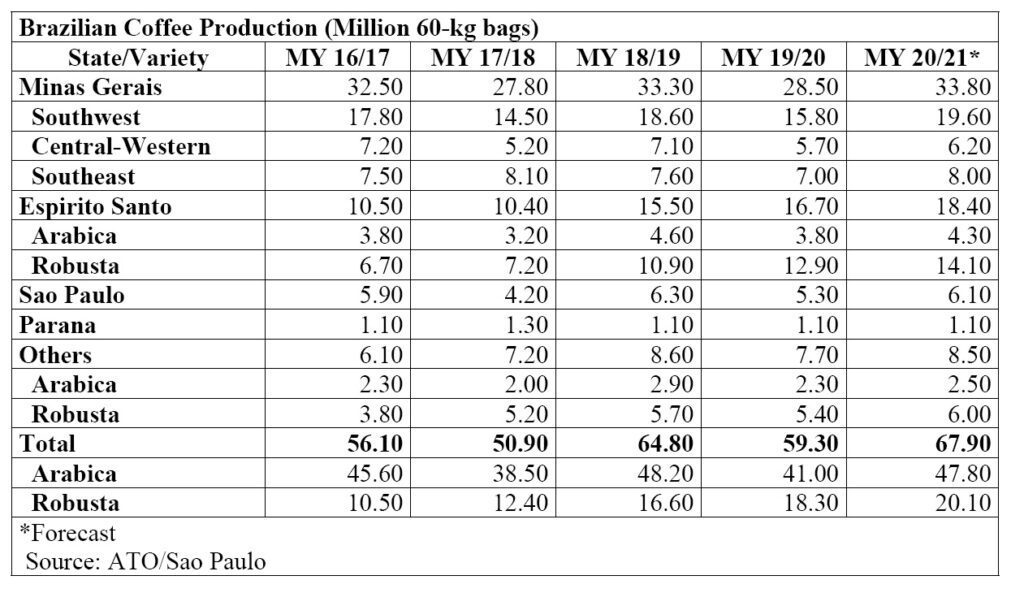

SAO PAULO, Brazil – The Agricultural Trade Office in Sao Paulo (ATO) projects coffee production for Brazil in marketing year (MY) 2020/21 (July-June) coffee production at a record of 67.9 million bags (60 kilograms per bag), green equivalent, a rise of 8.6 million bags compared to the previous crop year (59.3 million 60kg bags).

Arabica production is forecast at 47.8 million bags, up 17 percent vis-a-vis the previous crop season. Good weather conditions have generally prevailed in most parts of the Brazilian coffee regions, supporting fruit setting, development and filling, thus resulting in likely high yields. In addition, the majority of producing areas are in the on-year of the biennial production cycle.

The bulk of the Arabica coffee harvest should start in May/June and the quality of the crop is expected to be better than the previous year with larger bean size.

Robusta/Conilon production is expected to amount to 20.1 million bags, an increase of 1.8 million bags compared to MY 2019/20. Major producing states were favored by abundant rainfall volumes, improved use of good crop management practices, and clonal seedlings. Robusta/Conilon harvest started in March/April in major growing areas.

The Brazilian Agricultural Confederation (CNA), which represents agricultural producers in Brazil at the federal level, has warned the Brazilian government about the labor and transport obstacles from the COVID-19 pandemic given that coffee producers might face challenges to hire freight, harvest labor, and maintenance of farm equipment as cities and states restrict movement to prevent the virus from spreading. CNA says that social isolation and widespread lockdowns have already affected producers of perishables like fruit, vegetables, milk, and flowers.

Several coffee producing states have taken measures to guide farmers on how to prevent the spread of COVID-19. The state of Minas Gerais, which represents 50 percent of total Brazilian coffee production, issued a booklet providing instructions on how to reduce exposure to the virus during the harvest.

The state of Rondonia, second major Robusta/Conilon producer, has declared a state of public catastrophe through Decree # 24,887 of March 20, 2020. As a consequence, the State of Rondonia’s Secretariat of Agriculture has set a number of recommendations to guide coffee growers about how to proceed during the harvest, drying, transportation and trade of coffee beans.

