SAO PAULO, Brazil – In its Annual Report, the US Agricultural Trade Office in Sao Paulo (ATO) forecasts the Brazilian coffee production for Marketing Year (MY) 2021/22 (July-June) at 56.3 million 60-kg bags, a significant decrease of 19 percent compared to last year’s revised record output of 69.9 million bags. Adverse weather conditions in the Arabica coffee growing regions and trees mostly on the off-year of the biennial production cycle support the projected drop. Coffee exports for MY 2021/22 are projected at 35.22 million bags, a sharp drop of nearly 10 million bags from all-time record exports of 45.03 million bags in MY 2020/21, due to expected lower product availability.

Increased coffee consumption in the Brazilian households has offset the losses in “out of home” consumption with the temporary and intermittent closure of Brazilian coffee shops, hotels, bars and restaurants imposed by the COVID-19 pandemic.

ATO forecasts the Brazilian marketing year (MY) 2021/22 (July-June) coffee production at 56.3 million bags (60 kilograms per bag), green equivalent, a decrease of nineteen percent relative to the revised figure for the previous crop year (69.9 million 60 kg bags).

Arabica production is forecast at 35 million bags, a thirty percent reduction compared to the previous crop. The majority of producing areas are in the off-year of the biennial production cycle, resulting in lower production potential for the upcoming crop. Several growers have also pruned their coffee fields at above-average rates after the record crop in 2020, thus reducing the area to be harvested. In addition, adverse weather conditions have notably affected the production outcome for 2021.

The persistent drought and high temperatures in major coffee growing regions in the second semester of 2020 and in the beginning months of 2021 not only affected blossoming and fruit setting, but have affected fruit development/filling as well. The bulk of the Arabica coffee harvest should start in May/June and the quality of the crop could potentially be affected by the adverse weather conditions that have prevailed.

Robusta/Conilon production is expected to reach 21.3 million bags, an increase of 1.1 million bags compared to the current MY. Good rainfall volumes favored major producing states in addition to improved use of good crop management practices and clonal seedlings. Robusta/Conilon harvest started in April in major growing areas.

The Agricultural Trade Office (ATO)/Sao Paulo estimate for MY 2020/21 (July June) was revised upward to 69.9 million 60 kg bags, green equivalent an increase of three percent relative to the previous estimate (67.9 million bags), based on updated supply/demand information from the industry. Arabica production is estimated at 49.7 million bags, whereas the estimate for Robusta/Conilon production is 20.2 million bags. Post contacts report that producers have already marketed over 90 percent of the 2020/21.

Due to the COVID-19 pandemic and related social distance measures, Post did not conduct the regular annual field trips to major coffee producing areas to observe vegetative development, cherry set and fruit formation in order to evaluate the 2021 crop. Information was obtained from government sources, state secretariats of agriculture, producers associations, cooperatives, traders, consultants, and other major players in the coffee industry.

Production figures are forecast based on Post historical database, weather patterns observed in different coffee regions during the current vegetative/production cycle; comparison crop figures from several sources; and any other relevant material to support crop forecasting.

Production figures are forecast based on Post historical database, weather patterns observed in different coffee regions during the current vegetative/production cycle; comparison crop figures from several sources; and any other relevant material to support crop forecasting.

