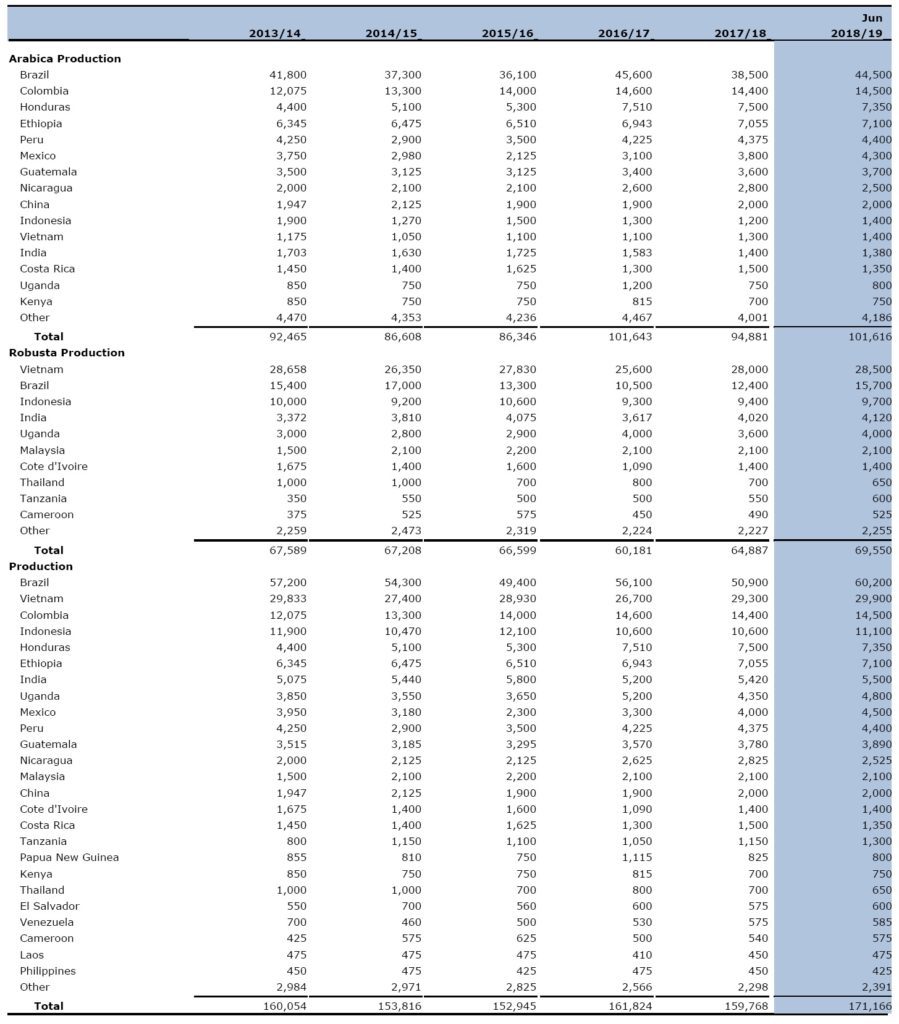

According to USDA’s “Coffee: World Markets and Trade” report, world coffee production for 2018/19 is forecast 11.4 million bags higher than the previous year at a record 171.2 million primarily due to Brazil’s record output.