Post conducted field trips to major coffee producing areas to evaluate the 2020 crop. Trips were made during the January-February 2020 period to the states of Espirito Santo, Minas Gerais, Parana, and Sao Paulo to observe vegetative development, cherry set and fruit formation. Information for other producing states was obtained from government sources, state secretariats of agriculture, producers associations, cooperatives, and traders.

The table below shows coffee forecast production by state and variety for MY 2020/21 as well as production estimates from MY 2016/17 to MY 2019/20.

In January 2020, the Brazilian Government (GOB), through the Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB), released its first survey projecting Brazilian coffee production in MY 2020/21. It forecasts between 57.15 and 62.01 million 60-kg bags, a 7.84 to 12.7 million-bag increase relative to MY 2019/20 (49.31 million bags – 34.30 and 15.01 million bags of Arabica and Robusta/Conilon coffee, respectively). CONAB projects Arabica production between 43.2 and 45.98 million bags, whereas the Robusta/Conilon crop is estimated between 13.95 and 16.04 million bags. CONAB has postponed the release of the second coffee survey for the 2020 crop until June 18 due to the restrictions imposed by the COVID-19 pandemic.

In January 2020, the Brazilian Government (GOB), through the Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB), released its first survey projecting Brazilian coffee production in MY 2020/21. It forecasts between 57.15 and 62.01 million 60-kg bags, a 7.84 to 12.7 million-bag increase relative to MY 2019/20 (49.31 million bags – 34.30 and 15.01 million bags of Arabica and Robusta/Conilon coffee, respectively). CONAB projects Arabica production between 43.2 and 45.98 million bags, whereas the Robusta/Conilon crop is estimated between 13.95 and 16.04 million bags. CONAB has postponed the release of the second coffee survey for the 2020 crop until June 18 due to the restrictions imposed by the COVID-19 pandemic.

Brazil: Coffee Area, Tree Inventory, and Yields

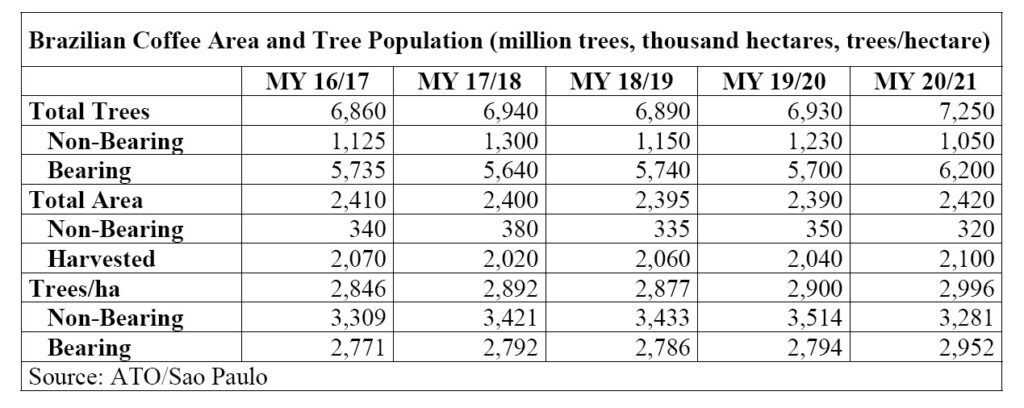

The table below shows the Brazilian coffee area and tree population from MY 2016/17 through MY 2020/21. Total area planted to coffee is projected stable at 2.42 million hectares, whereas coffee tree inventory slightly increased to 7.25 billion trees.

