and processes, maximising the benefits from investments, including those aimed at developing the direct digital engagement of millions of final consumers. All this will increase the potential of strategic partnership with worldwide players in the food & beverage industry, particularly with the leaders in the espresso coffee market, a typical Italian excellence, recognized at international level.

The similar origins and the principles shared by the founders and management of the group companies, such as the orientation to growth and excellence in a context of economic and financial sustainability, the enhancement of human resources and attention to local communities, are and will remain the reference values of the group.

The tough crisis due to Covid pandemic triggered deep changes in the European vending sector, in terms of accelleration of the concentration process and new ways of managing the business. The most solid and skilled players in the industry are turning these changes into opportunities. In this context, IVS Group was able to seize some extraordinary growth opportunities that probably would have not been available before Covid.

Strategic partnerships

On 2021, Paolo Covre, IVS Group chairman, commented: “IVS Group has been able to react to the crisis due to the pandemic, acting effectively on the internal organization and costs, but always keeping the utmost attention to the quality of the service and to commercial relations. The resilience of our results and our consequent credibility were essential in making possible strategic mergers with important companies such as Liomatic and Ge.S.A., involving their shareholders in a new growth phase.”

Paolo Covre continues:”The larger market share of the group will increase efficiency and service quality, and will make us, even more, the point of reference in the vending sector and a key partner for the coffee industry. The great flexibility and ability to generate cash shown even in adverse market conditions, is the best base for the future strategy, combining growth and shareholders remuneration. The dividend that the Board of Directors will propose to the shareholders’ general meeting, although still limited by a situation where Italian and international uncertainties are not yet over, is a sign of trust and gradual return to normality”.

About IVS Group

IVS Group S.A. is the Italian leader and the second player in Europe in the business of automatic and semi-automatic vending machines for the supply of hot and cold drinks and snacks (vending). The business is mainly carried out in Italy (82% of sales), France, Spain and Switzerland, with around 230,000 vending machines, a network of 87 branches and around 2,700 employees. IVS Group served more than 15,000 corporate clients and public entities, with more than 650 million vends in 2021.