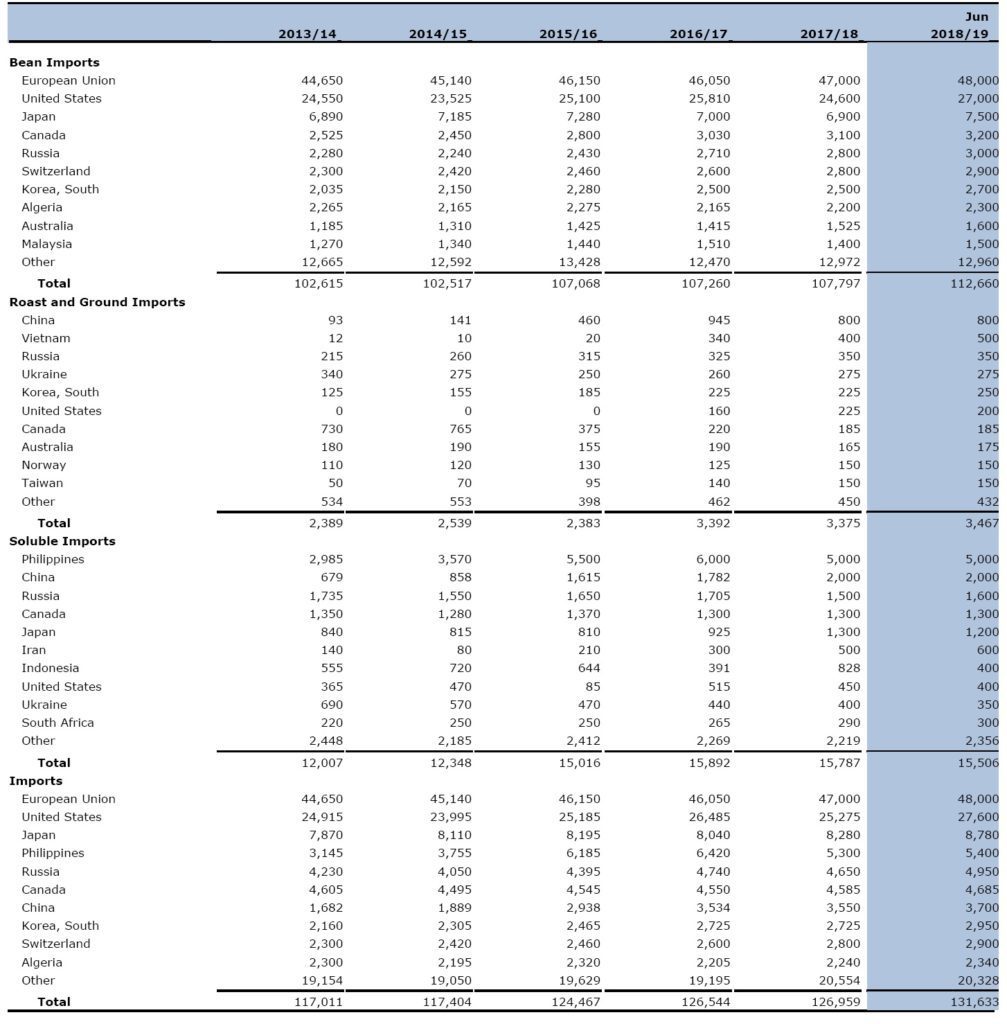

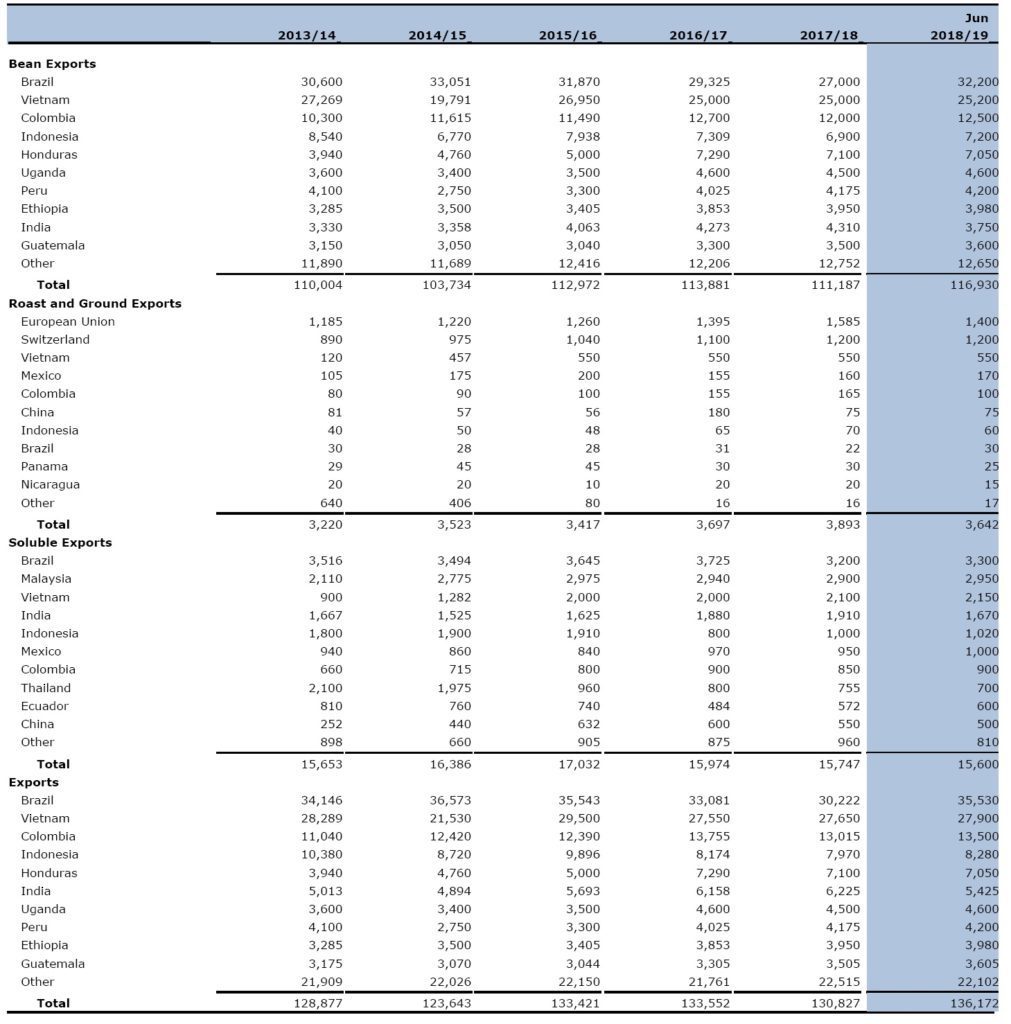

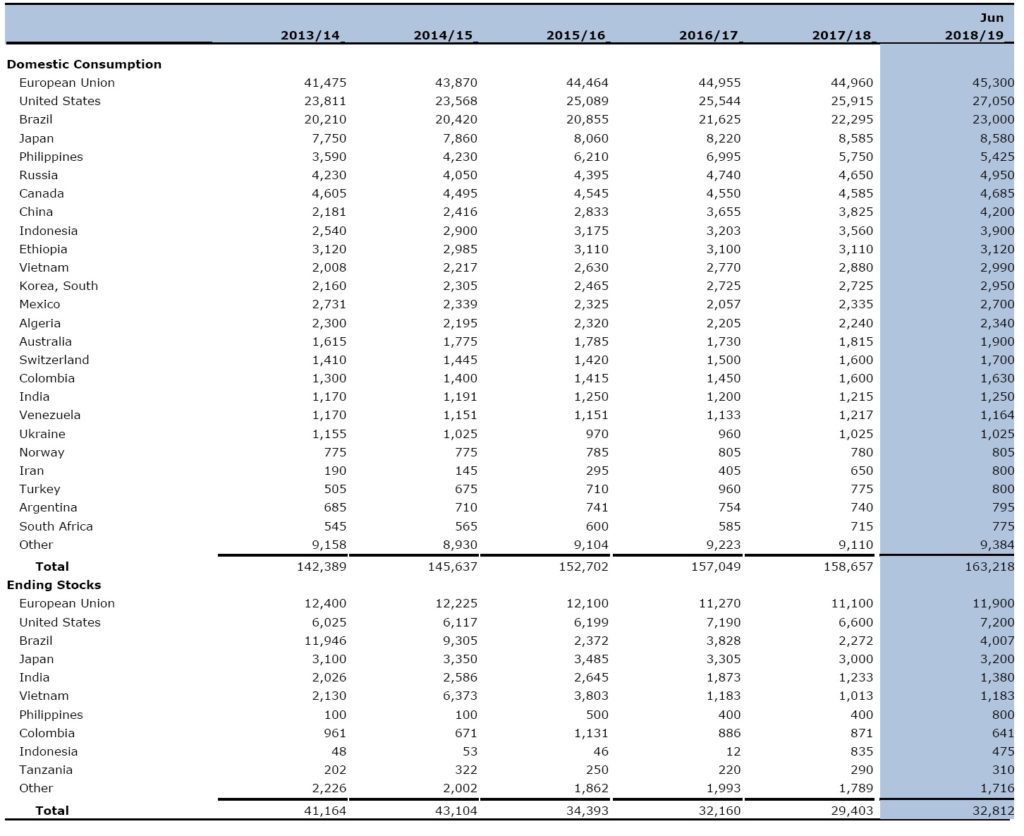

With global consumption forecast at a record 163.2 million bags, exports are expected up in response to strong demand.

Ending stocks are forecast to rebound following 3 years of decline. Brazil’s Arabica output is forecast to jump 6.0 million bags above the previous season to 44.5 million, with 80 percent of output coming from regions with trees in the on-year of the biennial production

cycle.

Also, trees in most regions benefited from favorable weather during the blossoming, cherry-setting, and fruit-forming stages. Although the Parana and south-eastern Minas Gerais regions are in the off-year of the biennial production cycle, the drop is expected to be less intense than average.