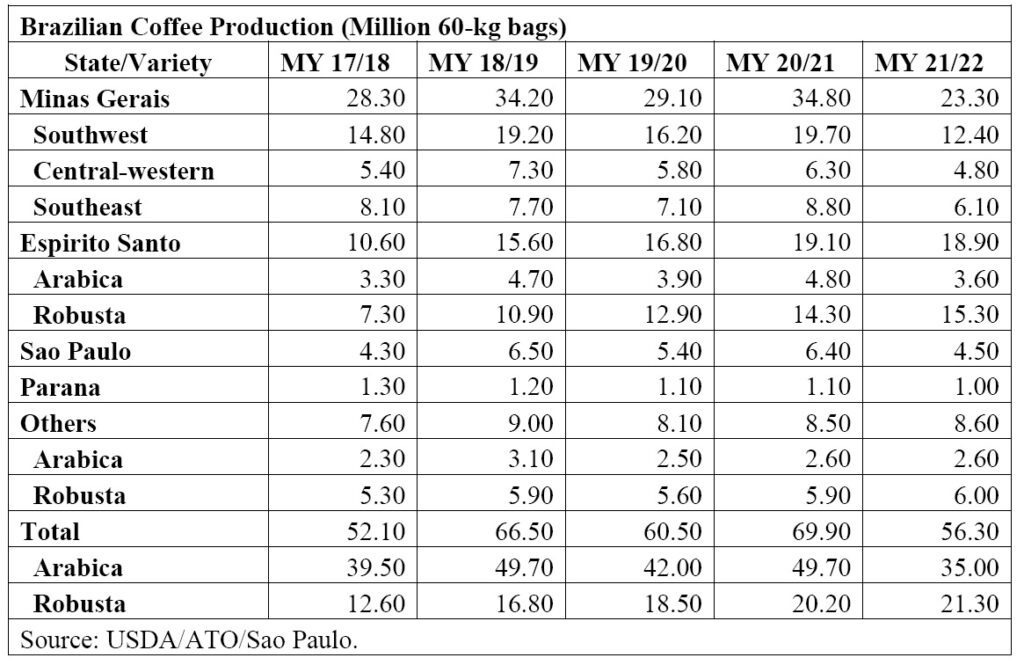

Post will later balance and validate the MY 2021/22 production figures when other supply/demand variables for the MY are available, e.g., exports, consumption, and ending stocks. The table below shows coffee forecast production by state and variety for MY 2021/22 as well as production estimates from MY 2017/18 to MY 202020/21.

In January 2021, the Brazilian Government (GOB), through the Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB), released its first survey projecting Brazilian coffee production in MY 2021/22. It forecasts between 43.85 and 49.59 million 60-kg bags, a 13.49 to 19.22 million-bag drop relative to MY 2020/21 (63.08 million bags – 48.77 and 14.31 million bags of Arabica and Robusta/Conilon coffee, respectively).

CONAB projects Arabica production between 29.72 and 32.99 million bags, whereas the Robusta/Conilon crop is estimated between 14.13 and 16.60 million bags. CONAB will release the second coffee survey for the 2021 crop on May 25.

The Brazilian Institute for Geography and Statistics (IBGE), GOB agency which also publishes Brazilian agricultural statistics, has released on May 12, the latest coffee crop survey (April 2021) forecasting the Brazilian coffee production for MY 2021/22 at 47.01 million 60-kg bags (31.81 and 15.20 million bags of Arabica and Robusta/Conilon coffee, respectively), a 24 percent decrease compared to the 2020 crop (62.08 million bags – 47.66 and 14.42 million bags of Arabica and Robusta/Conilon coffee, respectively).

Both government agencies, CONAB and IBGE, use a different methodology to forecast coffee production than Post and, both have been consistently lower than Post’s estimates. CONAB announced in later 2020 that it started to review production, supply, and demand statistics released by the Brazilian official agency for several commodities and production numbers for coffee should also be reviewed. The new methodology should include the review of data supplied by the different sources and a crop tour to evaluate coffee fields in loco.

CONAB is releasing its second survey on May 25th.

ATO/Sao Paulo forecasts the Brazilian coffee yield for MY 2021/22 at 28.01 bags/hectare, a reduction of 16 percent relative to MY 2020/21 (33.29 bags/hectare), predominantly due to the off-year of the biennial production cycle for Arabica trees and adverse weather patterns in Arabica growing areas. The expected steady Robusta/Conilon production in the majority of the coffee areas should offset to some extent the drop in the overall agricultural yield.