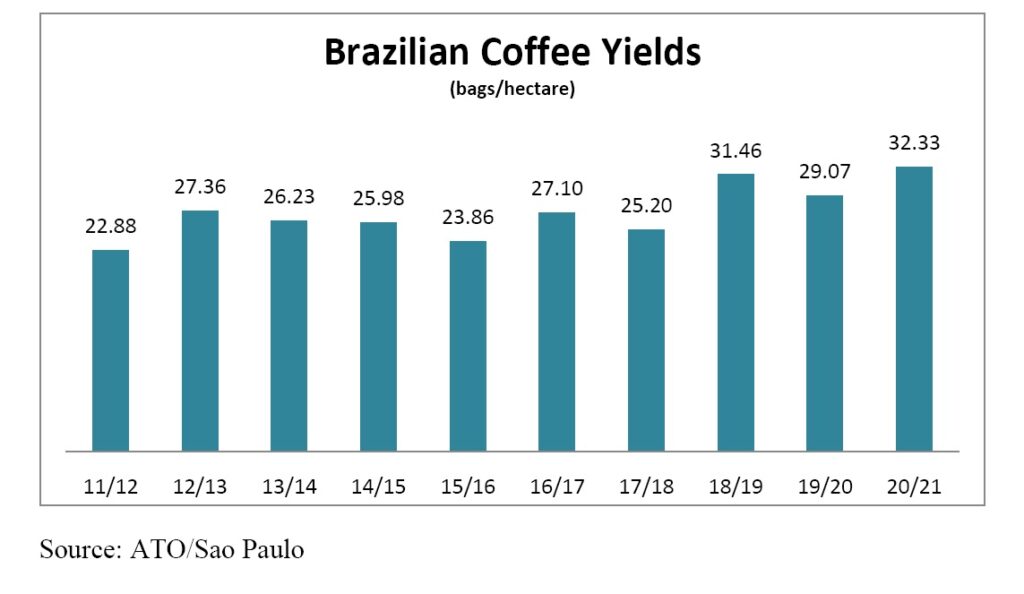

Brazil’s coffee yield for MY 2020/21 is forecast at 32.33 bags/hectare, an increase of 11 percent compared to MY 2019/20 (29.07 bags/hectare). Better yields are mainly due to the on-year of the biennial production cycle for Arabica trees as well as steady Robusta/Conilon production in the majority of the coffee areas. The graph bellows illustrates the evolution of Brazilian coffee yields since the 2011/12 crop.

Brazil’s coffee yield for MY 2020/21 is forecast at 32.33 bags/hectare, an increase of 11 percent compared to MY 2019/20 (29.07 bags/hectare). Better yields are mainly due to the on-year of the biennial production cycle for Arabica trees as well as steady Robusta/Conilon production in the majority of the coffee areas. The graph bellows illustrates the evolution of Brazilian coffee yields since the 2011/12 crop.

Coffee Prices in the Domestic Market in Brazil

As of November 2019, coffee prices, mainly Arabica, reacted positively as a consequence of low supplies for high-quality product, industry concerns related to the likely product availability in 2020, steady demand both domestically and abroad, in addition to the weak local currency, the Real, vis-à-vis the U.S. Dollar.

According to industry contacts, coffee prices have remained extremely competitive in 2020 despite the COVID-19 pandemic as global coffee supplies remain limited. In addition, brokers and wholesalers were short on beans and having difficulty securing new supplies. Coffee futures prices have also shown stability despite the recent appreciation of the U.S. dollar and the weakening of the Brazilian currency.

Transportation is also a factor keeping strong coffee prices worldwide. The COVID-19 pandemic has resulted in numerous delivery issues and shipping constraints around the globe, putting additional pressure on an already tight market. Supplychain disruptions, nationwide lockdowns and other virus-related setbacks are likely to keep coffee futures prices steady, at least in the short term.

The price differential between the Arabica and Robusta/Conilon varieties have steadily favored Arabica since the second quarter of 2019, as shown in the graph below, as Arabica prices have largely recovered compared to Robusta/Conilon.

Consumption

Brazil’s domestic coffee consumption for MY 2020/21 is projected unchanged at 23.53 million coffee bags (22.35 million bags of roast/ground and 1.18 million bags of soluble coffee, respectively) compared to the previous MY. In spite of the projected decrease in the Brazilian Gross Domestic Product (GDP) for 2020, a four percent drop, according to the Brazilian Government, coffee has high penetration in Brazilian households. Indeed, the Brazilian Coffee Industry Association (ABIC) estimates that 97 percent of the Brazilian households drink coffee regularly.

