BOGOTA, Colombia – According to the lastest USDA Gain Report, Colombian coffee production is forecast to reach 14.3 million bags green bean equivalent (GBE) in marketing year 2019/20, as the flowering period in the main coffee regions have indicated better production levels, assuming continued favorable weather conditions. A good flowering in trees helps to determine the size of the harvest. In the first month of MY 2019/20, October 2019, coffee production reached 1,136 GBE, the highest monthly level since July 2017.

Revised production estimates for MY 2018/19 is down from 14.3 to 13.9 million bags GBE, mainly driven by extended dry weather conditions that affected fruit-filling stages.

As a result of a successful replanting program, the Colombian Coffee Growers Federation (Fedecafe) estimates that average coffee productivity has increased to 18.8 bags GBE per hectare, 36 percent higher than the last decade (13.8 bags GBE). In 2018, 82,000 hectares were renovated, mostly with varieties resistant to rust, the planting density increased to 5,200 trees per hectare, with productivity at high levels of 18.8 bags GBE per hectare, and the average age of coffee plantations was reduced to 6.8 years, in 2010 it was 10.8 years.

Fedecafe and the Colombian government plan to increase the number of renovated hectares to at least 90,000 per year, which represent nearly 10 percent of total area planted. The renovation cost per hectare is estimated between 8 to 12 million Colombian pesos ($2,860-$4,285).

In addition to the replanting program, Fedecafe has promoted through its extension service, the strategy “More agronomy, more productivity” that is aimed to implement agronomic best practices to boost the results of the replanting program.

In 2018, Fedecafe estimates there are 540,000 coffee growing families, where small farmers with less than five hectares of land are responsible for approximately 69 percent of coffee production in Colombia.

There are approximately 900,000 hectares of coffee planted in Colombia, but only 780,000 correspond to technified crops, meaning they are partially planted with improved coffee varieties, such as rust resistant trees, dense plantations and are younger than 12 years old.

About 80 percent of coffee area is planted with rust resistant varieties, compared to 35 percent in 2010, when weather conditions had devastating effects on coffee production.

According to Fedecafe’s last coffee diseases survey, on average, borer infestation and rust levels continue to be below two percent.

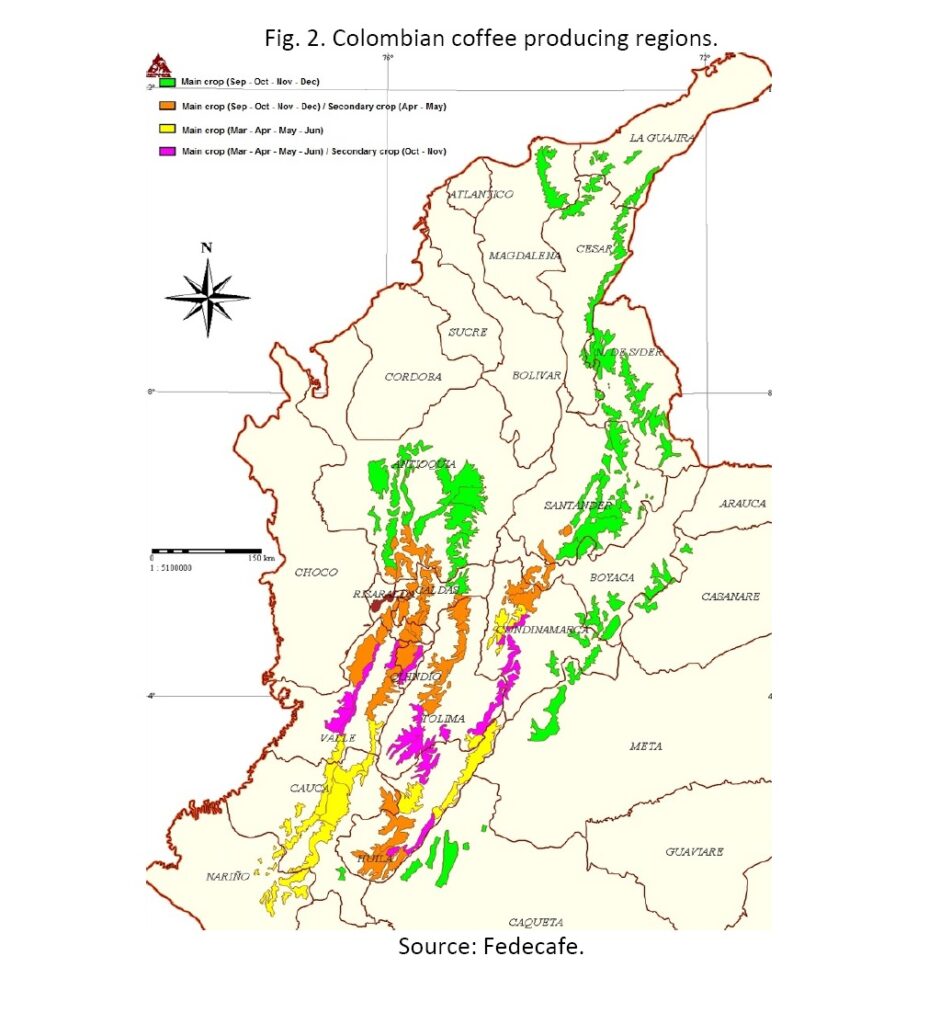

The departments of Caldas, Quindío and Risaralda are known as the Colombian “coffee region” (eje cafetero in Spanish) because years ago they grew and produced the majority of Colombian coffee. However, given lower agricultural labor costs and climate change, coffee production has shifted to other departments such as Huila, Antioquia and Tolima.