Brazil’s domestic coffee consumption for MY 2021/22 is forecast at 23.655 million coffee bags (22.705 million bags of roast/ground and 950,000 bags of soluble coffee, respectively), an increase of over one percent relative to the revised figure for MY 2020/21 (23.307 million bags – 22.36 million bags of roast/ground and 947,000 bags of soluble coffee, respectively.

Coffee consumption is correlated to some extent to the country’s economic activity. The current projection for the 2021 Brazilian Gross Domestic Product (GDP) is placed at 3.21 percent. In contrast, the GDP for 2020 is officially estimated by the Brazilian Institute of Geography and Statistics (IBGE) at – 4.1 percent due to the economic turmoil caused by the COVID-19 pandemic. ABIC reports that roast/ground coffee prices will likely increase during 2021 due to high costs to acquire green beans, in addition to the increase of energy and oil prices. The graph below shows the evolution of ground/roast coffee retail prices in Sao Paulo, the largest Brazilian city, as reported by Foundation PROCON.

According to the Brazilian Association of Coffee Industry (ABIC), the Brazilian demand for coffee is likely to take time to recover from the COVID-19 pandemic’s impact. The outlook is that consumption in Brazilian homes will remain at a high level. However, the recovery of coffee consumption outside the home, including coffee shops, hotels, bars, and restaurants should be slow.

Coffee already has a high penetration in Brazilian households, e.g., approximately 97 percent of the Brazilian households’ drink coffee regularly. Increased consumption in the Brazilian households has offset the losses in “out of home” consumption with the temporary closure of Brazilian coffee shops (roughly estimated at 10,000 units), hotels, bars and restaurants imposed by the Covid-19 pandemic.

The Brazilian Coffee Industry Association (ABIC) reports that the coffee industry processed 21.18 million bags, green equivalent, from November 2019 to October 2020, an increase of one percent compared to the same period the year before (20.90 million bags), despite the COVID-19 pandemic and the economic turmoil that affected the Brazilian economy in 2020. The table below shows domestic ground and soluble coffee consumption as reported by ABIC.

Coffee exports for MY 2020/21 are estimated at a new record volume of 45.03 million 60-kg bags, green beans, an increase of 4.77 million bags vis-a-vis MY 2019/20 (40.26 million bags) and up 3.6 million bags compared to the previous record volume exported during MY 2018/19 (41.43 million bags).

The outstanding 2020 coffee crop, in addition to the steady competitiveness of the Brazilian product due to the depreciation of the local currency, the Real, has supported strong exports. The estimate is based on year-to-date export volumes and anticipated May-June loadings. Green bean (Arabica and Robusta/Conilon) exports are estimated at 41 million bags, whereas soluble coffee exports are estimated at 4 million bags. Major green bean export destinations include Germany, the United States, Italy, Belgium, and Japan.

Industry sources report that the world has been experiencing challenging times and lower availability of containers for food products as a consequence of sanitary issues due to the COVID-19 pandemic and the high flow of containers notably to Asia, therefore decreasing the availability of containers for coffee exports. In addition, the significant devaluation of the Brazilian currency, the Real, vis-a-vis the U.S. dollar, has kept Brazilian overall exports highly competitive, thus encouraging massive exports. In contrast, imports have dropped sharply, causing the imbalance in containers that have led to delays.

Coffee is shipped in containers rather than in dry bulk vessels. Lack of space in vessels to hold products is also another constraint to larger export volumes. In spite of the aforementioned logistic hurdles, Brazilian exporters have been able to honor their commitments to the market.

ATO/Sao Paulo projects total ending stocks in MY 2021/22 at 1.51 million bags, down 2.5 million bags, relative to the previous year (4.01 million bags), due to expected tighter coffee supply during the season. As of April 2021, the Brazilian government does not hold any public coffee stocks. CONAB’s 2021 CONAB’s privately-owned stocks survey has not been released yet. The survey includes coffee stocks held by growers, coffee cooperatives, exporters, roasters, and the soluble industry as of March 31, 2021.