The Association expects that the increase in consumption in the Brazilian households should offset the losses in “out of home” consumption with the temporary closure of Brazilian coffee shops (roughly estimated at 10,000 units), hotels, bars and restaurants imposed by the COVID-19 pandemic. It’s too early to estimate any further change in consumption volumes and patterns due to COVID-19 and further data must be investigated and analyzed.

Exports

ATO/Sao Paulo forecasts total Brazilian coffee exports for MY 2020/21 at 41.02 60-kg million bags, due to the expected higher coffee supply, reaching the same record levels of MY 2018/19. Green bean exports are forecast at 37 million bags, while soluble coffee exports are projected at 4 million bags.

The exceptionally devaluated Real (R$) vis-à-vis the U.S. Dollar contributes to Brazil’s high competitiveness in the global market.

Coffee exports for MY 2019/20 are estimated at 36.62 million 60-kg bags, green beans, based on updated information from the industry. The estimate is based on year-to-date export volumes and anticipated May-June loadings.

Green bean (Arabica and Robusta/Conilon) exports are estimated at 32.7 million bags, whereas soluble coffee exports are estimated at 3.9 million bags. According to the April 2020 coffee trade statistics released by the International Coffee Organization (ICO), total world coffee consumption for 2019/20 is estimated at 166.06 million bags, an increase of 789,000 bags compared to 2018/19, Brazil represents roughly one third of total world exports.

ICO has also recently released a preliminary assessment of the demand-side effects of COVID19, specifically the impact of a global recession on coffee consumption. The analysis is based on a sample of the top-20 coffee-consuming countries, which represent over seventy percent of global demand, covering the period 1990-2018. The results show that a one percentage point drop in GDP growth is associated with a reduction in the growth of global demand for coffee of 0.95 percentage points or 1.6 million 60-kg bags. Additional demand-side effects relate to the impact of social distancing measures on out-of-home consumption as large parts of the hospitality industry are under lockdown and workplaces are closed.

The Brazilian Coffee Exporters Council (CECAFE) reported that shipments from Brazil have been regular so far, but shipping lines have already advised that container shortages might occur in the coming months, when Brazil is expected to harvest a record crop. Post contacts report that coffee importers in some of the largest consuming countries are stockpiling, bringing forward orders by up to a month to avoid shortages if supply chains are disrupted by the COVID-19 lockdowns. The global pandemic has pressed several countries around the globe world to impose severe restrictions on movement to mitigate the spread of the virus.

On trade policy, European Union (EU) coffee traders have recently warned Brazilian coffee growers and exporters about the stricter Minimum Residue Levels (MRL) set by the EU, a major destination of Brazilian coffee exports. The MRL is related to Chlorpyrifos, an active principle used to control coffee borer and leaf miner (“bicho mineiro”) in Brazil. The EU will no longer accept the active principle Chlorpyrifos, suggesting a MRL of 0,01 mg/kg of the active principle in processed coffee as opposed to the current MRL adopted in Brazil, which is 0,05 mg/kg.

Therefore, coffee growers will have to use alternative products to control coffee borer and leaf miner in order to avoid trade issues when exporting to the EU.

As reported by CECAFE and the Brazilian Soluble Coffee Association (ABICS), total coffee exports during the July 2019 – April 2020 period were 31.07 million bags, a decrease of 3.37 million bags compared to the same period for MY 2018/19 (34.44 million bags), as a consequence of the tighter coffee supply. Preliminary data until May 08 shows that coffee export registrations for May 2020 were 729,685 bags, while cumulative green coffee export shipments for May 2020 are 115,853 bags.

Stocks

ATO/Sao Paulo forecasts total ending stocks in MY 2020/21 at 4.79 million bags, up 3.41 million bags, compared to the previous year, due to expected higher coffee supply during the season. CONAB’s 2020 privately-owned stocks survey has not been released yet. The survey includes coffee stocks held by growers, coffee cooperatives, exporters, roasters, and the soluble industry as of March 31, 2020. Government stocks are virtually zero.