In 2018, these three departments accounted for 46 percent of Colombia’s total coffee production, while Caldas, Quindío and Risaralda only accounted for 16.5 percent. The “coffee region” is nowadays well known for developing tourist attractions to highlight Colombian coffee and its culture.

The map below illustrates the coffee producing regions of Colombia. The orange and purple areas in the map have two peak harvest periods during the calendar year given the presence of two dry and two wet weather conditions.

Colombian domestic prices depend on the New York international price and the Colombian peso (COP) to U.S. dollar currency exchange rate. Despite the exchange rate being favorable for exporters, the decrease in international prices severely affected internal prices in 2018 and the beginning of 2019.

Since May 2019, the recovery of international prices and the devaluation of Colombian peso against dollar have maintained internal prices above estimated average productions costs ($715,000 COP/125Kg bag, approximately $208 USD).

According to Fedecafe, about 40 percent of total Colombian coffee production receives significant price premiums for being specialty coffees. Colombian coffee producers plan to improve quality to sell mostly specialty coffees.

Colombian coffee consumption:

Colombian coffee consumption levels are revised upward from the previous estimates as consumption rates in production countries such as Colombia has grown at a faster pace in the last years, mainly driven by an increasing number of coffee shops and the creation of new coffee products.

Revised consumption estimate for MY 2018/19 is at 1.95 million bags GBE, paralleling the increase in coffee imports. In MY 2019/20, consumption is forecast to reach 2.0 million bags GBE, a 2.5 percent increase from the year before.

The major players in the Colombian coffee stores market are: Juan Valdez, OMA and Café Tostao. Other companies with a presence in this market include McCafe, Illy, Segafredo, and the mega-coffee retailer, Starbucks. Café Tostao started operations in late 2015 and has dramatically grown in the last years to have over 400 small coffee stores in Bogota, Cali and Medellin offering coffee and pastry products at a lower price than their competitors. This strategy has led Café Tostao to become the second largest seller of coffee in Colombia, after Juan Valdez.

Trade:

In MY 2019/20, revised coffee exports are forecast at 13.7 million bags GBE, with no changes from the year before. Despite lower than expected production, the quality of Colombian coffee improved and was thus more attractive for exports. Exports reached 13.7 million bags GBE in MY 2018/19. Coffee bean exports represent over 90 percent of total exports, followed by soluble coffee and roasted coffee.

In 2018, the United States continue to be the major single destination for Colombian coffee, importing approximately 45% of the total Colombian exports, followed by the European Union (25%), Japan (9%), and Canada (8%).

To satisfy the growing domestic demand along with increasing exports and lower production, in MY 2018/19 Colombian imports are estimated at 1.2 million bags GBE.

The coffee imports have been traditionally from Peru, Honduras and Ecuador. However, as of August 2019, Brazil became the top coffee supplier, accounting for 61 percent of total imports during MY 2018/19, followed by Peru (23.7%) and Honduras (12.1%). In MY 2019/20, imports are forecast to slightly increase to 1.3 million bags GBE to meet increasing local demand as export levels are high and production recovers at a slower pace.

Stocks:

There exists no government or FEDECAFE policy to support large scale carry-over stocks of coffee. In MY

2018/19 beginning stocks are estimated at 1.1 million bags GBE given delayed harvest and low prices which discouraged trade. In MY 2019/20 beginning and ending stocks are forecast to fall to 567,000 and 512,000 bags GBE, respectively, as a result of increasing exports and domestic demand.

Policy:

The decrease in domestic prices due to the reduction in international markets motivated coffee growers to demand government support. In 2019, the Colombian government allocated $155.5 billion COP (about $50 million) to coffee growers to protect farmers’ income through direct payments.

The government subsidizes the internal purchase price paying up to $30,000 COP ($9.5) per 125 kg (275 lb) bag when the domestic price falls below $715,000 COP.

The subsidy was effective only in February, March and April 2019, as prices have been above this break even point in other months.

The Financing Fund for the Agricultural Sector (FINAGRO) also provides loans with discounted payback terms and a special loan category that offers funds to small growers in replanting their coffee fields.

The majority of coffee growers are members of Fedecafe and take advantage of the organization’s educational programs, technical training, and sales support. Fedecafe provides technical support to coffee producers through the extension service that assists growers on good practices for planting, harvest and post-harvest, as well as processing that have an impact on the final quality of coffee.

In addition, Fedecafe manages low interest loan programs for the costs of replanting. Most of the policies and programs for the coffee sector are sponsored by the National Coffee Fund, which is a checkoff program that collects six cents per pound of coffee from producers. The Fund’s resources are managed by Fedecafe.