The bulk of the Arabica harvest starts between May and June. Robusta production is forecast to gain 3.3 million bags to 15.7 million.

Favorable temperatures and abundant rainfall are expected to boost yields in the three major producing states of Espirito Santo, Rondonia, and Bahia.

Also, expansion of clonal seedlings and improved crop management techniques are expected to aid this year’s gain.

The majority of the Robusta harvest started in April and May. The combined Arabica and Robusta harvest is forecast up 9.3 million bags to a record 60.2 million.

The additional supply of both Arabica and Robusta will fuel a sharp rebound in exports as well as continued growth in consumption, with the remainder boosting ending stocks. Vietnam’s production is forecast to add 600,000 bags to a record 29.9 million as cooler

Vietnam’s production is forecast to add 600,000 bags to a record 29.9 million as cooler

weather and off-season rains helped stimulate coffee trees just prior to flowering and cherry setting.

Last year’s large crop compensated for weak prices, allowing farmers to buy adequate inputs for this year’s crop and boost yields.

Cultivated area is forecast up slightly from last year, with nearly 95 percent of total output

remaining as Robusta. Exports, domestic consumption, and ending stocks are expected to rise as a result of higher available supplies.

Total output for Central America and Mexico is forecast unchanged at 20.3 million bags, though some countries in the region continue to struggle with the coffee rust outbreak that first lowered output 6 years ago.

Production has recovered in Guatemala, Honduras, Mexico, and Panama during this period

but remains depressed in Costa Rica, El Salvador, and Nicaragua due to the effects of coffee rust. Bean exports for the region are forecast down 200,000 bags to 16.7 million.

Over 45 percent of the region’s exports are destined for the European Union, followed by about one third to the United States.

Colombia’s production is forecast nearly flat at 14.5 million bags although output remains strong on favorable growing conditions. In the last decade, yields have increased about 30 percent due largely to a renovation program that replaced older, lower-yielding trees with rust-resistant varieties.

The program also reduced the average age of coffee trees from 15 to 7 years, further boosting yields. Bean exports, mostly to the United States and European Union, are forecast up 500,000 bags to 12.5 million, drawing ending stocks lower.

Indonesia’s production is forecast to gain 500,000 bags to 11.1 million. Robusta output is expected to reach 9.7 million bags on favorable growing conditions in the lowland areas of Southern Sumatra and Java, where approximately 75 percent is grown.  Arabica production is also seen rising slightly to 1.4 million bags. Higher yields in the dominant growing region of Northern Sumatra are expected to more than offset lower yields from certain areas that experienced heavy rainfall and strong winds during fruit

Arabica production is also seen rising slightly to 1.4 million bags. Higher yields in the dominant growing region of Northern Sumatra are expected to more than offset lower yields from certain areas that experienced heavy rainfall and strong winds during fruit

development.

Elevated output is expected to translate to exports gaining 300,000 bags to 7.2 million.

European Union imports are forecast up 1.0 million bags to 48.0 million and account for over 40 percent of the world’s coffee bean imports. Top suppliers include Brazil (29 percent), Vietnam (24 percent), Honduras (7 percent), and Colombia (7 percent). Ending stocks are expected to rebound 800,000 bags to 11.9 million.

The United States imports the second-largest amount of coffee beans and is forecast to jump 2.4 million bags to 27.0 million.

Top suppliers include Brazil (23 percent), Colombia (22 percent), Vietnam (15 percent), and Honduras (6 percent). Ending stocks are forecast to gain 600,000 bags to 7.2 million.

Revised 2017/18

World production is revised down from the December 2017 estimate by 100,000 bags to 159.8 million.

- Vietnam is reduced 600,000 bags to 29.3 million due to harvest losses related to late rains.

- Peru is up 575,000 bags to 4.4 million as rust damage was lower than anticipated.

World bean exports are raised 800,000 bags to 111.2 million.

- Ethiopia is up 600,000 bags to 4.0 million on greater exportable supplies.

- Peru is 575,000 bags higher to 4.2 million on larger available supplies.

World ending stocks are raised 100,000 bags to 29.4 million.

- European Union is up 600,000 bags to 11.1 million.

- Indonesia is raised from 42,000 bags to 835,000 due to higher imports and lower exports.

- India is reduced 900,000 bags to 1.2 million on lower output and higher exports.

- Brazil is down 300,000 bags to 2.3 million on lower production and higher consumption.